March 5, 2024

“What really struck me when I found Ashcroft was that it seemed to be a very conservative company––under-promise, over-deliver.”

Navigating the Seas of Wealth: A Naval Veteran’s Approach to Generational Wealth

Florida-based William Barry isn’t your average corporate accountant. A world-traveling Naval veteran and family man, William now uses his background in financial analysis and passion for entrepreneurship to build generational wealth.

Describing his investment journey, William explains, “I had some exposure to investments as an accountant, but it wasn’t until I ended up working at Raymond James that I learned about all the structured products available out there. My sister got involved in raising money for private equity investments, and that really opened my eyes to the world of accredited investors. When I finally hit that mark, I went all in. About 70% of my investments are in private equity, and Ashcroft is part of that split.”

According to William, Ashcroft has one key advantage over his other holdings. “The private equity world is a very slow moving animal,” he says.

“Whatever you put in, it’s going to be five-plus years before you see it come out. That’s the nice part about Ashcroft. It’s one of the few that actually pays the monthly coupon. What that has allowed me to do is build up more funds to do more subscriptions to some other smaller private equity investments.”

Investing with Intention

With much of his net worth wrapped up in investments, William has become a pro at identifying what’s worthy of his hard earned contributions. Before committing to partnership, William always works to understand if there’s “an itch in the market,” as he puts it. “I think the people who have a good idea are those fulfilling a real need,” he says. “However, I really invest more in people than I do businesses. Ashcroft is one of the ‘people’ investments.”

William first learned of Ashcroft while evaluating his investment strategy in the wake of COVID-19. “I was watching Bloomberg during the pandemic,” he recalls. “I was working from home and had it on in the background. I was looking at what to invest in because the market was going crazy, and I started hearing about companies doing work similar to Ashcroft, but they just didn’t fully click for me.”

Things finally did click when William discovered Ashcroft through his research. He quickly found that several factors aligned with his values, future vision, and risk tolerance. “I like the rate of return that you guys were making. You also have a strong model that you’re following,” he explains.

“First of all, your selection criteria is good. And that’s really the first and most key element. After that, you have a team in place to do all the transformation necessary to make that investment grow in value. I like that you’re very vertically integrated. Everybody’s on the same team with the property managers and the construction company that’s doing the work.”

Laying the Foundations for Generational Wealth and Future Prosperity

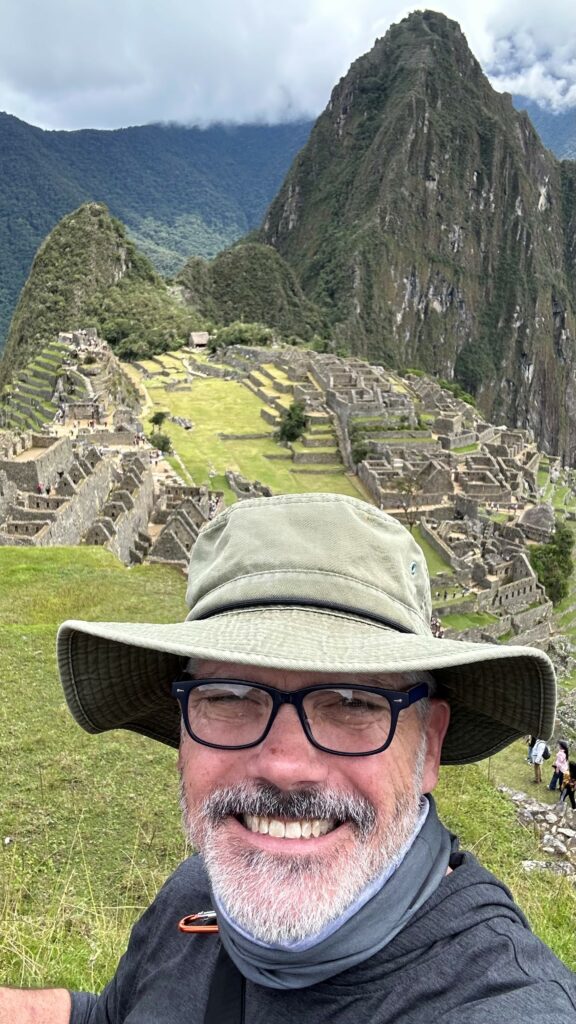

While happy to have found a trusted long term partner for passive investing, William isn’t quite ready to give up his work as an accountant and live off the interest. “With all my money tied up in private equity, I’m still living pretty modestly right now––basically, no debt; and although I’m traveling, I’m doing it pretty affordably,” he says.

“But this is going to be a somewhat extravagant year,” William admits. “I’m going to Peru this month and Kenya in May. We just did Romania in December. I’m probably going to do England in the Fall, and we’re going to throw Colorado in there, too. But mostly, we plan to continue living within our means and watching our investments grow.”

When it comes time to retire, William will be poised for a comfortable life with even more international travel. “When I get onto a fixed income platform, it’s pretty much all going to be the Ashcroft funds that drive that,” he says.

“I’m going to push as much money as I can into Ashcroft from my Roth, so I’m not paying any taxes. As I keep getting funds from other PE, the plan is to put it into Ashcroft until I’m at that point where my monthly passive income reaches a level where I don’t have to worry about it.”

Of course, William isn’t just worried about stockpiling cash for his own retirement. He has a vision for building financial security and generational wealth for his extended family and its future members. “I want to set up a family office for both my mom’s side and my dad’s side. With that base, everyone will be able to buy in (at any level of their investing strategy) for just a portion, even $500, to piggyback off of what the trust is doing. I don’t think my family has had that cohesive idea of us all working together to achieve much greater goals. So, I would like to change that thinking.”

“It’s not going to benefit my generation. It’s really for the next generation to come.”

William is just one of our 3,000+ investors. Hear what passive income has meant to over 100 of our investors.