March 30, 2023

By: Travis Watts, Director of Investor Development

Do you understand private placements and IRA investing?

In the world of commercial real estate, the ownership of large multifamily properties has traditionally been the domain of institutional investors, mutual funds, Real Estate Investment Trusts (REITs), insurance companies, and pension plans.

A primary reason is the substantial capital required for the acquisition of properties this size. However, the landscape has evolved in recent years to provide an accessible avenue for accredited investors to participate in these opportunities through real estate private placements.

What are real estate private placements?

Real estate private placement offerings provide accredited investors the opportunity of investing in large, institutional-grade real estate acquisitions, such as a 400-unit apartment complex.

The Limited Partners (individual investors) can benefit from passive income, debt leverage, potential tax advantages, and equity appreciation.

Instead of having to come up with a $25 million down payment personally, an individual investor can instead become a partial owner in the commercial property with an investment as modest as $25,000, making commercial real estate accessible for millions.

Moreover, Limited Partner investors can enjoy the advantage of property ownership without the day-to-day managerial responsibilities.

This relieves them from the burdensome tasks of tenant management, phone calls, maintenance, and deal underwriting. This is handled by the General Partner(s) and their team.

Real estate private placements provide you with:

- Passive Income: Revenue from apartment complexes is derived primarily from tenant rents and supplementary income streams, such as parking fees, onsite storage, and revenue share programs. The income after expenses is then shared between Limited Partners and General Partners.

- Forced Appreciation: By implementing a “value-add strategy” which entails improving amenities, landscaping, and the units on the property, the value of the property can be increased, and higher rental revenue can be achieved upon completion. Upon sale, the proceeds can then be reinvested utilizing a 1031 exchange which defers taxable gains, or investors can choose to “cash out” and move their capital elsewhere.

- Tax Advantages: Tax treatment for Limited Partners in real estate partnerships can be advantageous providing “paper losses” from depreciation, which can help offset passive income. Please consult with a licensed tax advisor for specifics.

Tax Deferred 1031 Exchanges: In the event of a property sale, some investment firms or General Partners can structure the sale to qualify for a “like-kind” exchange under Section 1031 of the U.S. Internal Revenue Code, enabling Limited Partners an option to defer capital gains taxes by contributing their Partnership Interests to a newly formed investment vehicle. This can help fast-track investment compounding.

Can you use your IRA to invest?

IRA Investing: A lesser-known option within real estate private placements is the use of self-directed Individual Retirement Accounts (IRAs). With over $30 trillion in American retirement accounts, there is a substantial reservoir of capital that many investors are unaware they can invest in opportunities beyond traditional stocks, bonds, and mutual funds.

Self-directed IRAs are overseen by custodians and allow investors to choose from alternative asset investments such as real estate, promissory notes, tax lien certificates, and private equity securities.

Real estate can protect your investment in times of market turmoil

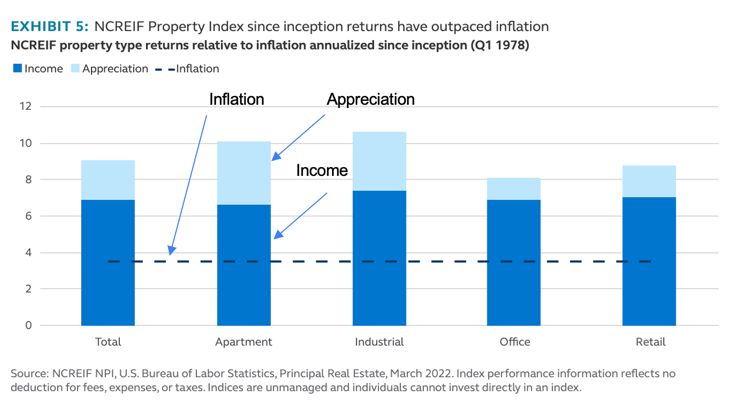

Total Return and Inflation Hedge: Commercial real estate investing presents an opportunity for a healthy return comprised of cash flow, equity upside participation, and potential tax advantages. This multi-faceted approach offers a total return potential that outpaces many other asset classes.

Furthermore, real estate investments historically function as a hedge against inflation, with rents, property values, and replacement costs rising in tandem with economic inflationary pressures. In fact, since 1978, the first year for which NPI data was available, private equity real estate has offered a total return of 9.2% on an annual basis with a 7% income return.

Source: https://fondsforum.de/en/blog/blog-einzelansicht/can-real-estate-beat-the-high-inflation-environment

Conclusion: For investors seeking a balance between risk and reward, multifamily apartment investing as a Limited Partner presents a compelling case. Using a “hands-off” approach to real estate investing, liberates investors to focus on what truly matters to them.

To learn more about investing in multifamily real estate, visit https://info.ashcroftcapital.com/fund or schedule a call with our Investor Relations Team.

Sources:

- $35 Trillion in Retirement Savings Tells a Tale of Two Economies™. (n.d.). Retrieved January 20, 2023, from https://www.planadviser.com/35-trillion-retirement-savings-tells-tale-two-economies/2 SEC.gov | Investor Alert: Self-Directed IRAs and the Risk of Fraud

- SEC.gov | Investor Alert: Self-Directed IRAs and the Risk of Fraud