July 13, 2023

By: Travis Watts, Director of Investor Development

It is natural to look to avoid pain points. We all have them, and they can be anything that prevents us from living an optimal lifestyle. From mundane tasks we would rather not do, to ongoing problems that persist every month. Having passive income not only helps monetarily alleviate pain points, but also emotionally. This article will discuss ways to address eliminating your pain points by investing in passive income.

Not financial advice. I’m not a CPA, an attorney, or a financial advisor. This article is intended for educational and informational purposes only.

Let’s begin with a quote from Aristotle (over two thousand years ago).

Here’s a more modern-day quote from Tony Robbins…

Without a doubt, for thousands of years, humans have been looking to avoid complications. Many investors, myself included, think of long-term goals. I’ve asked hundreds of investors about their goals over the years and nearly every time, investors share long-term goals with me.

Examples include:

“I want to retire from my corporate job by the age of ____.”

“I want to have ____ amount of net worth when I retire.”

“I want to create _____ amount of passive income per month in the next 10 years.”

Today I want to explore how you could start benefiting much sooner. What if you could start expanding your lifestyle this year?

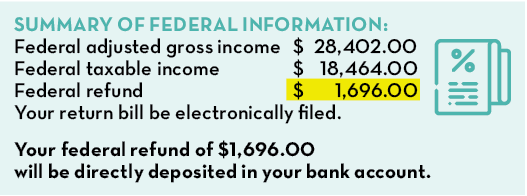

I’ll begin with a quick story. There was a time in my life, where I accrued bad debt from a hasty auto loan. I had purchased a luxury vehicle that frankly, I could barely afford. This also came at a point where my gross income was less than $30,000 per year.

As you can imagine, any re-occurring expense that I had in my life at that time was a big deal. This loan payment was a major pain point that made me cringe every time it came due. I would fill up with anxiety, because I worried that some unknown expense was going to pop up that would prevent me from making the payment causing me to lose my car.

(Not my house by the way ^)

In hindsight, my car payment was only $500 per month. But again, putting this in perspective of someone who earns less than $30,000 gross income per year, it was a big deal at that time. Like most people, I would go to work, save up money, and make my payment at the first of the month, and then my anxiety would drop down for two or three weeks until I started thinking about having to make the payment again. Living this way was uncomfortable but did you know….?

According to Lending Club, 60% of Americans Now Living Paycheck to Paycheck (As of January 2023)

This was my life just before I started investing in real estate, which was a huge game changer for me. Specifically, it was passive income that was the turning point. My first introduction to passive income was when I rented out a room in my first house. Today, this is called “house hacking”, back then it was called “having a roommate”. In any case, my roommate began paying me $600 per month in exchange for a furnished bedroom.

What did I do with this $600 check? I made my car payment! I effectively learned how to have someone else pay for my car. From an emotional standpoint, I eliminated one of my biggest pain points, which was much more satisfying than the money.

Throughout the years, I’ve used a similar strategy, and it’s really quite simple:

#1 Make an investment that produces passive income

#2 Use the passive income to eliminate a pain point

Here are a few practical examples of how you can apply this same strategy:

#1 Let’s say you have kids and they constantly make a mess of the house. This would be an example of a pain point. Let’s assume a house cleaning service cost $150 for a group or individual to come clean your house. Cleaning twice per month would cost $300.

What if you first invested $50,000 into an asset that produced passive income? Say that the investment offered an 8% annualized yield. Therefore, the monthly distribution would provide $333, which could be used to hire a house cleaning service, thus eliminating this pain point.

#2 Let’s say you have a high-stress job and it’s difficult to unwind at the end of the week. Using the same example as before, what if you invested $50,000 into an asset that produced passive income at an 8% annualized yield? You could consider setting up a massage on a Friday or a Saturday, two or three times per month and use your monthly distribution to pay for it. Thus eliminating the pain point and making your weekends a little more enjoyable.

#3 Here’s an example for those who want to take this strategy to the next level. MarketWatch released an article in 2022 stating that Ford Motor Company’s customers had an average auto loan payment of $832 per month for those who purchased a vehicle and financed it. This is compared to the average Ford lease payment of only $516 per month.

Consider this…

Instead of buying vehicles throughout a lifetime, financing them, and watching the “investment” disappear with depreciation, what if you invested $100,000 into a passive income producing asset that yielded 8% a year on average? That could generate a $666 monthly distribution.

Keep in mind with this example, I’m not even discussing potential equity upside on the investment, meaning the investment could increase in value over time (depending on what it’s invested in). I’m only talking about the possible passive income component.

Something else to consider…

#1 This strategy does not involve spending $100,000, as with buying vehicles that depreciate over time. This is simply moving cash into an investment, preserving the principle, and only using the passive income component to lease the vehicles.

#2 Compare this to what most people do. For example:

- If a person buys five cars in their lifetime

- They pay an average of $50,000 each time (including the taxes, fees, and registration)

- Each car depreciates to $10,000 because of high mileage and the ageing of the vehicle

- The vehicles get traded in for a new vehicle each time

This amounts to $200,000 in capital losses throughout a lifetime, and this doesn’t include any financing and interest cost if the vehicles were financed.

The Takeaway

Focusing on passive income can be a unique way to view investing. Most people are equity focused and use a “buy-low and sell-high” strategy. Most also defer the benefits of investing until retirement. You don’t have to suffer until your golden years and have pain points build up over time. You can start eliminating pain points today, using passive income as your tool.

I want to leave you with this quote from Benjamin Franklin:

I recently launched a series on Ashcroft Capital’s YouTube Channel called “Passive Income Lifestyle” which is designed to help you enhance your lifestyle and learning the game of passive income.

If you ever have questions, you can reach me at travis@ashcroftcapital.com. I’m always happy to help and have a conversation. I appreciate you taking the time to read. I hope you found some value in this short article!

To Your Success,

Travis Watts