January 17, 2024

By: Travis Watts, Director of Investor Development

Breaking Free from Age-Based Retirement Planning

In my early twenties, I had a realization that challenged the traditional narrative of what retirement means. The common path in America is to obtain an education, a job, and channel earnings into retirement accounts, then tap into social security in your 60’s. This left me questioning if there was another approach. I remember thinking to myself, why wait until your 60’s to retire? Why link retirement to age when it could be thought of as a number?

For example:

- Age 59.5 = access to retirement funds without penalty

- Age 62 = social security benefits

- Age 64 = average age of retirement in the US

Shifting away from this way of thinking led me to a profound understanding that retirement is a reachable financial number at any point in life. I began thinking of how to emulate the financial stability of the average 65-year-old retiree. In 2009, real estate became my unexpected entry into this journey, as it offered immediate passive income, tax-advantages, and equity upside potential.

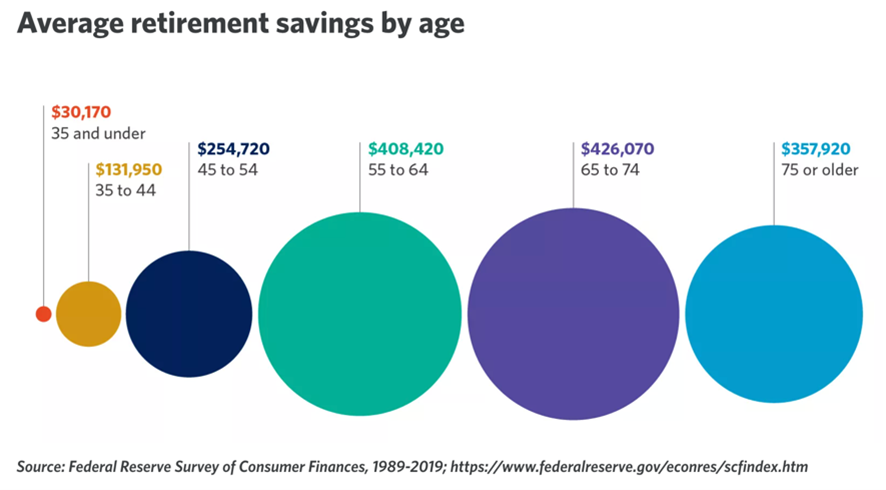

Amidst the financial messaging that championed stock investments, retirement accounts, and obtaining second jobs, I noticed an absence of discussions around sustainable, lifelong income. My quest began with studying retirement data, analyzing figures such as the average savings and investment portfolios and monthly income of 65-year-old retirees, which then revealed the milestones that would be needed to achieve this outcome. I began with reverse engineering the goal – starting from the end and working backward.

The First Step was Maintaining a Low Overhead

Despite earning less than $30,000 per year in my early twenties, I made the decision to invest in a modest two-bedroom townhome in 2009, leveraging nearly all my savings that had accumulated since the age of 15. Getting a roommate enabled me to split the expenses and kept my overhead low as I began the investment journey.

Highest and Best Income

Recognizing that a low income wouldn’t suffice long-term in this pursuit, I began vigorously seeking better-paying job opportunities. After hundreds of applications in a competitive market (this was during the Great Recession), I landed a labor-intensive role in the oil and gas industry, which offered significant earnings through hard work and long hours.

Saving and Investing Aggressively was Pivotal

I deviated from the conventional advice of saving 10-15% of my income and instead redirected 40-50% of my earnings towards investments.This led to a real estate portfolio surpassing $1 million by my late twenties. One crucial aspect I had to consider was generating passive income equivalent to social security and healthcare costs of a 65-year-old.

2023 Data Suggests:

The average social security payment in the US = $1,705.79 a month, according to the Social Security Administration

The average healthcare cost of a retired couple in the US = $950 a month, according to a report from RBC Wealth Management

Investing into income-generating real estate helped create a steady monthly income, providing financial stability for retirement. At minimum I would need $2,655.79 just for the two items above. The remainder of my investment portfolio would need to support my day-to-day lifestyle expenses.

Simple Math (for example purposes):

$1,200,000 invested with 8% annualized yield = $96,000 per year ($8,000 monthly)

We’re all different when it comes to lifestyle preference and knowing how much is enough. This depends on you, your lifestyle costs, and your investment strategy. Looking at retirement as an income number helped me visualize the approach. Then came the most difficult part of the strategy…

Paying Off My Mortgage

This was a seemingly daunting task. However, since only 19% of Americans at age 65 have a mortgage according to U.S. Census Bureau, I figured it was best to be in the majority of this statistic if I wanted to truly replicate the outcome. Admittedly, this took a lot of perseverance and several years of aggressive paydown, but inevitably it led to debt-free homeownership before my mid-thirties.

The Outcome

Call it what you will, retirement, early retirement, financial independence, or having a work-optional lifestyle, the outcome was having peace of mind over my finances. To me, retirement isn’t about stopping work; it is about pursuing meaningful endeavors, contributing positively to others’ and expanding your lifestyle along the way.

“Passive income can allow you to do more of what you enjoy, and less of what you don’t.”

Sharing my journey with you is simply to showcase that achieving retirement can be within reach, regardless of one’s background or starting point. I was not brought up having wealth or education when it comes to investing, and I’m no different than anyone else. I simply set a goal and relentlessly pursued it. Retirement is about setting goals, taking action, and persisting toward your desired outcome.

Regardless of your current path or age, remember, retirement can be a number. So, what’s yours?

- Begin with your goals

- Take action

- And here’s to your success

If you would like to learn more about how our current offerings could align with your retirement goals, schedule a call with our Investor Relations Team.