July 2, 2024

By: Travis Watts, Director of Investor Development

Evaluating Syndication in Multifamily Real Estate

Before diving into the top questions to ask a syndication partner, it’s essential to address some critical questions about your own investment goals and preferences. Understanding your personal investment objectives is vital not only for selecting a syndication partner whose goals align with yours but also for determining if syndication in multifamily real estate is suitable for you.

1. What Are Your Investment Objectives?

- Cash Flow

- Growth

- Tax Benefits

- Wealth Preservation

Clearly defining your investment objectives is the first step. This helps ensure that your goals align with those of the syndication partner and makes it easier to identify the right investment opportunities.

2. What is Your Investment Timeframe?

Consider whether you value liquidity or if you’re comfortable locking up your capital for extended periods. Some syndication operators only plan to hold a property for a couple of years. Others may not project a timeframe to sell; therefore, you may be invested for a decade or longer. Knowing your ideal investment timeframe in advance can help you select the right syndication opportunities.

3. What is Your Risk Tolerance?

Evaluate whether you are risk-averse or open to higher-risk opportunities with potentially higher returns. Your risk tolerance will significantly influence the types of deals you should consider.

For example, an opportunistic investment may entail a higher risk profile compared to investing in a value-add property with high occupancy that offers immediate cash flow. You can learn more about these investment types on our YouTube Channel.

Questions to Ask a Potential Syndication Partner

Understanding your own objectives is just one part of the equation. It’s equally important to ask the right questions when it comes to vetting a syndication partner. Below are three questions to consider.

1. What is Your Exit Strategy?

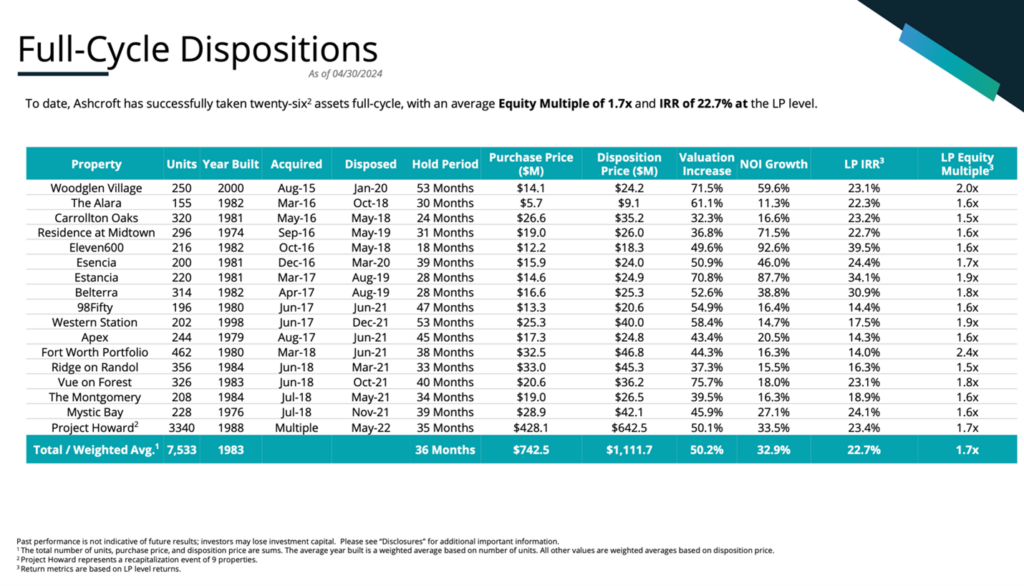

This question provides insight into your syndication partner’s experience, investment objectives, and business plan. At Ashcroft Capital, our focus is on creating value through well-defined exit strategies. Our track record shows a consistent pattern of identifying the right time to exit investments, ensuring optimal returns for our investors.

Our target hold period is five years for single assets and seven years for our funds. Historically, it takes about three years for us to complete a value-add business plan, so a projected 5–7-year timeframe allows for added flexibility to sell at the most opportune time.

2. What is Your Investment Strategy?

Ask why the syndication partner is pursuing a core, core-plus, value-add, or opportunistic strategy. Their rationale should reflect their experience, infrastructure, and available resources. A detailed explanation indicates confidence and preparedness.

At Ashcroft Capital, we specialize in value-add investment strategies. The business plan is to acquire stabilized, cash flowing properties, enhance them through strategic renovations and operational improvements, and ultimately increase their value over time.

This approach has allowed us to deliver double-digit net returns to our investors while improving the living conditions for our residents in the process. You can view a video example of one of our projects on our YouTube Channel.

3. Does the Partner’s Compensation Structure Align with Your Interests?

Be wary of partners who have no personal investment at stake but expect to get paid regardless of the investment’s performance. Ask if they get paid even if you lose money. Seek out partners who prioritize investor compensation and align their success with yours.

At Ashcroft Capital, we believe in aligning our interests with our investors. That’s why our General Partners co-invest as LPs in every deal. At a minimum, our GPs invest $100,000 in each deal, but in many cases, the amount is much higher. We also offer our investors a “coupon” on preferred return to ensure LPs are paid before the GPs.

Additionally, our asset management fees are not collected until our investors have been paid their full coupon. Our compensation structure is designed to reward performance, ensuring that we succeed only when our investors do.

Is Syndication in Multifamily Real Estate Right for You?

Though every investment entails a level of risk, much of this can be mitigated by investing with the right partners or managers. For syndication in multifamily real estate, the experience, defined exit strategy, clear investment approach, and precise business plan of your partner are crucial for success.

Our mission is to create exceptional investment opportunities through strategic acquisitions, diligent in-house property management, and a commitment to transparency and integrity. By asking the right questions—both of yourself and your potential partners—you can significantly enhance your ability to vet your next syndication investment effectively.

Discover the power of hands-off real estate investing. To learn more, we invite you to book a call with an Investor Relations representative. This complimentary, no-pressure call will equip you with the knowledge and information needed to make an informed decision.