May 28, 2025

By: Travis Watts, Director of Investor Development

Momentum You Can Measure

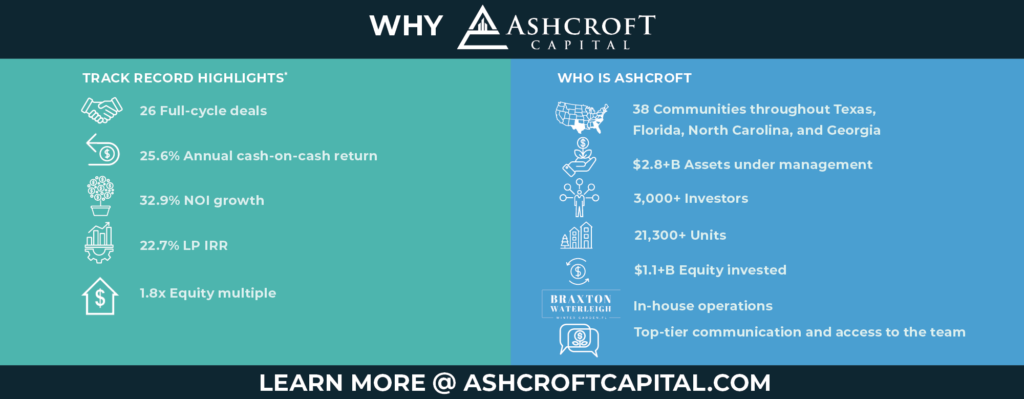

In today’s multifamily landscape, retention isn’t just a metric—it’s about returns. At Ashcroft Capital, we view resident satisfaction as a powerful lever for operational stability and long-term asset value. Halston Waterleigh offers a clear example of how strategic retention initiatives can drive performance on multiple levels—from leasing velocity to net-operating-income growth.

Over the past 30 days alone, 31 new residents have moved into Halston Waterleigh—at rents $50 above the existing rent roll. Simultaneously, we implemented a $25–$100 rent increase property-wide. The result? Accelerated leasing activity and stronger pricing power, underscoring both resident demand and our team’s execution strength. [Data as of May 19, 2025.]

Retention as Revenue Strategy

Since acquiring the asset, lease renewal rates have climbed from ~45% to nearly 60%. Every retained resident represents reduced turnover cost, steadier cash flow, and higher overall occupancy—key drivers of durable asset performance. *Data as of May 19, 2025.

Bilingual Teams, Local Engagement

A core reason for Waterleigh’s strong retention trajectory is our local team. Our bilingual (Portuguese-speaking) staff has forged strong ties with the Brazilian-American population in the submarket. That cultural alignment has translated into improved engagement, higher satisfaction, and “stickier” leases.

Resident Experience, Elevated

At Halston Waterleigh, we view hospitality as infrastructure. Our team curates at least two resident events per month, supported by weekly food trucks and lifestyle-driven programming.

Popular recent events include:

- Painting with a Twist – a wine and art social

- Mixology Nights

- Monthly Yoga Sessions – co-hosted with our adjacent Birchstone property

Events aren’t just amenities—they’re strategic tools that turn units into homes and neighbors into community.

Efficiency at Scale: Strategic Expansion

Ashcroft recently acquired the neighboring asset—formerly Ascend Waterleigh Club—in an institutional joint venture. This expansion unlocks meaningful operational synergies, including shared staffing, vendors, and resident amenity access. These efficiencies translate into enhanced margins and greater net-operating-income potential across both properties.

Security & Confidence Through Presence

Our Courtesy Officer Program, featuring an on-site sheriff, adds another layer of value. In exchange for a housing discount, the officer assists with:

- On-call security checks

- Pool lock-up and common area monitoring

- Attendance at resident events

It’s a low-cost, high-impact program that improves safety perceptions and strengthens community trust.

Innovative Leasing & Communication

Birchstone’s high-touch management model supports our communities with:

- Automated renewal nudges and resident surveys

- Price-drop alerts and availability campaigns

- Onsite check-ins and retention-focused communication

By streamlining the resident lifecycle, we not only enhance satisfaction—we preempt turnover.

Value Creation by the Numbers

Halston Waterleigh was acquired at a 5.5% cap rate, while the surrounding submarket now trades at ~4.8%. This spread creates a clear valuation lift for our investors—made more durable by rising retention and organic income growth.

And the upside potential doesn’t stop there. We estimate $75–$100 in additional rent lifts are still in play across the portfolio. That equates to approximately $30,000 in monthly incremental income—a pipeline of growth already in motion.

The Takeaway for Investors

Resident retention is more than an operational metric. At Ashcroft, we invest in teams, technology, and strategies that increase the lifetime value of each lease. Halston Waterleigh is proof that a thoughtful, localized retention strategy can generate both community loyalty and measurable investor upside.

Want the visual story? [Watch the Property Video]

This offering is currently open to accredited investors [Learn More]

Disclaimer: The offering referenced herein is available only to verified Accredited Investors under The Securities Act of 1933, Regulation D, Rule 506(c).

There is no assurance an investment will achieve the projected returns or that investors will receive a return of capital or a return on investment in the projected timeframe or at all. Projections are based on assumptions Ashcroft believes reasonable based on its past experience with similar investments. Past performance is no guarantee of future results, which may vary widely due to circumstances beyond Ashcroft’s control.

This information was derived from sources Ashcroft deems reliable. However, Ashcroft cannot provide assurances as to whether the information provided by these other sources is accurate, current or complete.