August 17, 2023

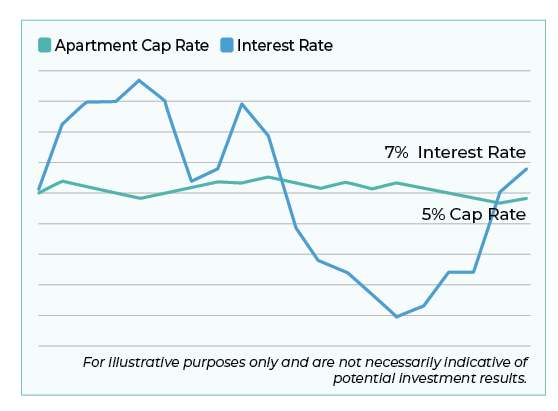

What is Negative Leverage?

Let’s talk about negative leverage. This is a scenario happening right now on many commercial real estate deals, and it’s critical to understand as an investor.

Before diving in, it’s important to understand the following terms:

Cap rate: The amount of income a property produces without a loan (i.e. if cash was paid)

Interest rate: The amount charged to borrow money (i.e. mortgage or loan interest)

Negative leverage occurs when an investment property is bought with an interest rate higher than the cap rate. At first glance, one might think, why buy a property that produces 5% cash flow if the loan must be obtained and paid at 7% interest? Technically, you would be losing 2% on the investment. (5% – 7% = -2%)

Examples of Negative Leverage

Let’s examine a couple case studies to see if this scenario can make sense as an investor.

Case Study #1: Buying a brand-new multifamily apartment building

If a brand-new multifamily property is purchased with all the latest and greatest, high-end finishes, amenities, and technology, then there is nothing substantial that can be done to drive the rents higher, the property is therefore reliant on whatever the market rents do.

There are three scenarios that could unfold:

- The market rents increase (there’s a chance of making money)

- The market rents remain stagnant (may or may not make money)

- The market rents decline (may lose money)

Case Study #2: Buying a value-add multifamily apartment building

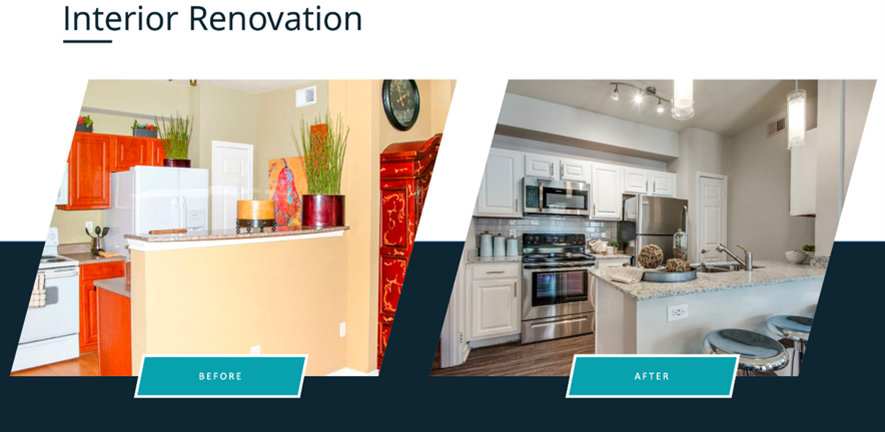

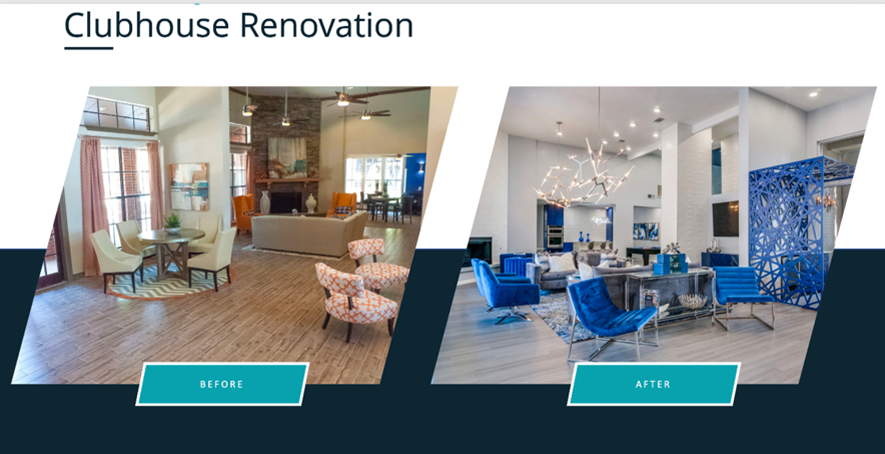

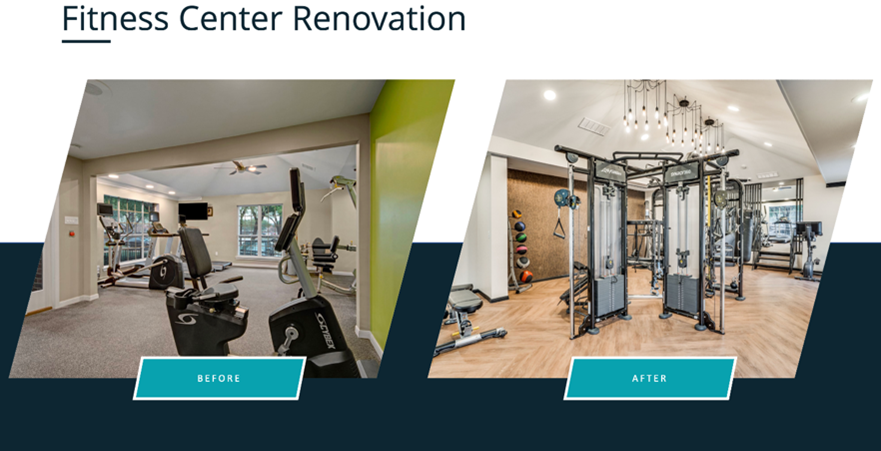

“Value-add” refers to an older, pre-existing property that is currently outdated, but can be renovated to compete with newer-built properties that offer modern amenities, technology, security, color schemes, and renter appeal. These properties are often rented at below market rent due to their current condition.

Example:

This makes sense if considered from a renter’s perspective. Many renters are willing to pay $500 more per month for a nicer, safer community that has more to offer. Unlike brand-new apartment buildings, there is an opportunity with value-add properties to make strategic improvements and renew the condition to appeal to more renters.

Here are few examples below of modernized value-add renovations:

Analyzing the Equity Potential

Let’s assume the average market rent is $1,700 per month. Newly constructed properties are renting for $2,000 per month and older/outdated properties are renting for $1,500 per month in a particular market. The opportunity with value-add is to make improvements and lift the rent to $1,700 per month to be in alignment with market rents.

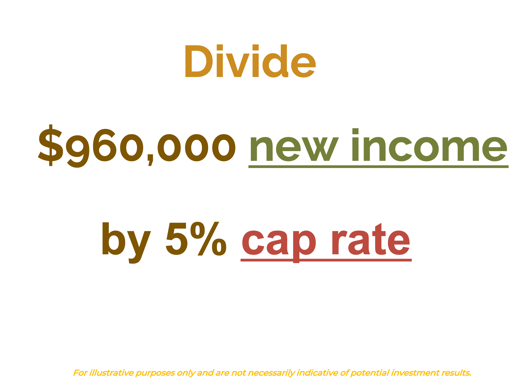

For example, if the property had 400 units in total, and each unit could be lifted $200 per month over a 5-year timeframe, that would increase the income by $960,000 per year. While this is great for cash flow, how much “value” or equity could be created if the property was sold at that point?

Use the following formula:

This would amount to a potential equity valuation increase of $19,200,000. Of course, this is a simplified example and there are more factors to consider, but it provides an interesting scenario to consider.

Understanding Rent Dynamics

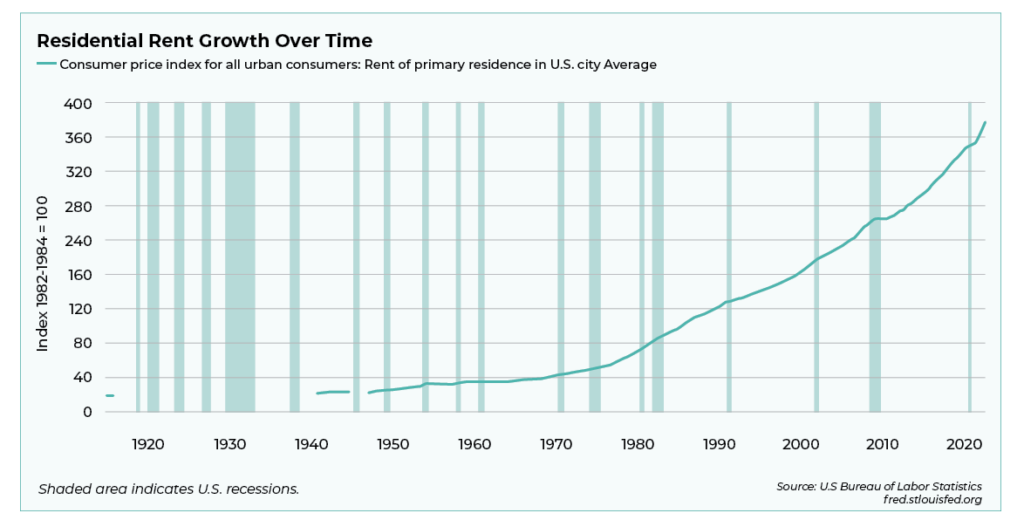

If the business plan is it to lift the rents of 400 units by $200 within a 5-year timeframe, that would amount to a $40 increase each year, or a 3% rent increase annually. Considering the property is being improved and providing more value for the residents, this could be a reasonable expectation. For a little perspective, below is the national rent growth since 1940 in the United States.

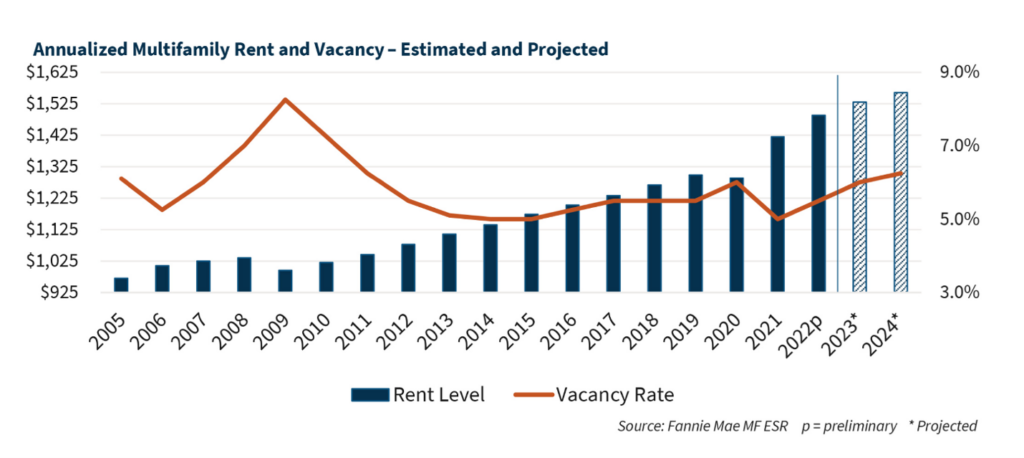

The chart above is not to suggest that rents always move up every year. Rent declines do occur, recent examples include 2009 and 2020 shown below. But real estate is a longer-term investment, 5 years in this example. Will rents be higher or lower in 5 years?

Circling back to our example, the same three scenarios could unfold in terms of rent:

- The market rents increase – There’s a chance of making money.

- The market rents remain stagnant – There’s a chance of making money if the property is improved and rents are lifted using a value-add business plan.

- The market rents decline – There’s risk that money may be lost, but there’s also a chance to make money if improvements are made to outpace the market rent decline.

Can Investors Still Profit from Negative Leverage

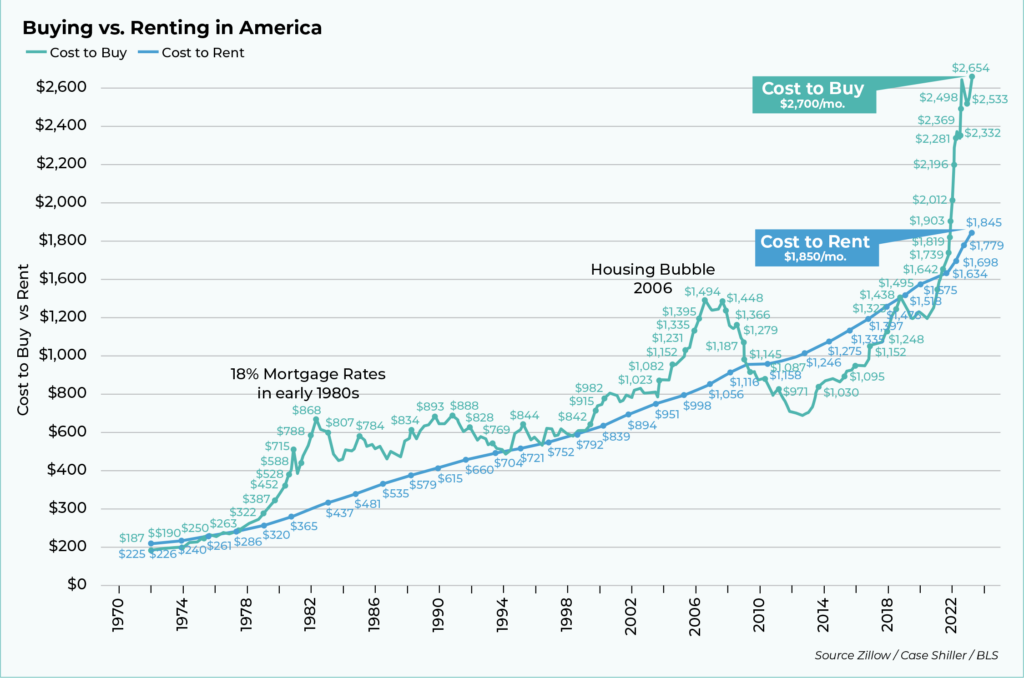

Right now, in America, there is high demand for rental housing. As shown above, the cost to own a home in 2023 is far more expensive compared to renting. Furthermore, there are added costs to home ownership: down payments, closing costs, property tax, higher insurance, ongoing maintenance, and potential HOA dues.

These factors are resulting in millions of Americans renting by necessity; in other words, they cannot afford to be a homeowner. Additionally, many are choosing to rent by choice because it may be cheaper or more economical than owning.

In recap, can real estate investors still make money in commercial real estate with negative leverage? The answer is likely yes, provided that the chosen business plan puts the odds in your favor.

Learn more at https://info.ashcroftcapital.com/fund or reach out anytime travis@ashcroftcapital.com. I have been investing in value-add real estate for 15+ years and I’ve made it my mission to help you and others learn the game.