August 29, 2023

By: Ben Nelson, Investor Relations Regional Manager

There is no shortage in 2023 of would-be financial experts offering advice on where you should and shouldn’t invest your capital. Countless unlicensed message-board “advisors” and people with “inside connection” spread misinformation that permeates investor communities. If unchecked, perception morphs into reality, and incomplete (or biased) information becomes hard to distinguish from the truth. We commonly refer to such widely held but false ideas as myths.

In my role at Ashcroft Capital, it is my job and pleasure to speak with and educate investors every day. Although most people don’t believe everything they read, I have heard several doozies in 2023 that left me scratching my head. An investor often cannot even remember when or where they heard these myths or if there is any validity to them, but they concern them all the same. Rather than rehashing common misconceptions about real estate investment, I want to focus on three larger concerns I have heard during my more recent conversations.

1. “Real estate cannot make money in a rising rate environment.”

Coming out of a historically low-interest rate environment, especially at the pace at which the US Federal Reserve has hiked rates over the past 18 months [1], real estate investors are not in a comfortable position. Rising interest rates result in lower property prices, elevated borrowing costs, and a generally more restrictive market. But before you think there is no money to be made in real estate, there are two things you should consider: First, the borrowing rates that allowed for such a free-moving market in the post-pandemic were a statistical anomaly and not the norm. “30 Year Mortgage Rates in the United States averaged 7.74%from 1971 until 2023, reaching an all time high of 18.63% in October of 1981 and a record low of 2.65% in January of 2021.” [2]

With current mortgage rates at 7.77% [3], we are on par with the average rate over the past 52 years. Over the past five decades, countless trillions of dollars of wealth have been created through investments in real estate. Second, change has remained the only constant over the history of real estate investing (or any other industry). Real estate moves in cycles, and every market provides opportunities for the most prepared and savvy investors to reap the rewards.

2. “The recent construction boom has caused an oversupply of multifamily housing.”

Although it is true that in some markets the housing supply has reached or even exceeded current demand, this blanket statement couldn’t be further from the truth. In June 2023 Fannie Mae’s chief economist, Doug Duncan, stated, “Housing’s performance is a testimony to the strength of demographic-related demand in the face of baby boomers aging in place and Gen-Xers locking in historically low rates, both of which have helped keep housing supply at historically low levels . . . Homebuilders continue to add to that supply, but years of meager homebuilding over the past business cycle means the imbalance will likely continue for some time.” [4]

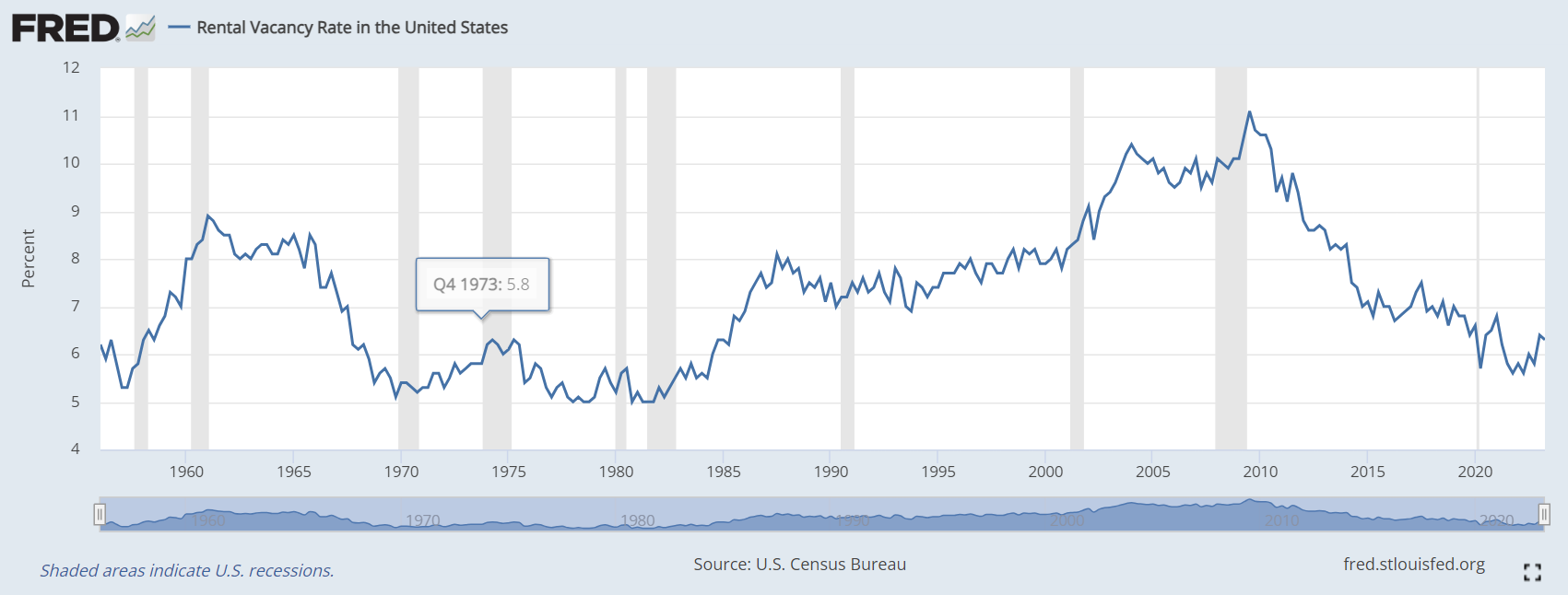

The data points vary by source, but the shortage is believed to be somewhere between three and seven million homes. As Nadia Evangelou, NAR senior economist and director of real estate research, recently explained, “Middle-income buyers face the largest shortage of homes among all income groups, making it even harder for them to build wealth through homeownership.” [5] To further dispel the oversupply myth, data shows that rental occupancy has hovered between 94% and 95% since the first quarter of 2020, despite the fact that multifamily construction reached a 50-year high nationwide in 2022. [6, 7] However, to make money in this environment, you must choose your markets carefully. The markets with the highest development, job growth, and migration should also have the highest absorption rate.

3. “Rents cannot continue to grow, forcing you to rely on appreciation that isn’t coming.”

At various times in our economic history, real estate appreciation has seemed to be more of a certainty than an area of concern. When cap rates are low and loan-to-value rates are high, you hear about everyone making money, and it almost seems too easy. I disagree. Markets often move irrationally, and a good investment idea can become old news in an instant in this information age. Rental rates have grown substantially since 2020, largely fueled by a spike in inflation, a growing US population, and an overall housing shortage. However, these growth rates were never sustainable, and time-tested market economics eventually balance the scales.

According to Zillow’s rental report for July 2023, rent increases have slowed down overall, but growth is still slightly higher than pre-pandemic rates (8). The chart below from the St. Louis Federal Reserve shows how rental rates have outpaced CPI inflation data over the past 40 years. Although the gap between inflation and rent growth has definitely narrowed in 2023, the data points showing long-term consistent growth are promising. Will appreciation in real estate be more challenging in the near term? Most likely, yes. But to say it will go away entirely is more fiction than prediction.

Honorable mention: “I know property values have gone down, but I am going to wait for the bottom.”

Although this isn’t necessarily a myth about real estate investing, it is a misconception about investing in general. Timing any market is nearly impossible, and those who are able to usually do so once or twice in their lifetimes. In a widely referenced USA Today article from 2018, Ken Fisher stated, “Time in the market beats timing the market.” [8] Hundreds of studies have proven that the greatest determining factor in wealth creation is investing consistently over long periods of time. The truth is that you will likely never sell at the top or buy at the bottom, but if you are patient and persistent, you can generate excellent long-term returns. Don’t let the goal of perfect timing deter you from excellent timing.

Busting Through

When life hands you lemons, make lemonade. A rising rate environment creates new challenges, but it does not eliminate opportunities. Ashcroft Capital’s acquisition team has over 80 years of combined experience navigating different real estate cycles, and they are confident in their ability to execute on highly accretive properties in any environment. Simply put, if our target properties are going on sale, we’re buyers.

Ashcroft Capital will continue to implement its proven value-add strategy to the benefit of our limited partners, even if markets act differently in the next five years than the previous five. In our current offering, the Ashcroft Value Add Fund III, we have made significant purchases in hot markets where rental properties are in high demand. Combined with our track record of growing net operating income, we feel that these myths don’t have a leg to stand on.

If you are interested in reviewing our current offering, please visit https://info.ashcroftcapital.com/fund, or schedule a call with our Investor Relations Team at investorrelations@ashcroftcapital.com. We look forward to the opportunity to work with you and align our investment interests.

Sources:

- “Board of Governors of the Federal Reserve System: Policy Tools” Board of Governors of the Federal Reserve System, 26 July, 2023, https://www.federalreserve.gov/monetarypolicy/openmarket.htm.

- “United States 30-Year Mortgage Rate” Trading Economics, 2023, https://tradingeconomics.com/united-states/30-year-mortgage-rate#:~:text=30%20Year%20Mortgage%20Rate%20in,percent%20in%20January%20of%202021.

- Odion-Esene, Brai & Jennings, Chris, “Compare Current Mortgage Rates” Forbes, 29 August 2023, https://www.forbes.com/advisor/mortgages/mortgage-rates-08-23-23/.

- Tayeb, Zahra, “The US housing market is defying doomsayers thanks to a supply crunch, Fannie Mae says” Markets Insider, 4 July, 2023, https://markets.businessinsider.com/news/stocks/us-housing-market-home-prices-supply-crunch-demand-fannie-mae-2023-7.

- “Middle-Income Buyers Face the Most Severe Housing Shortage” National Association of Realtors, 8 June, 2023, https://www.nar.realtor/newsroom/in-the-news/middle-income-buyers-face-the-most-severe-housing-shortage.

- U.S. Census Bureau, “Rental Vacancy Rate in the United States” FRED, Federal Reserve Bank of St. Louis, 29 August, 2023, https://fred.stlouisfed.org/series/RRVRUSQ156N.

- Helhoski, Anna, “Rental Market Trends in the U.S. — Rent Growth Finally Slows” nerdwallet, 11 August 2023, https://www.nerdwallet.com/article/finance/rental-market-trends.

- Fisher, Ken, “You don’t need perfect timing, just time, to earn big returns in the stock market’ USA Today, 16 September 2018, https://www.usatoday.com/story/money/columnist/2018/09/16/stock-market-2018-avoid-timing-returns/1303307002/.