April 8, 2025

As we enter the second quarter of 2025, the U.S. multifamily real estate sector remains resilient despite a backdrop of economic uncertainty and shifting government policy. This report outlines the key trends, data points, and what we’re seeing in the market, so you can navigate this year with confidence.

Key areas of focus include:

- Multifamily Market Stabilization and Rent Trends

- Interest Rate Outlook

- Construction Pipeline and Supply Trends

- Evolving Housing Preferences and the Case for Renting

- Investor Sentiment and Investment Volume

Multifamily Market Stabilization

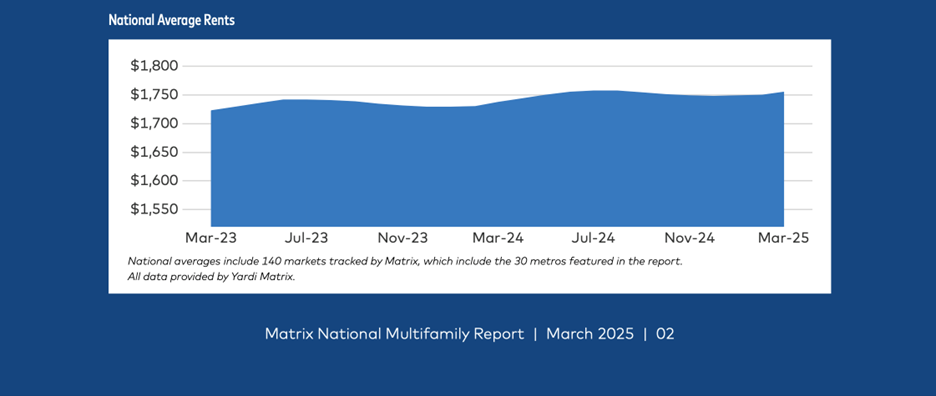

YardiMatrixMultifamily National Report

U.S. multifamily asking rents hover around $1,755 according to Yardi Matrix. Effective rent growth is holding around 1% year-over-year, and the U.S. multifamily sector is showing encouraging signs of stabilization.

National vacancy rates remain steady at approximately 5%, though muted compared to pandemic-era highs, this consistency signals solid demand fundamentals. Multifamily lending activity has increased 27% year-over-year from $246 billion to $312 billion, which represents the first calendar year of growth since 2021.

Nationally, new deliveries continue to hit the market, but absorption remains robust. Strong demographic drivers, including delayed homeownership and in-migration to high-growth markets, are sustaining occupancy in many regions. Sun Belt metros such as Dallas-Fort Worth, Tampa, and Charlotte continue to outperform, buoyed by population gains and business expansion.

These trends point to a resilient and stabilizing multifamily market. In our view, 2025 is a compelling environment to capitalize on cash flowing multifamily opportunities that have long-term upside appreciation—especially in high-growth markets where fundamentals remain strong. *See our offerings page for current opportunities.

Sources:

Lument: Multifamily Stable Amid Strengthening Demand

Yardi Matrix – National Multifamily Market Report (Feb 2025)

This information was derived from sources Ashcroft deems reliable. However, Ashcroft cannot provide assurances as to whether the information provided by these other sources is accurate, current or complete.

Interest Rate Outlook

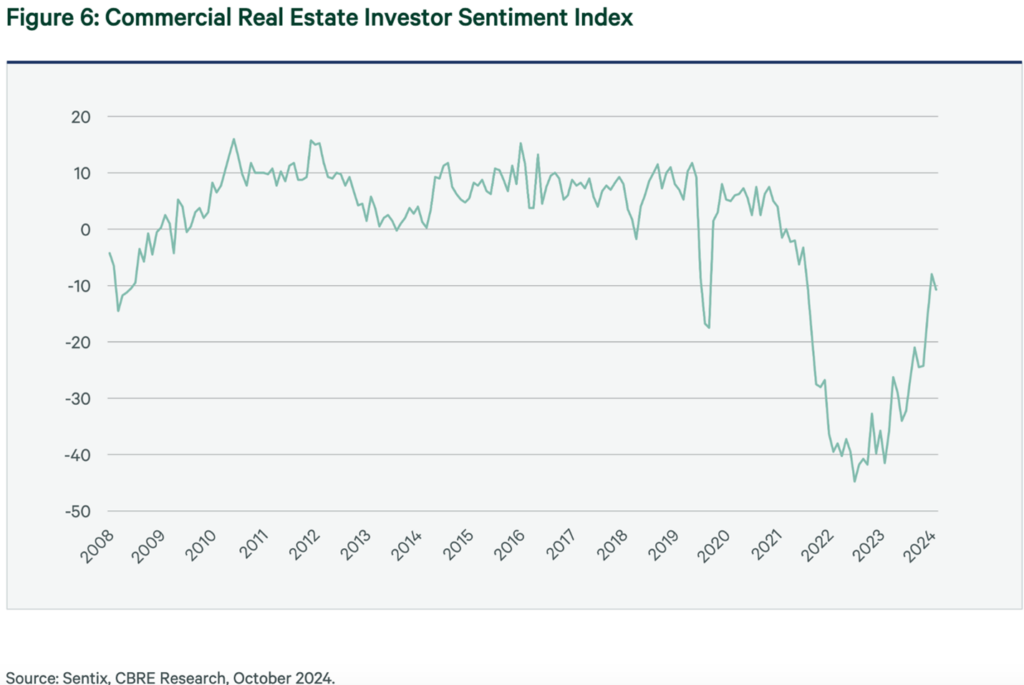

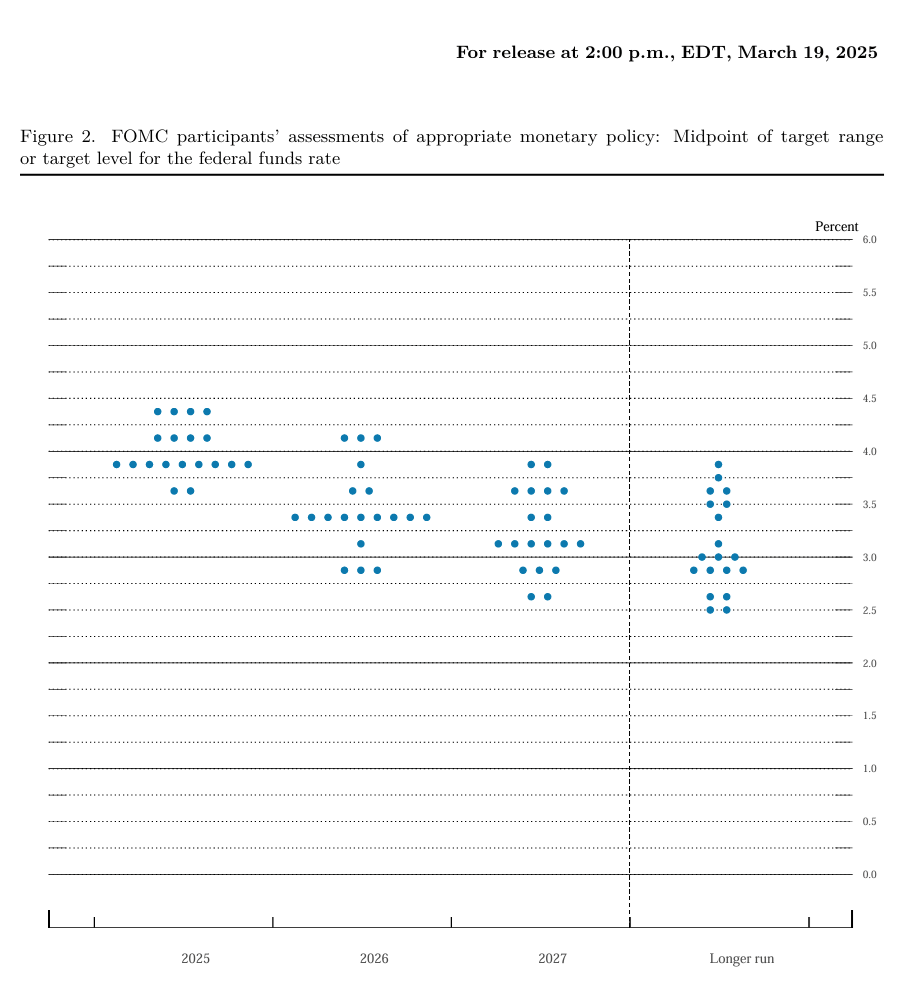

Federal Reserve March 2025 FOMC Projections

The Federal Reserve held its benchmark rate steady at 4.25%-4.50% in March 2025. This marks a cautious approach amid mixed economic indicators and inflation lingering near 2.7%, above the Fed’s 2% target. Despite market anticipation of multiple rate cuts this year, the Fed has signaled a wait-and-see stance, influenced by economic volatility and global trade policy.

This policy position presents both challenges and opportunities for multifamily stakeholders:

- Refinancing Constraints: Borrowers hoping to refinance at lower rates may need to wait longer as spreads remain elevated.

- Asset Valuation Pressure: Cap rates have stabilized but are unlikely to compress significantly until rates decline further.

- Capital Market Reengagement: Clarity around rate direction could spur renewed lending and transaction activity, particularly for stabilized core assets.

Nevertheless, investor expectations remain upbeat, however, with many analysts forecasting one or two cuts in the second half of 2025, we are cautiously optimistic that multifamily lending will see a lift in the back half of the year.

Sources:

Federal Reserve March 2025 FOMC Projections

Reuters: Inflation and Fed Policy Outlook

Axios: Fed Holds Steady Amid Market Uncertainty

This information was derived from sources Ashcroft deems reliable. However, Ashcroft cannot provide assurances as to whether the information provided by these other sources is accurate, current or complete.

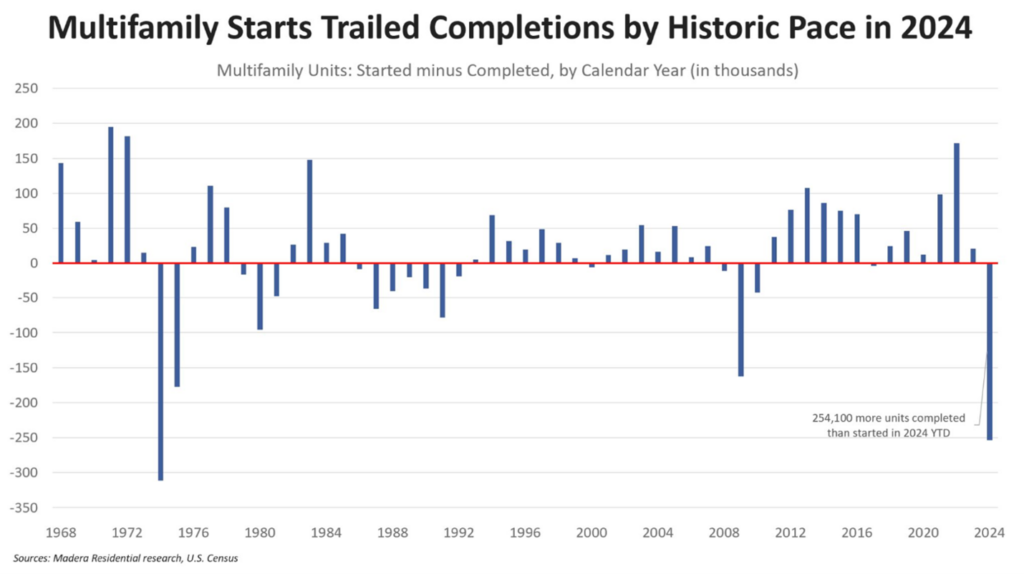

Construction Pipeline and Supply Trends

Multifamily construction starts have decelerated significantly due to elevated interest rates, wage inflation and commercial repricing since 2022. According to rental housing economist Jay Parsons, multifamily builders started 254,100 fewer units than they completed in 2024. That’s the second-biggest deficit on record (behind only 1974), and another indicator that new apartment supply is set to plunge by 2026. Additionally, total multifamily starts in 2024 came in lower than any year since 2013, when the country was still pulling out of the Great Financial Crisis. Labor constraints, elevated materials pricing, and financing difficulties continue to hinder new starts.

Multifamily construction starts have decelerated significantly due to elevated interest rates, wage inflation and commercial repricing since 2022. According to rental housing economist Jay Parsons, multifamily builders started 254,100 fewer units than they completed in 2024. That’s the second-biggest deficit on record (behind only 1974), and another indicator that new apartment supply is set to plunge by 2026. Additionally, total multifamily starts in 2024 came in lower than any year since 2013, when the country was still pulling out of the Great Financial Crisis. Labor constraints, elevated materials pricing, and financing difficulties continue to hinder new starts.

In the Sun Belt, construction remains active but is increasingly concentrated in select suburban submarkets with strong absorption metrics and favorable zoning policies. Austin, Tampa, and Raleigh are examples of metros still seeing pipeline momentum, driven by job growth and in-migration. Conversely, coastal and high-barrier markets such as San Francisco, Los Angeles, and New York are experiencing greater slowdowns due to zoning challenges, softening rent growth, and longer lease-up timelines.

Overall, this construction cooldown is helping rebalance supply and demand dynamics in markets that saw record deliveries from 2022 to 2024. Analysts expect this pause to support more sustainable rent growth in the coming 12–18 months, preserving pricing power for landlords and improving fundamentals for investors.

Sources:

NAHB Multifamily Starts Report Q1 2025

Yardi Matrix U.S. Supply Trends Q1 2025

Jay Parsons – Rental Housing Economist

This information was derived from sources Ashcroft deems reliable. However, Ashcroft cannot provide assurances as to whether the information provided by these other sources is accurate, current or complete.

Shifting Housing Preferences

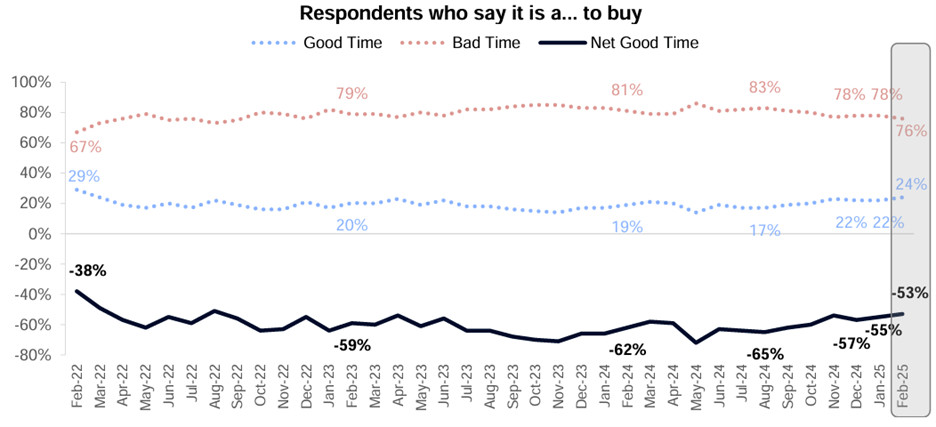

FannieMae Home Purchase Sentiment Index

FannieMae Home Purchase Sentiment Index

Recent surveys from Fannie Mae and Zillow confirm that the “rent vs. buy” decision continues to tilt in favor of renting. As of February 2025, 76% of surveyed consumers believe it is not a good time to buy a home, although this is down from 78% in January largely due to mortgage rates reducing slightly since the start of the year. Contributing factors for renting being more favorable include:

- Mortgage rates remaining “high” between 6.25% and 6.5%

- Near record-high home prices and constrained inventory

- Wages have not kept pace with housing costs

- Many younger buyers are burdened with student loan debt and rising living costs

- Ongoing uncertainty around job security and economic stability

The median first-time homebuyer has reached an all-time high age of 38 years old. Renting remains a more flexible and accessible alternative for many households—especially Millennials and Gen Zers. Lifestyle amenities, lower maintenance burdens, and geographic mobility continue to be popular trends among renters in 2025.

At Ashcroft Capital, we continue to cater to these preferences by offering co-working lounges, best-in-class fitness centers, package lockers, pet-friendly policies, and by hosting community events. These initiatives continue to reinforce demand for our Class A and Class B properties.

Check out our Ashcroft Capital + Birchstone Residential spotlight video to learn more.

Sources:

Fannie Mae Home Purchase Sentiment Index

National Association of Realtors – CNBC

This information was derived from sources Ashcroft deems reliable. However, Ashcroft cannot provide assurances as to whether the information provided by these other sources is accurate, current or complete.

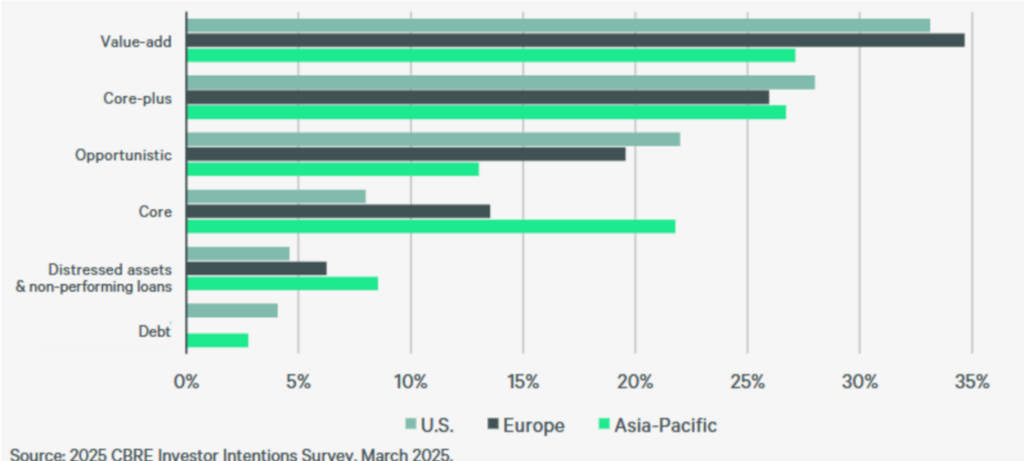

Investor Sentiment & Investment Volume

CBRE – U.S. Real Estate Market Outlook 2025

CBRE expects a continued recovery for investment sales in 2025, with volume up by as much as 10% by the end of 2025. Despite recent macroeconomic and stock market volatility, investor sentiment for multifamily apartments continues to improve. CBRE’s latest capital markets survey indicates that investors are selectively re-entering the market, favoring:

- Value-Add Class B Workforce Housing (Strong demand + limited new supply)

- Core-Plus Class A and B in Suburban/Sub-Sunbelt Markets (High-growth metros like Orlando, Raleigh, Tampa, and Dallas-Fort Worth remain favored)

Capital sources are increasingly favoring multifamily over office or retail, given multifamily’s relative performance, demographic tailwinds, and inflation-resistant cash flows. While cap rates remain above 2021 levels, most institutional buyers anticipate improved deal flow in H2 2025.

Lower interest rates, particularly that of the U.S., would help stimulate foreign and domestic capital inflows. CBRE forecasts that cap rates will slowly fall and stabilize at higher levels than in the last cycle due to interest rates remaining higher than they were during the 2010s. Treasury yields and rents are the biggest drivers of cap rates, other significant factors include the risk premium and GDP growth.

Our outlook for multifamily is increasingly optimistic, with improving sentiment, favorable capital trends, and a projected rebound in transaction volume. As capital reorients toward multifamily and if interest rate conditions gradually continue to improve, 2025 could present a timely entry point for investors seeking resilient, inflation-hedged returns in a recovering market.

Sources:

CBRE Capital Markets Outlook 2025

This information was derived from sources Ashcroft deems reliable. However, Ashcroft cannot provide assurances as to whether the information provided by these other sources is accurate, current or complete.

Conclusion

As we move into Q2 2025, the multifamily sector is emerging from a period of reset with encouraging signs of resilience and opportunity. At Ashcroft Capital, we remain focused on leveraging our vertically integrated platform to identify high-growth potential investments in markets with favorable fundamentals.

Through active asset management, strategic value-add renovations, and disciplined capital allocation, we continue to seek risk-adjusted returns for our investors. Whether through equity offerings or the Ashcroft Income Note, our goal remains to create long-term value in a dynamic economic landscape.

We look forward to the remainder of 2025 with continued dedication to delivering institutional-quality investments to our partners.

The offerings referenced herein are available only to verified Accredited Investors under The Securities Act of 1933, Regulation D, Rule 506(c).

This information is provided by sources Ashcroft deems reliable, but may not be accurate, current or complete. Although Ashcroft believes such forward-looking statements are based on reasonable assumptions, no assurance can be given that they are correct because actual results are uncertain and unpredictable.

This information was derived from sources Ashcroft deems reliable. However, Ashcroft cannot provide assurances as to whether the information provided by these other sources is accurate, current or complete.

Ashcroft is not an investment adviser or a broker-dealer and is not registered with the U.S Securities and Exchange Commission. The information in the presentation should not be used as the sole basis of any investment decisions, nor is it intended to be used as advice with respect to the advisability of investing in, purchasing, or selling securities, nor should it be construed as advice designed to meet the investment needs of any particular person or entity or any specific investment situation. Nothing in this presentation constitutes legal, accounting, or tax advice or individually tailored investment advice. The recipient of this presentation assumes responsibility for conducting its own due diligence and assumes full responsibility for any investment decisions.

Any prior investment results and returns are provided for illustrative purposes only and are not necessarily indicative of potential investment results. Past performance is no guarantee of future results and should not be relied upon as an indicator of the future performance or success.

There can be no assurance that the offerings described above will achieve its investment objectives or that investors will receive a return of their capital or the projected return on investment. Any reference to an investment’s past or potential performance is not and should not be construed as a recommendation or as a guarantee of any specific outcome or profit and should not be relied upon as an indicator of an investment opportunity’s future performance or success.