February 21, 2024

By: Travis Watts, Director of Investor Development

A Year of Stability Amid Challenges

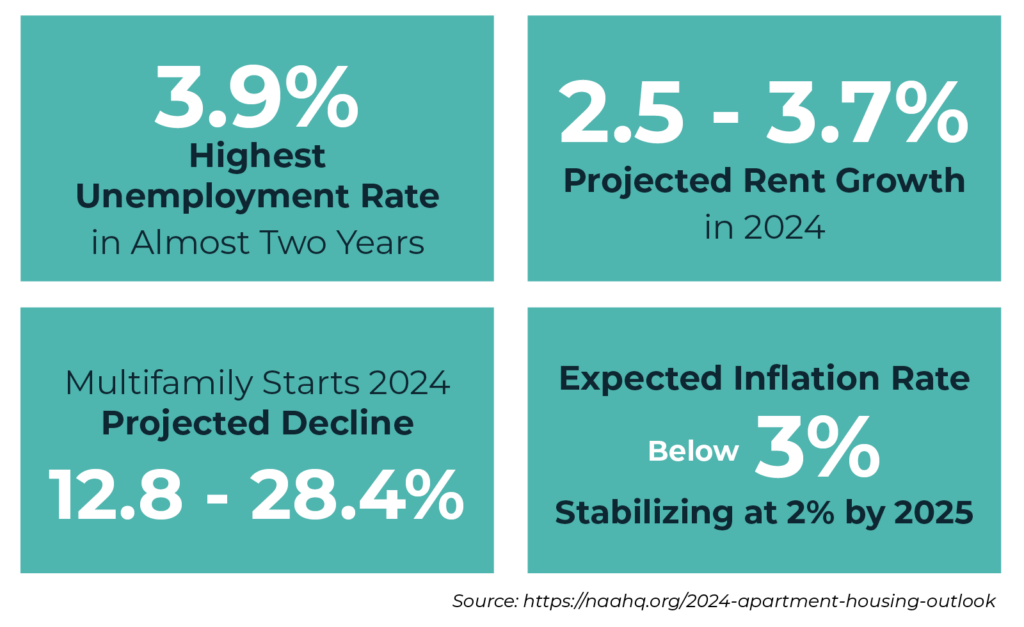

The multifamily market in 2023 has shown resilience and adaptability in a sea of economic uncertainties. With an unemployment rate that remained impressively low at 3.9%, and rental growth predictions between 2.5% and 3.7%, the sector has shown remarkable resilience.[1]

However, it’s not all smooth sailing. A noticeable dip in new construction raised eyebrows, signaling a potential future shortage of housing.

Economic Tailwinds and Multifamily Market Stability

As we progress into 2024, the multifamily market appears poised for a year of dynamic growth and opportunity. Despite the challenges of recent years, including economic fluctuations and interest rate hikes, strategic market shifts set the stage for a promising year ahead.

In 2024, the multifamily market is expected to benefit from a combination of economic recovery and strategic adjustments. With the unemployment rate maintaining a low profile and a positive outlook on rent growth, investors and property owners could anticipate a stable and potentially lucrative landscape. This stability is further bolstered by a nuanced understanding of the Federal Reserve’s monetary policies, which is centered on market stability.

Interest Rates and Investment Dynamics

The Federal Reserve took a firm stance against inflation with rate hikes in 2022, aiming to stabilize the economy. This monetary policy shift directly impacted the multifamily market, affecting property values and investment decisions. While higher interest rates pressured valuations, there’s a silver lining: the anticipation of rate normalization could favor investors in the long run.[2]

Navigating Supply and Demand Dynamics

One of the critical factors influencing the multifamily market in 2024 will be the balance of supply and demand. While new construction has slowed in response to economic pressures, the demand for rental units continues to climb, especially in high-growth regions like the Sun Belt.[3] This imbalance presents both challenges and opportunities, as developers and investors race to meet the demand without oversaturating the market.

The upcoming year is expected to bring a flood of new units to the market, a result of the development boom in 2021. However, this surge coincides with less favorable economic conditions, making the competition fiercer. The expected drop in construction by summer 2024 highlights a crucial supply challenge, especially with a significant number of multifamily loans maturing in the near term.[4]

Rental Market Trends: A Mixed Bag

Demographic shifts towards the southern and Sun Belt regions are reshaping demand, creating hotspots for multifamily investments. As the gap between owning and renting widens, renting becomes an increasingly attractive option, supporting the rental market’s strength.

Rent averages nationally have steadied at around $1700, a figure influenced by the Fed’s interventions which have tempered rent growth.[5] Despite this stabilization, experts like CoStar are optimistic, forecasting a rebound in rent growth and occupancy rates into 2024, thanks to economic recovery and a tight supply of new units.[6]

Strategies for Success: Value-Add Multifamily Investments

Success in the multifamily market in 2024 will require a blend of adaptability and innovation. Investors who are quick to identify the shift towards value-add projects and sustainable building practices could position themselves well to capitalize on the evolving landscape.

By revitalizing older properties, investors may unlock potential rent increases, aligning with the broader trend of positive rent growth over time. Focusing on Class B apartments targets the substantial middle-income demographic, offering a blend of affordability and quality. Additionally, a focus on tenant needs and preferences, such as the demand for flexible living spaces and amenities, will be key to maintaining high occupancy rates and driving rental growth.

The Role of Technology and Data Analytics

Technology and data analytics will play an increasingly important role in shaping the multifamily market in 2024. From optimizing property management to enhancing tenant engagement, the integration of tech-driven solutions will be a critical factor in differentiating competitive offerings. Moreover, data analytics will provide invaluable insights into market trends, tenant behavior, and investment opportunities, enabling more informed decision-making.

Ashcroft Capital’s property management group, Birchstone Residential has already implemented and is benefiting from these new technology solutions.

- AI led follow-up tool (6:52)

- Fraudulent application software (8:23)

- Purchase order program (18:35)

- Online reputation auditor (21:10)

Conclusion: A Year of Opportunity Awaits the Multifamily Market

Looking ahead, the multifamily market is poised for a transformative phase. With interest rates expected to ease and strategic investments in growing markets, the outlook is bright for those who adapt and plan ahead.

As the sector continues to evolve, adapting to economic shifts and capitalizing on emerging trends will be key to achieving sustained success in the multifamily market. Whether you’re an investor, developer, or property manager, the multifamily market in 2024 promises a landscape rich with potential for growth, innovation, and long-term success.

Want to take a deeper dive?

Tune into new episodes of Multifamily Market Report on YouTube

Sources:

- Munger, Paula. “2024 Apartment Housing Outlook.” National Apartment Association. December 4, 2023. https://www.naahq.org/2024-apartment-housing-outlook.

- Caldwell, Preston. “When Will the Fed Start Cutting Interest Rates?” Morningstar. January 29, 2024. https://www.morningstar.com/markets/when-will-fed-start-cutting-interest-rates.

- “U.S. Population Trends Return to Pre-Pandemic Norms as More States Gain Population.” United States Census Bureau. https://www.census.gov/newsroom/press-releases/2023/population-trends-return-to-pre-pandemic-norms.html.

- “United States Multifamily Capital Markets Report.” Newmark. 3Q 2023. https://www.nmrk.com/insights/market-report/united-states-multifamily-capital-markets-report.

- “Multifamily Rents Remain Flat in January, Reports Yardi Matrix.” Yardi. February 14, 2024. https://www.yardi.com/news/press-releases/multifamily-rents-remain-flat-in-january-reports-yardi-matrix.

- Munger, Paula. “2024 Apartment Housing Outlook.” National Apartment Association. December 4, 2023. https://www.naahq.org/2024-apartment-housing-outlook.