September 7, 2023

By: Ben Nelson, Investor Relations Regional Manager

How do syndicators choose the right deal for you?

Real estate investing can offer lucrative opportunities to those willing to take risks, but careful research is necessary for repeated success. So how do real estate investment firms conduct their due diligence?

Real estate investors (“REIs”) often overlook certain aspects of deal research, the evaluation process for choosing deals, and strategies to handle situations when a suitable deal cannot be found.

Factors that determine potential profits

When conducting deal research, REIs consider various factors contributing to a potential investment’s profitability and success including cash flow, leverage, equity, appreciation, and risk.

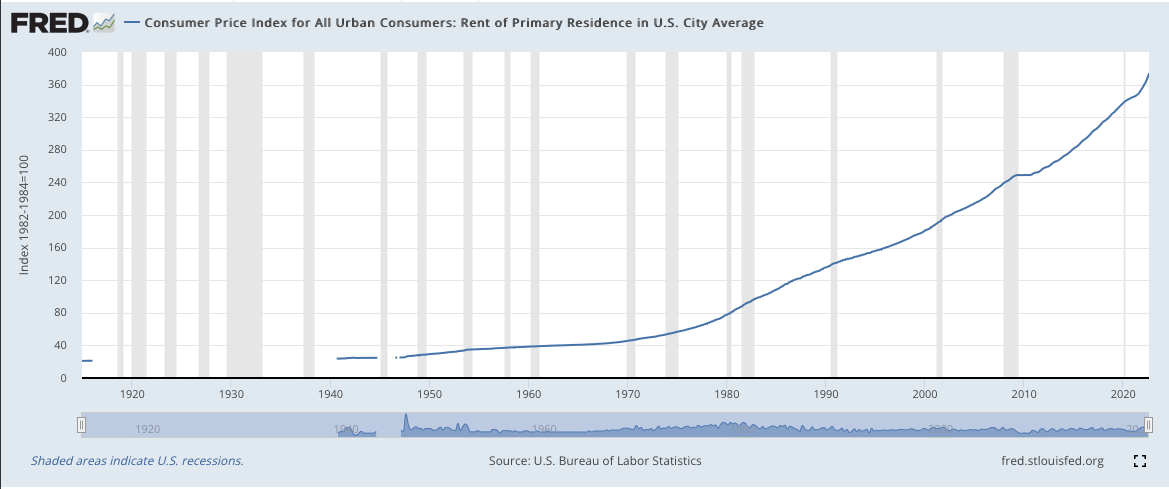

Cash flow is a vital consideration for REIs, as it refers to the income generated by a property after deducting expenses. Positive cash flow can promote steady income and the potential for reinvestment or passive income streams.

Leverage is another significant component of deal research. REIs analyze the potential to borrow funds or use alternative sources of capital to finance the investment. By leveraging their capital with debt, investors can maximize their returns and increase profitability.

Equity refers to the ownership value that an investor has in a property. As the property appreciates over time, investors’ equity grows, providing them with potential opportunities for refinancing or selling at a higher price.

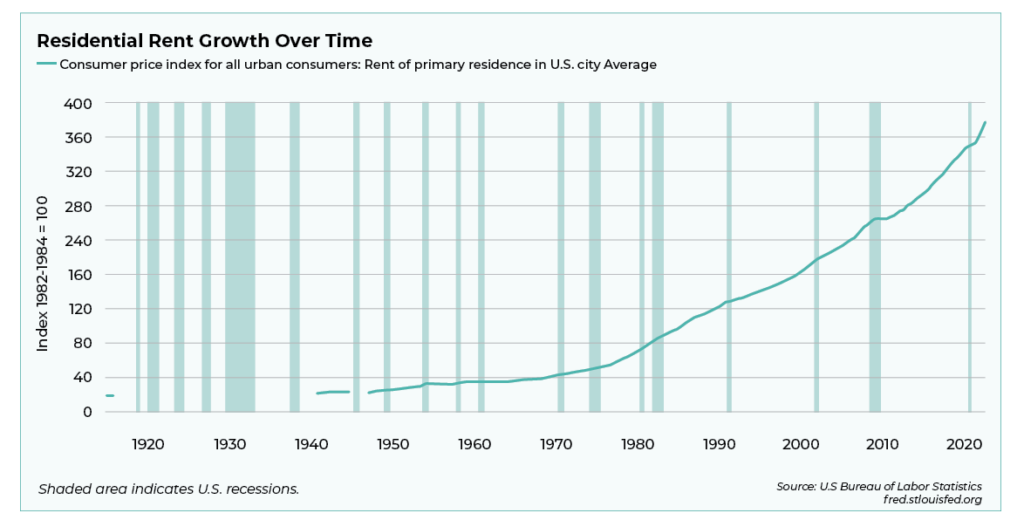

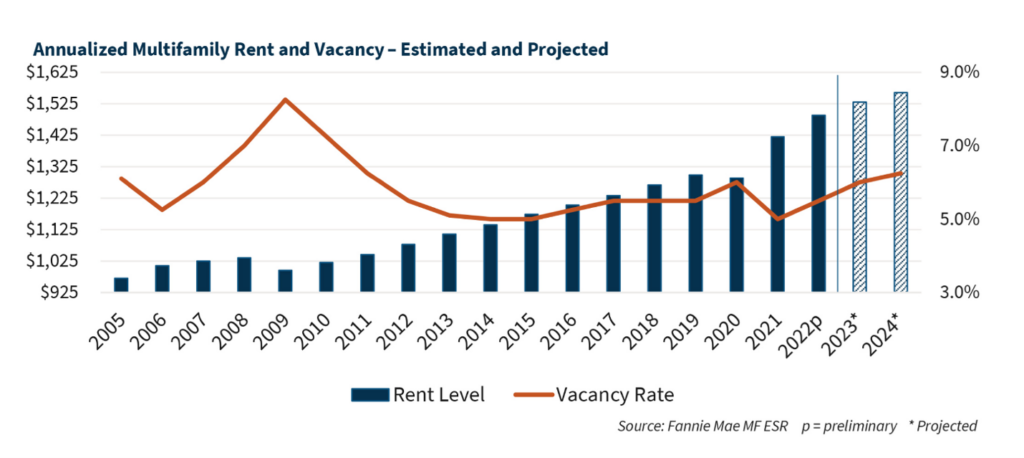

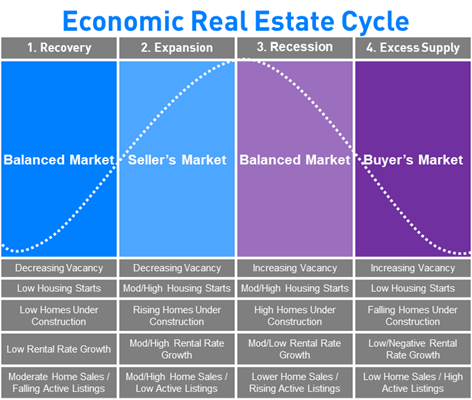

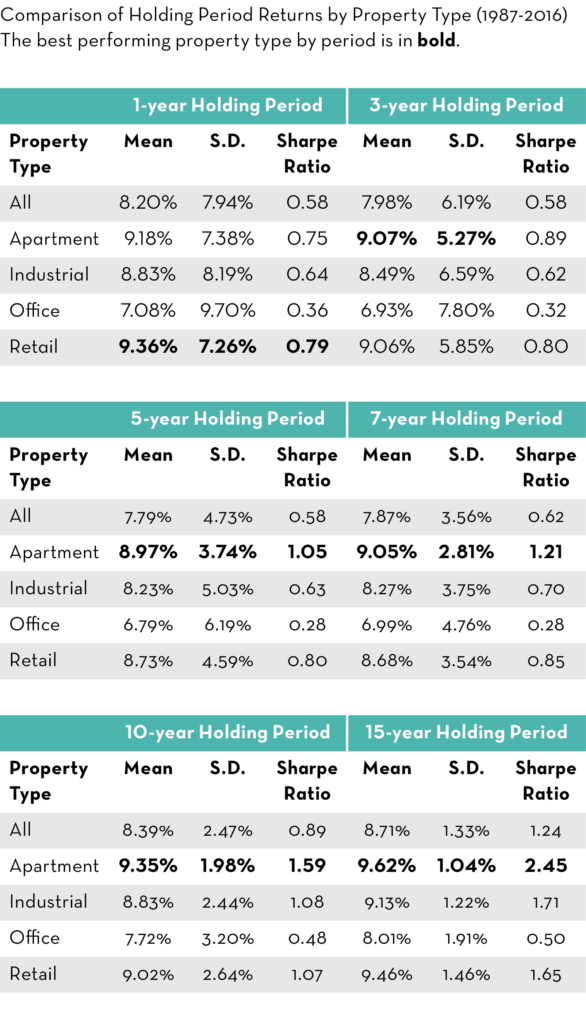

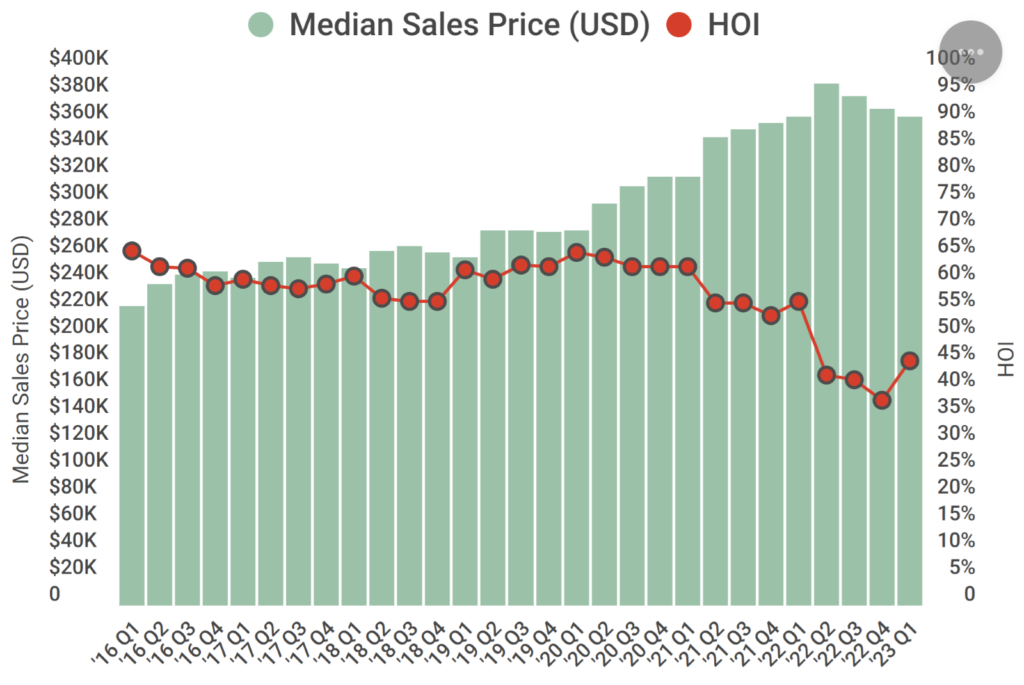

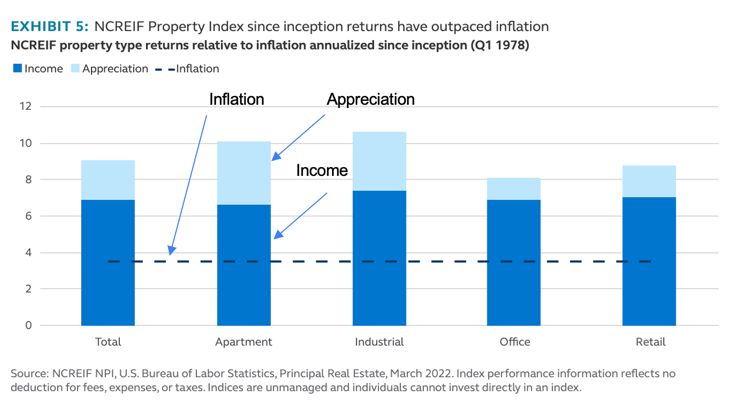

Appreciation is a key factor in long-term wealth creation. REIs carefully assess market trends, location advantages, and potential growth factors that can drive property value appreciation. This appreciation can result in significant returns when the property is sold.

Risk assessment plays a crucial role in deal research. REIs evaluate the potential risks associated with a property, such as market volatility, tenant turnover, or potential repairs and maintenance costs. Understanding the inherent risks and balancing those against potential returns allows REIs to make informed investment decisions.

By considering these factors and conducting thorough research, REIs can identify and evaluate investment opportunities that align with their investment goals and risk tolerance, leading to successful real estate investments.

Proper deal research requires a thorough analysis of multiple factors to determine the viability and profitability of each multifamily real estate investment opportunity. Ashcroft Capital conducts deal research involving these key steps:

Market Research

Before pursuing a specific deal, it is crucial to conduct comprehensive market research.

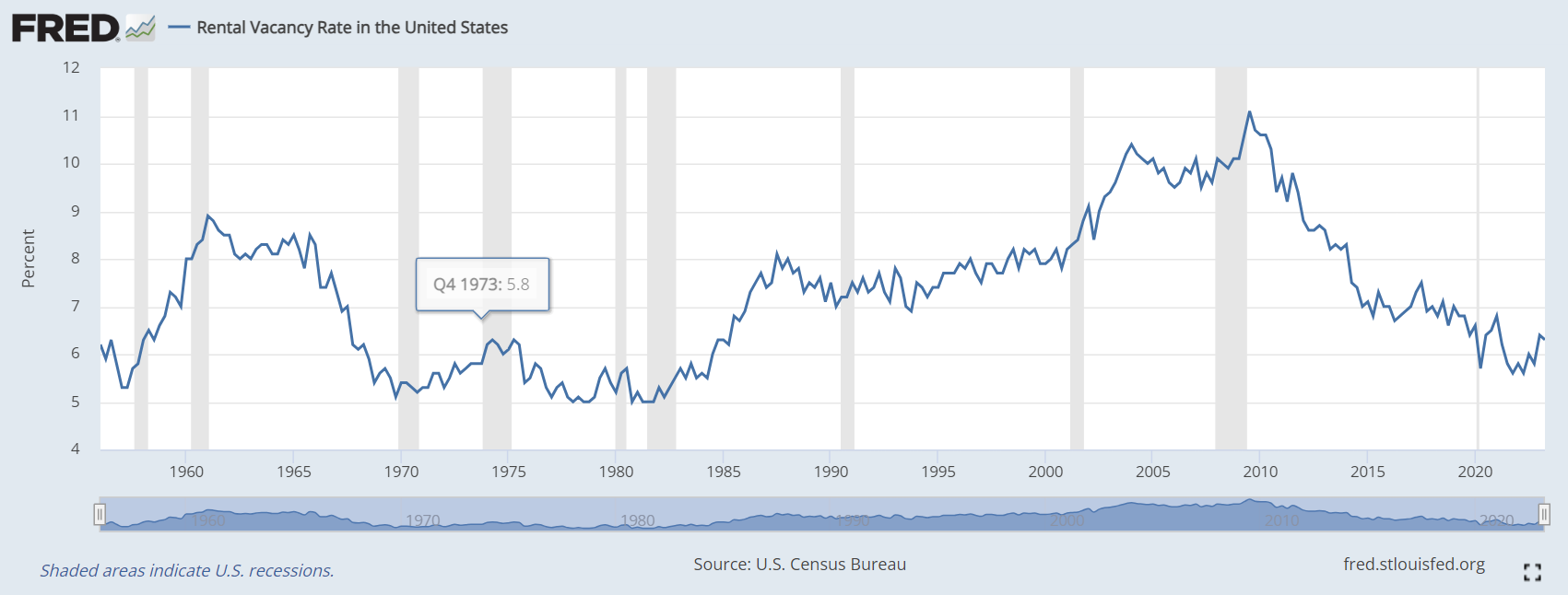

This research involves evaluating a particular market’s economic strength and growth potential, studying demographic trends, and analyzing supply and demand dynamics.

Understanding market conditions helps deal sponsors identify promising locations for potential investments.

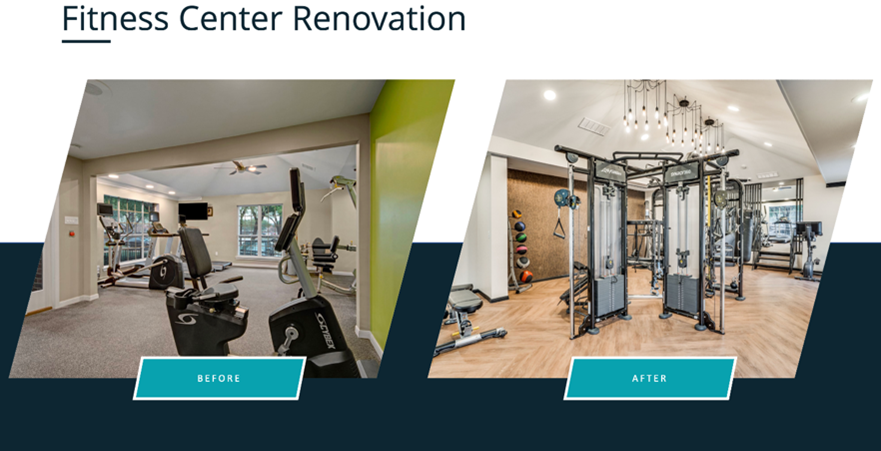

Assessing Potential Repairs

Evaluating the condition of a property and estimating the cost of repairs is essential in forecasting a deal’s potential profitability.

This includes, but is not limited to, conducting property inspections, obtaining contractor estimates, and considering the potential return on investment for necessary

repairs or renovations.

Calculating Long-Term Expenses

In addition to immediate repairs, it is important to calculate long-term property ownership expenses, including project maintenance costs, property management fees, insurance, and property taxes.

Accurately gauging these expenses creates a comprehensive understanding of the property’s cash flow potential.

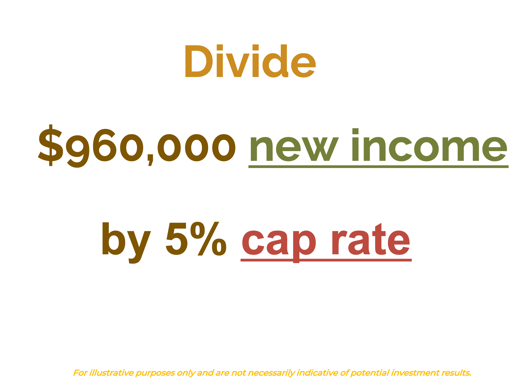

Determining Net Operating Income (NOI)

NOI is a key metric in real estate investing, representing the property’s revenue minus operating expenses.

It is one the most frequently used metrics as calculating NOI is crucial for assessing an investment’s profitability and potential returns.

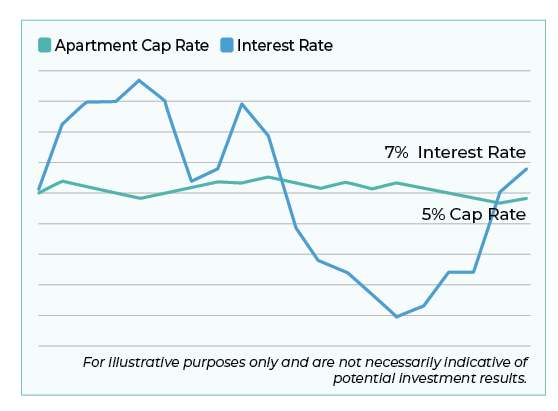

Calculating Cap Rates

Cap rates, short for capitalization rates, measure a property’s potential return on investment. The cap rate is calculated by dividing the property’s NOI by the purchase price.

Comparing cap rates across different properties and markets helps sponsors make informed decisions.

Researching Comparisons

To better understand the competitiveness of a potential deal, sponsors research comparable properties in the surrounding area.

Analyzing recent sales data, rental rates, and market trends enables investors to determine the viability of the deal and its potential for growth and appreciation.

Purchase Price Negotiations

Once a suitable property is identified, negotiating the purchase price is vital to the deal-making process. Conducting thorough research on comparable properties, property conditions, and projected returns allows sponsors to operate from a strong negotiating position.

Determining Investment Goals

At the outset of their deal research, sponsors establish clear investment goals by defining the minimum desired return on investment, risk tolerance, preferred investment strategy (such as cash flow, appreciation, or both), and ideal time horizon. These goals serve as guideposts in the deal evaluation process.

Securing Financing

Part of the deal research process involves identifying and securing suitable financing options for the investment.

These options could include traditional bank loans, private lending, or partnerships with other investors. Proper financial planning and analysis are required to ensure the investment is financially viable.

Conducting Due Diligence

Once a deal is chosen, conducting due diligence is imperative to fully understand the property’s legal, financial, and operational elements.

This process often involves a comprehensive evaluation of property documentation, including leases, financial statements, environmental reports, and any relevant permits or licenses.

Also, sponsors must check for risks, violations, potential lawsuits, and unpaid penalties to assess a property’s potential.

Renter Demographics

Researching renter demographics can be invaluable towards understanding the target market for potential properties.

Analyzing population growth, migration patterns, income levels, employment opportunities, and lifestyle preferences helps sponsors to identify properties that align with the target demographic.

Becoming a seasoned real estate investor is a long and careful process, but conducting effective deal research to find the right property doesn’t have to be a daunting task.

Ashcroft Capital’s Deal Research Strategy

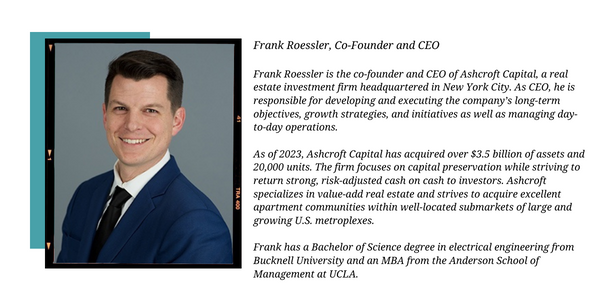

Ashcroft Capital employs a meticulous deal research strategy that has produced exceptional risk-adjusted returns to their investors.

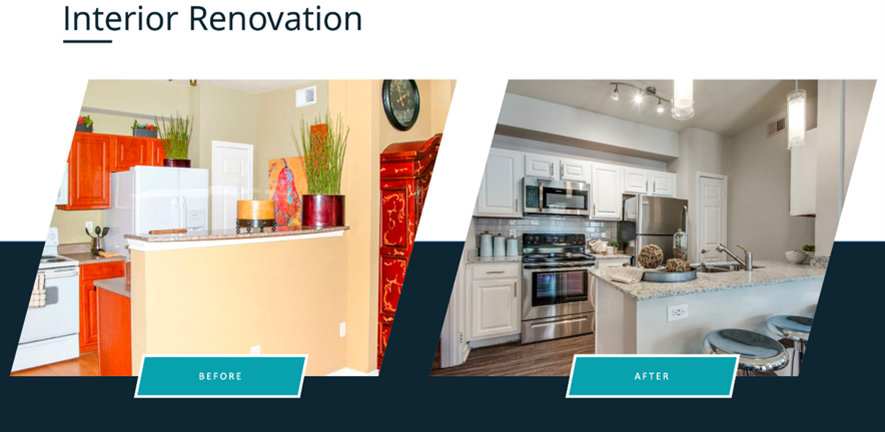

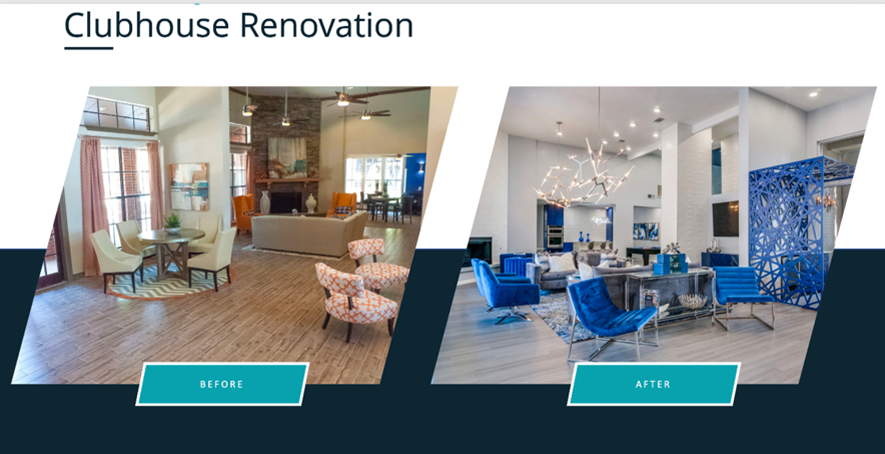

The investment strategy centers around identifying properties with “good bones” and the potential for substantial improvement. This includes evaluating the strength of the location, risk tolerance, and return potential opportunities within a specific market.

Ashcroft Capital seeks Core+ properties in strong submarkets with moderate risks and the potential for value-add opportunities.

These properties typically have high occupancy rates and steady cash flows but may benefit from strategic improvements or management. These are often infill property locations that are usually around 20-25 years old.

Ashcroft Capital’s rigorous due diligence process is comprised of more than 100 steps to exhaustively evaluate potential multifamily real estate deals.

This inspection includes third-party reports and property inspections and a full review of all titles and zoning, a 38-point on-site evaluation and inspection (including a walk-through of each unit, review of maintenance logs, and staff interviews), a 24-point financial analysis including on-site lease audits, review of all financial statements, occupancy histories, and cash flow audits.

This highly detailed approach ensures that each property fits within their investment criteria and exhibits the characteristics for substantial returns.

They also consider existing relationships with buyer(s) when evaluating potential deals. A strong network and established relationships in the industry can provide valuable insights and opportunities for advantageous transactions.

Ashcroft Capital actively researches various markets, focusing on emerging locations that offer attractive investment opportunities. While specific markets may evolve over time, they prioritize areas demonstrating economic growth, diverse employment sectors, and favorable demographic trends.

Ashcroft Capital Value-Add Funds

Ashcroft Capital has identified two exceptional investment opportunities, Halston Lakeside and Elliott Cocoplum, as the second and third assets in the Ashcroft Value-Add Fund III (AVAF3) portfolio.

These properties offer a unique combination of regional and economic benefits, making them attractive for investors seeking to capitalize on high-growth markets, quality construction, and a robust business plan.

By investing in the current fund, investors can capitalize on the strong market fundamentals, attractive location benefits, and significant value-add potential of these properties while enjoying the stability and security of a well-structured investment managed by an experienced real estate investment firm.

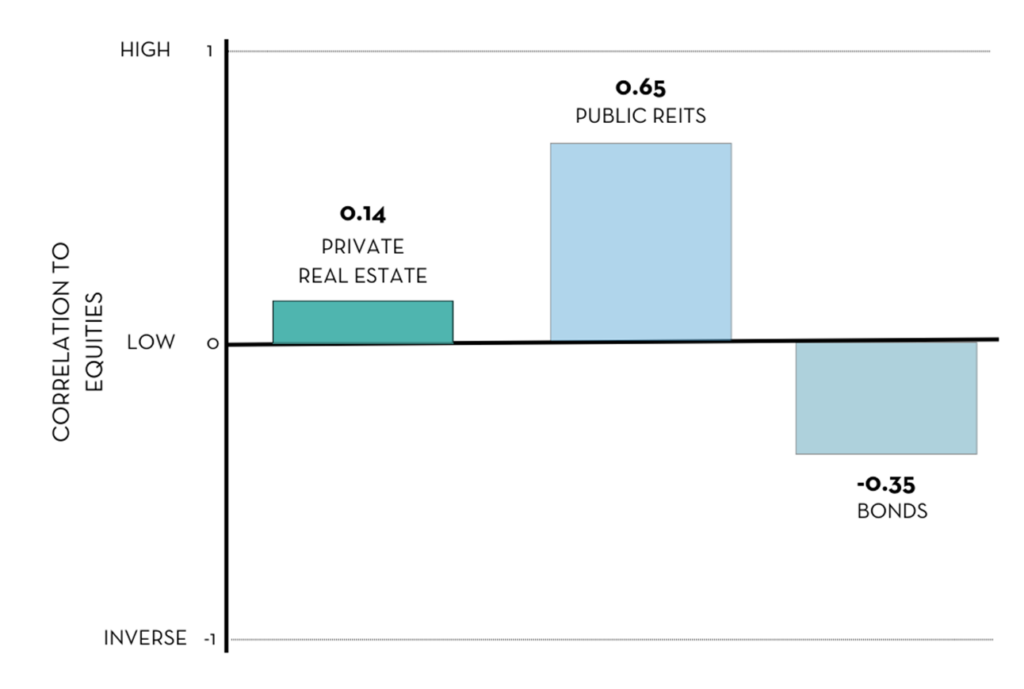

Real estate funds like our current fund differ from syndications by investing in multiple properties rather than a single deal.

The fund is structured so that investments are allocated across multiple properties thereby mitigating concentration risks and creating diversified sources of return.

Our current fund is an open private placement fund for accredited investors interested in diversifying their portfolios into multifamily real estate. The fund will own multifamily properties with an anticipated fund life of 5-7 years.

This current fund offers limited partners Class A and Class B share types, with a minimum investment of $25,000. An investment in Class A shares earns 9% annual fixed distributions but does not participate in the upside of dispositions. Class B shares earn a 7% preferred return and participate in the profitability of property sales.

To learn more about investing in multifamily real estate, visit https://info.ashcroftcapital.com/fund or schedule a call with our Investor Relations Team at investorrelations@ashcroftcapital.com.