January 8, 2025

As we enter the new year, the U.S. multifamily real estate sector continues to show resilience and opportunity amidst an evolving economic landscape. In this report, we’ll explore the latest market data, trends, and insights shaping multifamily real estate in Q1 2025.

Key areas of focus include:

- Improving Market Conditions and rent growth trends.

- Interest Rate Movements and their possible impact on financing opportunities.

- Construction Slowdowns and their implications for future supply.

- Shifting Housing Preferences, reinforcing the case for renting.

- Investor Sentiment and optimism for the multifamily sector.

Improving Market Conditions

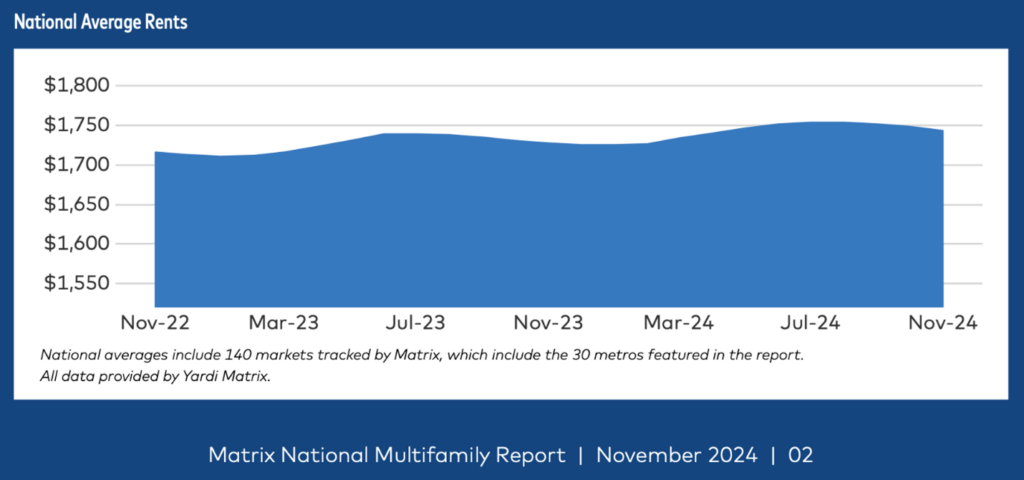

The U.S. multifamily market continues to show signs of steady recovery. According to the latest Yardi Matrix National Multifamily Report (above) published on December 11, 2024, national asking rents averaged $1,744, with notable regional variations. Year-over-year rent growth remained steady at just under 1%.

This modest growth reflects sustained rental demand despite challenges like elevated interest rates, competition from new construction, and affordability concerns. National occupancy rates remain stable above 94%, reflecting strong and sustained demand for stabilized multifamily assets across the country.

Several factors contribute to this recovery:

- Job Growth and Migration Trends: High-growth markets, particularly in the Sun Belt states such as Texas, Florida, and North Carolina, continue to attract significant migration due to job opportunities, lower costs of living, and favorable business climates.

- Housing Supply Constraints: Persistent challenges in single-family home affordability have kept many individuals renting longer, further supporting multifamily occupancy and rent growth.

- Investment Outlook: Multifamily real estate remains an attractive asset class for investors seeking steady cash flow and portfolio diversification. Stabilized assets, especially in markets with strong demographic trends, continue to demonstrate reliable returns compared to other real estate sectors.

Looking forward, market fundamentals appear positioned for continued improvement, driven by robust demand and the gradual stabilization of new supply deliveries. However, rising operating expenses and insurance costs remain key challenges for multifamily operators. Nevertheless, investors are showing confidence in the sector as multifamily assets offer a hedge against inflation and are less volatile compared to office or retail sectors.

Sources:

Cushman & Wakefield U.S. Multifamily MarketBeat

Marcus & Millichap, 2024 U.S. Multifamily Investment Forecast

CBRE, U.S. Real Estate Market Outlook 2024 – Multifamily

Yardi Matrix, National Multifamily Report, December 11, 2024

Interest Rates Trending Downward

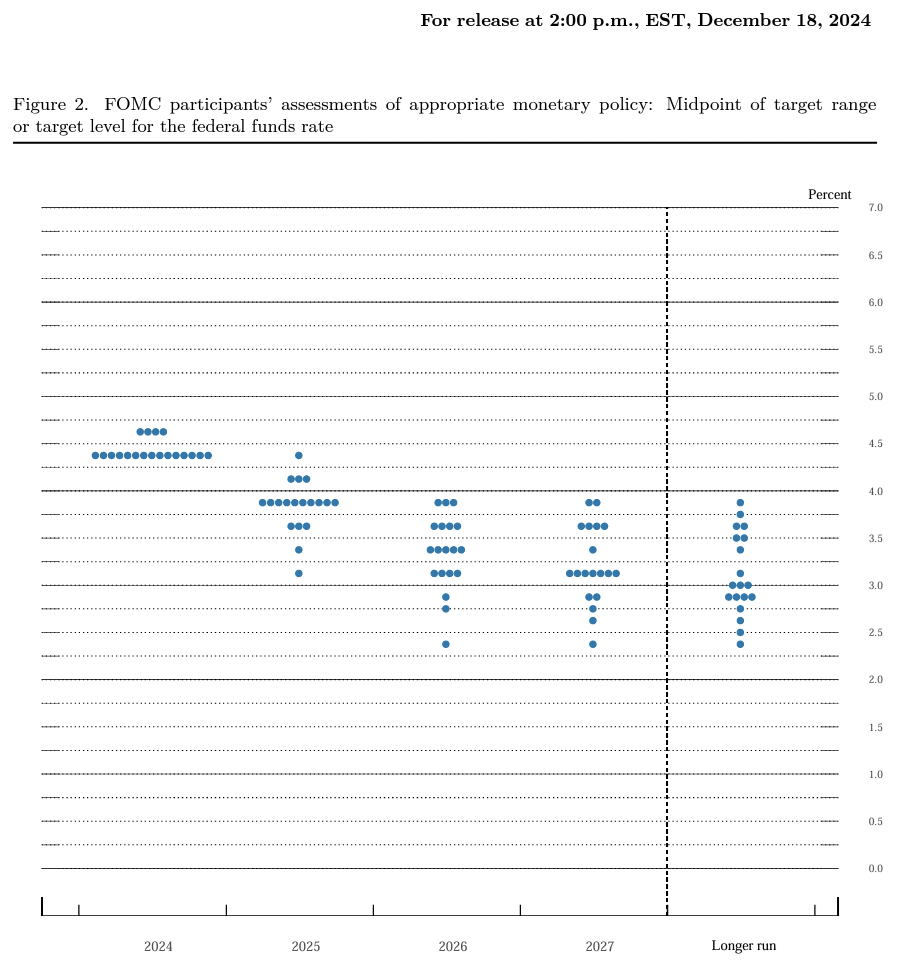

On December 18, 2024, the Federal Reserve announced another 25-basis point cut to the federal funds rate, bringing it to a range of 4.25% to 4.5% (as shown above). This marked the Fed’s third-rate reduction in 2024 as it continues its policy pivot in response to cooling inflation and slower economic growth. The move aligns with the Fed’s earlier projections, which anticipate rates potentially falling further in 2025 and 2026.

These rate cuts reflect a broader shift toward monetary easing, aimed at stimulating economic activity as inflation trends toward the target range of 2.5-3%. For the multifamily sector, this decision carries several significant benefits:

- Refinancing Opportunities: Property owners and operators can potentially take advantage of the declining interest rates to refinance existing loans, reducing debt costs and enhancing property-level cash flow. This creates immediate savings for owners and can free up capital for value-add improvements or distributions to investors.

- Increased Transaction Activity: Lower financing costs often result in a surge in deal flow, as both institutional and private investors capitalize on more favorable borrowing conditions. Additionally, the Federal Reserve’s rate reductions, along with their transparency on likely future rate cuts, help to alleviate the volatility that paralyzed the markets over the past few years. Multifamily properties, already considered a resilient asset class, are likely to attract additional capital seeking strong risk-adjusted returns.

- Higher Potential Valuations: As borrowing costs decline, cap rates typically compress, driving higher valuations for stabilized multifamily assets. This trend may provide opportunities for owners to exit investments at premium prices or refinance at improved terms.

- Attractiveness Relative to Other Asset Classes: Multifamily investments remain a standout option compared to office or retail properties, where fundamentals have lagged. With interest rates trending downward, the appeal of multifamily as an inflation hedge with potential steady cash flow becomes even stronger.

The December rate cut also signals growing confidence that inflation is under control, paving the way for further rate reductions in 2025. Analysts forecast that additional cuts could occur as early as Q2 2025, further boosting liquidity in the lending markets and increasing investor appetite for multifamily deals.

Sources:

Economic projections from the December 17-18 FOMC meeting

JPMorgan, How Interest Rate Cuts Could Impact Commercial Real Estate

Construction Slowdown Continues

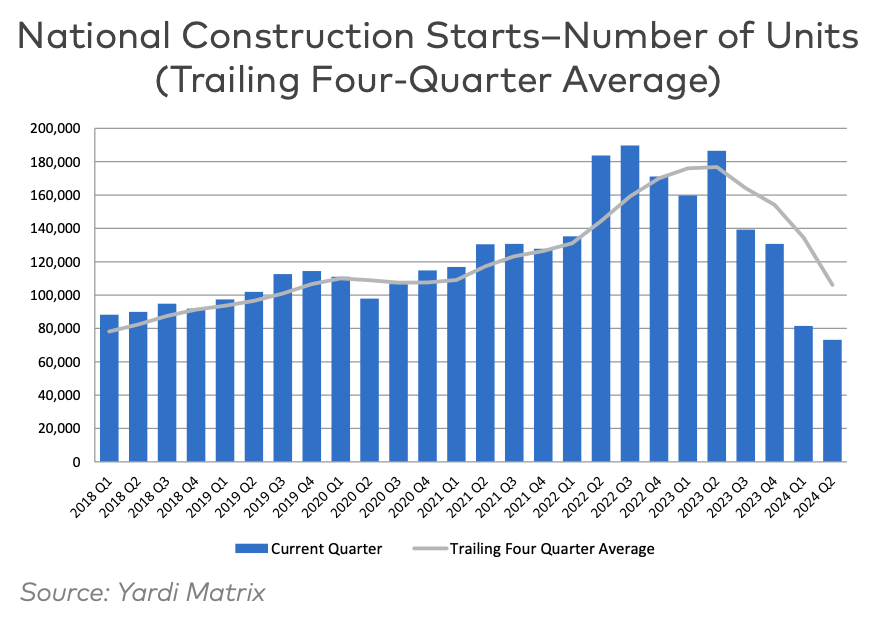

After hitting post-pandemic peaks, multifamily construction activity is experiencing a notable decline. The National Association of Home Builders (NAHB) projected a 20% drop in new multifamily starts for 2024, driven by elevated material costs, higher financing expenses due to persistent interest rate levels, and broader economic uncertainty. Developers are also contending with ongoing labor shortages, which have compounded delays in project timelines.

Recent data suggests that the pipeline of under-construction units—estimated at approximately 900,000 units nationally as of Q4 2024—will continue to stabilize supply through late 2025. Notably, the slowdown has been more pronounced in high-barrier markets where rising land prices and stricter zoning regulations make development less feasible. Conversely, Sun Belt markets like Texas, Florida, and Arizona, while also cooling, continue to account for a substantial share of new deliveries due to sustained population growth and demand for housing.

This moderation in construction activity could prove beneficial for rental growth prospects in 2025 and beyond. Fewer new units entering the market should help reduce supply-side pressures, particularly in regions facing record-high deliveries over the past two years. Analysts forecast that rent growth could return to the 3-4% range nationally in 2025 as existing inventory absorbs current demand.

Additionally, multifamily construction financing remains a challenge in the current environment. The Mortgage Bankers Association (MBA) reported a 30% decrease in multifamily lending volume year-over-year in 2024, a reflection of tighter credit conditions and elevated cap rates. This dynamic has further contributed to developers pausing new projects while waiting for more favorable market conditions.

Sources:

(NAHB), Multifamily Housing Market Outlook Q4 2024

Mortgage Bankers Association (MBA), Multifamily Lending Report Q4 2024

Yardi Matrix, U.S. Multifamily Supply Forecast 2024, National Construction Starts

The Case for Renting

New insights from Fannie Mae’s Home Purchase Sentiment Index reveal that 77% of consumers believe now is not the right time to buy a home, reflecting a combination of elevated mortgage rates, persistently high home prices, and economic uncertainty.

As of Q4 2024, 30-year fixed mortgage rates remain around 6-6.5%, making homeownership unattainable for many, especially first-time buyers. Additionally, housing inventory remains constrained, further inflating home prices and creating affordability pressures.

In this environment, renting continues to be a more affordable and flexible option in most major markets. Recent data from Zillow suggests that renting is up to 40% cheaper than buying in high-cost regions such as California, New York, and Washington D.C. Millennials—who represent the largest share of renters—are driving this trend, with 27% indicating plans to rent long-term due to:

- Affordability challenges: The gap between rent payments and mortgage costs continues to widen.

- Flexibility: Renting offers mobility, especially appealing to younger professionals who prioritize career opportunities in different cities.

- Maintenance avoidance: Rising home repair and insurance costs add to the financial burden of homeownership.

Did you know 66% of renters say renting fits their current lifestyle more than owning a home? Source: Entrata

Additionally, a growing preference for lifestyle amenities offered by modern multifamily developments, such as fitness centers, coworking spaces, and pet-friendly policies, further attracts renters. Our latest multifamily acquisition, Halston Waterleigh, offers these lifestyle amenities. Accredited investors can invest in this rare Class A value-add opportunity right now. Learn more HERE

This sustained demand for rentals reinforces the stability and appeal of the multifamily sector in 2025 as new supply slows, aligning with broader economic recovery trends.

Sources:

Fannie Mae, Home Purchase Sentiment Index Q4 2024

Zillow, Rent vs. Buy Affordability Report

Yardi Matrix, U.S. Multifamily Market Insights Q4 2024

Investor Sentiment Is Turning Optimistic

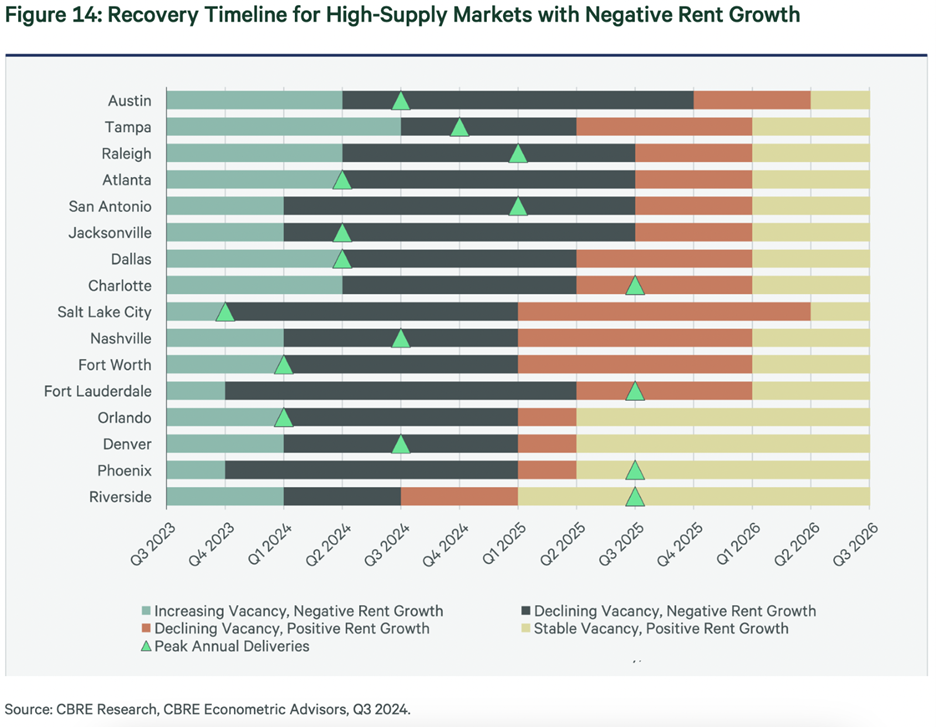

The U.S. multifamily market appears to have entered a phase of stabilization, with strengthening fundamentals helping to lift investor confidence, according to CBRE Econometric Advisors Q3 2024 report.

“Sentiment has improved significantly, as many investors believe that values have bottomed,” said Kelli Carhart, Executive Managing Director of Multifamily Capital Markets at CBRE, in a statement accompanying the report.

This shift in sentiment suggests that the market may be moving past its period of decline as key indicators begin to stabilize.

In the multifamily sector, optimism is particularly pronounced due to higher-than-expected demand and improving affordability dynamics:

- Easing Inflation: Inflation levels have declined steadily in 2024, now trending at 2.5-3% annually, closer to the Federal Reserve’s long-term target. This has reduced pressure on consumer spending and supported rental affordability.

- Interest Rate Outlook: Expectations of a further reduction in interest rates by mid-2025 have boosted investor confidence, as lower borrowing costs would improve property valuations and enhance investment yields. The Federal Reserve’s more dovish stance has encouraged renewed capital flows into CRE, particularly multifamily assets.

- Robust Multifamily Demand: Multifamily continues to outperform other CRE asset classes due to strong renter demand, driven by elevated mortgage rates and affordability challenges in the single-family housing market.

Additionally, markets with strong job growth and population inflows—such as Texas, Florida, and the Southeast—are seeing increased investor activity as they continue to benefit from demographic trends. For example, John Burns Research highlights that markets like Dallas-Fort Worth and Tampa have seen a 15-20% year-over-year increase in net rental absorption through Q4 2024.

Investors are also becoming more strategic, targeting value-add opportunities and newer Class A properties in suburban markets where rental demand remains robust. Moreover, the relative resilience of multifamily assets compared to office and retail sectors has reinforced their appeal for institutional and private investors alike.

Sources:

Globest.com, CBRE Declares the Multifamily Market Has Bottomed Out

Federal Reserve, Economic Projections Report Q4 2024

Yardi Matrix, Multifamily Performance Metrics Q4 2024

CBRE Research, CBRE Econometric Advisors Q3 2024

Conclusion

At Ashcroft Capital, we’re closely monitoring these evolving market trends to identify opportunities that align with current dynamics and investor priorities. Our focus remains on targeting well-located, stabilized multifamily assets in high-growth markets where demographic and economic factors drive sustained demand.

By leveraging our fully vertically-integrated platform and AAA data-driven process, we aim to capitalize on opportunities that offer strong risk-adjusted returns while mitigating potential downside risks. This includes adapting to shifting capital flows, maintaining operational efficiency, and preserving value through disciplined investment strategies.

As always, our commitment is to deliver best-in-class performance and provide our investors with opportunities that foster long-term growth and financial opportunities.

Latest Offerings

- Prime Class A asset in Orlando’s fast-growing submarket

- Rare Value-add: Achieving strong rent premiums without unit renovations

- Equity upside: Anticipated monthly or quarterly cashflow distributions with strong growth potential

- Acquired below replacement cost, offering immediate value

- High Yield: 10–12% annualized promissory note, offering non-compounded, interest-only payments scheduled to be paid monthly. Includes a four-year term with two optional one-year extensions and bonus opportunities for select early or larger investors.

- Diversification: Capital is invested into properties controlled by Ashcroft, providing exposure to a range of assets.

- Risk Mitigation: Limited first-loss protection and priority in the capital stack over equity investors in affiliate-owned deals.

Ashcroft is not an investment adviser or a broker-dealer and is not registered with the U.S Securities and Exchange Commission. The information in the presentation should not be used as the sole basis of any investment decisions, nor is it intended to be used as advice with respect to the advisability of investing in, purchasing, or selling securities, nor should it be construed as advice designed to meet the investment needs of any particular person or entity or any specific investment situation. Nothing in this presentation constitutes legal, accounting, or tax advice or individually tailored investment advice. The recipient of this presentation assumes responsibility for conducting its own due diligence and assumes full responsibility for any investment decisions.

Any prior investment results and returns are provided for illustrative purposes only and are not necessarily indicative of potential investment results. Past performance is no guarantee of future results and should not be relied upon as an indicator of the future performance or success.

There can be no assurance that the offerings described above will achieve its investment objectives or that investors will receive a return of their capital or the projected return on investment. Any reference to an investment’s past or potential performance is not and should not be construed as a recommendation or as a guarantee of any specific outcome or profit and should not be relied upon as an indicator of an investment opportunity’s future performance or success.