June 12, 2024

“I feel like I’m on a team, but I’m a silent partner––and that is important to me.”

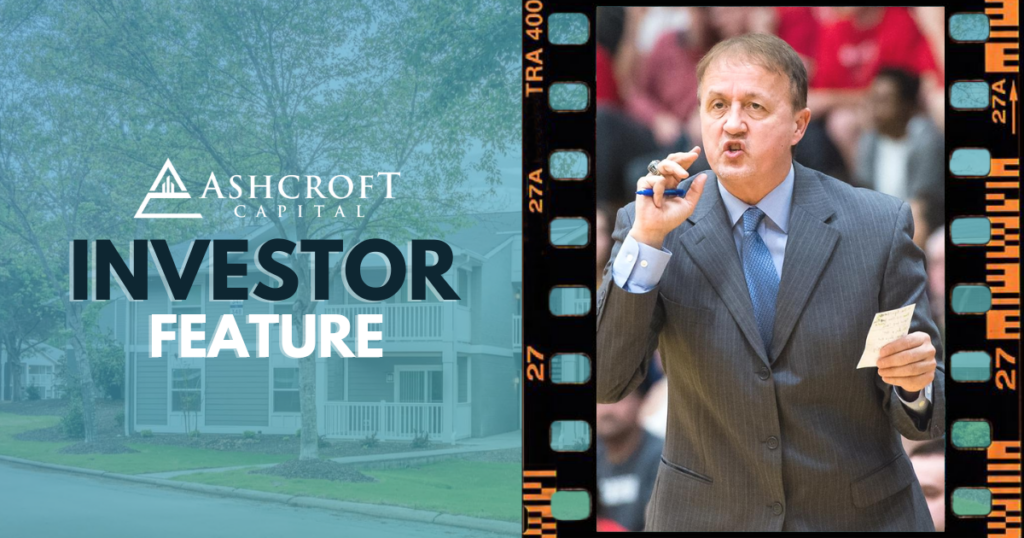

As the associate head coach for men’s basketball at Washington State University, Jim Shaw knows what it means to invest in the future. For more than thirty years, he has guided and mentored young men on and off the court. His demanding job, constant travel, and reflection on his ideal retirement have all inspired Jim to invest in his own future.

Putting Landlord Duties on the Bench

“My dad was a landowner and so I’ve been around investment,” says Jim of his early exposure to earning multiple streams of income. “As I progressed in my career, I looked for ways to set up passive income. I started out with rental homes, which worked really well because we bought them at a time when the housing market had almost collapsed in 2008. But with my full-time career, I discovered that it’s hard to be a long-distance landlord.”

Luckily, Jim’s son-in-law introduced him to the concept of real estate syndication, opening a new potential for passive income that is truly hands-off. “I’ve slowly weaned my way out of the landlord game and into this one,” he explains.

After bonding with Joe Fairless over their ties to The Big 12, and conducting some independent research, Jim decided to give Ashcroft a shot. He’s now been with Ashcroft for over five years.

Jim’s Investment Playbook

In addition to looking for five percent or greater returns, Jim employs a ‘worst-case-scenario’ rule of thumb for investing. “I want to make sure that I can afford the worst-case scenario. In this case, people are always going to need a place to live. Interest rates going up affects everybody and everything; but at the same time, the rental market should stay strong because less people can buy homes. Evaluating the worst case is great because everybody feels good when the best-case scenario happens instead.”

Jim is hoping to stack up some of those best-case scenarios to pad his future retirement. “What I’d like in the long-term is plenty of discretionary income so that when I retire, I’m not just relying on social security; I should have two or three other income streams.” And he’s worked out a clever strategy to maximize the benefits of his role until he gets there. “Once you hit age 50 and you’re a state employee, there are a lot of ways you can pre-tax your dollars,” says Jim.

“I max everything––then I use the cushion from Ashcroft to make sure I have enough monthly income.”

Finding Balance Amidst COVID and the Current Market

A stellar coach and strategist, Jim is quickly adapts to change and thinking one step ahead. “I made the decision to sell my rental properties based on the circumstances surrounding the pandemic. I like balance in most areas, and it became really unbalanced to be a landlord because you just didn’t have a lot of levers to continue your income stream during the crisis. And I don’t have time right now to really focus on my investments, so that made the decision to sell simpler.”

“With Ashcroft, I like the fact that I don’t have to put a tremendous amount of time into it. I still have a very demanding career. I like being the silent partner and letting the experts be the experts.”

In a tumultuous post-COVID world, Jim trusts Ashcroft to navigate the changing tides and still deliver. “There are challenges in the investment world right now with interest rates, but the reality (in my opinion) is interest rates probably won’t come back down. I think they’re getting close to leveling out. We got unbalanced for a while: zero is unbalanced as it essentially gives money away. I think ultimately, they’ve come back to a balance point. From a strategy standpoint, I’ll let the experts figure out what the new normal is going to be and how we can still achieve our goals financially.”

Taking Lessons from the Court into Investing

Having the Ashcroft team on hand to offer regular communication, a solid action plan, and a high level of return gives Jim the space to focus on the court. In fact, his role as a coach reminds Jim of what he likes most about Ashcroft. “In coaching you try to eliminate mistakes and maximize what you control. You’re dealing with 18 to 22-year olds. If you can get them to have a consistent attitude and a consistent work ethic, then you can form a unified personality and common goals,” Jim explains.

“With Ashcroft, I feel like I’m on a team, but I’m a silent partner––and that is important to me. Let the experts be the experts and try to have a good attitude.”

Jim is just one of our 3,000+ investors. Hear what passive income has meant to over 100 of our investors.