February 16, 2024

By: Travis Watts, Director of Investor Development

The FIRE Movement, an acronym for Financial Independence Retire Early, has gained significant traction since its inception, particularly after the 2008 financial crisis. Primarily centered around stocks, this movement advocates for aggressive savings coupled with low-cost index fund investing to amass a nest egg substantial enough to sustain a person’s lifestyle indefinitely.[1]

However, beyond the realm of stocks, there lies a compelling avenue within the real estate sector that aligns seamlessly with the principles of the FIRE Movement.

Understanding the FIRE Movement with Stocks

A core staple of the FIRE Movement revolves around building a robust portfolio through diligent saving and disciplined investment. Participants typically channel a significant portion of their income – often 50% or more – into low-cost index funds (stocks) over a span of 10 to 20 years. Upon reaching a predetermined financial milestone, typically a one to two-million-dollar portfolio, individuals then sell off 4% a year from their investments to sustain their lifestyle.

The Simple Math

4% of $1,000,000 = $40,000 per year

4% of $2,000,000 = $80,000 per year

The idea behind the “4% Rule” is that historically the stock market has averaged around 8-9% a year in equity growth, thereby, withdrawing 4% a year creates a buffer to account for inflation while also facilitating continued portfolio growth.[2]

Extending the FIRE Strategy to Real Estate

In parallel with the principles of the FIRE Movement, real estate offers a compelling alternative investment avenue. Considering the innate cash flow potential that real estate can provide, investors can adopt a strategy where they use passive income as the “withdrawal rate”, rather than selling off the portfolio. Private real estate investments are inherently illiquid, so selling off a percentage of a portfolio is usually not applicable. Instead, collected rent and revenue can provide monthly income and any equity gains (when a property sells at a profit) allows the portfolio to grow over time, and could provide a buffer for inflation similar to that of the 4% Rule’s methodology.

Realizing the Benefits of Real Estate Investment

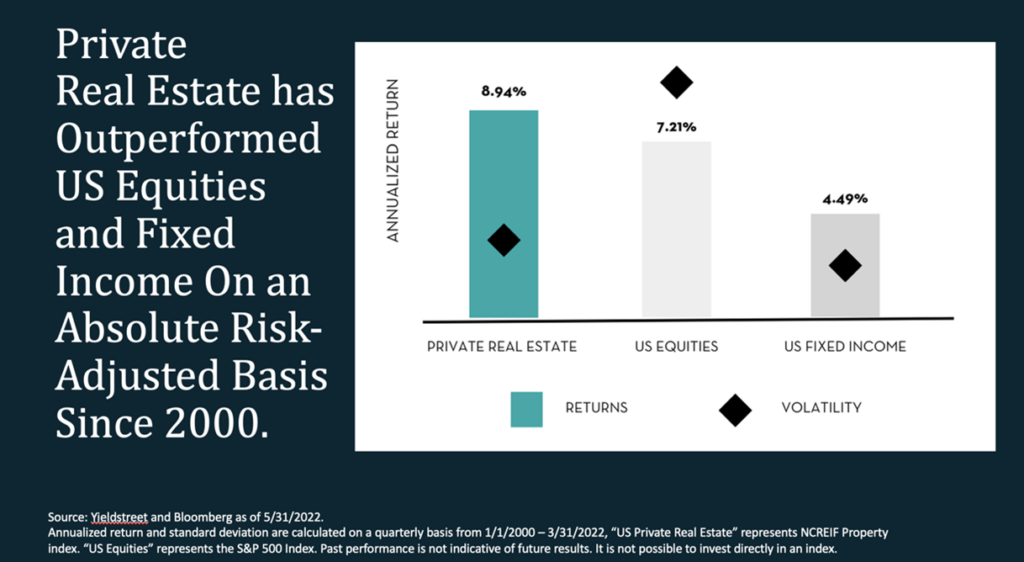

The allure of real estate investment lies not only in the potential for diversified income streams, but it also offers a myriad of tax advantages, it is not highly correlated to stocks, it offers relatively low volatility and since the year 2000, private real estate has outperformed US Equities on an annualized basis.

Crafting a Personalized Path to Financial Independence

While the FIRE Movement underscores the pursuit of financial independence and early retirement, its implementation remains inherently flexible. Investors can tailor their approach based on individual preferences and risk appetite. For many investors, the addition of real estate can simply be a way to diversify a portfolio while unlocking new avenues for income generation.

Bob’s Case Study

Let’s examine a quick case study for example purposes:

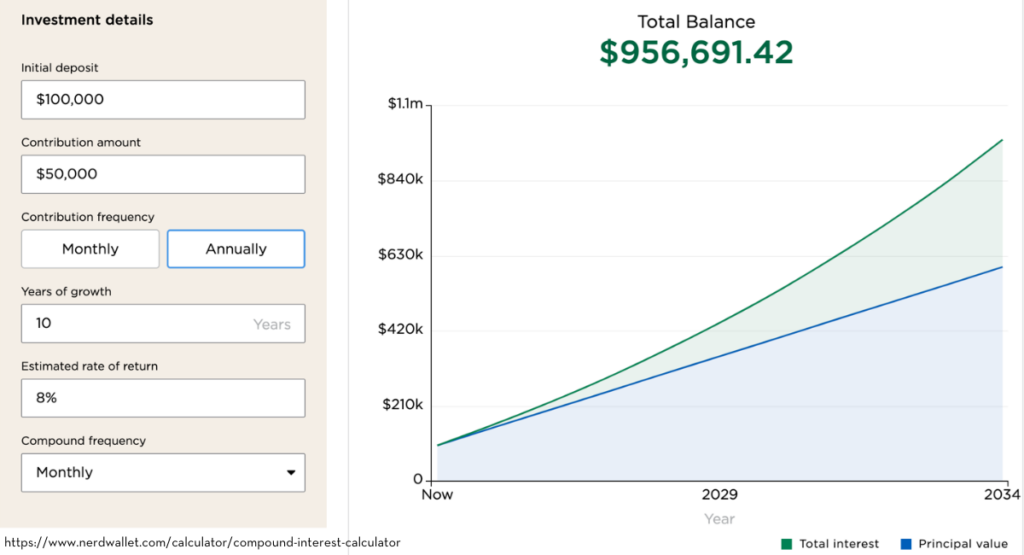

- Bob has $100,000 to invest.

- Bob earns $125,000 a year at this job ($100,000 after taxes).

- Bob maintains a 50% savings rate (after taxes)

- Bob lives on $50,000 every year.

- Bob allocates $50,000 toward his investments every year.

Simply saving this amount of income could amass a portfolio worth around $600,000 in a 10-year timeframe without factoring in any investment returns. But if we factor in an 8% annualized rate of return for these 10 years, Bob’s portfolio would be close to $1,000,000. This calculation does not include equity gains, this is purely generated from cash flow, so the portfolio could amount to much more.

At this point, FIRE begins to unfold. Bob can choose to live on his cashflow; roughly $80,000 a year assuming an 8% yield, or he may choose to take some time off, retire a spouse, switch careers, or embrace charity. The point is, Bob has options.

Summary: The FIRE Movement

In recap, that is what the FIRE movement is all about. It’s about having more options. Many choose to continue working after reaching “FI” and opt-out of the “RE” retirement component because they enjoy their career or see a need for contribution. That is the beauty of it, it’s completely in your hands to modify your lifestyle the way you see fit. Something to think about for the week.

Want to take a deeper dive?

Tune into weekly episodes on YouTube

Sources:

- Kerr, Alexandra. “Financial Independence, Retire Early (FIRE) Explained: How It Works.” Investopedia. January 31, 2024. https://www.investopedia.com/terms/f/financial-independence-retire-early-fire.asp

- Suknanan, Jasmin. “What is the 4% rule and how can it help you save for retirement?” CNBC. November 30, 2022. https://www.cnbc.com/select/what-is-the-4-percent-retirement-savings-rule.