May 2, 2023

By: Ben Nelson, Investor Relations Regional Manager

Investing can be exciting, and sometimes frustrating, but it is one of the greatest ways to build long-term wealth. For most investors, a singular and all-important question remains paramount: “How should I diversify my assets?” Those who have accumulated enough wealth to consider investing can find no shortage of strategies to minimize risk while maximizing returns. While many of these strategies work (until they don’t), some have withstood the test of time. One of those strategies is known as Modern Portfolio Theory (MPT).

Put simply, MPT is the process of constructing a diverse portfolio of assets to drive strong returns, while reducing overall risk. Modern Portfolio Theory is founded on the idea that different investments and investment classes inherently carry different levels of risk and return. By diversifying your portfolio across multiple types of investments and asset classes with different risk/reward profiles, you can reduce the overall risk of your portfolio and still participate in positive performance. This theory is less about beating market indices year over year, but about a steady advance of your portfolio over a longer time horizon.

In this article, we will discuss how investors use the Modern Portfolio Theory to create a diversification strategy to maximize portfolio performance while accounting for an acceptable level of risk. We will also discuss alternative investments, such as real estate, and how they fit into a diversified portfolio.

Lessons from the Past: Looking Backward to Move Forward

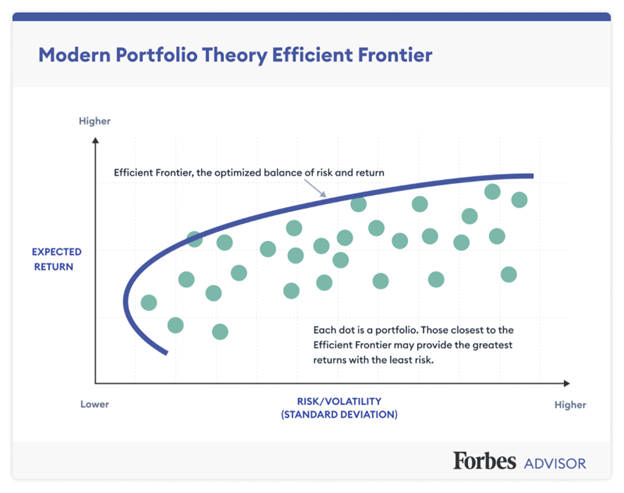

Modern Portfolio Theory is based on a concept called the Markowitz Efficient Frontier or Efficient Frontier. American economist and Nobel Laureate, Harry Markowitz, first proposed this theory in a 1952 issue of The Journal of Finance. Markowitz argued that portfolios should optimize expected return relative to volatility. He also asserted that a portfolio’s assets should be selected based on how an asset will impact others as the overall value of the portfolio changes.[1]

The graph below illustrates this concept and the level of risk an investor should be willing to assume in order to achieve higher returns. The line represents all possible combinations of risk versus reward that can be obtained through diversification. Riskier investments will have a higher potential return, but also greater volatility and potential for losses.

The illustration shows that a portfolio that falls outside the Efficient Frontier is suboptimal because it either carries too much risk relative to the anticipated return or too little return relative to its risk. If a portfolio falls below the Efficient Frontier, it does not allow for enough return compared to the risk level being taken. In contrast, the illustration shows that a portfolio whose anticipated return falls on the upper portion of the curve is considered optimal, maximizing the investor’s expected return based not only on overall market risk, but risk relative to the other investments in the portfolio.

Markowitz believed that most investors are risk-averse and would select assets in a portfolio with the least risk, even with the possibility of lower returns.[2] Using MPT, an investor will consider how much risk they’re willing to take against the return they expect from their investment.

Correlation measures how different assets move together or against each other over time. If two different assets have a high correlation (i.e., 0.85 to 1.00), they tend to react similarly. If they have a low correlation (i.e., 0.10 to 0.00), they tend to move in different directions at different times. According to the MPT, diversifying a portfolio across asset classes with lower correlations to each other could reduce investors total risk. Markowitz stresses that investors who can diversify and reach zero or near zero correlation between assets can minimize the volatility of their portfolio and maximize their expected returns on a risk-adjusted basis.[3]

Risk is measured in terms of volatility and can be categorized into systematic and unsystematic risk.[4]

Systematic risks affect all assets in an economy simultaneously. Interest rates, inflation, recessions, and geopolitical conflicts are all examples of systematic risks. Unsystematic risk refers to risks that affect only a particular asset or group of assets (e.g., a product recall or natural disaster). Once an investor has determined their level of risk tolerance and expected return, they can create a diversified portfolio that effectively manages both types of risk.

Achieving Optimal Diversification

Based on the MPT an important first step is to decide on an asset allocation strategy that suits the investor’s tolerance for risk. Asset allocation refers to the percentage of your portfolio invested in different asset classes (e.g., stocks, bonds, alternatives, real assets, cash). Asset allocation is an ever-evolving process, as market environments (and your personal situation) can shift quickly.

Depending on the different asset classes an investor selects, they may reduce their overall exposure to any one type of risk. The crux of the MPT is to create a balanced portfolio that includes assets that tend to do well when the economy is growing and when the economy is contracting.

Alternative assets, like private multifamily real estate funds, typically exhibit a low correlation with traditional assets. In addition, real assets, such as real estate, traditionally hold their value, even during recessions, as value is retained in the land.

Introducing Ashcroft’s Value-Add Fund III

Real estate funds like the Ashcroft Value-Add Fund III (AVAF3) differ from syndications by investing in multiple deals rather than a single property. The fund is structured so that investments are allocated across multiple properties in multiple states, creating diversified sources of return and mitigating concentration risk. Along with income generation, Value-Add Fund III will allow investors to participate in the upside potential of a portfolio of real-estate assets in different areas of the United States.

The Ashcroft Value-Add Fund III (AVAF3) is an open private placement fund for accredited investors interested in diversifying their retirement and wealth portfolios into multifamily real estate.

If you would like to learn more about investing in multifamily assets, visit https://info.ashcroftcapital.com/fund, or schedule a call with our Investor Relations Team at investorrelations@ashcroftcapital.com.

Sources:

- Portfolio Selection. Retrieved September 23, 2022, from The Journal of Finance, Vol. 7, No. 1. (Mar., 1952), pp. 77-91. https://www.math.hkust.edu.hk/~maykwok/courses/ma362/07F/markowitz_JF.pdf

- What Is Modern Portfolio Theory (MPT) and Why Is It Important? thestreet.com™. (n.d.). Retrieved September 30, 2022, from https://

www.thestreet.com/investing/modern-portfolio-theory-14903955 - Ibid.

- Ibid.