April 26, 2024

By: Travis Watts, Director of Investor Development

Experts Predict Return to Normalcy for Apartment Rents

As the multifamily rental market rebounds from the turbulent economic fluctuations, there is an emerging consensus among experts that we are witnessing a return to traditional market dynamics.

In this episode of Multifamily Market Report, Director of Investor Development, Travis Watts highlights this change, underscoring the move toward stability after years of unpredictable rent growth.

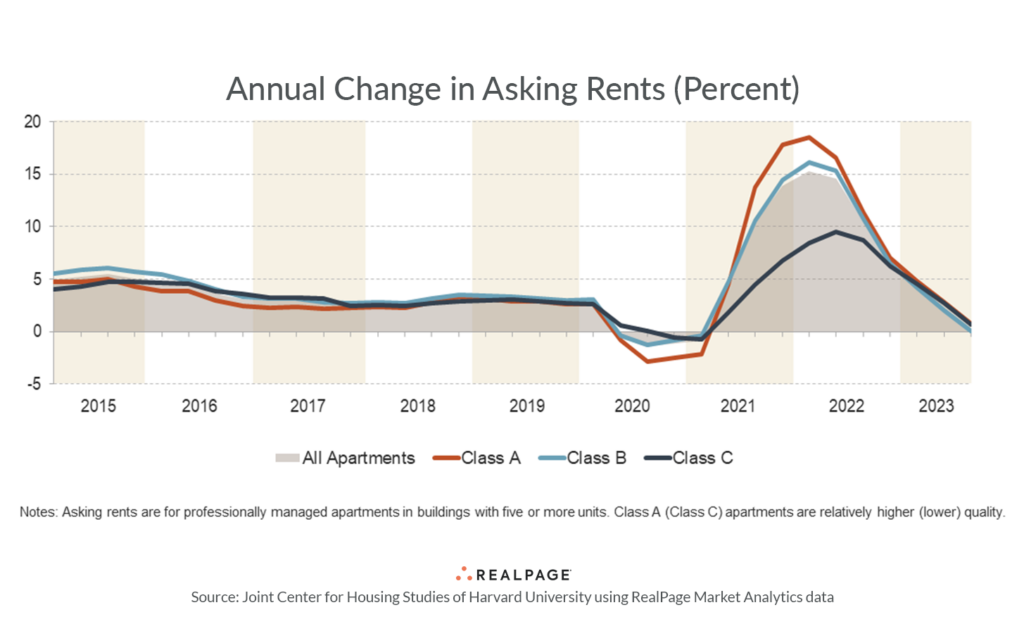

A recent chart from RealPage provides a complete view of asking rents from when Ashcroft Capital became a company in 2015. The trajectory of apartment rents was hovering steadily between 4-5% annually until the pandemic’s onset disrupted this pattern.1

The economic shock of 2020, characterized by widespread job losses and business closures, led to a sharp drop in demand. However, a surge in government stimulus subsequently reinvigorated the market, resulting in a substantial rent increase in 2021. 2 This spike, although significant, was recognized as neither healthy nor sustainable.

Then demand dropped as people lost their jobs, businesses closed, and the economy struggled. That was the unfortunate reality of 2020. Soon, stimulus money was pumped out to Americans and businesses nationwide. As the economy began to reopen, rehire, and recover, a high level of demand was placed on apartments once again, seen by the massive uptick in rents in 2021.3

Why Double-Digit Growth is Unsustainable

Just imagine for a moment if apartment rents went up 10% a year for the foreseeable future, and the average American was getting about a 4% annualized pay raise. Obviously, apartments and shelter would become unaffordable for Americans after about a decade of this and completely unsustainable after 20 or 30 years.

Reflecting on these trends, it’s clear that continuous double-digit growth would eventually render housing unaffordable, outstripping average annual pay raises and placing significant financial strain on American households.

This is why historic data from RealPage shows long-term average rent growth has been about 2.9% a year. Freddie Mac supports this view in their 2024 economic forecast, suggesting a more modest rent growth of about 2.5% this year.4

The normalization process was further influenced by the Federal Reserve’s interventions in 2022. The Federal Reserve began pumping the brakes on the overheating economy, and in turn aggressively raising interest rates. At the same time, government stimulus measures were gradually phasing out.

Ongoing Multifamily Demand Fuels Apartment Rents in 2024

As you undoubtedly stumble across fear-based headlines about no rent growth or declining rent growth in the multifamily sector, remember that this is a return to normalcy. The fundamentals of the multifamily sector remain strong. We cannot expect double-digit rent growth year over year.

Despite the concerns of declining growth rates, the demand is out there. The ongoing need for rental units is bolstered by various factors, including the high cost of single-family homes which continues to price out many individuals, the steady stream of college graduates entering the market, and overall population growth.

As the multifamily rental market recalibrates, it’s crucial for investors and stakeholders to understand the implications of these shifts and to approach market opportunities with a well-informed perspective. The current trend towards normalization is not just a phase, but a sustainable move towards long-term stability in the housing market.

If you want to learn more, further insights or investment opportunities in the multifamily market, resources such as quarterly market reports, industry articles, and YouTube videos are available for proactive investors.