August 1, 2023

By: Ben Nelson, Investor Relations Regional Manager

As investors, we are always looking to deploy capital into the market or a particular asset class at the most opportune time. Fortunately, well-documented evidence shows us how markets can rotate through semi-predictable cycles. The biggest challenge is timing. How do we pinpoint where we sit on these cycles, and how long will these cycles last?

“Don’t try to time the market” is one of the most popular pieces of advice you will hear from any financial advisor, and this is a sound strategy overall. One 2021 CNBC article states, “Looking at data going back to 1930, the firm found that if an investor missed the S&P 500′s 10 best days each decade, the total return would stand at 28%. If, on the other hand, the investor held steady through the ups and downs, the return would have been 17,715%” [1]. The difference in returns in this example is eye-opening and reinforces the idea that the most effective way to build long-term wealth is to invest consistently in quality assets. However, as investor psychology would have it, buying and holding is easier said than done. Most investors do not tend to plan based on a 91-year time horizon. Uncertainty breeds hesitancy, and waiting for the perfect time is how most investors completely miss an excellent opportunity.

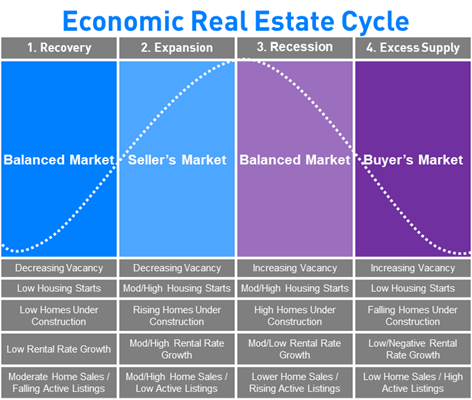

Real estate cycles flow in loosely defined phases of recovery, expansion, hyper supply, and recession. Famed economist and pioneer in real estate research Homer Hoyt discovered that real estate market cycles typically last at least 18 years before repeating themselves [2]. This raises the question: Where are we in the current cycle? An even more important question: Is now a good time to invest in real estate? The answer lies in each market.

It’s Just a Phase

Analyzing the different elements used to determine real estate phases can be tricky. Certain data can point definitively to being in one phase, whereas other data suggest we are between phases.

Recent data from the Yardi Matrix acknowledged that the “fundamentals for multifamily ‘remain strong’ with ongoing demand, continued rent growth, and nearly 1 million new deliveries expected over the next two years. But property values and sales prices have plummeted in 2023, and the high cost of debt has reduced demand and is also expected to lead to more defaults in the months ahead” [3]. Most investors prefer assets that have seen their value drop (are on sale) but are nonetheless predicted to have healthy multiyear demand.

Furthermore, JPMorgan’s recently released 2023 Midyear Commercial Real Estate Outlook shows multifamily rental costs rising more slowly, but multifamily properties are still showing fundamental strength. “The national vacancy rate for multifamily was at 4.5% at the end of 2022, according to Moody’s Analytics, even as the rate of rent increases fell. Vacancy rates vary widely across metro areas, but the median vacancy rate nationwide is 3.9% as of April” [4].

As Yardi Matrix Manager of Business Intelligence Doug Ressler explained, “Multifamily risk is some of the lowest in the industry, as opposed to office or retail. And that’s because of the fundamental fact that people need housing, and there’s a shortage of housing that won’t be corrected in the next five or six years” [5].

To summarize the broader real estate market, vacancies are decreasing even as rents rise because of the increasingly high cost of home ownership and interest rates. New construction growth is high but struggling to keep up with demand because high rates and supply chain issues hamstring efforts. Rent growth is low to moderate, even as U.S. monthly rents reach an all-time high of $1,716 a month [6]. Absorption is moderate to high as “the country’s affordable housing supply continues to lag far behind demand.”

Choose a Choosy Syndicator

The real estate market you invest in is as important as macro-based trends or the phases of the market cycle. There are investment opportunities in every real estate market and phase if you know where to look. While one market may be in a recession, another might be expanding rapidly. This is why it is so advantageous to work with an experienced real estate syndicator like Ashcroft Capital.

Not only were we able to find nonmarketed properties in an environment where “the pace of multifamily transactions is roughly 70 percent slower in 2023 than in recent years” [3], but we were also able to expand into three of our highly coveted target markets.

The Ashcroft Value-Added Fund III will be a smaller fund than its predecessors, but its properties coupled with informed purchase timing could be beneficial to our limited partners.

Sources:

- Stevens, Pippa, “This chart shows why investors should never try to time the stock market” CNBC, 21 March, 2021, https://www.cnbc.com/2021/03/24/this-chart-shows-why-investors-should-never-try-to-time-the-stock-market.html.

- Kurtzahn, Stephen, “Real Estate Market Cycles – Where We’re At Today And What’s Next” Yahoo, 22 August, 2022, https://www.yahoo.com/video/real-estate-market-cycles-where-134552654.html.

- Pascus, Brian, “Strong Fundamentals, Weak Market: Why Multifamily Is a Hall of Mirrors” Commercial Observer 3 July, 2023, https://commercialobserver.com/2023/07/strong-fundamentals-weak-market-multifamily-hall-mirrors.

- Brooks, Al, “2023 midyear commercial real estate outlook” J.P. Morgan Chase 1 May, 2023, https://www.jpmorgan.com/insights/real-estate/commercial-real-estate/midyear-commercial-real-estate-outlook.

- Pascus, Brian, “Strong Fundamentals, Weak Market: Why Multifamily Is a Hall of Mirrors” Commercial Observer 3 July, 2023, https://commercialobserver.com/2023/07/strong-fundamentals-weak-market-multifamily-hall-mirrors.

- Brooks, Al, “2023 midyear commercial real estate outlook” J.P. Morgan Chase 1 May, 2023, https://www.jpmorgan.com/insights/real-estate/commercial-real-estate/midyear-commercial-real-estate-outlook.