November 15, 2023

By: Travis Watts, Director of Investor Development

The Overlooked Phenomenon:

The potential of a reverse market crash is an important concept that few industry professionals are discussing. It’s important to understand the implications for individuals across different socioeconomic classes, and most importantly, what it means for you as investors.

Understanding Market Cycles:

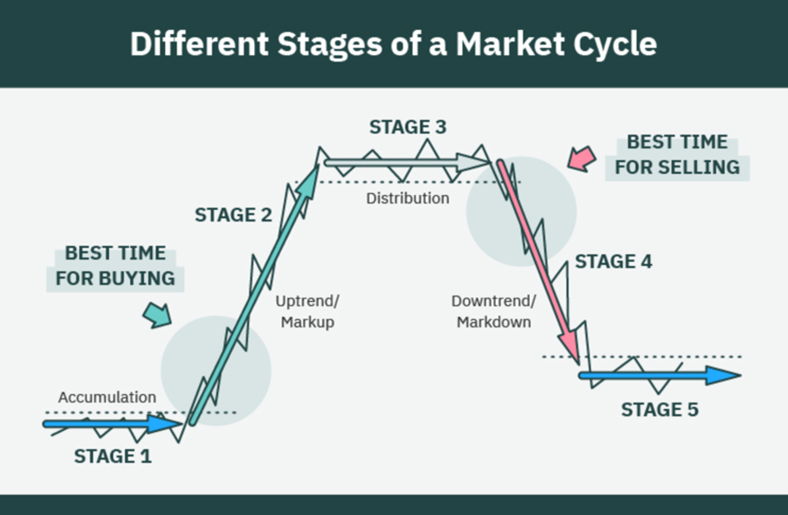

To begin, it’s crucial to acknowledge the historical patterns of market cycles. We can categorize these in five stages as shown below:

- Accumulation

- Uptrend

- Distribution

- Downtrend/Recession

- Bottoming

After bottoming, we revert to stage 1… accumulation.

Presently, we find ourselves in stage 4 – a downtrend on the precipice of a potential recession.

Will We Have a Recession?

Deutsche Bank conducted a recent analysis of the past 34 recessions in the U.S. and identified four warning signs that historically predict recessions:

- A rapid rise in interest rates (The Fed funds rate has increased roughly 5.2 percentage points over the past 20 months)

- An inflation spike (Inflation soared to a four-decade high above 9% in June of 2022)

- An inverted yield curve (U.S. Treasuries have been stuck in inversion since July 2022)

- An oil price shock (Oil prices have soared roughly 33% since June to over $95 per barrel)

Alarmingly, all four of these red flags are currently present in the country, something to consider.

Lessons from Past Recessions:

Reflecting on past recessions, such as the Dot Com Crash in 2000, the Great Recession in 2008, and the 2020 COVID-19 Recession, we observe a similar pattern of markets soaring rapidly leading up to a sudden drop in the market.

As we approach the end of the Fed’s tightening cycle, the question is…will we witness a reverse market crash?

The Concept of a Reverse Market Crash:

Simply put, a reverse market crash is characterized by a sudden rise in asset prices that leads to the rich getting richer and the poor getting poorer. How?

Rising interest rates negatively impact the valuations of real estate, stocks, and private companies as higher rates slow growth and increase borrowing costs. Over the past 20 months, we have seen these declines begin to unfold. In a reverse market crash, the Federal Reserve cuts rates, which reinflates asset prices.

But is this really a good thing?

Implications for Different Socioeconomic Classes:

The potential benefits of a reverse market crash are not evenly distributed across the classes:

The Poor

They statistically own very few assets. In this case, there would likely be little to no improvement in their financial situation. Making matters worse, soaring asset prices often lead to higher rents and consumer goods increasing in price, making daily life more difficult and widening the gap between the rich and the poor.

The Middle Class

Many Americans are currently struggling with rising housing costs. If a middle-class renter can’t afford a house today with an 8% mortgage, it might seem as though lower rates would be beneficial, but what happens if housing prices take off again?

Is it better to buy a $500,000 home today with an 8% mortgage or a $650,000 house with a 5% mortgage? Spoiler alert – it’s roughly the same payment. For middle-class Americans who are already homeowners and also hold investments, there would be some benefit, but much of this benefit would be offset by rising consumer inflation.

The Wealthy & Investors

Did you know 89% of all U.S. stocks are owned by the wealthiest 10% of American households?

The bottom line is investors and the wealthy own assets, real estate, stocks and businesses. In the event of a reverse market crash, this would boost their existing portfolios and lower rates make it easier to acquire even more assets.

Once again, the wealth gap would further increase between the rich and the poor, leaving the middle-class in a squeeze.

Are your investments ready?

In a reverse market crash, asset prices rise due to interest rates being cut, but the benefits are only felt by a select few. The question is, do you want to be part of the select few? Are you an investor prepared to take action and capitalize on the potential price appreciation?

At Ashcroft Capital, we are taking action by purchasing institutional-quality multifamily apartments at a discount and improving the properties for residents and investors. Our current investment opportunity is prepared to weather the storm.

We are ready if interest rates remain high, or if interest rates drop in the coming years, and a reverse market crash unfolds. This strategy will boost the valuation of our properties as debt becomes more affordable for buyers. Are you ready to join us?