June 22, 2023

By: Ben Nelson, Investor Relations Regional Manager

Mark Twain once said, “History doesn’t repeat itself, but it often rhymes.” Pondering that quote and searching for a corresponding rhyming verse in US market history, I, like many others, am at a loss. The environment we are seeing right now is unique in the history of global finance and is uncharted territory for both large and small investors. On the one hand, markets seem especially resilient, with major US indices like the S&P 500 and NASDAQ recently reaching their highest levels in 14 months [1] and unemployment numbers holding at their lowest levels in the past 20 years [2].

On the other hand, the phrases “incoming recession,” “stubborn inflation,” and “rising interest rates” come up as often as “bull market” and “tremendous growth.” It’s downright confusing, from economics PhDs trying to explain it to Main Street investors trying to navigate it on their own. Where can you put your capital in a market like this and still sleep comfortably at night? I am a firm believer in investing in things that are essential to people’s lives, like affordable housing, and I think there are opportunities to capitalize during these times if you know where to look. Let’s explore together the different forces driving today’s market and try to make sense of them.

Real Wage Growth and the Embattled Consumer

The May 2023 US CPI data came in at +4.0% year over year [3], halving the +8.0% report from May 2022 [4] and being hailed by policymakers as another signal that the battle against inflation is gaining positive ground. On the heels of that news, I recently asked a large group of investors if they felt falling inflation was trickling down to their respective households and was met with a resounding “no.” I am sure many who are reading this will agree: our money still feels stretched thin. Although inflation may be falling, as measured by a highly complicated and potentially flawed formula, most investors aren’t experiencing any relief. To make matters worse, real wages, loosely defined as wages adjusted for inflation [5], have fallen in 25 of the past 26 consecutive months [6], resulting in a US consumer savings rate roughly half of its average over the past decade [7] and the addition of $250 million in household credit card debt [8].

The Housing Shortage That Won’t Quit

If you’ve ever purchased a home, you’ve probably heard of the term “housing inventory.” This is the measure of homes currently for sale in any market and is typically measured in months of sales available at the current pace. I inquired with my realtor about the current inventory in Collin County, Texas (population estimated at 1.2 million and growing; [9], and was told it has dropped by 12% from May 2022. It feels like every time I see a home for sale in my area it is akin to discovering a four-leaf clover. Further, the current national housing inventory would last only three months, far below the average over the past decade. Redfin estimates there are 39% fewer homes for sale than before the COVID-19 pandemic, highlighting that existing homeowners with a low fixed-rate mortgage aren’t leaving willingly (10). The lack of inventory combined with the shortage of housing creates an interesting dilemma. It most certainly means that homebuilders are racing to shore up that shortage and begin new housing construction, but new construction takes time, and potential homeowners are still staring down a 7% mortgage rate.

Cost to Rent vs. (High) Cost to Own

Paulina Cachero of Bloomberg recently reported that “the buy-to-rent premium hasn’t been this big since 2006, at the peak of the housing bubble” [11]. Realtor.com found that across the 50 largest metropolitan areas in the US, an average renter pays about 40% less per month than a first-time homeowner, based on asking rents and monthly mortgage payments [12]. It’s no wonder that nationwide mortgage applications dropped to a 28-year low only three months ago [13].

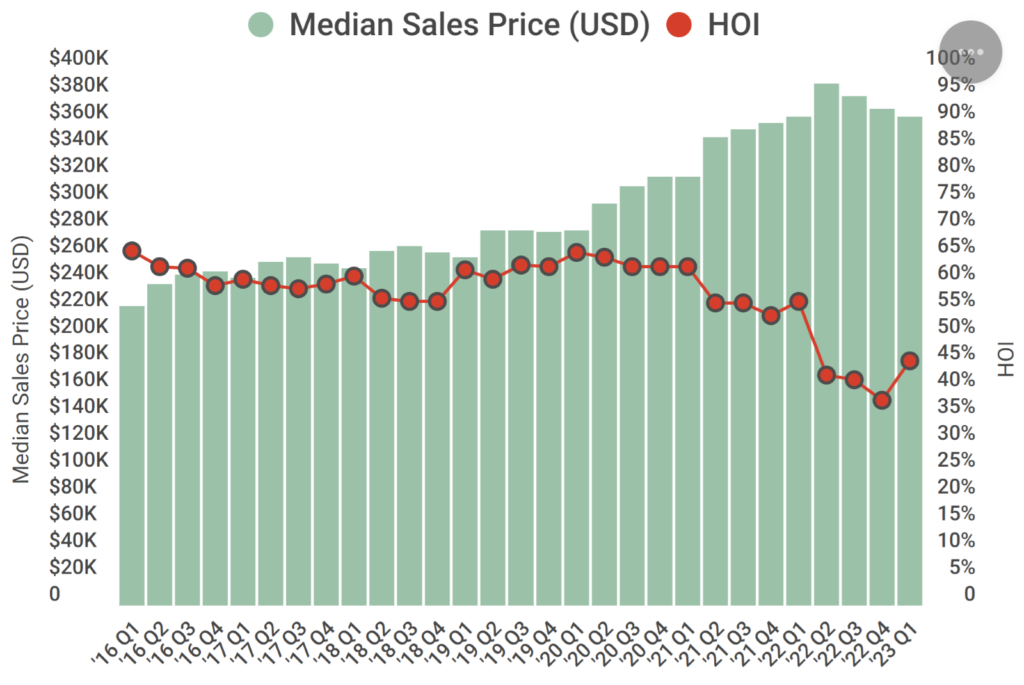

This chart from the National Association of Home Builders [14] details the contrast between the median sales price of an average home in the US against the Home Affordability Index from 2016 to the first quarter of 2023. The trend is moving in the right direction in Q1, but is it enough to move people toward home ownership? Are we in a housing affordability crisis right now? As the old saying goes, “If it looks like a duck, walks like a duck, and quacks like a duck, then it just may be a duck.”

The Long and Now the Short

I realize I dumped a lot of data on you just now, but I did it to make a few points. First, the typical US consumer buying power is much weaker than at any time in recent history. On average, consumers have less purchasing power, lower savings, and more debt than the generations that preceded them. This is not a good formula for those wanting to buy a home. Second, buying a home is more expensive than most consumers can afford. Low inventories have caused a rise in home values to levels that most people cannot comfortably stomach. Combined with 30-year fixed mortgage rates at 7%, most are choosing another path. Third, the contrast between the cost of home ownership and renting is unusually wide, and consumers have taken notice. Many who had planned to own a home one day have decided that being a renter has many lifestyle advantages that ownership does not. According to a report from the National Multifamily Council, by 2035 the US will still be 4.3 million apartments short of meeting the demand for affordable housing [15].

Focusing on Necessity and Demand

Nothing in the world of investing is a certainty, but the data suggests that the demand for apartment living will remain elevated for years to come. At Ashcroft Capital we buy affordable class B apartments in high-growth markets with diversified economies and then elevate them with our value-add strategy. Our limited partners have been watching us execute this model for years and have continued to invest despite rapid changes in borrowing costs. Higher interest rates have compressed the value of our target properties, creating outstanding opportunities to acquire high-demand cash-flowing assets at an attractive discount. The Ashcroft Value Add III fund is in the process of buying our second and third properties in the fund in submarkets we believe have significant running room, and we would love to tell you more. Affordable housing is a human necessity and investing with a knowledgeable syndicator in high-demand checks many of the boxes. So does this period in market history ”rhyme” with another? Not likely, but it’s possible a new verse is being written that will provide clues for future generations.

If you would like to learn more about investing in multifamily assets, or have questions about our current fund, we encourage you to schedule a call with our Investor Relations Team.

Sources:

- Evans, Brian, and Kim, Hakyung, “S&P 500, Nasdaq rally for sixth straight day as traders hope Fed’s rate-hiking cycle is nearly over: Live updates” CNBC, 15 June, 2023, https://www.cnbc.com/2023/06/14/stock-market-today-live-updates.html.

- “The Employment Situation — May 2023” U.S. Department of Labor, Bureau of Labor Statistics, 3 June, 2023, https://www.bls.gov/news.release/pdf/empsit.pdf.

- “Consumer Price Index Summary” U.S. Bureau of Labor Statistics, 13 June, 2023, https://www.bls.gov/news.release/cpi.nr0.htm#:~:text=(ET)%20Tuesday%2C%20June%2013,a%20seasonally%20adjusted%20basis%2C%20after.

- “Consumer Price Index – May 2022” U.S. Bureau of Labor Statistics, 10 June, 2023, https://www.bls.gov/news.release/archives/cpi_06102022.pdf.

- “Real Wage” United Nations Economic and Social Commission for Western Asia, https://archive.unescwa.org/real-wage.

- Bilello, Charlie (@charliebilello). “US wages outpaced inflation on a YoY basis in May by 0.2%, ending the ignominious streak of 25 consecutive months of negative real wage growth. Great to see, hopefully continues.” Twitter 13 June, 2023, 9:19 AM, https://twitter.com/charliebilello/status/1668608946242830338.”

- Waters, Carlos, “Americans are saving far less than normal in 2023. Here’s why” CNBC, 27 April, 2023, https://www.cnbc.com/2023/04/27/us-personal-savings-rate-falls-near-record-low-as-consumers-spend.html.

- Tedder, Michael, “Here’s How Much Americans Owe In Credit Card Debt” The Street, 2 June, 2023, https://www.thestreet.com/money/heres-how-much-americans-owe-in-credit-card-debt.

- “Collin County Profile” The County Information Program, Texas Association of Counties, 2023, https://txcip.org/tac/census/profile.php?FIPS=48085.

- Rosen, Phil, “Housing market inventory keeps declining and that’s bad news for homebuyers” Insider, 20 June, 2023, https://www.businessinsider.com/housing-market-inventory-real-estate-investing-property-mortgage-rates-buyers-2023-6.

- Cachero, Paulina, “Buy-or-Rent Premium Is Highest Since 2006 Housing Bubble” Bloomberg, 24 March, 2023, https://www.bloomberg.com/news/articles/2023-03-24/should-i-buy-a-home-mortgage-premium-vs-renting-is-highest-since-2006#xj4y7vzkg.

- Rosen, Phil, “Housing market inventory keeps declining and that’s bad news for homebuyers” Insider, 20 June, 2023, https://www.businessinsider.com/housing-market-inventory-real-estate-investing-property-mortgage-rates-buyers-2023-6.

- Lorsch, Emily, “Rent or buy? Here’s how to make that decision in the current real estate market” CNBC, 26 April, 2023, https://www.cnbc.com/2023/04/26/rent-or-buy-heres-how-to-decide-in-the-current-real-estate-market.html.

- “NAHB/Wells Fargo Housing Opportunity Index (HOI)” National Association of Home Builders, 2023, https://www.nahb.org/news-and-economics/housing-economics/indices/housing-opportunity-index?mf_ct_campaign=yahoo-synd-feed.

- “Apartment Supply Shortage” National Multifamily Housing Council, 2023, https://www.nmhc.org/industry-topics/affordable-housing/apartment-supply-shortage.