July 1, 2025

As we enter the third quarter of 2025, the U.S. multifamily real estate sector stands at a critical inflection point. Following years of historic rent volatility, record supply pipelines, and macroeconomic headwinds, the market is now showing clear signs of stabilization and renewed momentum. Key performance indicators across occupancy, absorption, and transaction activity reveal a sector in the early stages of recovery — one that is increasingly supported by strong demand fundamentals, constrained new construction, and an anticipated shift in monetary policy.

Key areas of focus include:

- Rent Recovery in Motion: Tracking the Rebound in Multifamily Demand

- Holding Pattern or Pivot Point? Inside the Fed’s 2025 Rate Trajectory

- From Boom to Balance: Navigating the New Construction Landscape

- Tightening the Gap: Occupancy and Vacancy as Renters Return

- Deals, Debt & Discipline: How Investors Are Moving in Q3

Rent Recovery in Motion: Tracking the Rebound in Multifamily Demand

Source: https://www.yardimatrix.com/publications/download/file/7359-MatrixMultifamilyNationalReport-May2025?signup=false

Source: https://www.yardimatrix.com/publications/download/file/7359-MatrixMultifamilyNationalReport-May2025?signup=false

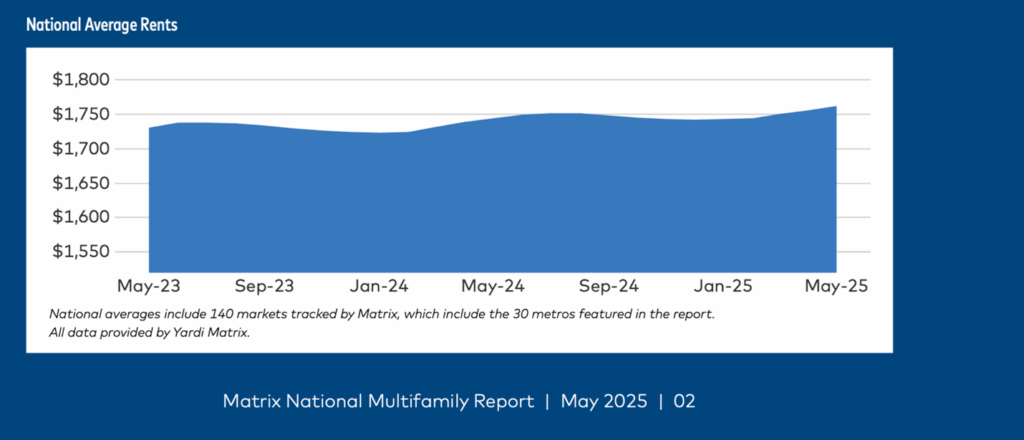

Multifamily rent growth continues to modestly rebound after a period of supply-driven softness. Outlooks for 2025 remain cautiously positive: Zillow anticipates +1.6% annual rent growth, while Yardi Matrix forecasts approximately +1.5% nationally. These projections reflect expanding demand aligned with robust Q2 leasing.

By May, Yardi reported the average U.S. advertised asking rent increased to $1,761, marking a $6 month-over-month increase and maintaining a +1.0% YoY rate. Although growth remains tame compared to historic norms, it indicates stabilization following the volatility of 2023–24.

Demand for apartments also remains strong. RealPage recorded 138,300 market-rate units absorbed in Q1 2025, the most active start to a year in over three decades. But Q2 surpassed that milestone—RealPage forecasts indicate an additional 156,000 units absorbed in Q2, maintaining the elevated demand momentum. Combined, approximately 294,000 units were absorbed through the first half of the year—a pace comparable to the early peak of 2021.

This demand surge reflects multiple underlying factors:

- Strong job and wage growth continue to support housing needs.

- Improving affordability increases renter retention and household formation.

- Single-family market strain from high home prices reinforces multifamily viability.

Looking ahead, the strong first half of 2025 positions the multifamily sector for continued strength into Q3 and Q4. While supply remains near historic highs, demand is clearly matching the pace, stabilizing occupancy and supporting modest rent growth. Given the anticipated tapering of new deliveries in late 2025, conditions are primed for rent growth to trend upward into 2026, especially in markets with limited new supply.

Sources:

BARRONS

YARDIMATRIX

REALPAGE

Holding Pattern or Pivot Point? Inside the Fed’s 2025 Rate Trajectory

Source: www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250618.pdf

Source: www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250618.pdf

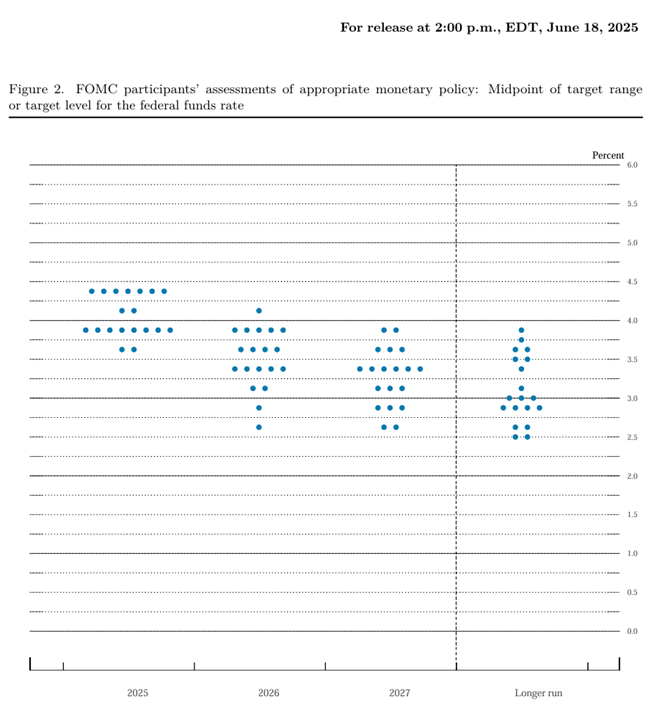

At the June 18th, 2025 FOMC meeting, the Federal Reserve maintained its benchmark federal funds rate at 4.25%–4.50%, holding steady for the seventh consecutive month. While inflation has cooled from its 2022–2023 highs, the Fed continues to emphasize its “data-dependent” approach, citing a need for more sustained progress toward its 2% inflation target before considering cuts.

Recent commentary from Fed Chair Jerome Powell reflects a cautious tone, noting:

“We’ve seen encouraging signs on inflation, but we are not yet confident enough to begin easing policy. Labor markets remain tight, and services inflation is still sticky.”

The futures market continues to price in a potential rate cut in Q4 2025, although that outlook remains fluid. For the multifamily sector, sustained elevated rates have translated into:

- Loan pricing that is typically in the 6.0%–6.5% range, with lenders tightening terms.

- Increased investor appetite for fixed-income alternatives, like structured note offerings.

- A flight to quality, favoring Class A and stabilized assets with strong cash flow.

The current rate environment reinforces the importance of disciplined underwriting, proactive debt management, and active asset management to navigate ongoing macroeconomic volatility.

Sources:

REUTERS

FEDERALRESERVE.GOV

FEDERALRESERVE.GOV(2)

From Boom to Balance: Navigating the New Construction Landscape

Multifamily construction activity continues to moderate as we enter the second half of 2025 across the U.S. as developers respond to a challenging mix of elevated borrowing costs, slowing rent growth, and heightened operational expenses. Builders are pulling back, and the effects are beginning to show in both permit activity and project starts.

- Completions are down ~28% since last summer’s peak, according to U.S. Census Bureau data, as cited by Freddie Mac, marking a significant cooldown in pipeline deliveries. Industry analysts anticipate further declines throughout 2025, which may offer relief to oversupplied markets and help stabilize rent growth.

- Permit activity has dropped sharply across many U.S. metros. Developers cite underwriting challenges and higher construction costs as deterrents to new project launches.

- Orlando, one of the most active multifamily markets in the last cycle, is now experiencing a pronounced pullback.

- Starts fell by ~60% in 2024.

- Completions are slowing into 2025.

- Rent growth is forecasted to reach a modest +2.4% by year-end 2025, indicating a more balanced market ahead.

This construction slowdown, while painful for some developers, is a necessary reset after years of record-breaking deliveries. As new supply levels off and demand remains steady, the market is poised to enter a healthier equilibrium. For investors, this means improved pricing power, more stable occupancy, and potentially stronger cash flow margins in 2026 and beyond — particularly in supply-constrained submarkets.

Sources:

BARRONS

AXIOS

MARKETWATCH

FREDDIEMAC

Tightening the Gap: Occupancy and Vacancy as Renters Return

National multifamily fundamentals remain resilient, with leasing activity continuing to absorb new supply and demand holding firm despite a high volume of completions.

Absorption Trends

As mentioned previously, approximately 294,000 units were absorbed in the first half of the year — putting the market on pace with 2021’s strong post-pandemic recovery. RealPage further indicates that annual demand has exceeded supply for two consecutive quarters — a trend historically lasting seven quarters — reinforcing this positive cycle.

- RealPage reported occupancy in the 94.2%–95.7% range through Q2, with recent data from Yardi Matrix reporting 94.4%.

Vacancy Rates

With this level of occupancy and continued deliveries, the national vacancy rate floats in the mid 5% range (~5.8%), closely mirroring expectations after Q2 stabilization.

Outlook

- Occupancy is poised to stabilize: With rent growth settling at ~1%, occupancies in the mid 94% range represent a balanced equilibrium under current supply dynamics.

- Strengthening demand rebound: Continued strong absorption suggests demand remains robust even as the pipeline delivers.

Sources:

CREDAILY

YARDIMATRIX

CARBON RE INVESTMENTS

Deals, Debt & Discipline: How Investors Are Moving in Q3

The multifamily investment landscape continues to strengthen as we enter Q3. Despite an elevated rate environment, transactional momentum has not only returned — it’s accelerating.

Transaction activity remains robust. As a reminder, first-quarter investment sales reached approximately $30 billion, up 35.5% year-over-year, and prompted a strong Q2 as well.

Strength across regions:

- The Southeast is seeing record demand: Q1 absorption in markets such as Atlanta has surpassed 56,000 units, matching the sum of 2021–2023 combined totals.

- Dallas–Fort Worth, a key growth market in 2025, posted a 23% year-over-year increase in transaction volume, with Q1 sales reaching $1.42 billion, nearly double the $637 million recorded in Q1 2024.

Lending remains selective yet active.

In Q2, the rebound persisted, with debt issuance remaining solid. While Q2 numbers are still being finalized, early Trepp data shows that bank-originated multifamily loans experienced a 67% YoY jump in Q1, suggesting Q2 maintained similar momentum.

- Early CBRE data also highlights a 13% QoQ rise in its Lending Momentum Index for commercial lending in Q1—suggesting a strong pipeline heading into Q2.

- Loan rates average ~6.2%, reflecting the sustained impact of elevated Treasury yields.

- Lender caution is evident, with underwriting focused on stabilized assets, moderate leverage (55–65% LTV), and borrower track records — particularly in bridge-to-perm and refinance solutions amid 2026 maturities.

Looking ahead, the expectation of Fed rate reductions later this year—part of a wider “Fed pivot” toward mid-3 percent policy rates—could usher in enhanced debt affordability and increased deal flow. Strong absorption and weakening new deliveries reinforce a favorable environment for operators and investors in the back half of 2025.

Sources:

NEWMARK

REALPAGE

CBRE

TREPP

MMG

Conclusion

The first half of 2025 has been marked by rising demand, moderating supply, and a subtle but growing shift in investor sentiment. Multifamily housing continues to outperform expectations, particularly in supply-constrained and high-growth submarkets. National absorption through Q2 has reached nearly 300,000 units — one of the strongest year-to-date performances on record — while new project starts and permits decline sharply. This recalibration between demand and supply is setting the stage for improved pricing power, tighter vacancy rates, and stabilized rent growth as we look ahead.

While interest rates remain elevated, the forward-looking narrative from the Fed suggests that relief could arrive in late 2025 or early 2026. In the meantime, investors are increasingly shifting capital into cash-flowing real assets that can offer insulation against inflation and economic uncertainty. This is particularly true for multifamily, where fundamentals remain intact, and the structural demand for rental housing continues to outpace delivery schedules.

Ashcroft Capital remains committed to delivering institutional-quality investments through a proven platform and experienced leadership team. Whether through our equity syndications or note offerings, our mission is to offer investors access to resilient, risk-adjusted opportunities in one of the most enduring real estate sectors in the U.S. economy.

We appreciate your continued trust and look forward to navigating the remainder of 2025 with clarity, focus, and disciplined execution.

Disclaimer: The offering discussed herein is available only to verified Accredited Investors under The Securities Act 1933, Regulation D, Rule 506(c).

Neither Ashcroft Capital LLC, nor any of its affiliated companies (collectively,” Ashcroft”), is an investment adviser or a broker-dealer nor are any of them registered with the U.S.

Securities and Exchange Commission. The information in this presentation should not be used as the sole basis of any investment decisions, nor is it intended to be used as advice with respect to the advisability of investing in, purchasing or selling securities, nor should it be construed as advice designed to meet the investment needs of any particular person or entity or any specific investment situation. Nothing in this presentation constitutes legal, accounting or tax advice or individually tailored investment advice. This presentation is not an offer to buy or sell securities nor a solicitation of such offers,

The content in this presentation contains general information and may not reflect current developments or information. The information is not guaranteed to be correct, complete or current. The reader assumes responsibility for conducting its own due diligence and assumes full responsibility for any investment decisions.

Examples are provided for illustrative purposes only and are not necessarily indicative of potential investment results, nor does this material constitute an exhaustive explanation of the investment process, investment strategies or risk management.

This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements express Ashcroft’s expectations or predictions of future events or results. They are not guarantees and are subject to many risks and uncertainties. There are a number of factors beyond Ashcroft’s control that can cause actual events or results to be significantly different from those described in the forward-looking statements. Any or all of the forward-looking statements in this document or in any other statements Ashcroft makes can turn out to be wrong. Except as required by applicable law, Ashcroft does not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. In light of the significant uncertainties inherent in the forward-looking statements made in this document, the inclusion of this information cannot be considered a representation by Ashcroft or any other person that its objectives, future results, levels of activity, performance or plans will be achieved.