June 12, 2024

By: Travis Watts, Director of Investor Development

What the Federal Reserve’s Moves Mean for Commercial Real Estate

The Federal Reserve (“the Fed”) plays a critical role in shaping the economic landscape of the United States, primarily through its control over interest rates. These rates can influence borrowing costs, consumer spending, and investment decisions across various sectors, including commercial real estate. Understanding how the Federal Reserve’s interest rates impact commercial real estate is crucial for investors and owners. In this article, we’ll examine what the Federal Reserve’s moves mean for commercial real estate.

The Expectation

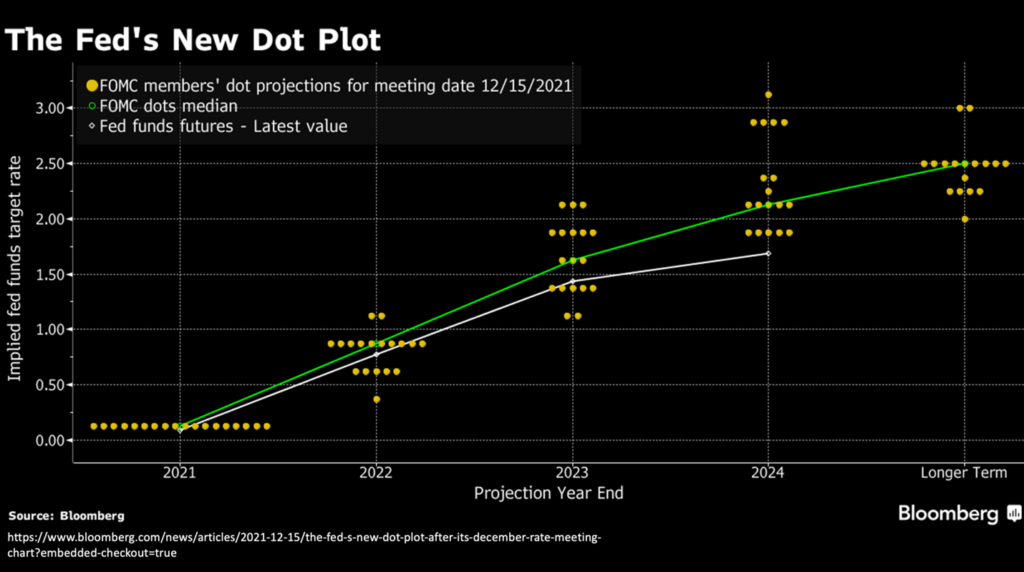

Looking back to late 2021 (before the recent rate hike cycle), commercial real estate investors and owners were seeking insight into what interest rates might do in the coming years. This data is critical to consider as it leads to decisions such as what type of debt to place on a property and where valuations might be headed soon.

The chart below, published in December of 2021, shows the expectation that the federal funds rate was likely going to increase in the coming years at a slow and steady pace to an approximate range of 2.5% – 3% by 2025. The federal funds rate is the interest rate that banks charge each other to borrow or lend excess reserves overnight. The federal funds rate directly influences the cost of borrowing.

When the Fed raises the federal funds rate, it becomes more expensive for banks to borrow money. This increase is typically passed on to consumers and businesses in the form of higher interest rates on loans and mortgages. For commercial real estate, higher interest rates mean increased costs for financing property purchases and development projects. [1]

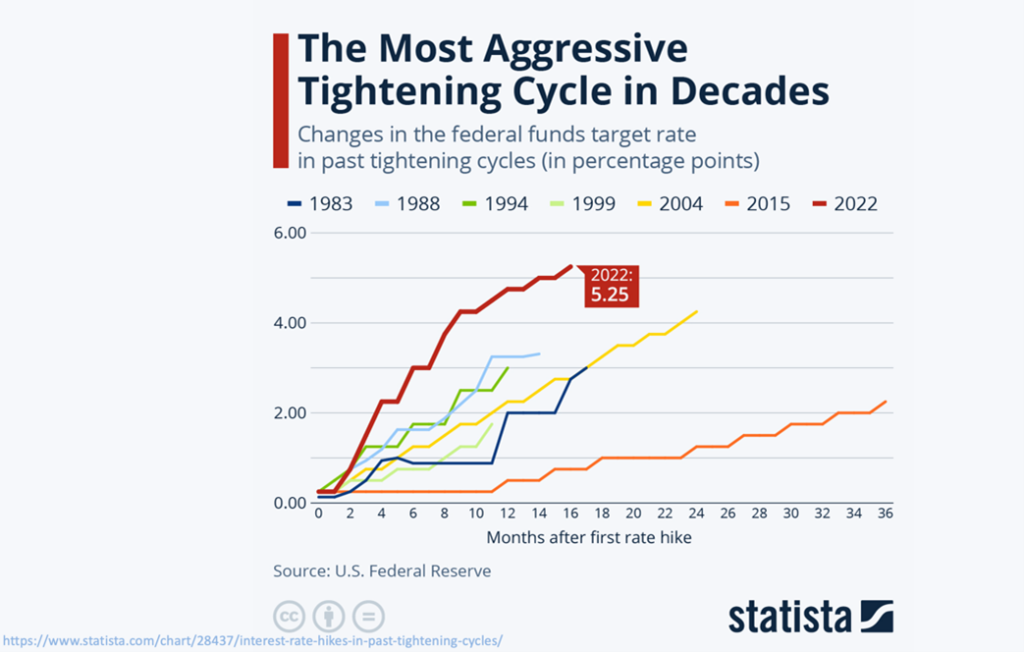

The Reality

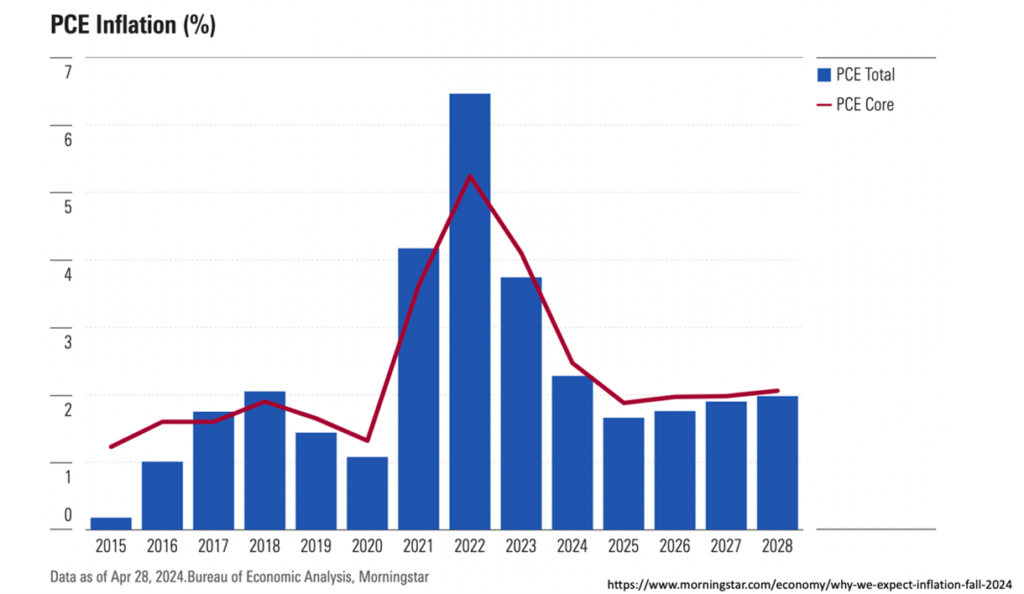

Fast forward to 2023, and we had experienced the most aggressive tightening cycle in decades. The federal funds rate was raised to 5.25% -5.5%, nearly double the projected rate from late 2021. This was to reduce inflation that began to rapidly rise in 2022; however, as a side effect, this aggressive tightening cycle placed commercial real estate into a downturn. Let’s examine the impact in more detail.[2]

Borrowing Costs

Developers and investors often rely on loans to fund commercial real estate projects. Compared to retail mortgages with a 30-15-year maturity term, the maturity length of commercial loans is often much shorter. Generally, commercial bridge loans are intended to provide 6-12 months’ worth of financing before a complete repayment of the loan is due.

These types of loans are common in commercial real estate as well as other commercial mortgages which often fall within a 5-10 year-term until maturity. This is important because when these loans mature, the debt needs to “reset” to the current interest rate environment, or the property needs to be sold to another buyer.

The problem commercial real estate has faced over the past two years is that higher rates reduce the distributable cash flow or income from properties with adjustable loans, as these rates move in tandem with the current rate environment. If a fixed-rate loan is nearing maturity, it will likely need refinancing, which is now challenging as mortgage rates have nearly doubled since 2021. Additionally, commercial real estate valuations have declined due to higher rates, leading to decreased investment activity, more distressed properties, and a slowdown in new developments.

Influence on Property Values and Cap Rates

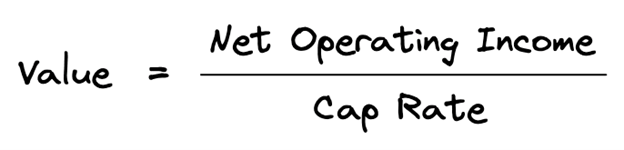

Commercial real estate values are influenced by a combination of income generated from the property and the capitalization (cap) rate, which is used to estimate the investor’s potential return on investment.

The cap rate is influenced by interest rates. As interest rates rise, cap rates tend to increase to compensate for the higher cost of borrowing. Higher cap rates typically lead to lower property values because the same level of income from a property results in a lower valuation.

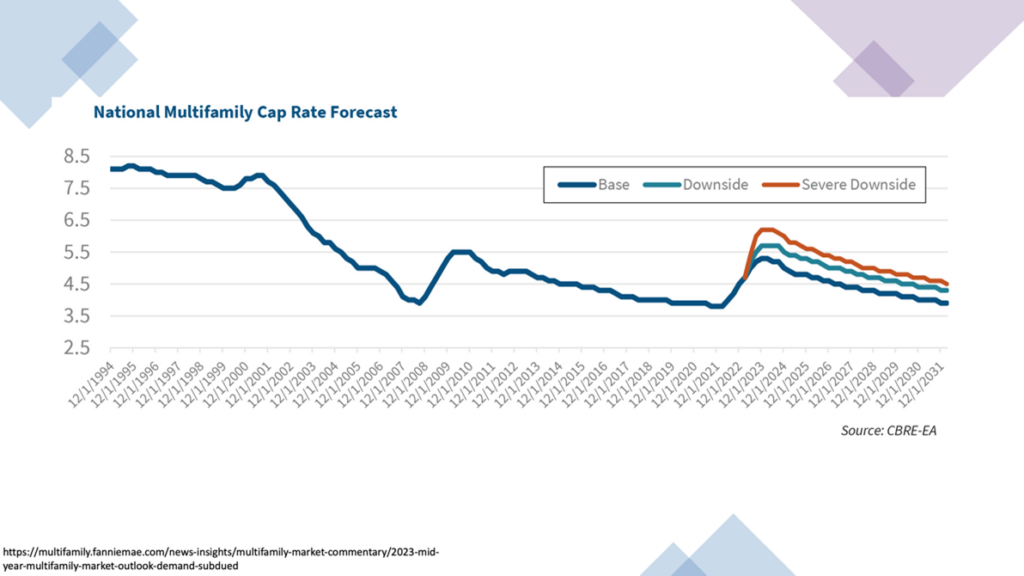

For example, if a property generates $1 million in annual income and the cap rate is 5%, the property is valued at $20 million. However, if the cap rate increases to 6% due to rising interest rates, the property value drops to approximately $16.7 million. This inverse relationship between cap rates and property values has significantly impacted the commercial real estate market as shown below in the chart published by CBRE. The last time we experienced a significant uptick in cap rates was during The Great Recession.

Commercial Real Estate Supply and Demand

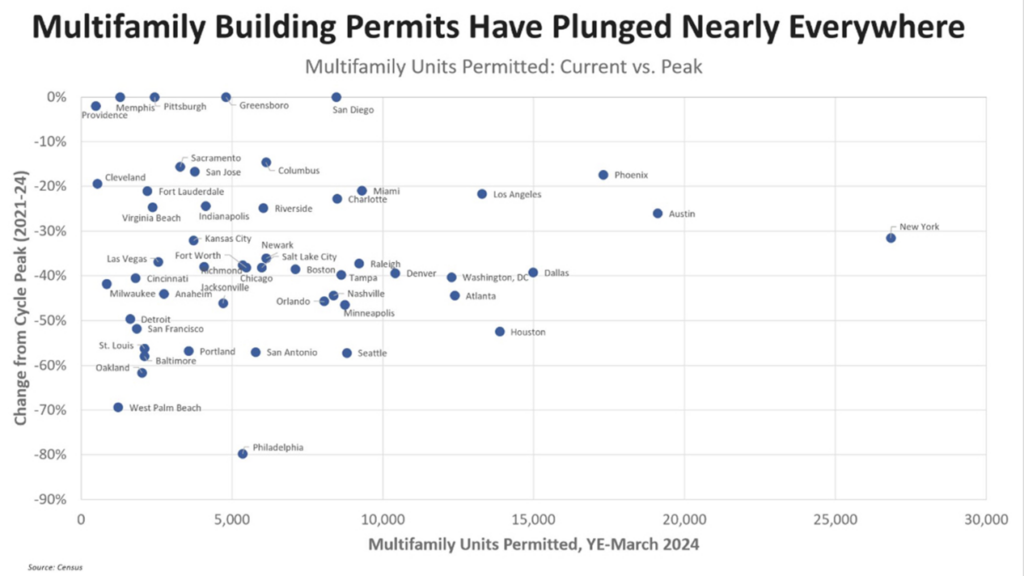

Simply put, higher interest rates soften demand for commercial real estate. Businesses facing higher borrowing costs may delay or scale back expansion plans, reducing the demand for office spaces, retail locations, and industrial facilities. On the supply side, developers become more cautious, delaying new construction projects until borrowing costs become more favorable. This has resulted in multifamily building permits plummeting over the past couple of years as you can see in the chart below.

The Silver Lining

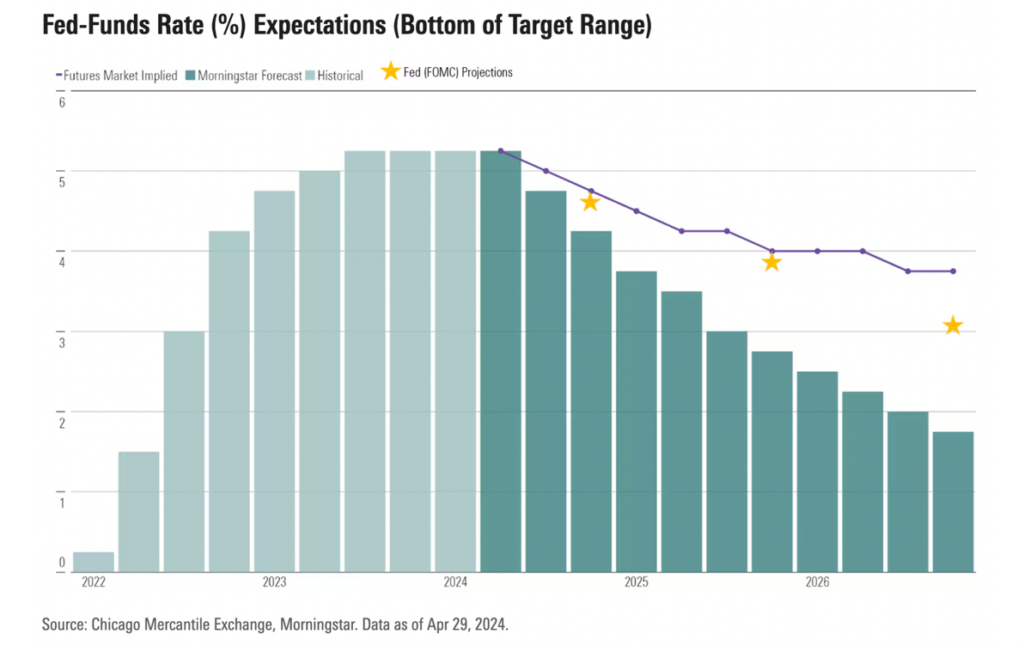

A rare opportunity is taking fold in commercial real estate this year. As the Fed has held rates steady for nearly a year and inflation has meaningfully declined since its peak in 2022, the expectation now is for rates to come down in the coming years.[3]

When interest rates are lowered, the commercial real estate sector typically experiences several positive effects:

#1 Increased Demand:

- With cheaper access to capital, real estate becomes more attractive to investors. This can lead to more buyers seeking commercial properties, which helps drive up prices.

#2 Enhanced Returns:

- Investors benefit from lower mortgage rates, which can improve the profitability of their investments. Lower interest payments may lead to increases in the net income on properties, which can boost distributable cash flow to investors.

- Additionally, existing property owners often look to refinance their loans when rates are lowered, reducing their debt servicing costs and freeing up capital for renovations or expansions. Others may choose to do a cash out refinance and return capital to investors.

#3 Rising Property Values

- As discussed previously, if cap rates decrease (which they are forecasted to do in the coming years) then property values typically increase. Similar to the previous example, if a property generates $1 million in annual income and the cap rate drops from 6% to 5%, the property value increases from approximately $16.7 million to $20 million.

In the short term (if demand rebounds) there will be an increased lack of new supply in the coming years as builders have largely pulled back from starting new construction projects due to lack of supply and higher rates. For perspective, it typically takes 2-3 years to build a commercial property such as a large apartment building. According to the NMHC (National Multifamily Housing Council) the U.S. is already in short supply and needs to build 4.3 million more apartments by 2035 to meet demand for rental housing, meanwhile new permits are down nearly 40% from their peak in many U.S. markets. High demand coupled with a lack of supply often results in rising property values.[4]

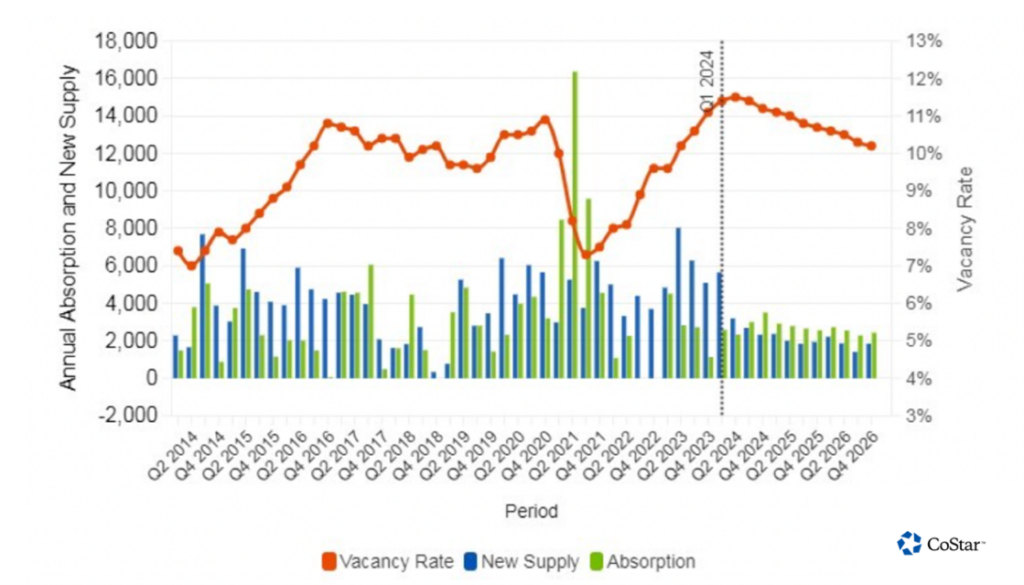

As shown in the chart above published by CoStar, new supply is forecasted to taper off in the coming years as absorption (the number of units occupied within a market) outpaces the number of units available. This is great news for buyers in today’s market, assuming this forecast works out.

Navigating the Federal Reserve’s Actions

Higher interest rates have challenged the commercial real estate market, affecting short-term property values. However, suppressed valuations present an opportunity to “buy the dip” as demand remains strong. Savvy investors and developers can capitalize on this through careful planning and strategic investments.

At Ashcroft Capital, we continue to focus on acquiring institutional-quality properties in strong growth markets. Since late 2022, we purchased properties at roughly a 25% discount compared to the peak pricing in 2021 and early 2022. This rare opportunity allows us to leverage our fully integrated approach, covering every facet of the investment lifecycle — from funding and construction to providing an exceptional resident experience.

Together, our management company, Birchstone Residential, leverages their expertise and understanding of industry knowledge and best practices to create long-term results for our investors. Existing investors, we are grateful for your continued partnership, and new investors, welcome and please visit www.ashcroftcapital.com for current offerings and opportunities or give us a call at 646-308-1511.