July 11, 2024

By: Danielle Jackson, Investor Relations, Senior Manager

Family Finances Matter

It takes money to make money! We’ve all heard this saying, and while true, it’s not 100 percent accurate.

Making money takes time, effort, knowledge, and capital that is converted into income. But the wealthy don’t just expect their wealth to grow; they plan for the next generation to maintain and build it.

Generational wealth is a method of securing financial wellness to help safeguard the financial wellness of our children, perhaps our grandchildren, and so on. The goal is to grow assets and income over time, putting each generation in a better financial position than the previous one.

However, 70 percent of affluent families lose their wealth by the next generation and 90 percent lose it the following generation, making investors unable to create a lasting legacy.[1]

Don’t let that data scare you – there are ways others have created generational wealth that lasts well beyond their children and grandchildren.

Consider Investing and Diversify

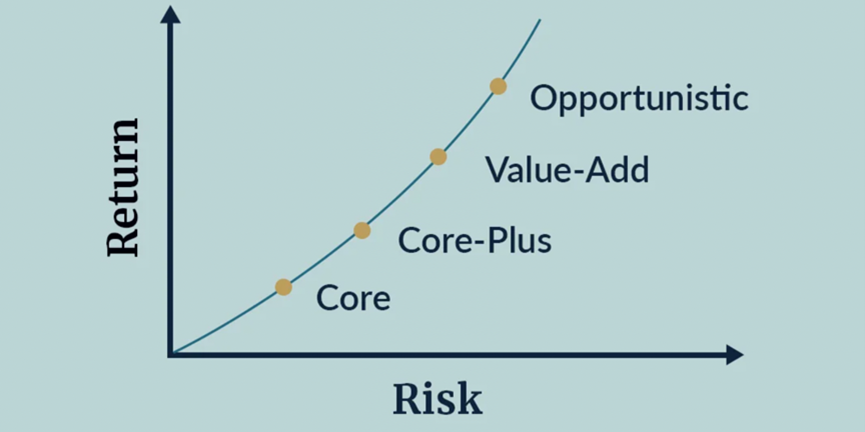

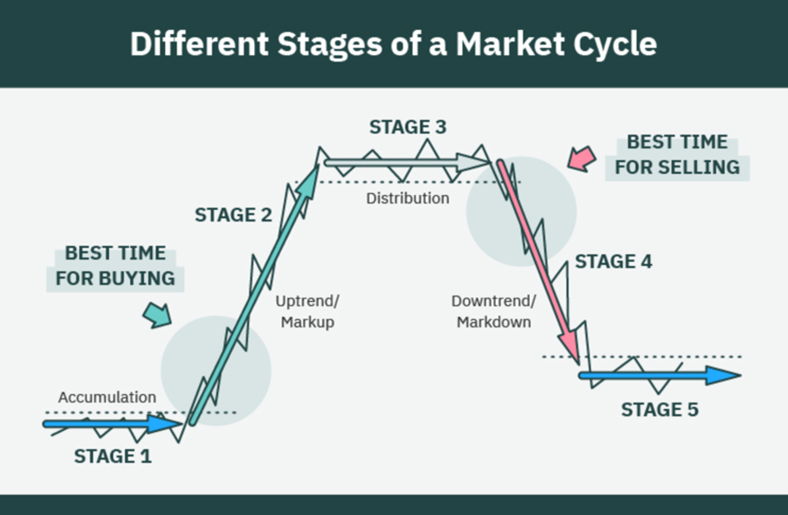

Generational wealth is ideally cultivated in a way that creates generous upside potential but with capital preservation. There are many ways investors may approach that challenge.

When investing in the financial markets, one of the most common strategies investors use to achieve this goal is building a diversified investment portfolio. Overexposure to any single stock, investment type, or sector can significantly increase risks.

While the concept of diversification is well known, some investors may fail to apply this principle to the overall mix of assets within their portfolio. Due to 2022’s inflation, geopolitical tensions, supply chain issues, etc., Wall Street saw the largest annual percentage drop for the three main stock indexes since 2008.[2]

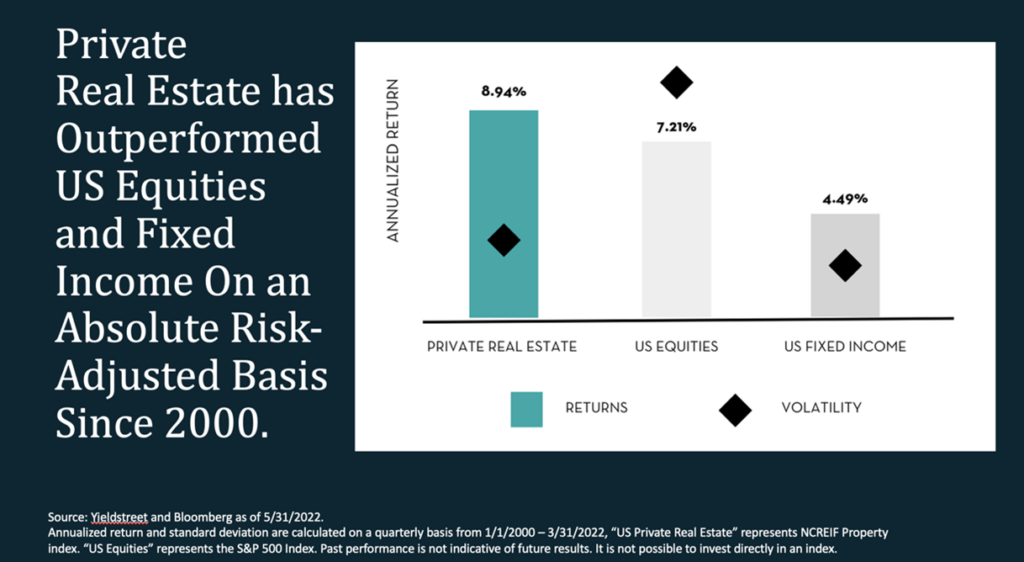

Investors seeking strategies to diversify their portfolios, hedge against inflation and offset risk may want to consider real estate.[3] Real estate can offer a reliable, tangible asset with potential for consistent cash flow and is not directly subject to short-term market volatility. Additionally, historical trends show that real estate values have often outpaced inflation, making real estate an attractive option for those looking to build long-term generational wealth.[4]

By investing in different types of assets, you aim to mitigate your overall exposure to any one type of risk. The goal is to create a balanced portfolio with both growth and income-producing assets, maximizing returns while reducing risk.

Financial Literacy Sustains Generational Wealth

Financial literacy is the skills, knowledge, and tools that allow people to make sound financial decisions. It extends beyond just knowing your finances and includes being an active participant in financial planning, while maintaining the ability to manage emotional and psychological factors that could influence your decision-making.

Many people who inherit wealth may not be educated on the importance of financial knowledge. As a result, they may delay acting in their investment portfolio out of fear of the unknown.

Why is it important? When it comes to building generational wealth, financial literacy is key. Only 22 percent of U.S. high school students have access to personal finance courses.[5]

Additionally, a recent annual survey found that only 52 percent of U.S. adults are “financially literate,” and less than 37 percent understood “comprehending risk” (i.e., understanding uncertain financial outcomes).[6]

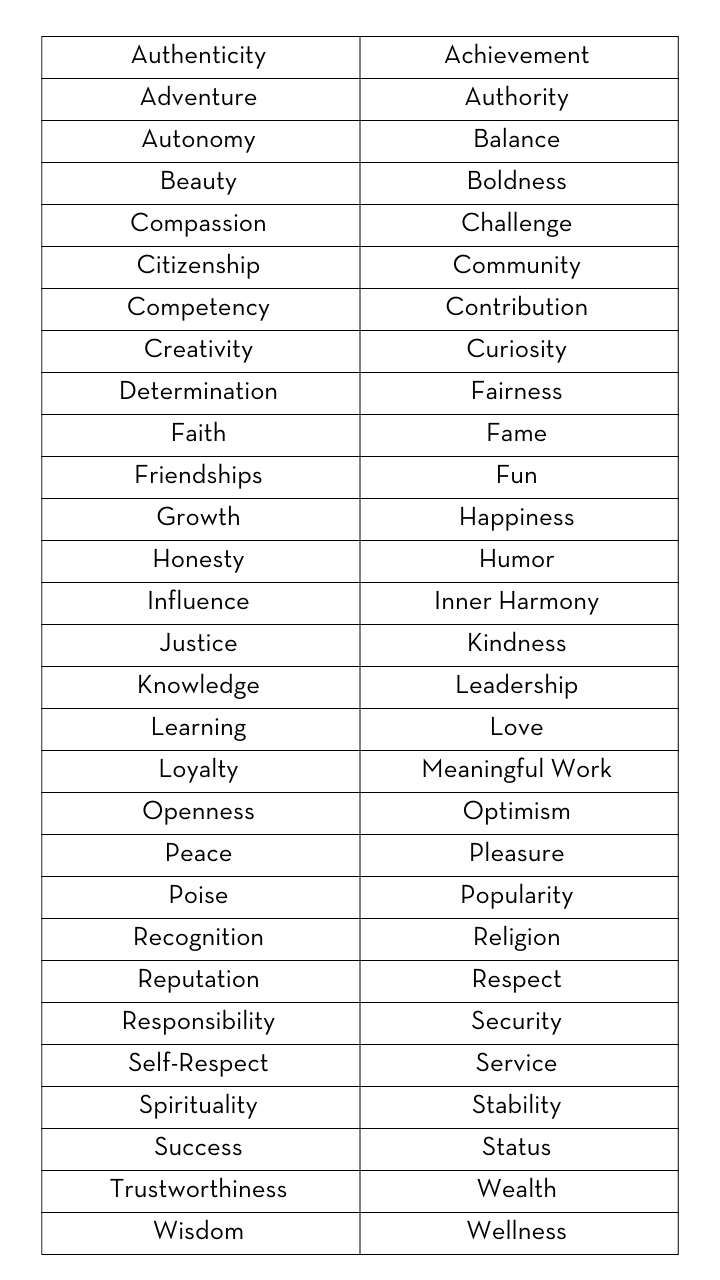

We all have unique values, goals, and dreams that motivate us. Accessing and understanding the financial information needed to make those dreams happen can be extremely empowering.

The good news is that you can start investing in your children’s and grandchildren’s financial education now. Ensure they know the basics of budgeting, savings, retirement, and investing, and give them the tools they need to protect their long-term wealth.

Having open conversations about money and investing, including both your methodical decisions and not-so-logical decisions, can help your family learn and make better choices in the future. As an investor, it is inevitable that you will experience a loss.

Rather than dismissing those losses, view them as an opportunity to educate your family to help them avoid making those same mistakes down the road. Teaching your family how to save, spend, and give will help develop financial responsibility.

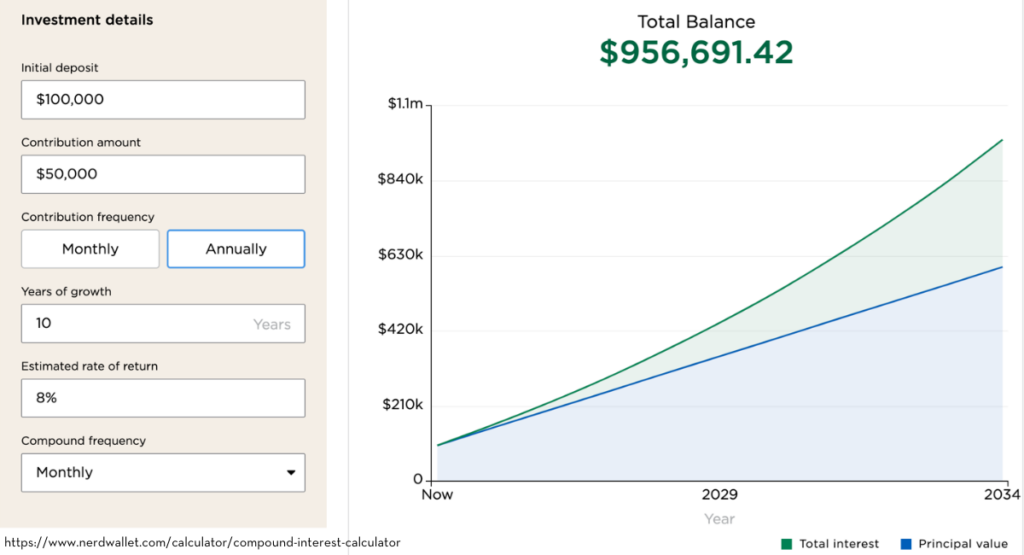

Involving your children in the financial planning process is critical to helping them understand the importance of small actions and their potential major impacts on future financial outcomes.

Secure Your Family Finances: Ashcroft Capital’s Multifamily Investments

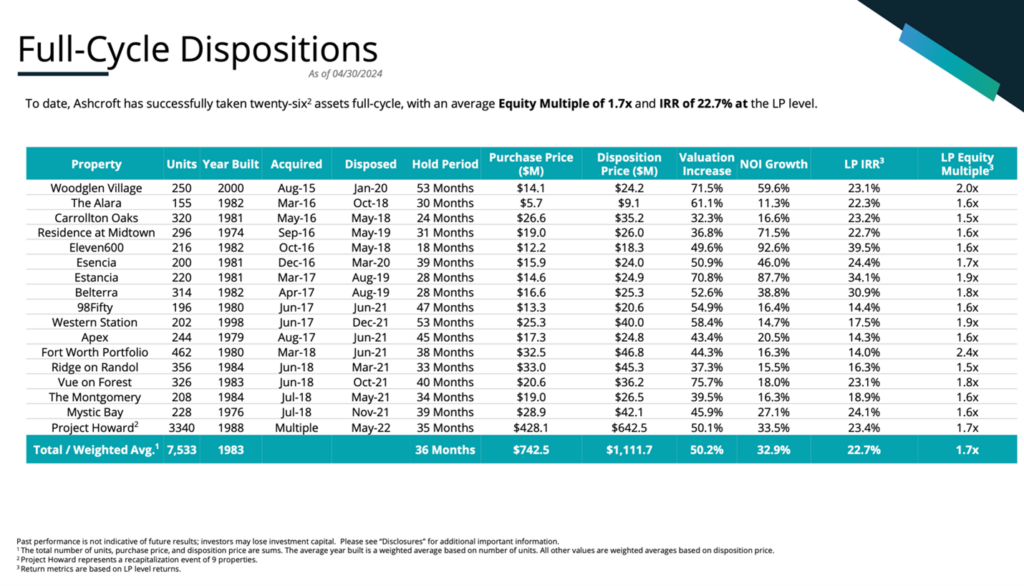

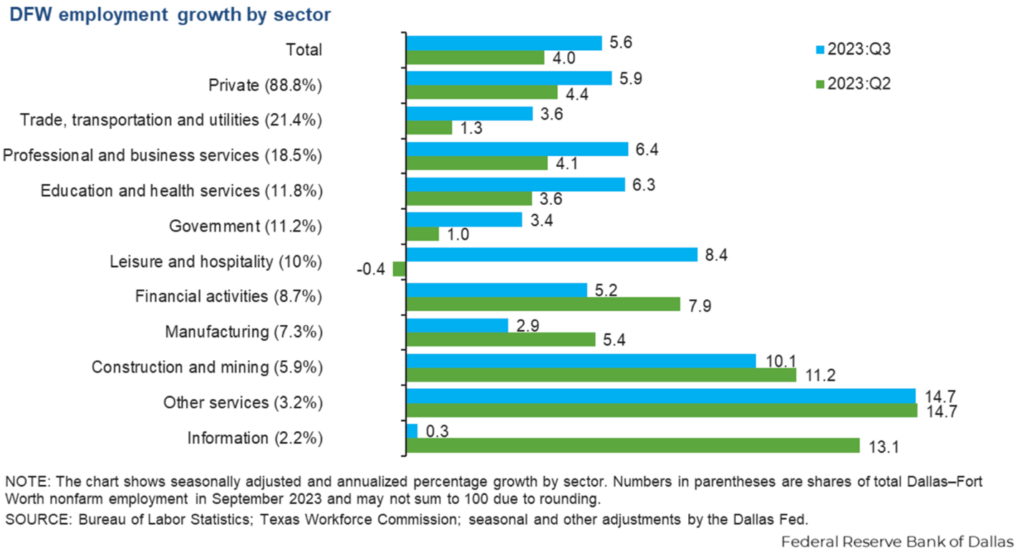

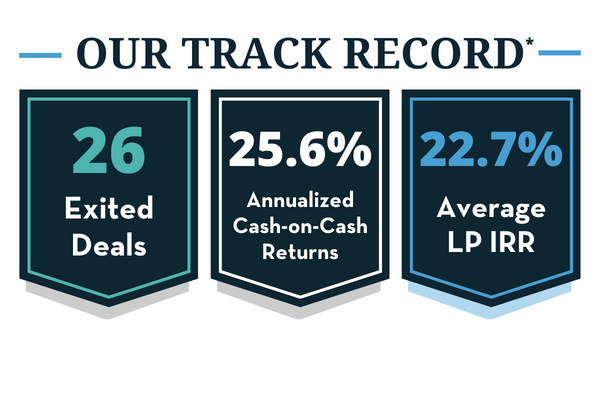

Ashcroft Capital is headquartered in New York and has a team of real estate professionals that focus on capital preservation and wealth generation. Due to our focus and expertise, over 4,000 investors have trusted us with their capital.

Drawing upon the experiences of our over 300 employees, our team knows how to maximize the returns on our properties, create superior living spaces for our tenants, and allow our investors to realize their financial goals.

Our investment model is tailored for investors who want to enjoy all the benefits of owning multifamily real estate without the headaches of being a landlord. Moreover, we are committed to supporting your investment journey by providing resources for navigating the real estate investment industry and syndication throughout 2024 and beyond.

If you would like to learn more about investing in multifamily assets, or our current investment opportunities, schedule a call with Investor Relations today.