November 11, 2025

By: Travis Watts, Director of Investor Development

How Multifamily Investors Are Quietly Reshaping the Wealth Landscape

For decades, wealth creation in America has taken many forms.

In the 1980s, it was stockbrokers. In the 1990s, it was dot-com founders. The 2010s brought Silicon Valley and digital disruption to the forefront. But looking ahead, a more time-tested, resilient strategy may take the lead:

Multifamily real estate ownership.

Not the traditional, hands-on landlord model, but fractional ownership in professionally managed multifamily assets designed to generate passive income and preserve capital over time.

For investors seeking real estate exposure, cash flow, and long-term growth potential, this may be the defining opportunity of the next decade.

The Macro Shift: Why Real Assets Matter More Than Ever

Several structural trends continue to support the multifamily sector, even amid changing market dynamics:

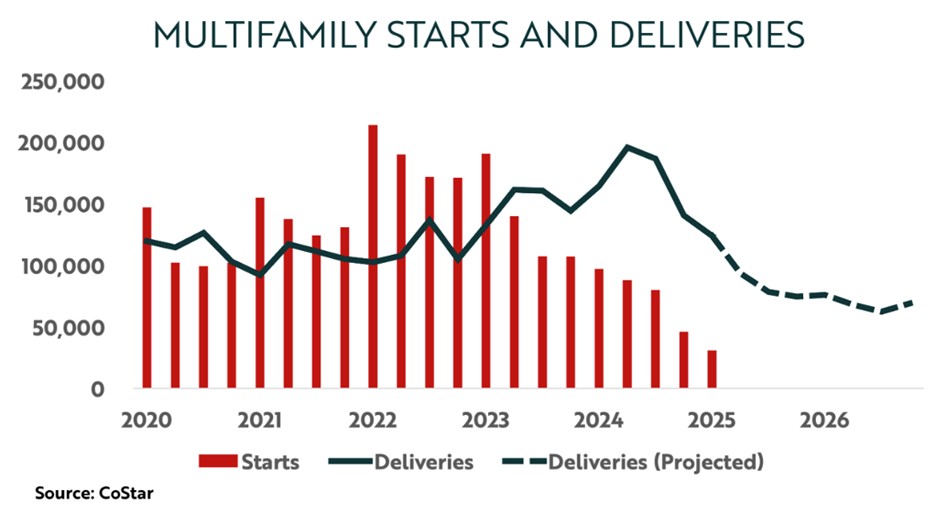

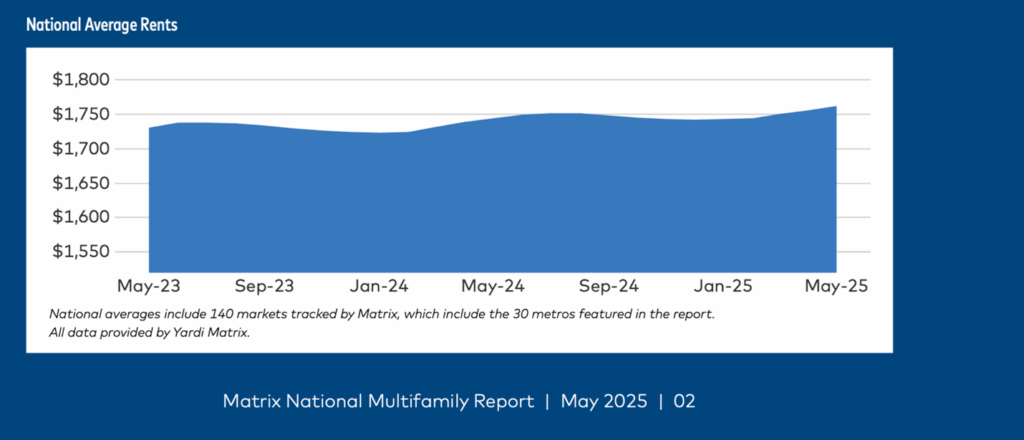

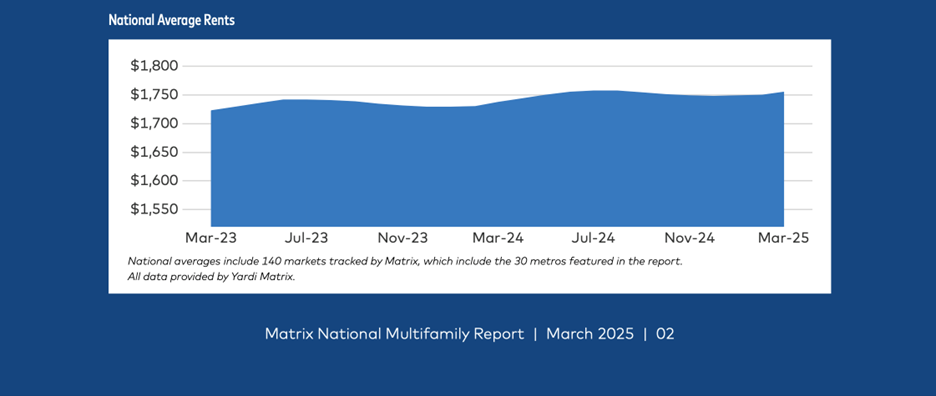

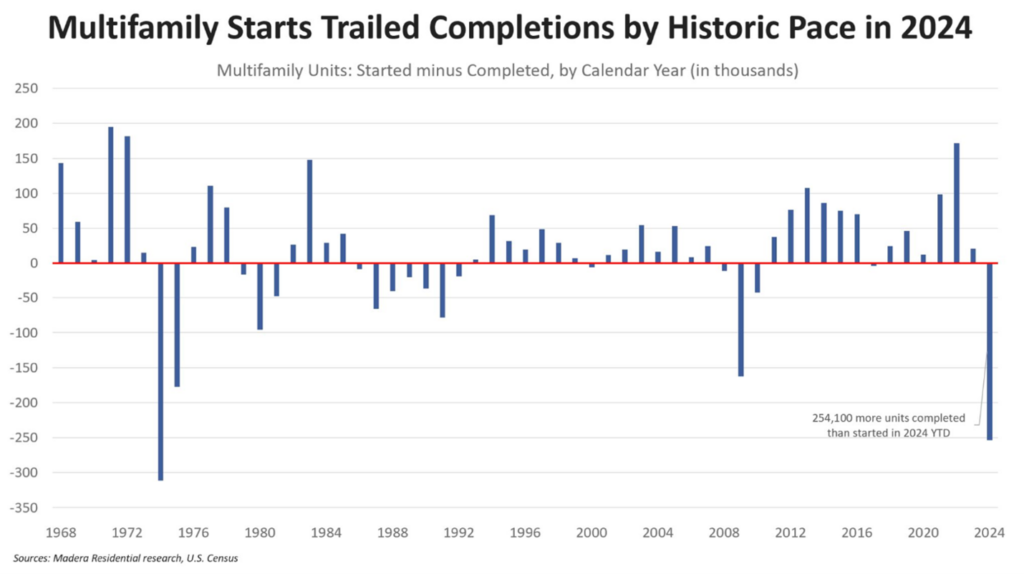

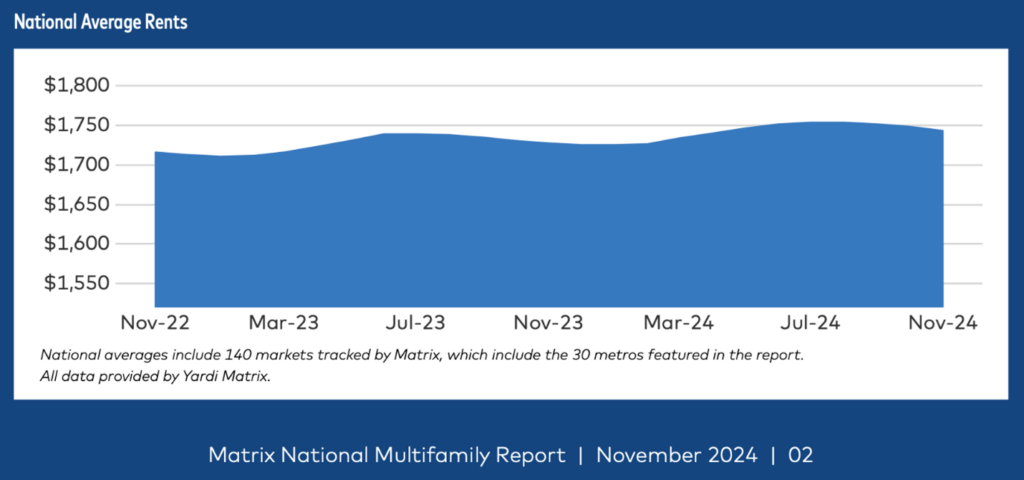

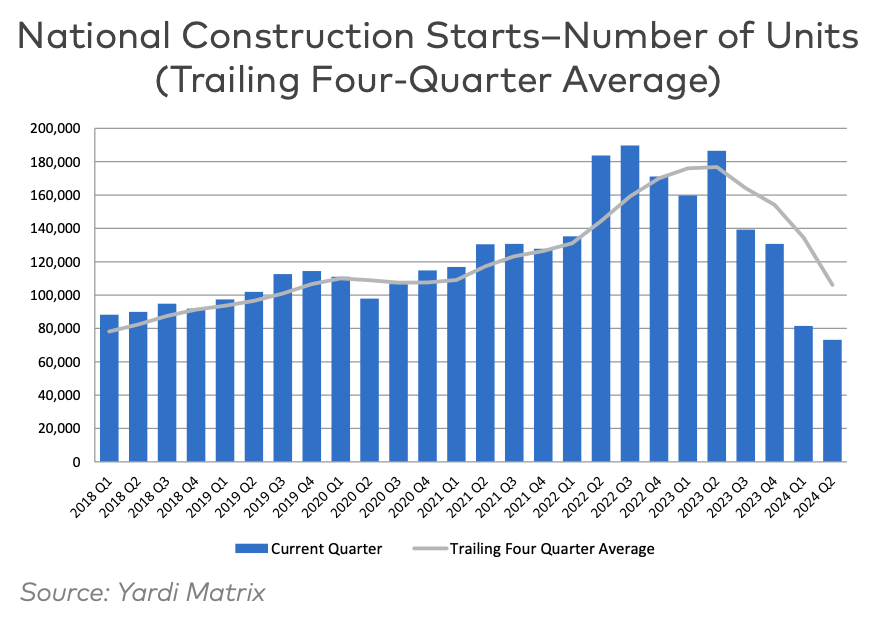

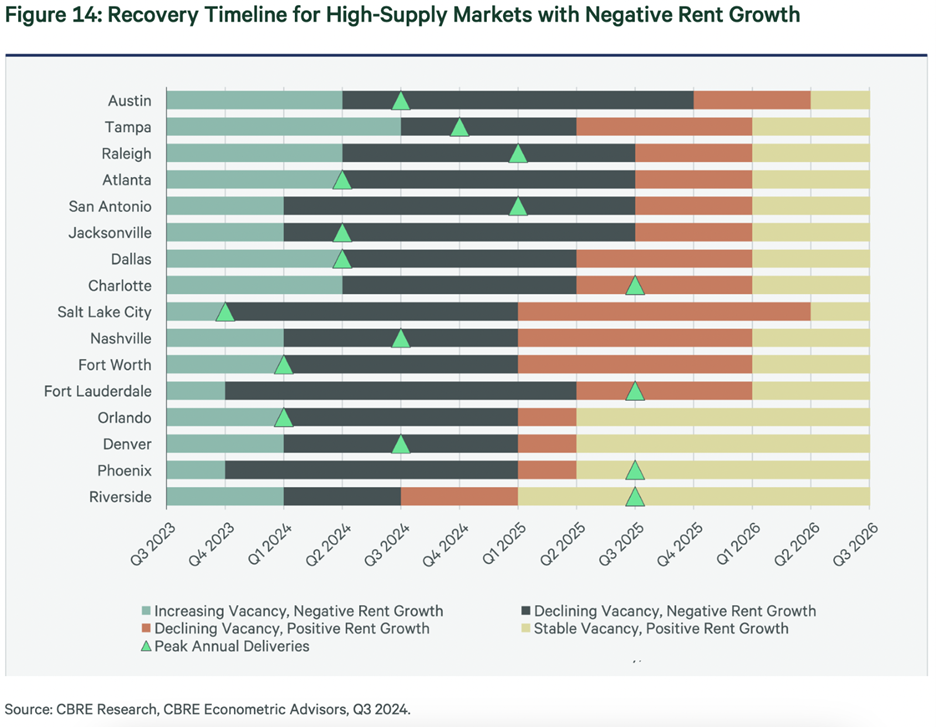

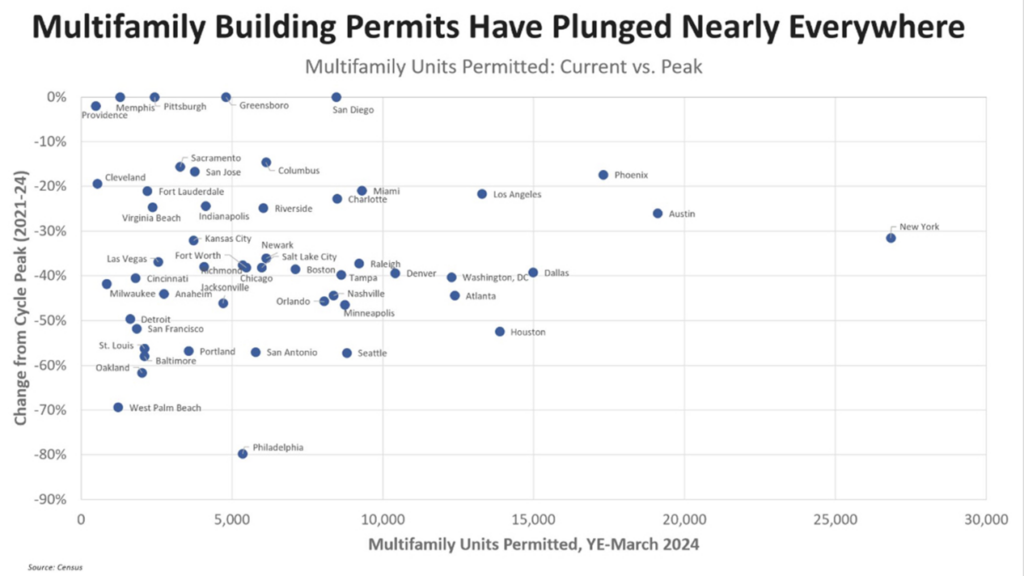

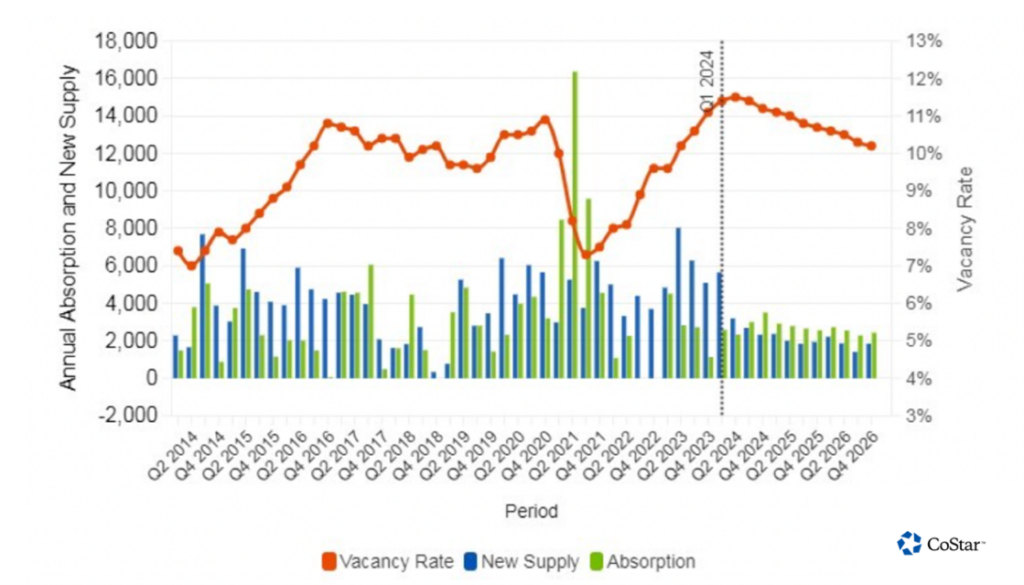

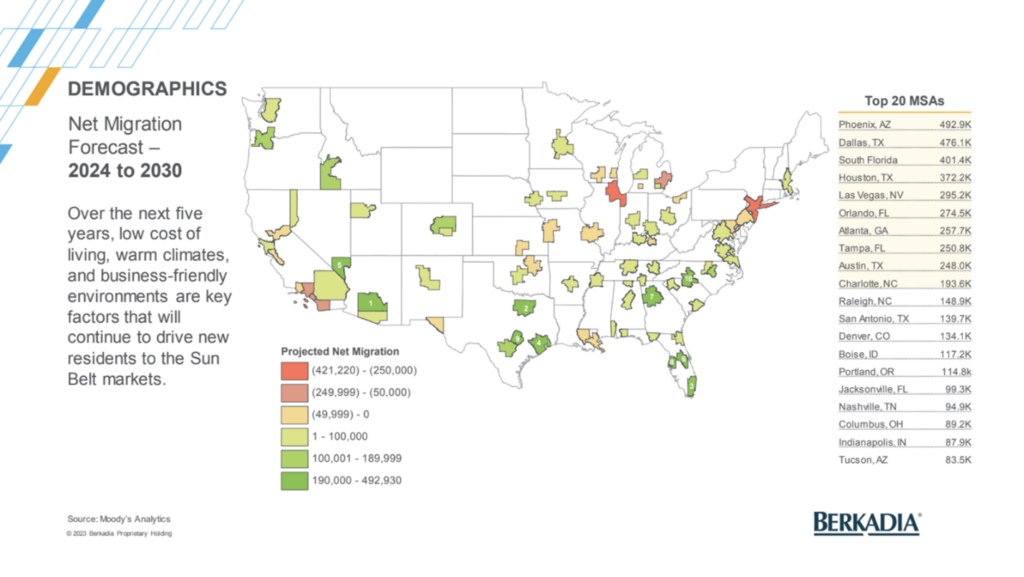

- A Persistent Housing Gap: The U.S. still faces a significant housing shortfall, particularly in the more affordable sector of high-growth metros, where population and job growth continue to outpace new construction.

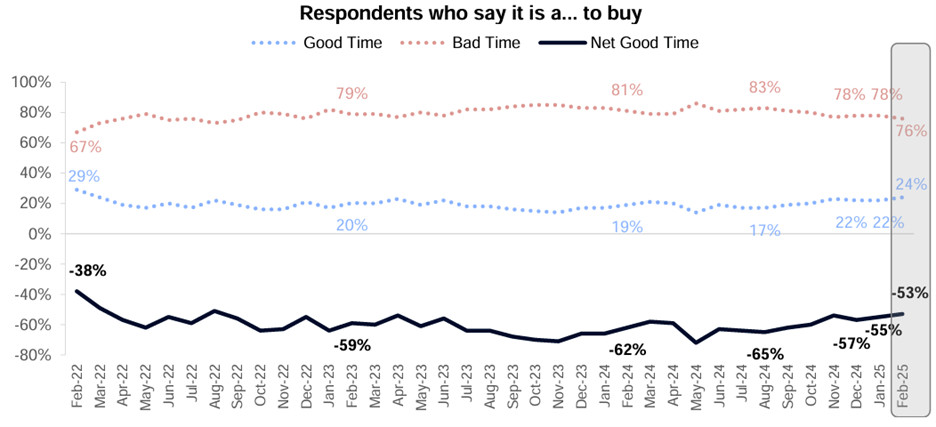

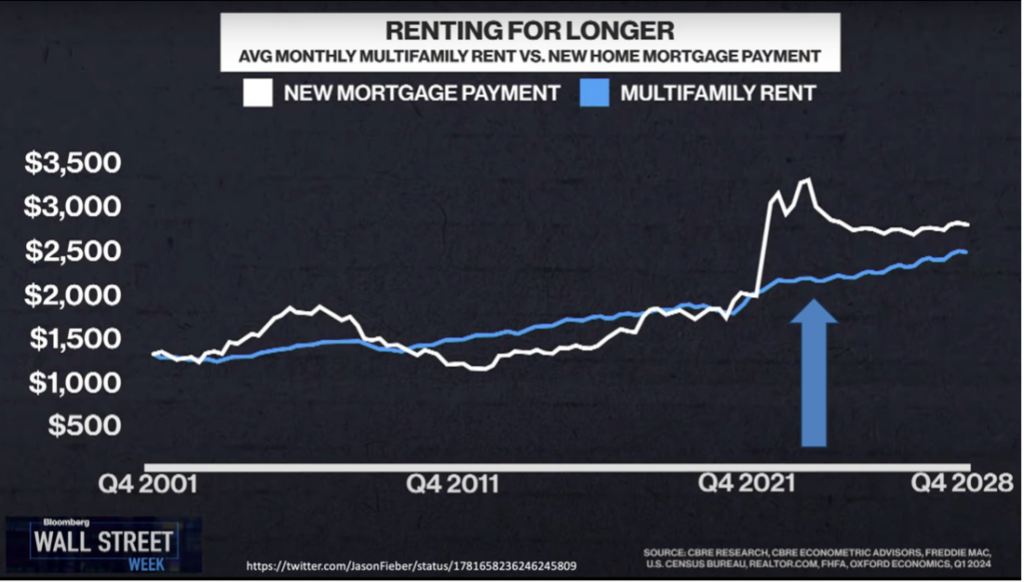

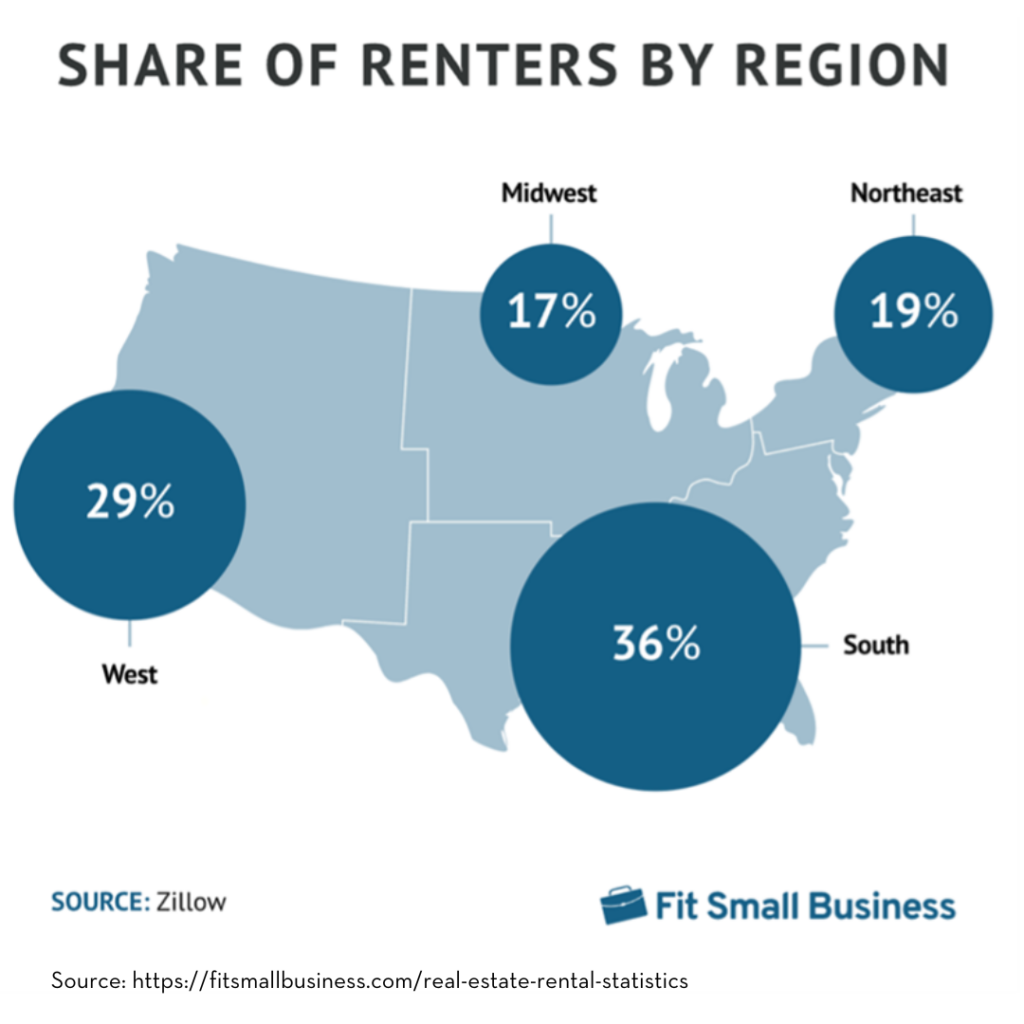

- Lifestyle-Driven Renting: Many households are choosing to rent longer due to flexibility, affordability constraints, and preference.

- Stock Market Volatility: Recent stock volatility has prompted many investors to seek lower-volatility alternatives with potential for passive income.

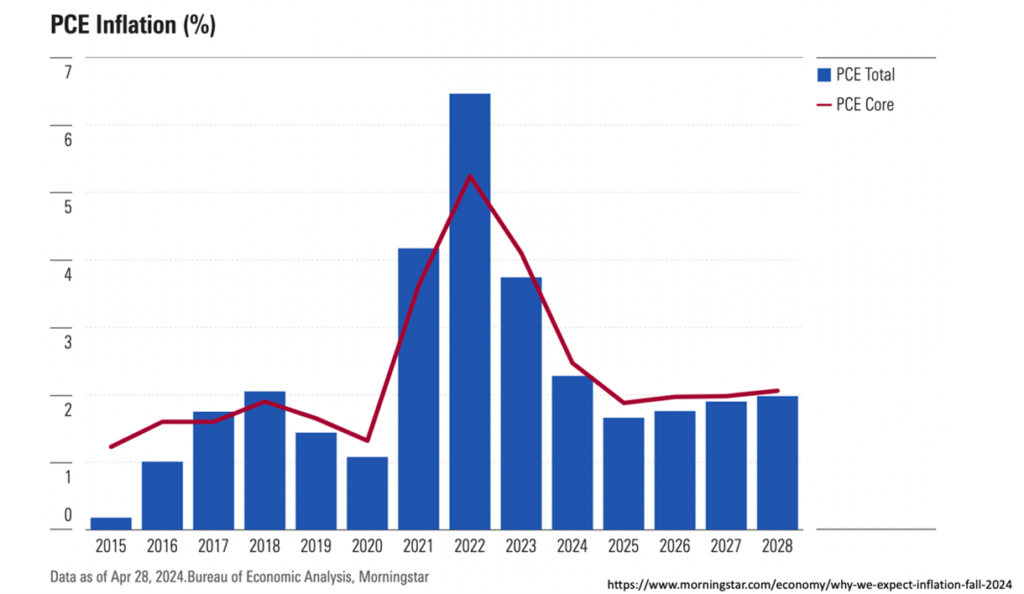

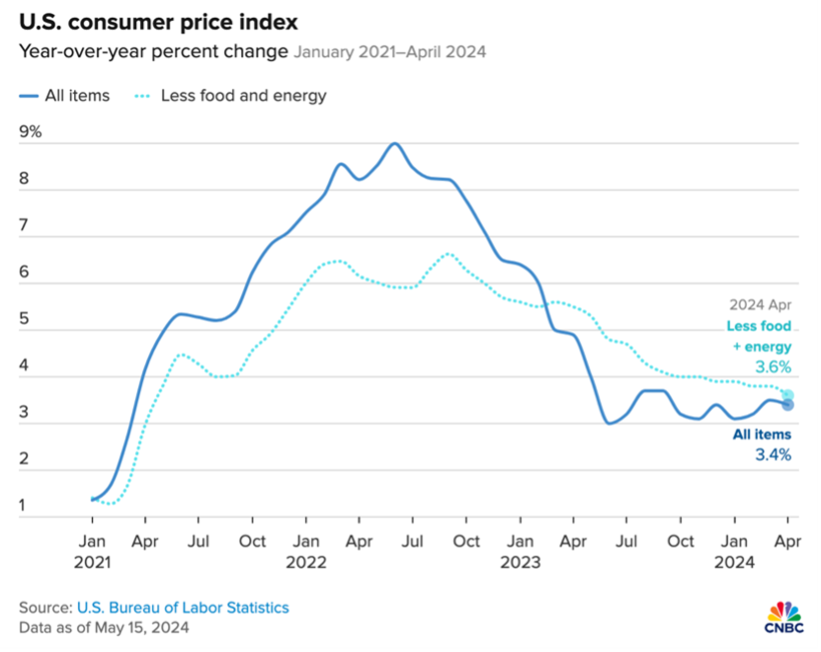

- Inflation Considerations: Historically, real estate has demonstrated the potential to provide a degree of inflation protection due to rent adjustments and the continued high costs of building new product.

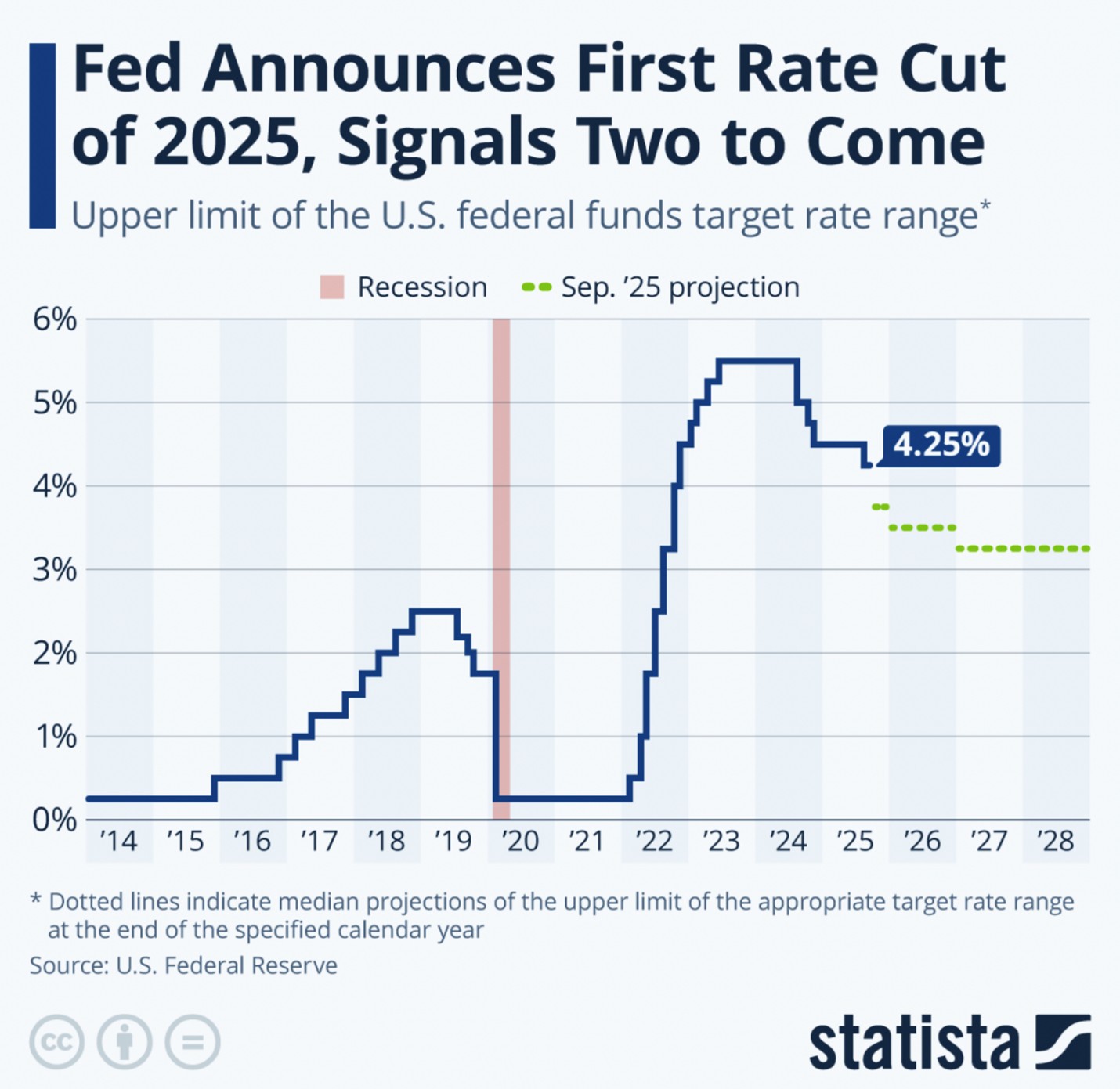

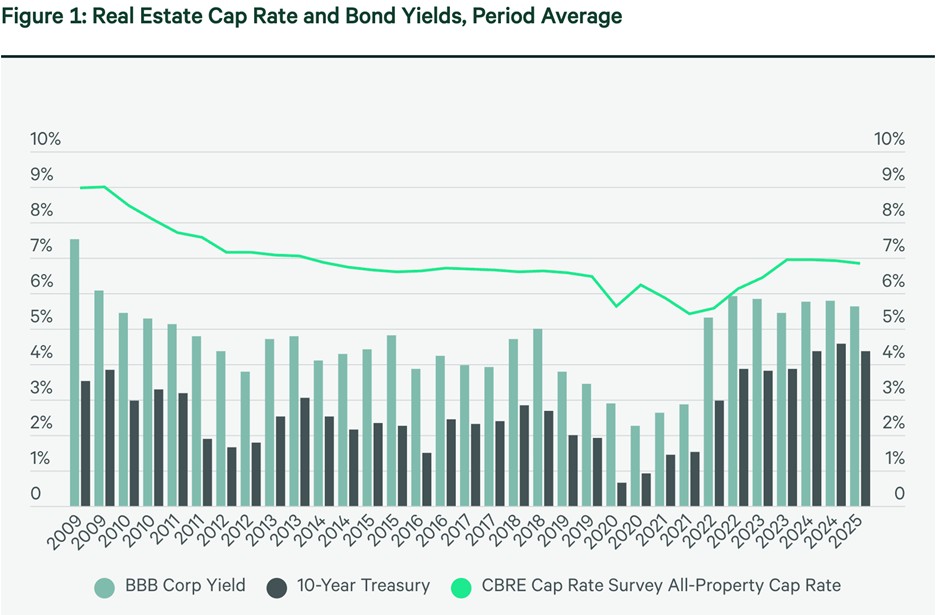

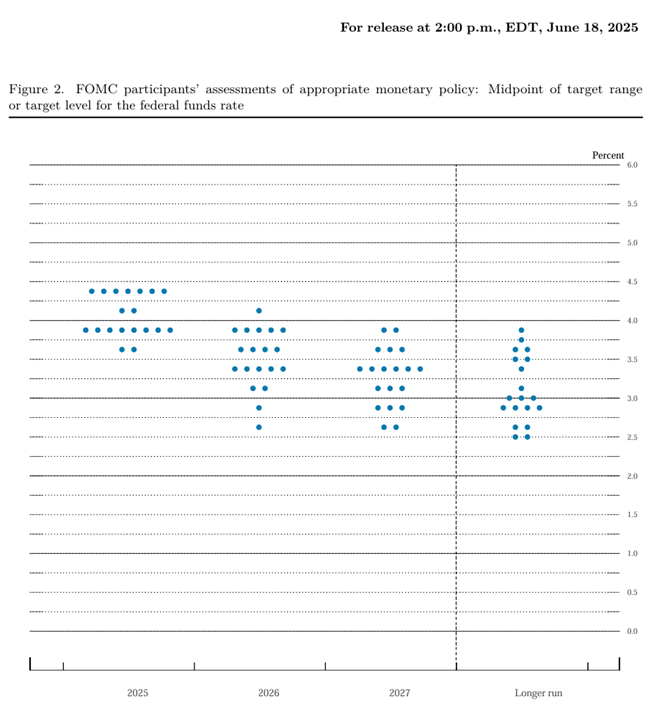

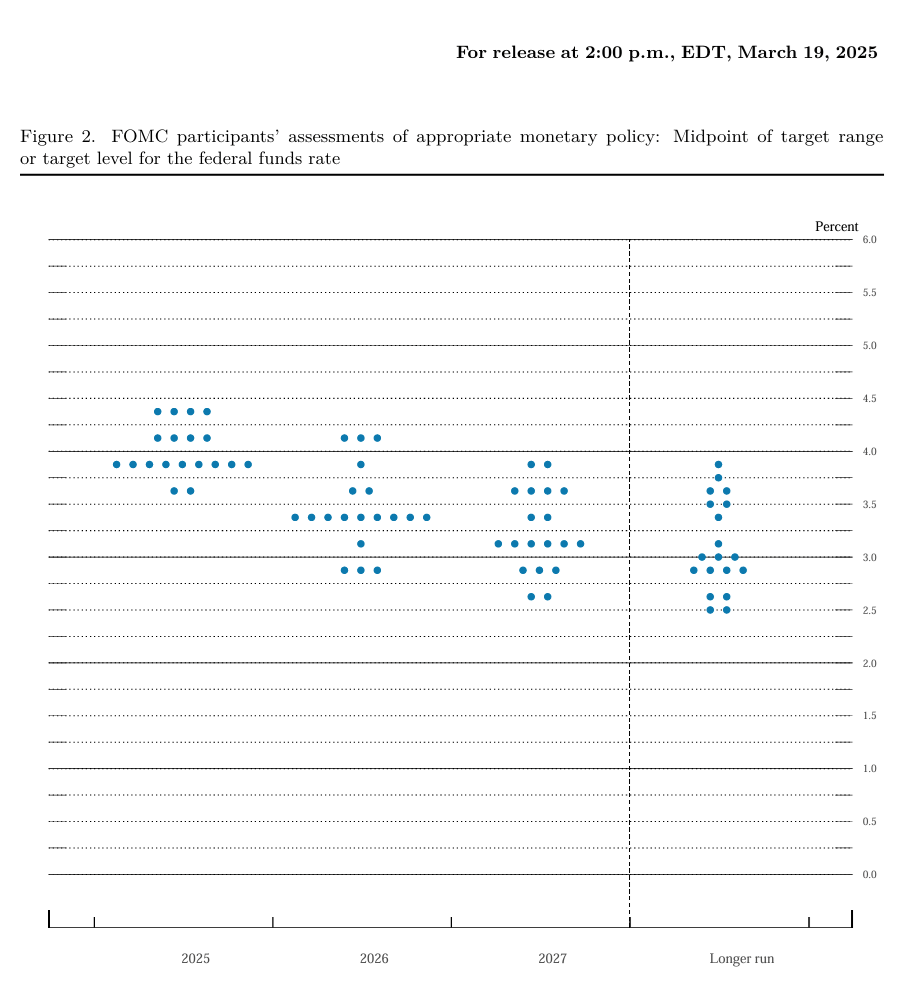

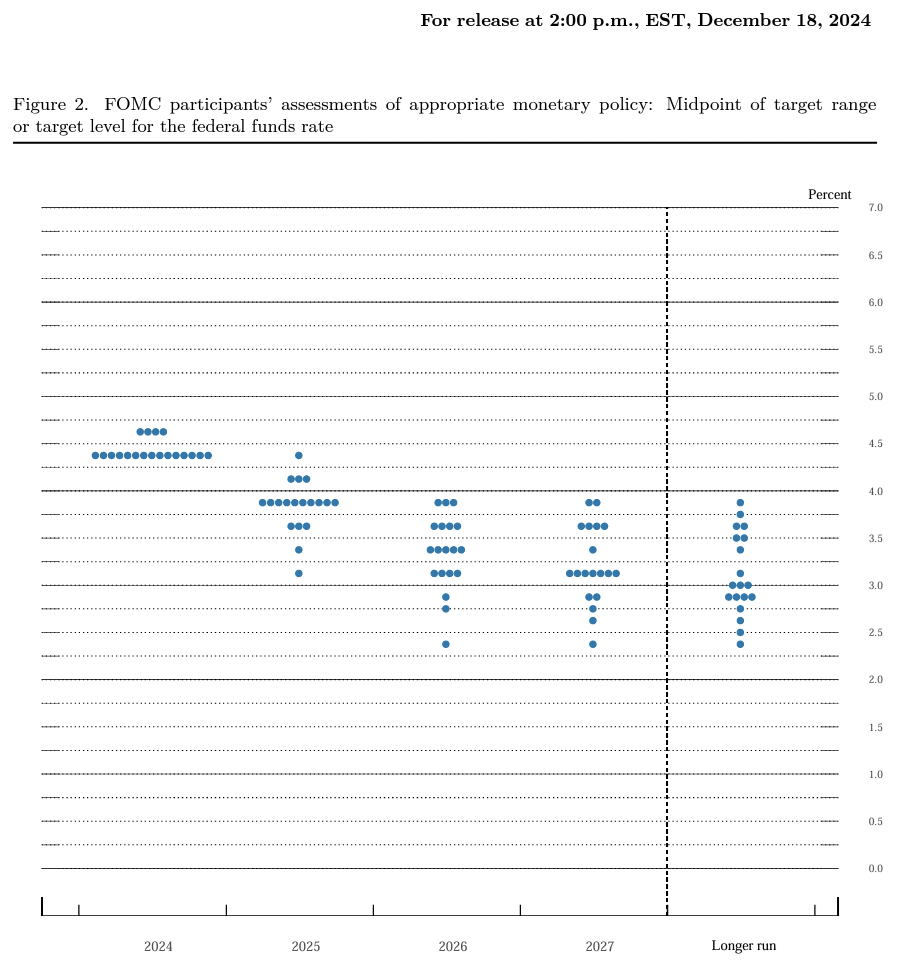

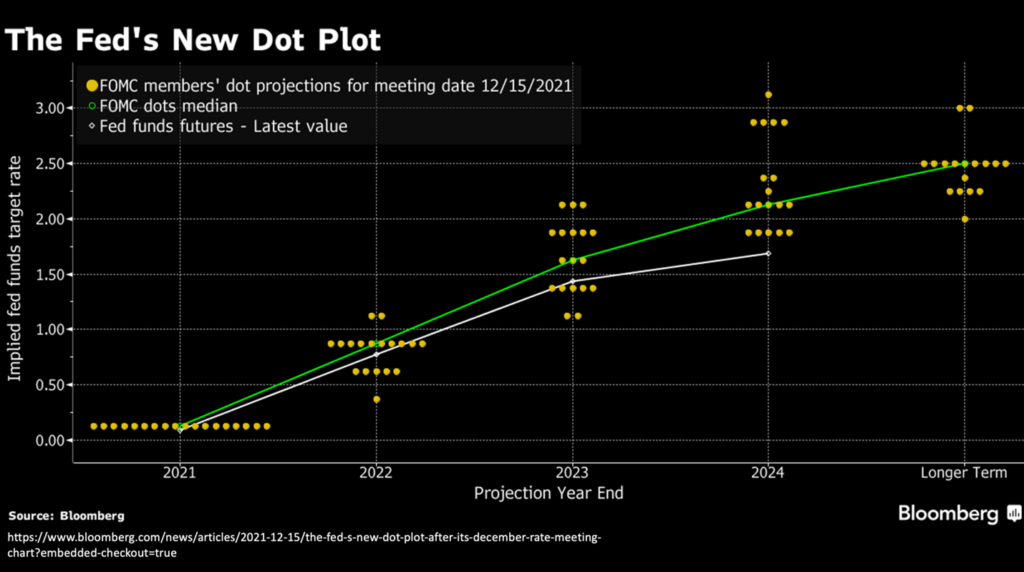

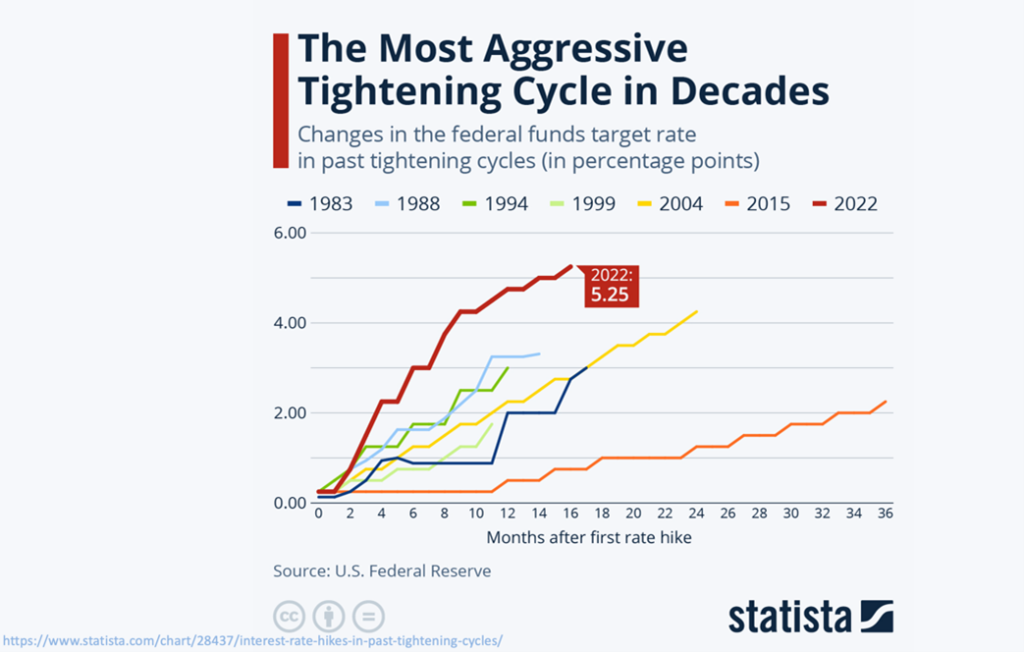

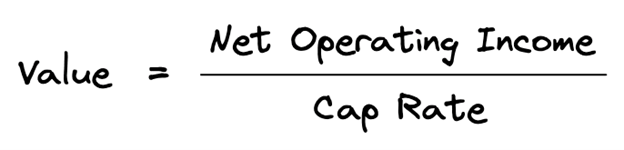

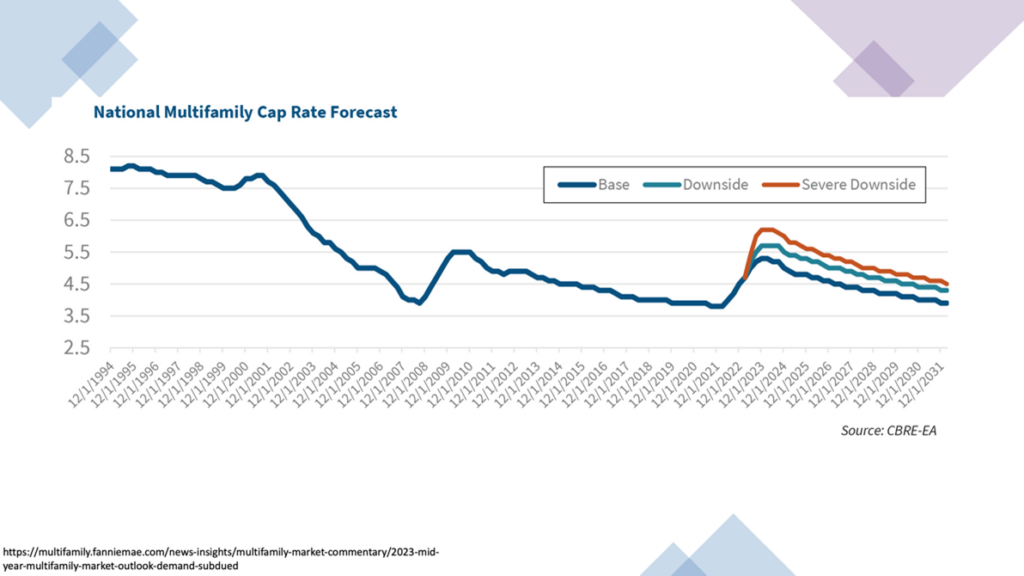

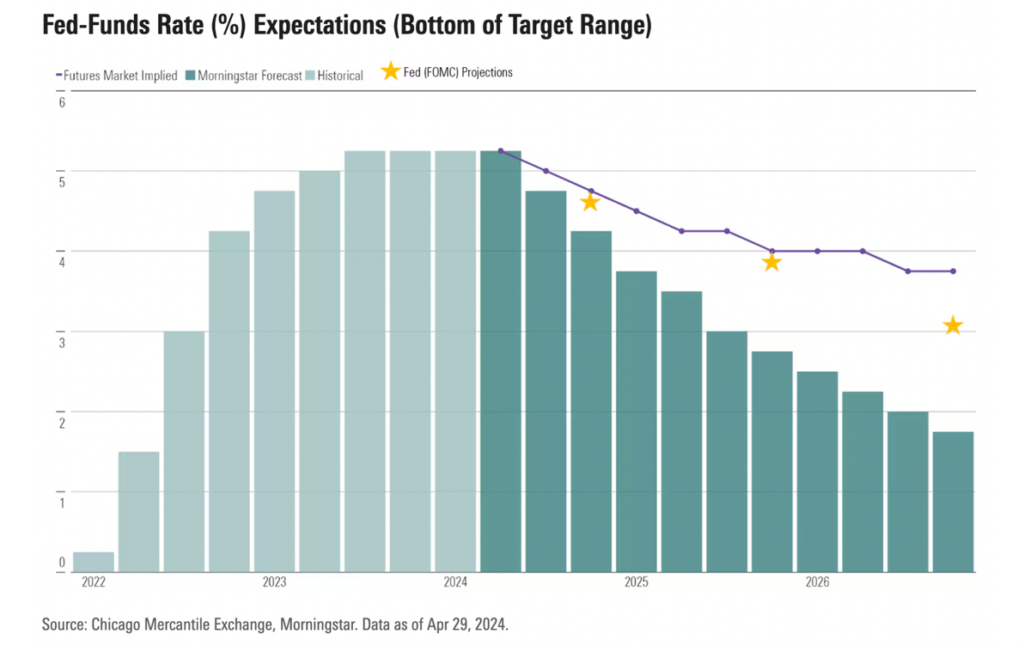

- Declining Rate Environment: The Fed recently began reducing rates, which is bullish for real estate valuations. Lower rates provide buyers more affordability when financing.

We anticipate these trends to continue benefiting well-positioned multifamily assets, and the investors aligned with them.

Reframing Returns: From Growth to Income

Today’s investors aren’t just seeking growth, they’re seeking income in a declining rate environment.

Multifamily investing can offer the potential for both targeted monthly income and targeted appreciation over time. But unlike more volatile asset classes, real estate’s value lies in its foundational utility: people will always need a place to live.

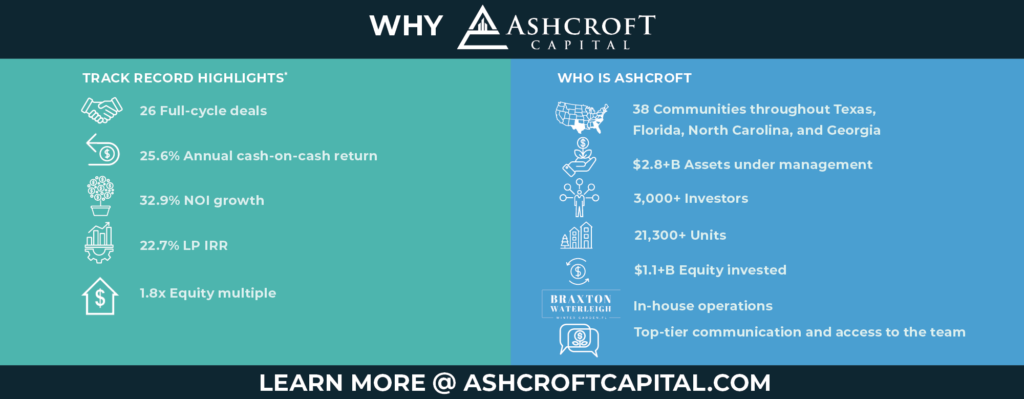

At Ashcroft Capital, we offer two main types of investment opportunities, each built to meet different investor goals.

For those focused on income, the Ashcroft Income Note offers scheduled monthly payments, making it a strong option for cash flow investors.

For those interested in long-term growth, equity investments like Halston Waterleigh provide ownership in multifamily assets with the potential for appreciation and modest ongoing distributions.

Across all offerings, our goal is consistent: To help investors preserve capital, generate cash flow, and build long-term value.

* This material is neither an offer to buy or sell securities or a solicitation of such offers.

Institutional Demand Meets Individual Access

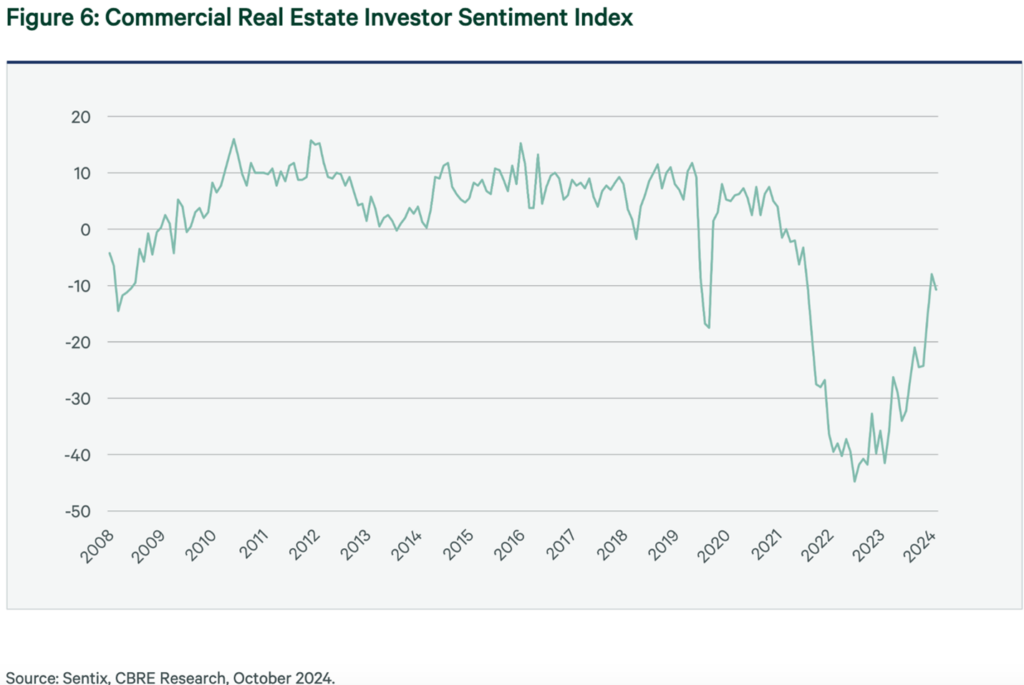

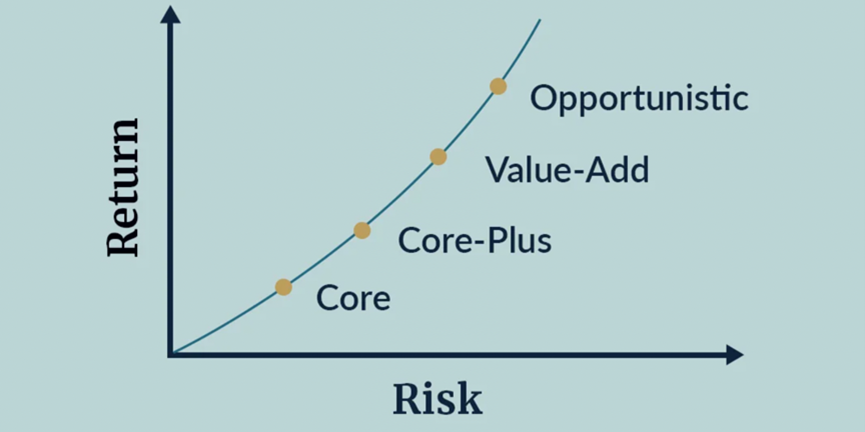

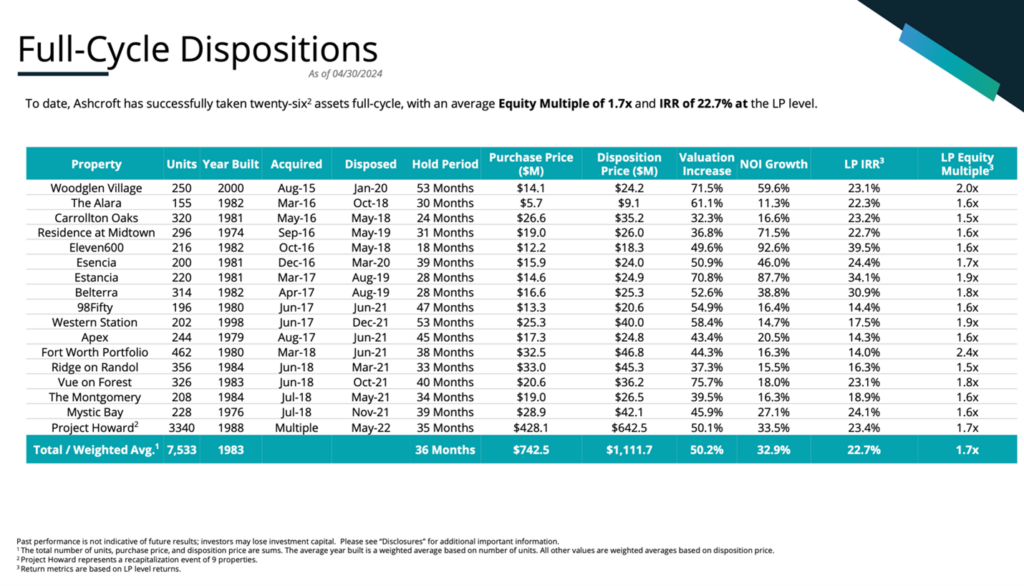

Institutional interest in multifamily real estate has increased significantly over the past decade, driven by a healthy risk/reward profile and historically strong performance.

But this isn’t just a story for pension funds or large private equity groups. Through Ashcroft’s platform, individual accredited investors can gain access to institutional-quality multifamily assets that are professionally managed, strategically selected, and built for Limited Partner participation.

This model allows our investors to participate in real estate ownership without the operational burdens of property management.

Passive Real Estate Ownership—Not Landlording

Owning multifamily real estate through a private placement offering isn’t the same as being a landlord. Investors aren’t managing properties, screening tenants, or handling maintenance request

Instead, they’re participating in a professionally operated investment vehicle targeting:

- Monthly cash flow

- Long-term capital preservation

- Potential tax advantages

- Diversification from publicly traded investments

In short, this is real estate investing built for simplicity and scale; aligned with the needs of today’s accredited investors.

Positioned for 2025 and Beyond

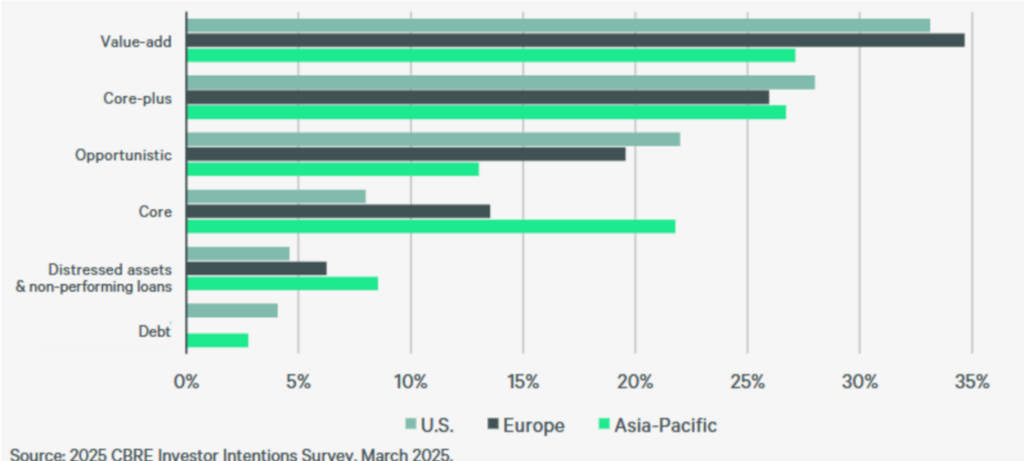

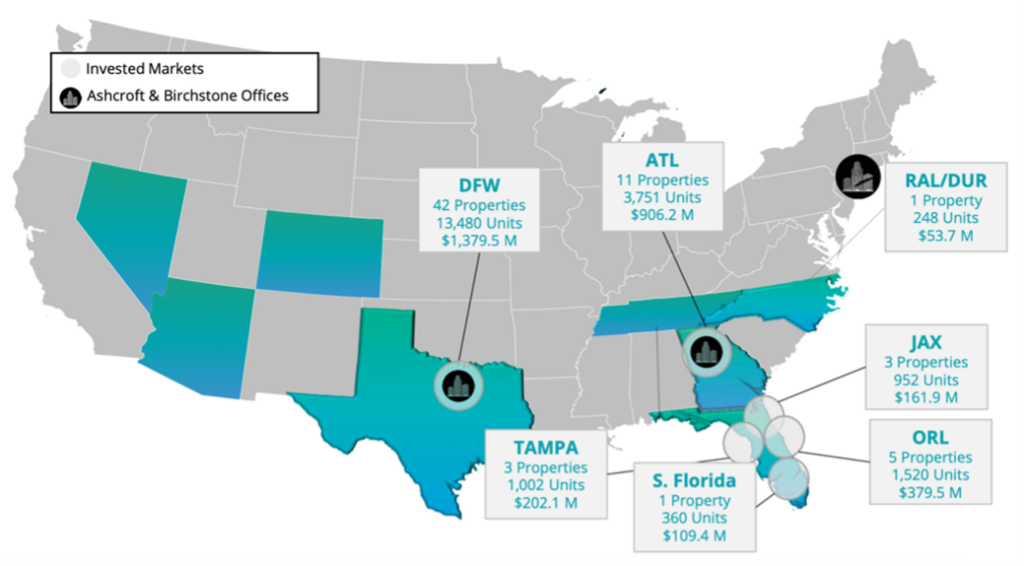

Ashcroft Capital continues to focus on core-plus, core and value-add multifamily investments in high-growth markets. Our in-house team handles acquisitions, construction management, and operations with a focus on cost efficiency and investor experience.

In an environment where many firms are taking a wait-and-see approach, we’re committed to active sourcing, disciplined underwriting, and creating opportunities for our investor community.

We believe long-term success in real estate isn’t about speculation; it’s about strategy, streamlined operations, and execution.

Past performance is not necessarily indicative as future results.

Final Thought: Think Like an Owner

The next decade may not belong to the loudest markets, but rather the most resilient ones.

For investors re-evaluating their portfolio in today’s environment, multifamily real estate limited partnerships offer a compelling balance of income potential, downside protection, and long-term alignment with real-world demand. We welcome you to join us for a property tour in Orlando this November or December. Please email investors@ashcroftcapital.com to learn more.

Are you investing for headlines—or for outcomes?

Ashcroft Capital exists to help investors like you think like owners, without taking on the day-to-day hassle of ownership. If you’re ready to explore that difference, we’re here to help.

Connect with our team to explore current opportunities or learn more about our investment thesis for 2025 and beyond.

——-

Disclaimer: This material is for informational purposes only and is not intended as an offer to buy or sell securities or a solicitation of such offers to purchase securities. Any such offer will be made only through official offering documents and only to verified accredited investors as defined by Regulation D, Rule 506(c) of the Securities Act of 1933.

This content may contain forward-looking statements, including references to potential regulatory developments and future access to private real estate investments through retirement accounts. These statements are subject to risks and uncertainties, and actual outcomes may differ materially.

Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal. Investors should consult their financial and legal advisors before making any investment decision. Ashcroft Capital does not provide tax, legal, or investment advice. Any discussion of potential tax-advantaged strategies is for illustrative purposes only and may not be available to all investors. This material does not constitute an offer to buy or sell securities or a solicitation of such offers.