October 27, 2025

By: Travis Watts, Director of Investor Development

The Case for Optimism in Multifamily

The U.S. multifamily market is entering a pivotal period. While attention remains fixated on interest rates and inflation, a deeper structural imbalance is emerging: one that could define multifamily investment performance over the next decade. The core issue: supply is quietly falling behind demand. For investors today, this presents an opportunity hiding in plain sight.

The Understated Imbalance

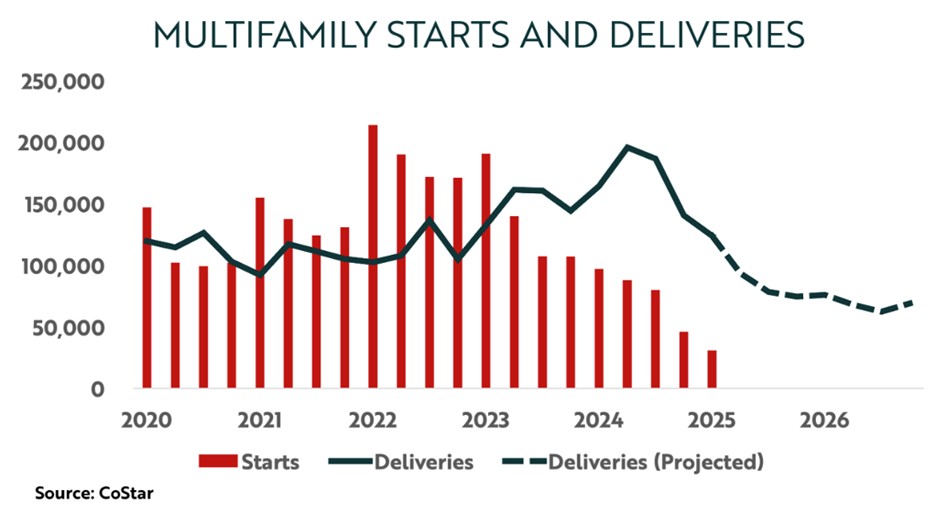

Recent headlines have focused on multifamily deliveries peaking in select markets. On the surface, it would appear the sector is headed for oversupply. However, a closer analysis reveals the opposite.

Starts for new multifamily construction have declined by more than 30% year-over-year as of Q2 2025, according to CoStar’s analysis of Census Bureau data. Rising construction costs, restrictive zoning laws, tightening credit markets, and long permitting timelines have created a bottleneck in the new supply pipeline. What we’re witnessing is not a glut, but a short-term delivery surge masking a longer-term drought. This isn’t a bubble about to burst; it’s a well running dry.

In effect, the U.S. is building fewer apartments, at precisely the time demographic and migration patterns are driving up demand.

Source: https://www.graycapitalllc.com/report-the-multifamily-window-why-2025-could-be-the-best-buy-opportunity-in-years/

Demographics Don’t Wait

Demand fundamentals remain robust. Millennial and Gen Z households are forming at a faster clip, and affordability constraints in the single-family market are locking more Americans into rental living for longer periods.

Meanwhile, migration to the Sunbelt—where Ashcroft’s portfolio is concentrated – continues to outpace national averages. States like Texas, Florida, Georgia, and North Carolina are absorbing outsized population inflows, with workforce renters leading the charge.

When supply slows and demand persists, the implication is clear: rent growth pressure builds over time.

Why This Matters for Investors

Multifamily has long been a favored asset class for its relative stability and growth potential. But today, we have an environment where cap rates have already expanded, and transaction volumes are beginning to increase, selectivity and operational edge matter more than ever.

The silent supply crisis amplifies the importance of:

- Buying Right: Access to off-market or favorably priced assets is essential as opportunities become more competitive.

- Operating Efficiently: Creating value through operational improvements and cost savings can drive investor returns more than simple rate improvement.

- Holding Long-Term: Investors positioned to ride out rate volatility may benefit from compressed supply and strengthening rent fundamentals in the years ahead.

Ashcroft’s Strategic Response

At Ashcroft, we see this imbalance not as a risk to be avoided, but as an opportunity to be earned. We are actively acquiring in targeted markets where the supply/demand imbalance is most acute. Our vertically integrated model spans from acquisitions, asset management, renovations, warehousing bulk materials and operating property management in-house. This enables us to underwrite and execute with discipline and scale.

Recent acquisitions, such as Halston Waterleigh, reflect our focus on resilient submarkets with constrained future supply and strong in-place demand. Our value-add approach is designed to improve resident experience, drive retention, and enhance the upside on our properties, without relying on market trends to become more favorable.

Conclusion: Quiet Crises Create Quiet Opportunities

While much of the market remains preoccupied with rate policy, the deeper story is unfolding in the fundamentals. The underbuilding of multifamily stock is not an immediate headline, but it is a slow-moving force that can shape returns for years to come.

For investors seeking long-term growth, inflation protection, and demographic tailwinds, multifamily remains a compelling opportunity, especially for those aligned with experienced operators who are already positioned for what’s next. Every real estate cycle creates volatility and distraction, but the long-term investor looks for a quiet signal underneath. Today, that signal is supply.

Interested in how today’s market could impact your portfolio?

Why This Matters for Investors

Multifamily has long been a favored asset class for its relative stability and growth potential. But today, we have an environment where cap rates have already expanded, and transaction volumes are beginning to increase, selectivity and operational edge matter more than ever.

Connect with our team to explore current opportunities or learn more about our investment thesis for 2025 and beyond.

——-

Disclaimer: This material is for informational purposes only and is not intended as an offer to buy or sell securities or a solicitation of such offers to purchase securities. Any such offer will be made only through official offering documents and only to verified accredited investors as defined by Regulation D, Rule 506(c) of the Securities Act of 1933.

This content may contain forward-looking statements, including references to potential regulatory developments and future access to private real estate investments through retirement accounts. These statements are subject to risks and uncertainties, and actual outcomes may differ materially.

Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal. Investors should consult their financial and legal advisors before making any investment decision. Ashcroft Capital does not provide tax, legal, or investment advice. Any discussion of potential tax-advantaged strategies is for illustrative purposes only and may not be available to all investors. This material does not constitute an offer to buy or sell securities or a solicitation of such offers.