October 9, 2024

By: Travis Watts, Director of Investor Development

Every quarter, as part of our Ashcroft Insights Market Report, we highlight industry reports, data, and trend research for multifamily investors. Below is an overview of what we’ve been reading and studying as we enter Q4 2024:

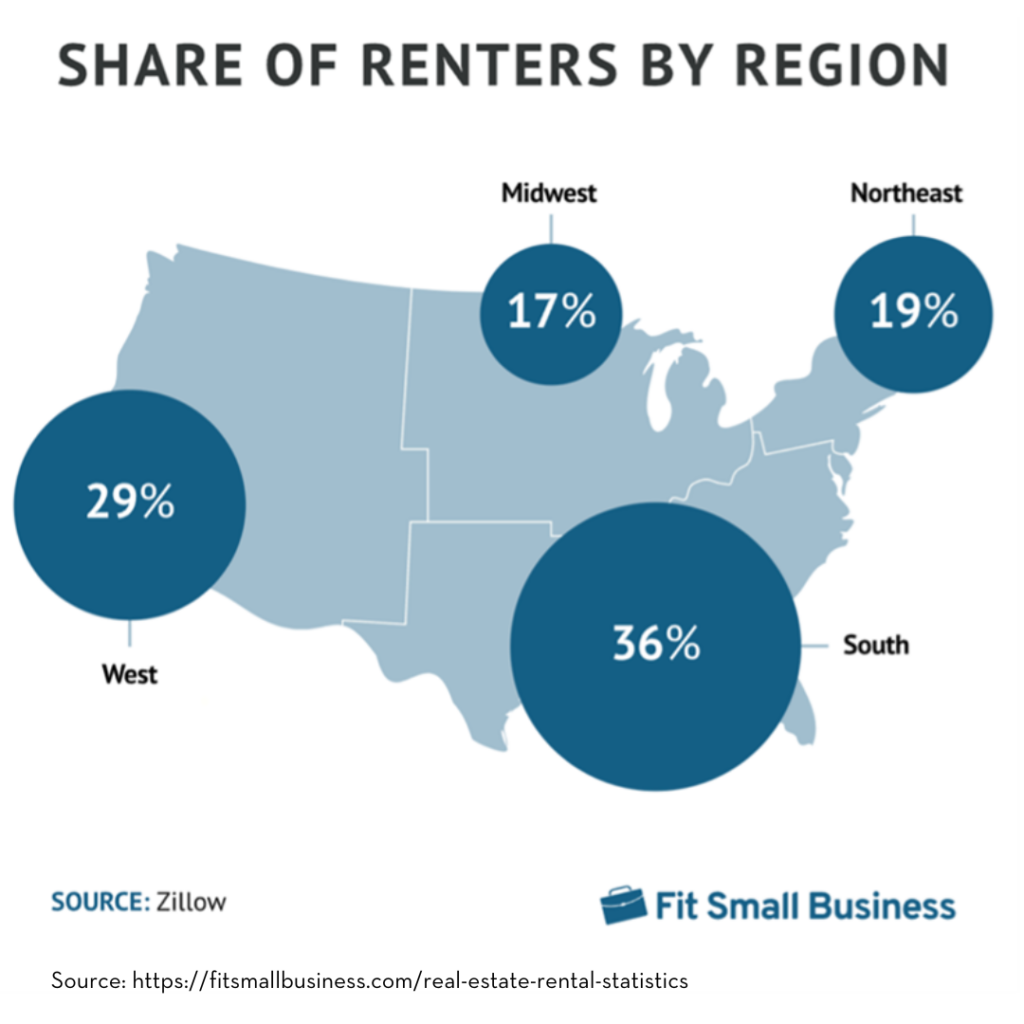

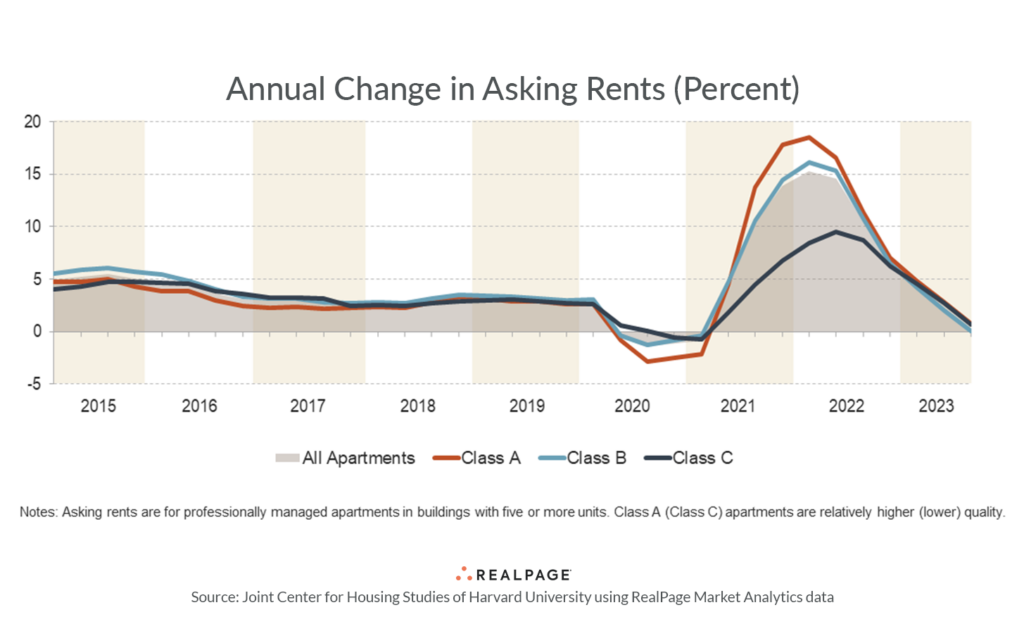

Improving Market Conditions: According to Multi-Housing News, the U.S. multifamily market is showing signs of gradual improvement, despite challenges in certain regions. National rent growth has rebounded, with average rents rising modestly by 0.8% year-over-year as of August, while occupancy rates for stabilized assets held steady at 94.7%. These improving conditions offer a promising outlook for multifamily apartments, particularly in core and stabilized markets where demand remains strong.

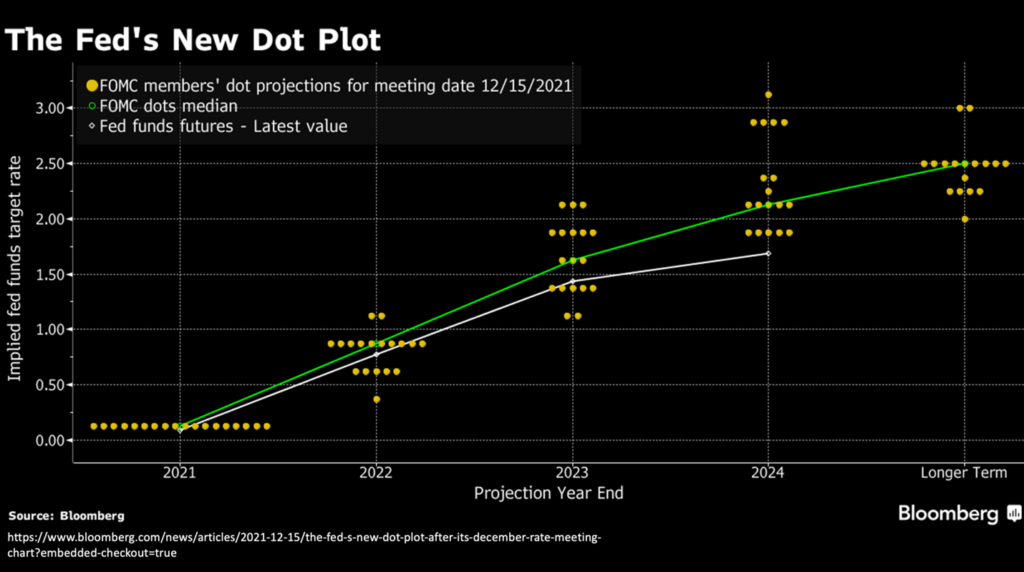

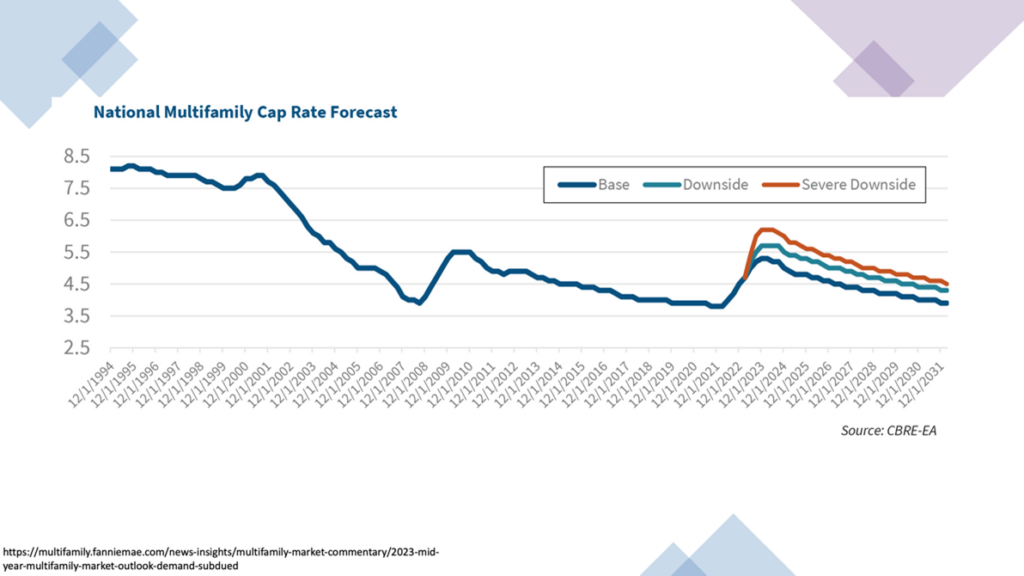

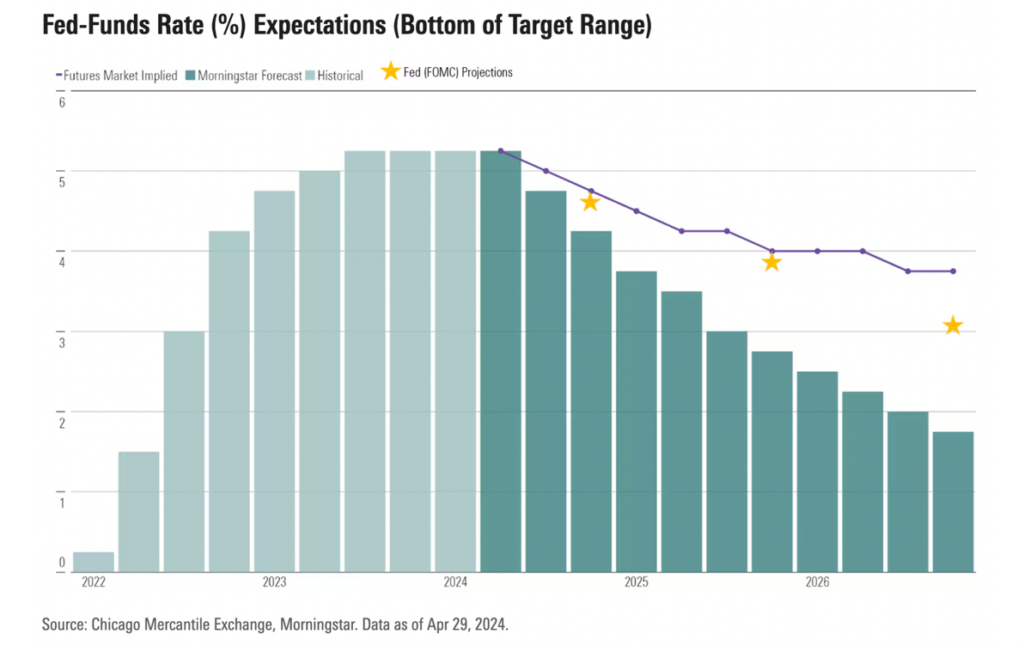

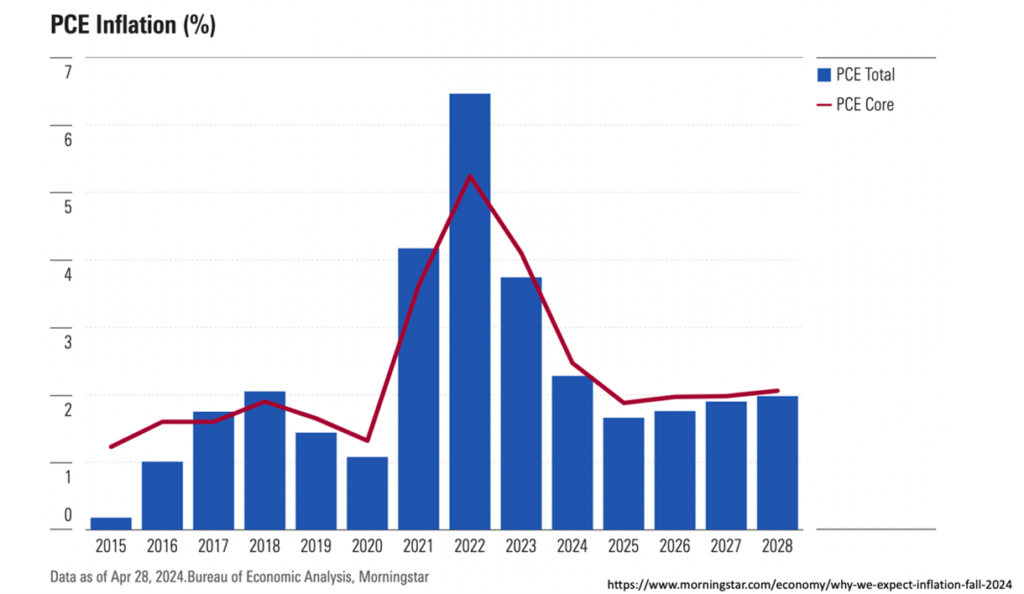

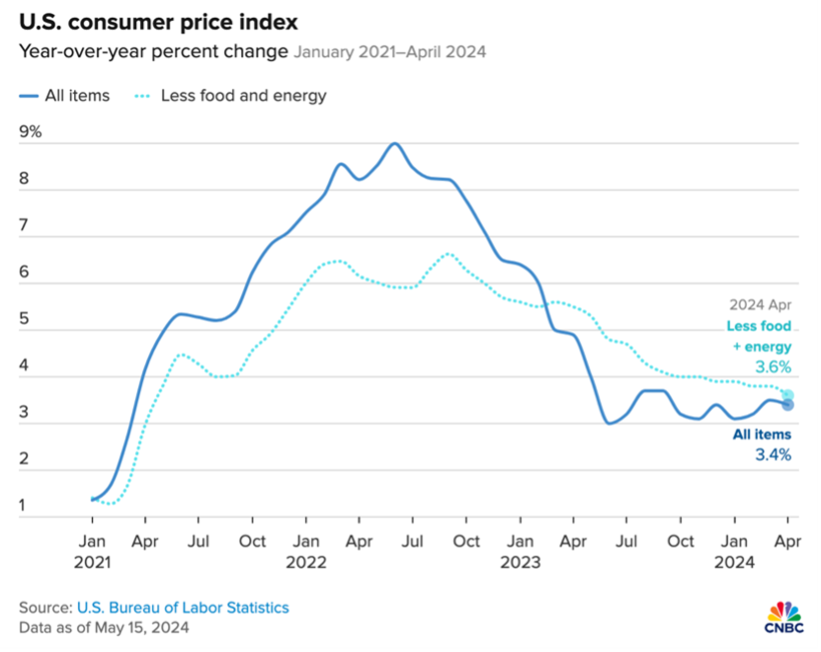

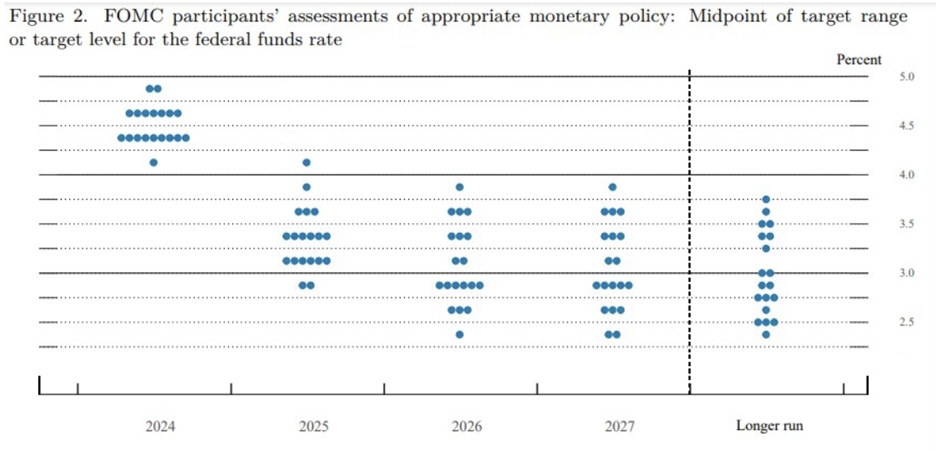

Rates on the Decline. On September 18, 2024, the federal funds rate was reduced by 50 basis points or 0.5%. Recent Federal Reserve projections suggest that interest rates may decline in the future. The new target rate is 4.75% to 5%. Powell said on September 18th the Fed projects the interest rate falling to about 4.4% by the end of this year and 3.4% by the end of 2025.

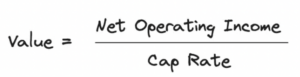

For multifamily real estate investors, lower interest rates present opportunities, as they reduce borrowing costs. This can increase cash flow for real estate properties and improve investment returns. Additionally, this could create a favorable environment for investors, as multifamily assets typically perform well in low-rate environments, where financing costs are key. Investing in such assets now could yield significant long-term benefits as rates decrease, potentially driving higher demand and property values.

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240918.pdf

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240918.pdf

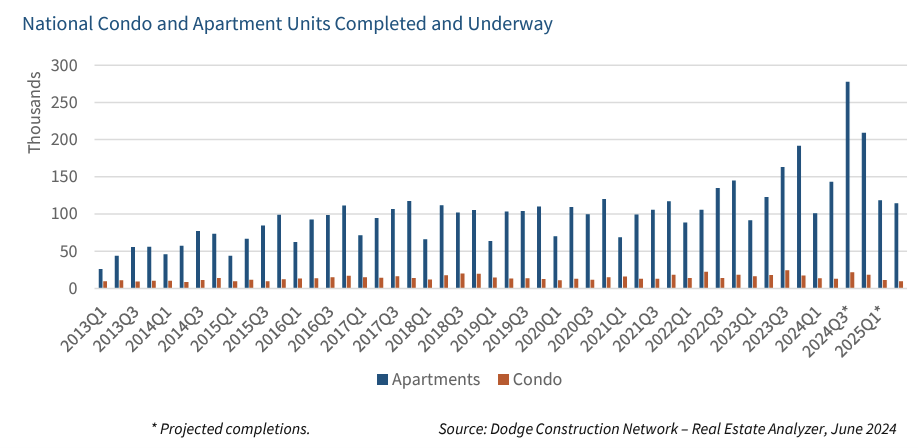

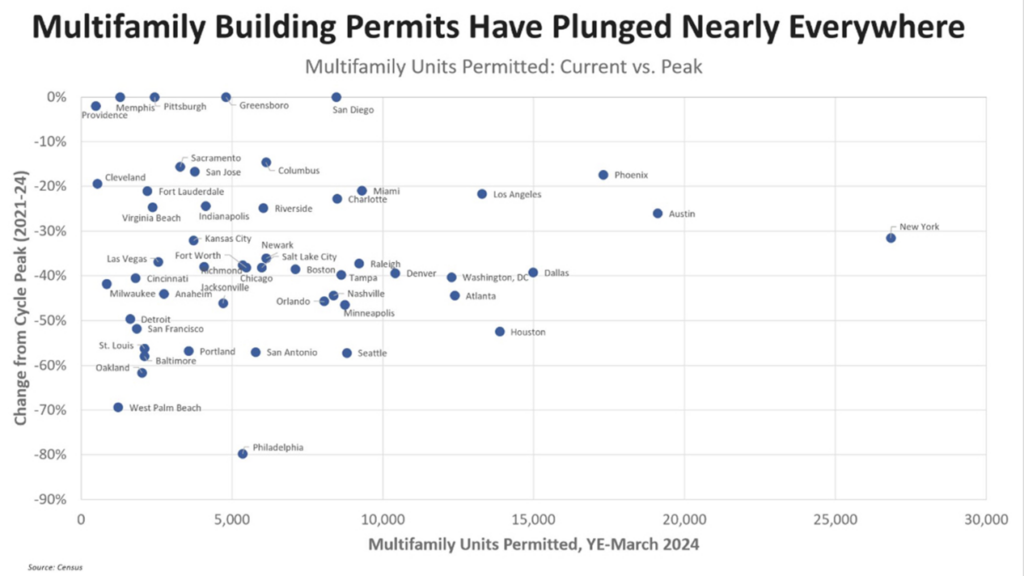

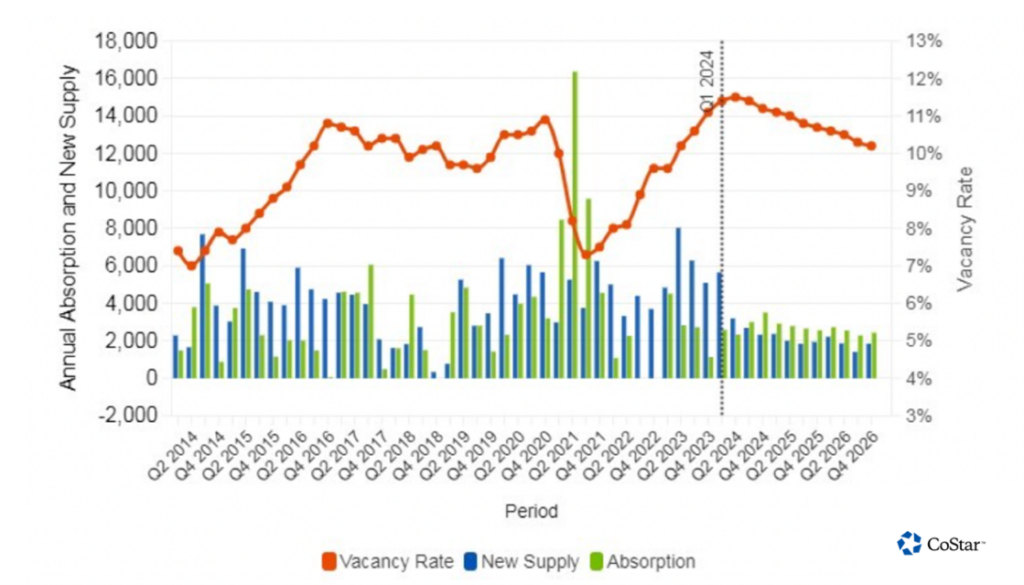

Construction Slowdown: Multifamily construction in the U.S. is experiencing a slowdown after reaching post-pandemic highs. The number of new starts has significantly decreased, particularly as developers have pulled back in response to rising costs and economic uncertainty. According to the National Association of Home Builders (NAHB), multifamily starts are projected to drop by 20% in 2024. Despite this, a significant number of units remain under construction, which will continue adding to supply throughout the year and into 2025. This supply influx, paired with shifting demand trends, indicates a period of stabilization for the multifamily market. The slowdown may result in significantly lower deliveries in 2025 and 2026, which could in turn boost rental growth.

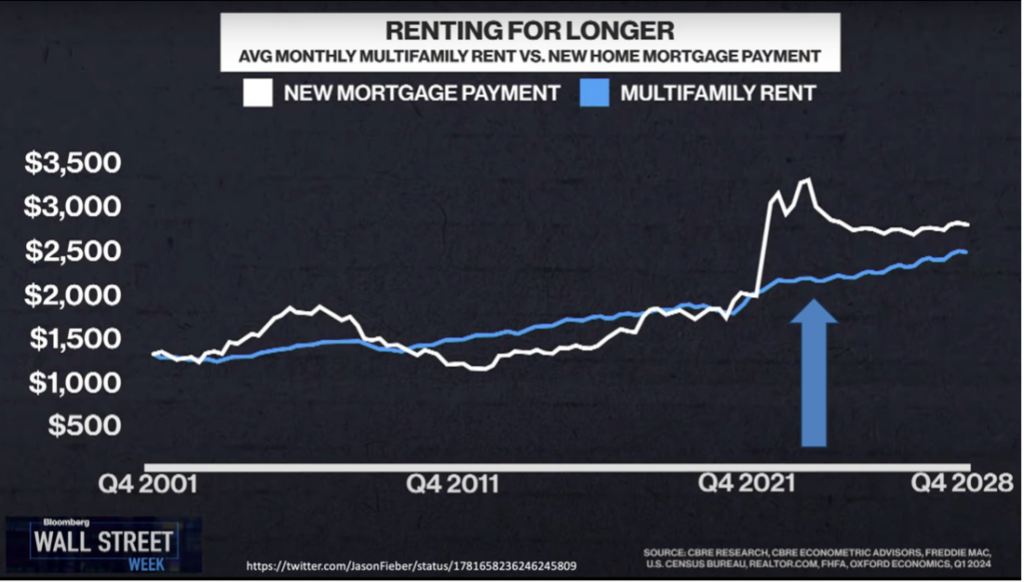

Renting Affordability: According to the Fannie Mae Home Purchase Sentiment Index released in September 2024, an overwhelming 83 percent of consumers believe it’s a bad time to buy a house. Renting remains more affordable than owning a home in many parts of the United States, particularly in major metropolitan areas. Rising home prices and high mortgage costs continue to be challenges for home buyers. According to Freddie Mac, the 30-year fixed rate mortgage saw the largest one-week increase since April, following the release of a stronger-than-expected September jobs report. Rates are hovering around 6.32% for a 30-year fixed-rate mortgage as of October 10th.

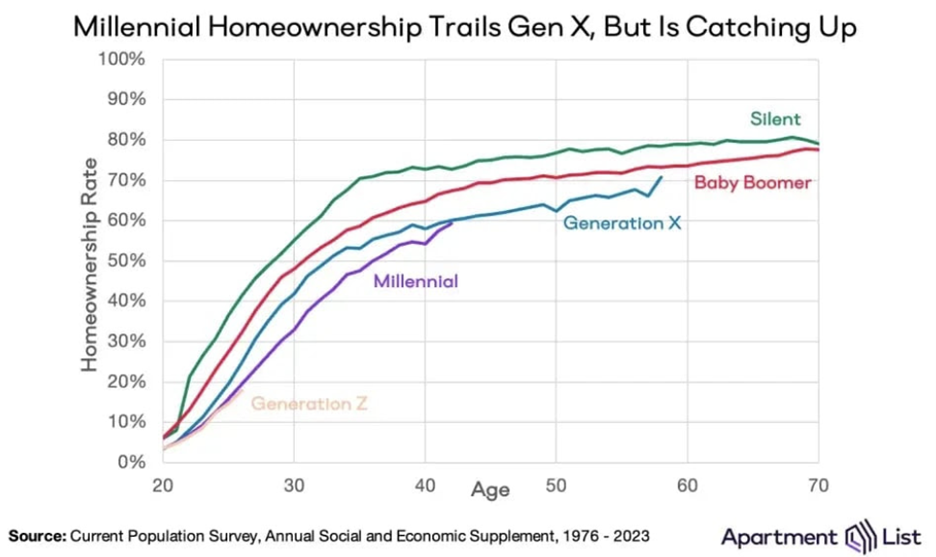

According to Apartment List, millennials have developed a reputation for struggling in the housing market. As a comparison, by age 30, 55 percent of the Silent generation owned homes, compared to 48 percent of Boomers, 42 percent of Gen Xers, and just 33 percent of Millennials.

New survey data from Apartment List shows that in 2022, 24.7% of millennials said they plan to continue renting long-term rather than buy a house. This is nearly twice the percentage from a survey in 2018 (13.3%).

Here are the reasons 2022 survey respondents gave for continuing to rent long-term:

- 74% said they cannot afford to buy a home right now

- 42% said they like the flexibility of renting

- 36% said they prefer to avoid home maintenance and other extra costs

- 29% said buying a home is financially risky

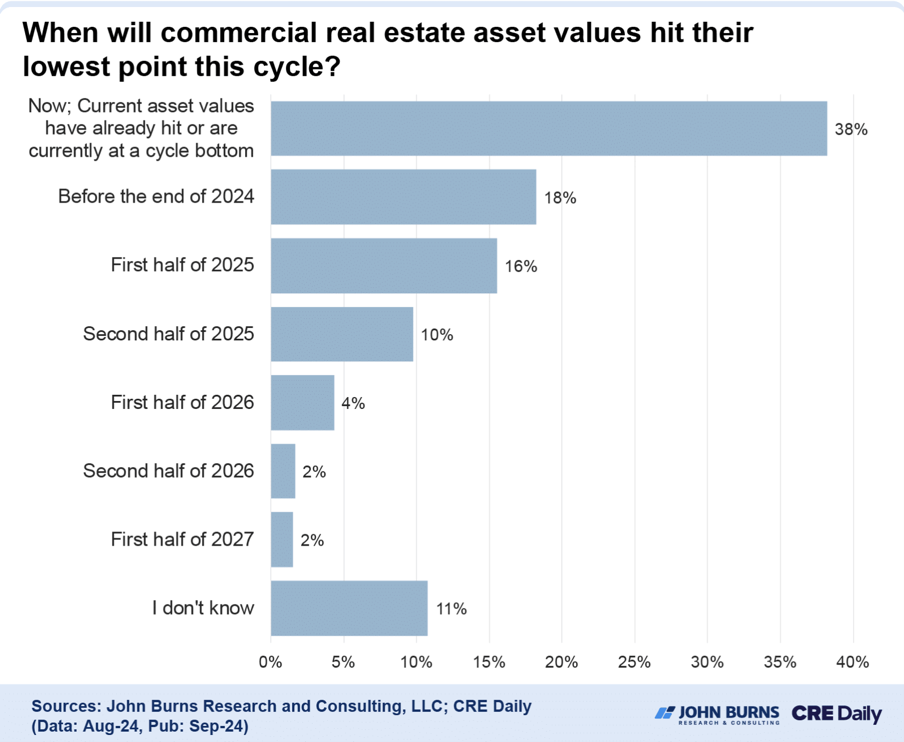

Investors believe the worst is over: According to John Burns Research and Consulting, despite recent challenges in commercial real estate (CRE), most investors expect growth in the near future. Over half (56%) expect CRE asset values to bottom out in 2024, while 38% think values have already reached their lowest point.

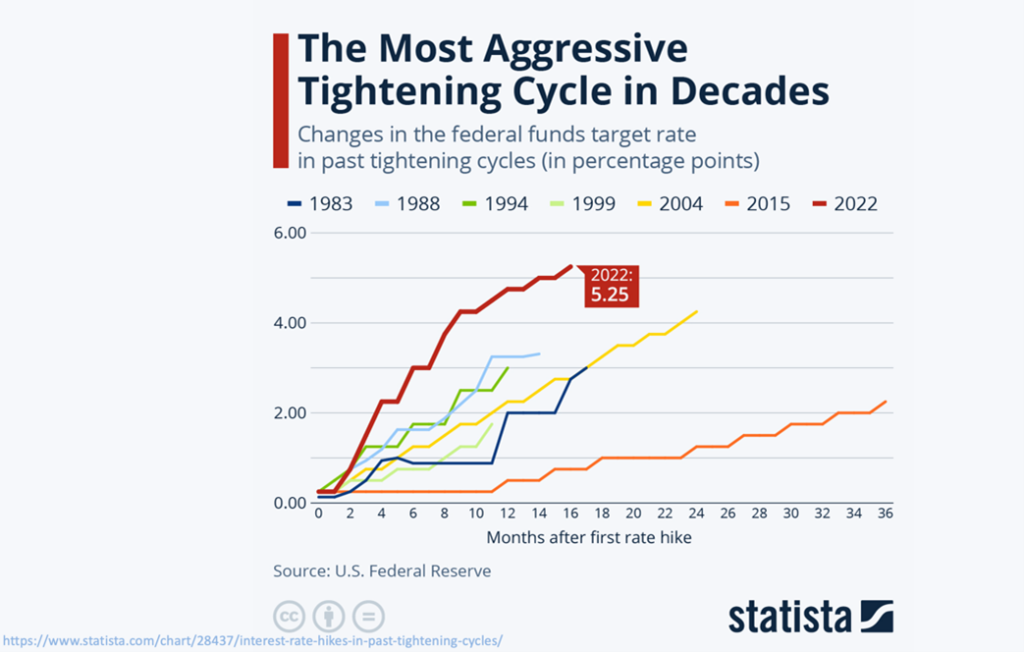

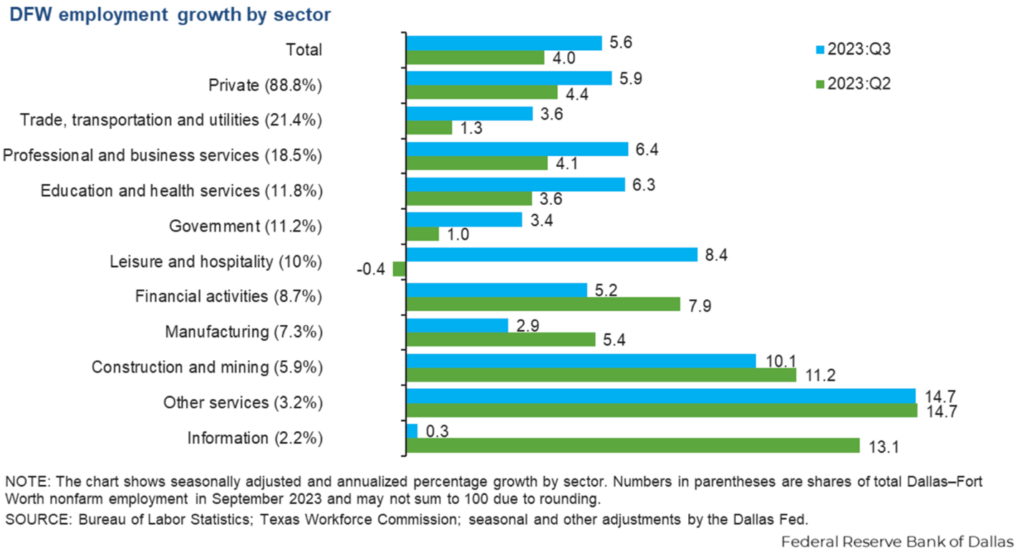

The Federal Reserve’s aggressive rate hikes beginning in 2022 largely dried up capital, hitting the commercial real estate sector particularly hard. The office sector struggled due to the shift to remote work, while the multifamily sector faced oversupply. Signs of easing inflation and softening labor markets are fueling expectations for additional interest rate cuts, which could revitalize investment activity. For apartments, we’re seeing a solid labor market, higher-than-expected demand/absorption, and the prospect of lower rates driving optimism.

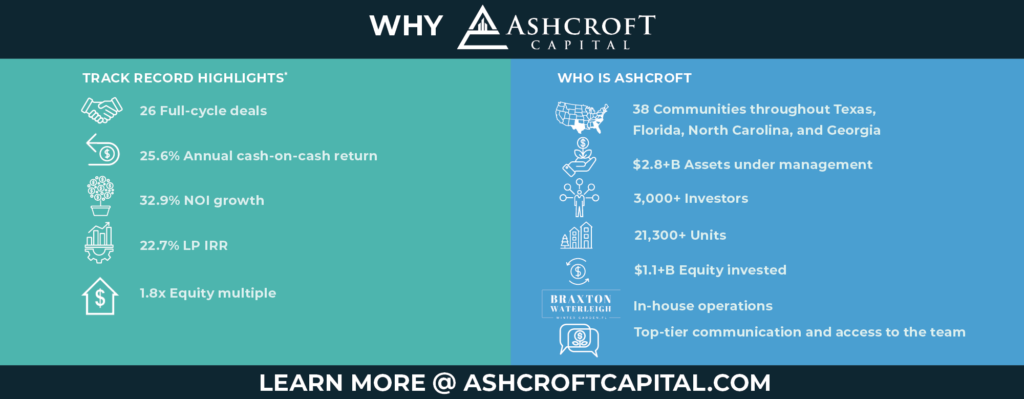

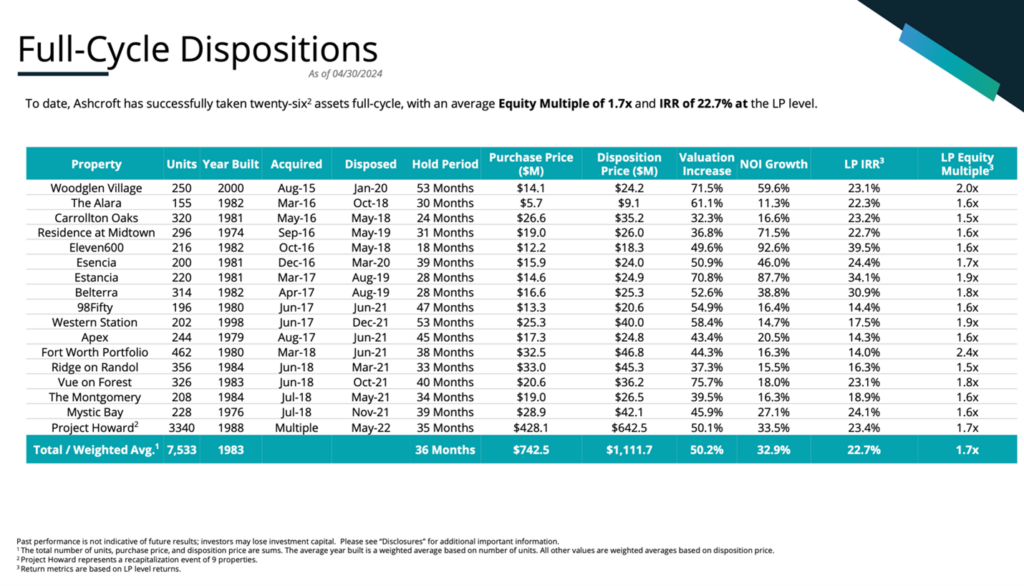

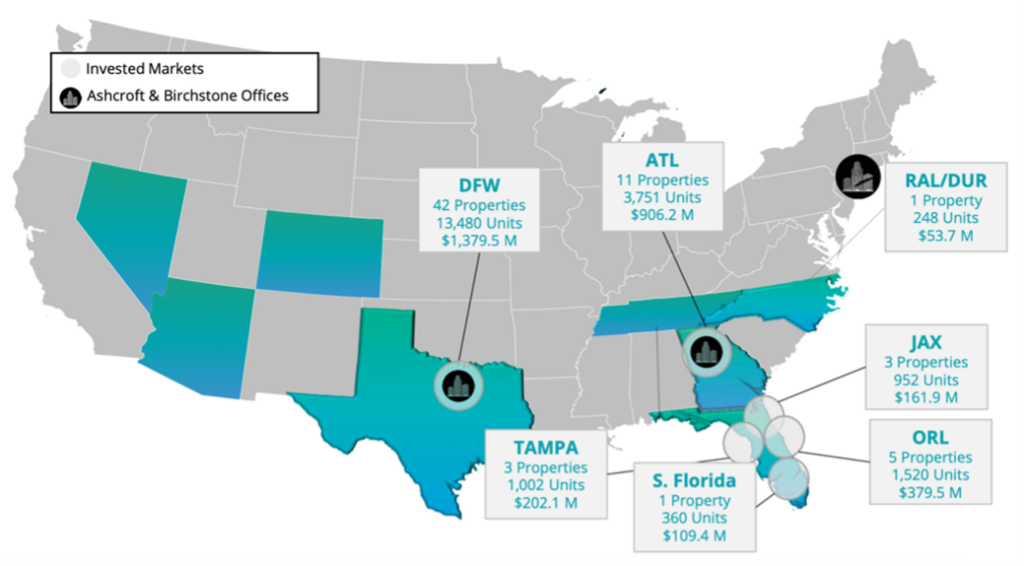

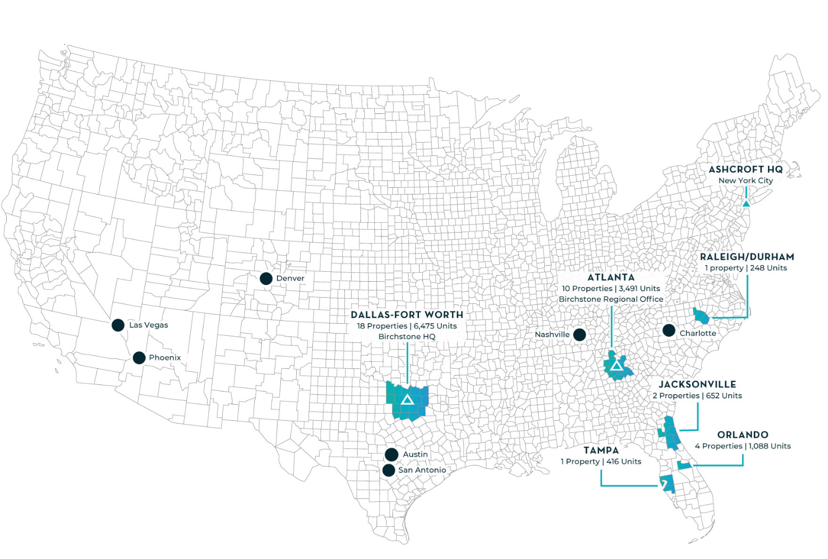

Conclusion: At Ashcroft Capital, we remain committed to identifying investment opportunities that align with current market trends. As always, we will continue to monitor and report on key economic indicators to keep you informed.

If you have any questions, suggested topics or would like to discuss future opportunities, don’t hesitate to reach out. We appreciate your trust in Ashcroft Capital. For additional articles and resources, please visit our News Section.

LATEST OFFERING

- Class A property located in top 3 fastest growing submarkets

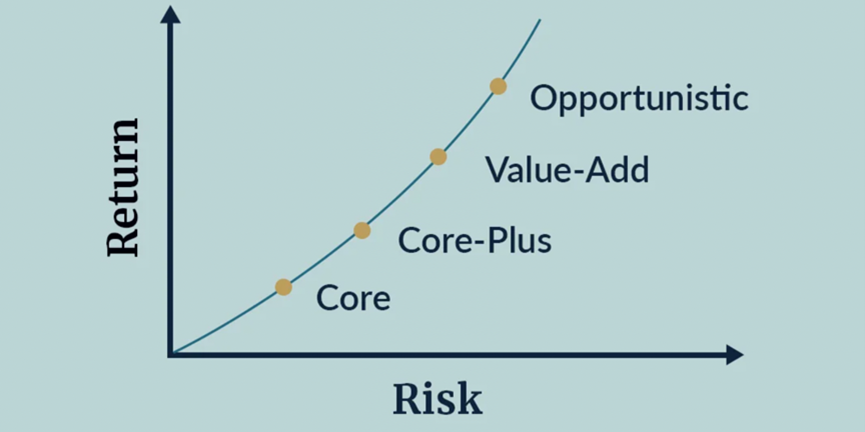

- Value-add business plan

- Purchased below replacement cost