June 4, 2024

By: Travis Watts, Director of Investor Development

How Economic Shifts and Lifestyle Choices are Impacting Relocation Trends

Events over the past few years, many of them a result of the pandemic, have created both new challenges and opportunities regarding where Americans are moving.

The pandemic introduced new-found geographical freedom for many Americans, as work-from-home options gained popularity. As of March 2023, a Pew Research Center survey found that 35% of US workers who can remotely work from home all the time. Before the pandemic, only 7% of workers worked from home. This prompted a shift in priorities when choosing where to live. However, it’s interesting to note that most current moves are not primarily job-related, suggesting other factors like cost of living and quality of life may be additional drivers. [1]

High-cost cities continue to push renters and homeowners further out from the city center. Notable markets include Los Angeles, San Francisco, and New York City. These cities are among the most expensive in the U.S. and many residents are relocating to markets with lower overall costs, better access to outdoor spaces, and less congested living conditions.

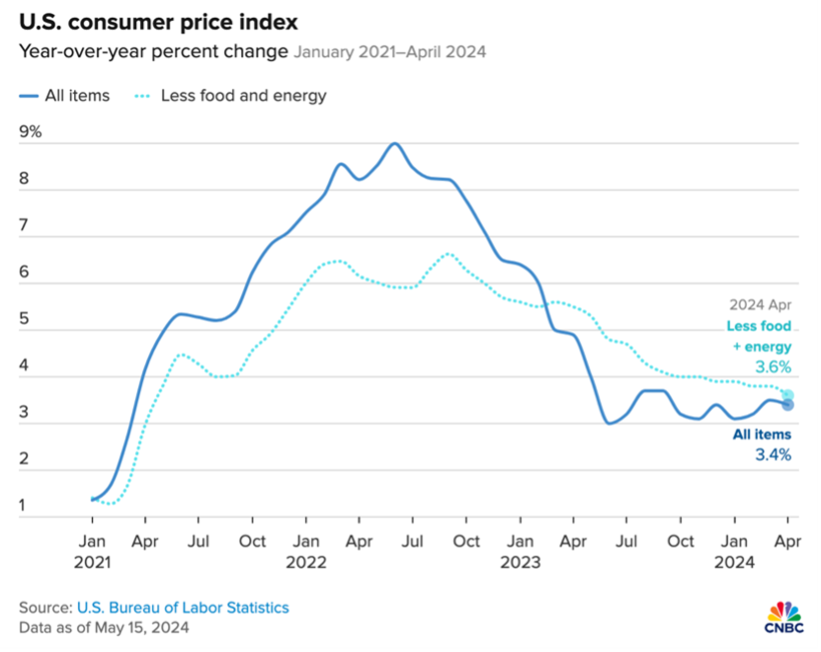

As the cost of living in the U.S. continues to rise, albeit at a slower pace compared to previous years, more residents are choosing to move to states where their dollar stretches further. [2]

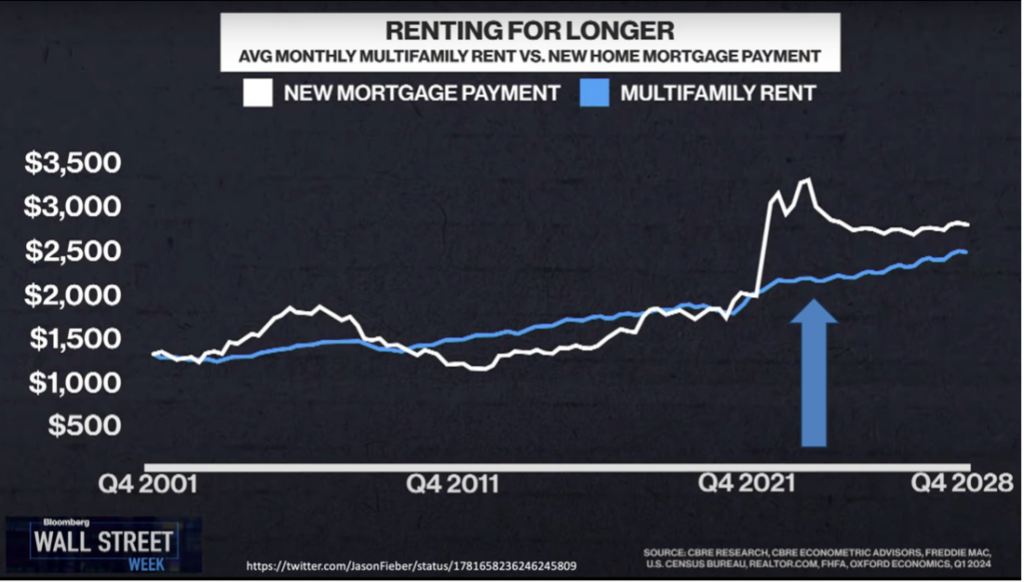

With the consumer price index rising and the Federal Reserve maintaining high interest rates for nearly a year, the housing market continues to experience affordability challenges. The surge in living expenses (most notably in 2022) and ongoing high interest rates have complicated the home-buying process and continues to place demand on the rental market as more individuals find it difficult to afford mortgages.[3]

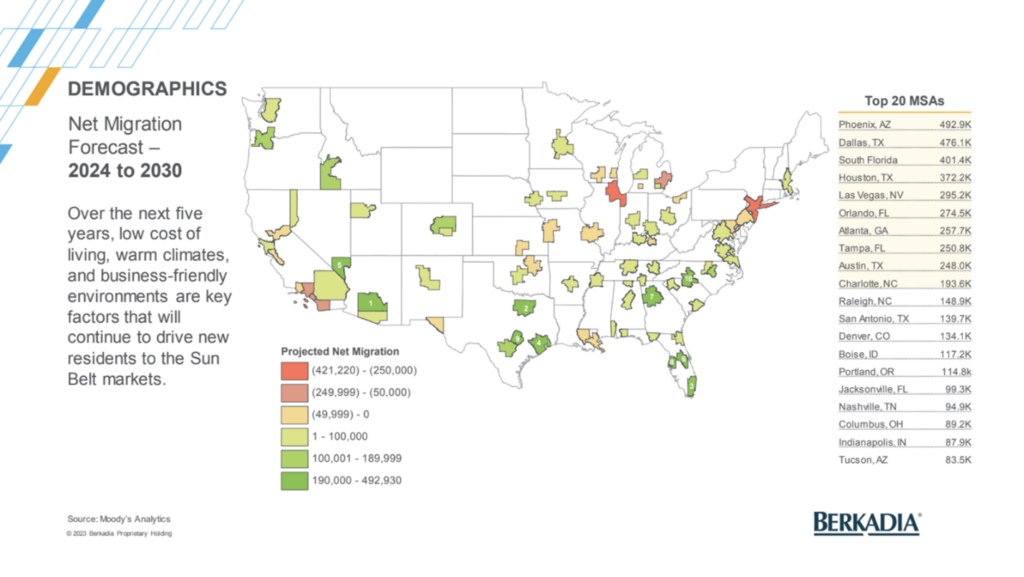

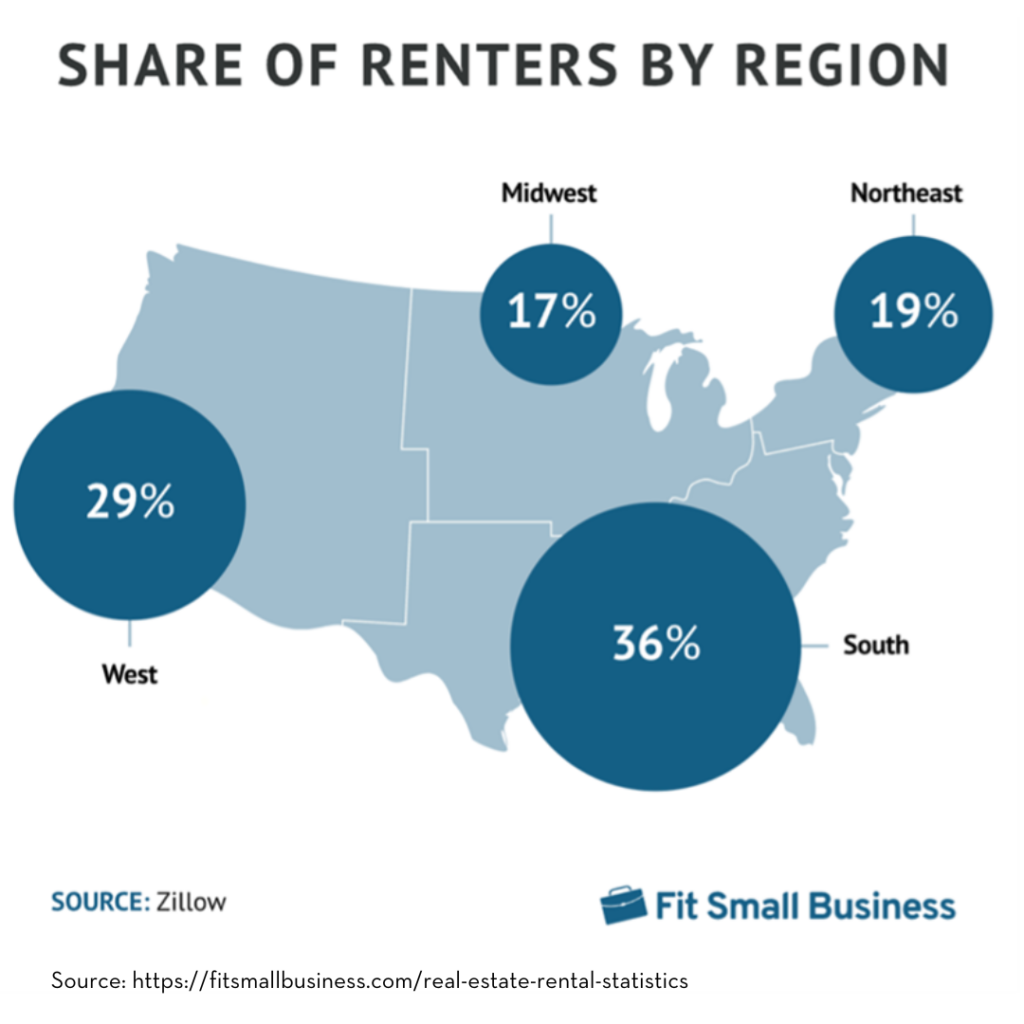

Southern states remain top relocation destinations, driven by their tax-friendly policies and growing job markets. Tax-friendly Sunbelt states, such as Florida and Texas, continue to drive the highest demand nationally.

Southern Charm: U-Haul Reveals 2023 Relocation Trends

The allure of the South continues to dominate relocation preferences. In fact, nine of the top ten metros with the highest net migration, between July 1, 2020, and July 1, 2023, were southern.[4] The movement towards the South, particularly the Southeast, is influenced by factors such as lower income taxes, pleasant weather, and more affordable cost of living.

According to U-Haul’s Growth Index, certain states emerged as hotspots for movers in 2023. This data outlays migration patterns in the US of leaving high-cost-of-living areas for new locales—with many focusing on Sunbelt submarkets.

- Texas

- Florida

- North Carolina

- South Carolina

- Tennessee

- Idaho

- Washington

- Arizona

- Colorado

- Virginia

Texas led as the top destination for the sixth time in eight years, driven by its favorable tax policies and bustling job market. As many as 53 Fortune 500 companies have corporate headquarters in the state, with Houston and Dallas ranking in the top five municipalities in the country.

For a second year in a row, Florida took the number two spot. For added perspective, this state has ranked in the top four of U-Haul’s Growth Index for the last nine years. A recognized absence of state income tax and overall lower living costs add to its warm weather allure, especially among high-income earners. According to a 2023 SmartAsset report, Florida gained the largest number of high-income workers defined as earning $200,000 per year or higher.

These are not the only southern states that have become beacons for individuals and families looking for better economic prospects. Other states, like North and South Carolina, have also seen substantial inbound migration, attributed to diverse economic bases and high living standards. [5]

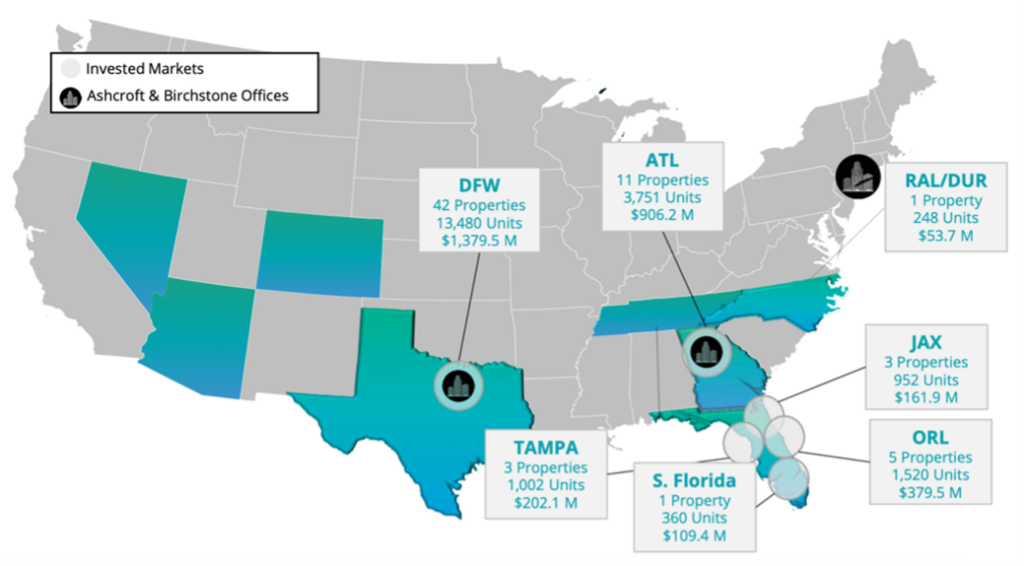

Ashcroft Capital Targets Suburban Sunbelt Opportunities

Ashcroft Capital continues to strategically invest in suburban markets throughout the Sunbelt region, targeting areas with strong signs of population and economic growth, diversified job markets, landlord-friendly laws, and tax-friendly locations.

Acquisitions and research teams are led by Ashcroft Capital’s CEO, Frank Roessler, and Chief Investment Officer, Scott Lebenhart. In any given year, 200+ acquisition opportunities are analyzed, and at a minimum of twice per year, Ashcroft Capital runs a proprietary research-based economic study used to identify the top U.S. markets best positioned for multifamily investment. This process is known as the Ashcroft Advantage Analyzer, or “AAA Process” for short.

A combination of data is analyzed from third-party services, like CoStar, RealPage, Green Street, and U.S. Census. The information is collected from more than 200 markets across the United States, then it is applied as a weighting system to help the firm identify which multifamily markets have the strongest fundamentals to target. This multifaceted approach allows multifamily investment firms like Ashcroft Capital to strategically position their portfolios to capitalize on emerging real estate dynamics.

Capitalizing on Change: Leveraging Relocation Trends

As 2024 progresses, political policy, lifestyle, jobs, and work flexibility will continue to dictate relocation trends. Understanding these trends and shifting dynamics can help you make informed decisions about your next investment. If you would like to learn more about investing in multifamily assets, or investment opportunities, schedule a call with Investor Relations today.