March 7, 2024

By: Travis Watts, Director of Investor Development

Choosing the right market to invest in is critical to investing success. In this article we will explore our process for identifying multifamily markets at Ashcroft Capital.

Where We Invest

Our footprint spans across U.S. Sunbelt markets, throughout Texas, Florida, North Carolina, and Georgia, with over 62 acquisitions since inception. There is a strong trend of Americans migrating from across the country to Sunbelt metros. This has been the case for many years, which has led to us acquiring properties in these markets; however, multifamily markets can change over time, and these metros may not always be in high growth with strong demand. Let’s dive into our selection process and reveal how we navigate this ever-changing landscape when identifying multifamily markets for our investors.

The AAA Process for Identifying Multifamily Markets

At a minimum of twice per year, we run our Ashcroft Advantage Analyzer, “AAA,” which is our proprietary research-based economic study used to identify the top U.S. markets best positioned for multifamily investment. We utilize a combination of data from third party services, like CoStar, RealPage, and Green Street, as well as U.S. Census information, to collect data on markets across the United States. We then analyze this data and apply a weighting system to help us identify which multifamily markets have the strongest fundamentals for us to target.

Fundamentals We Look For When Identifying Multifamily Markets

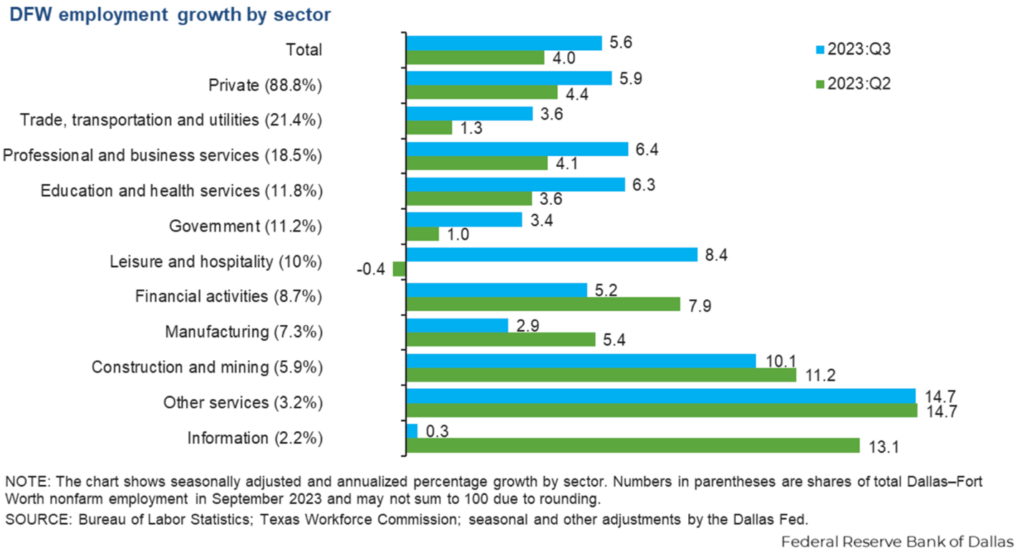

Two fundamental trends we look at very closely are migration trends (where people are moving to) and employment trends (where companies are locating to and where they are already established).

A growing population helps to reduce vacancies and places demand on the housing sector, which can boost rent growth over time. A diversified and growing job market helps reduce risk by ensuring that our residents have many employment opportunities nearby if one or two sectors are impacted.

Take for example Dallas, Texas where we have acquired 18 properties.

Texas has joined California as the only other state in the nation with a population of more than 30 million, according to recent data from the U.S. Census Bureau. Texas’ population has grown by 470,708 people since July 2021, the highest in the country.

Net domestic migration accounted for roughly half of that growth. This is the number of people moving to Texas from other states, while the other half is split almost evenly between net international migration and natural increase. Natural increase is the difference between births and deaths.

This increased population growth has created demand for more local housing and has helped push property values and rental rates up. In addition, there is an ongoing need for safe, affordable residential rental housing as many residents are currently priced out of the single-family housing market or cannot afford the rents of newly built, luxury properties in DFW.

Below, we can see that the employment sectors for Dallas, TX are highly diversified, and many sectors are expanding:

Additional Metrics

There are many other categories and trends to consider when it comes to identifying multifamily markets aside from migration trends and the job market. These include, but are not limited to:

1. Economic Indicators:

- Employment rates and trends

- GDP growth and economic stability

- Median household income

- Consumer confidence levels

2. Demographics:

- Age distribution

- Household size and composition

- Migration patterns

3. Housing Market Metrics:

- Supply and demand dynamics (inventory levels, new construction)

- Homeownership rates

- Rental vacancy rates

- Price trends (median home prices, price-to-rent ratios)

4. Infrastructure and Development:

- Transportation infrastructure (highways, public transit)

- Accessibility to amenities (schools, shopping centers, parks)

- Planned or ongoing developments and infrastructure projects

5. Regulatory Environment:

- Zoning regulations and land use policies

- Property tax rates

- Regulatory environment for landlords and property investors

6. Market Sentiment and Investment Activity:

- Investor interest and activity levels

- Market sentiment indicators (surveys, sentiment indexes)

- Capital flows (investment volume, sources of capital)

7. Risk Factors:

- Natural disaster risk (flood zones, earthquake-prone areas)

- Environmental concerns (pollution, contamination)

- Socio-political stability

8. Rental Market Dynamics:

- Rent growth trends

- Occupancy rates

- Rental yield potential

- Affordability for renters

Analyzing this amount of data is no easy task. That is why we created the AAA process and built an industry-leading team comprised of hundreds of employees, including Analysts, Acquisitions Associates, a Managing Director of Asset Management, a Chief Investment Officer, and a Managing Director of Capital Markets.

Investing Made Simple

At Ashcroft Capital, we want to make it simple and easy for our investors. We have you covered from start to finish. From identifying multifamily markets, locating properties, and structuring deals, to managing the properties and business plan. Our investment model is tailored for investors who want to enjoy all the benefits of owning multifamily real estate without the headaches of being a landlord. Ashcroft Capital negotiates the purchasing and financing of institutional-quality properties on behalf of investors. We are known for our best-in-class value-add strategy that creates forced appreciation in addition to organic market growth.

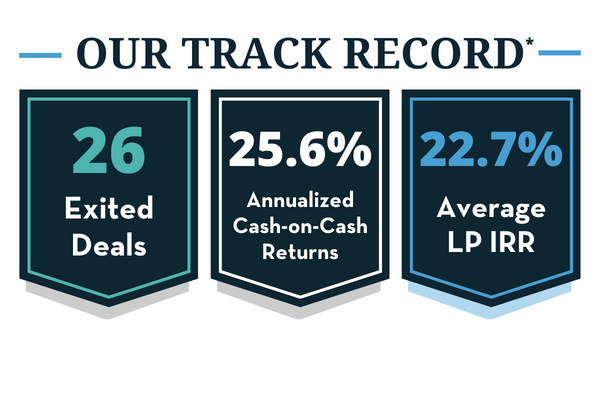

Ashcroft Capital’s Track Record

Since inception, we have delivered 25%+ annualized cash-on-cash returns to investors on the first 26 deals we have taken full cycle through the business plan. We have over $2.8 billion dollars in assets under management (AUM) and more than 21,000 units. Our track record is a direct result of a commitment to excellence in property management and a focus on capital preservation for our investors.

Next Steps

Whether you are a new investor or seasoned professional, we welcome you to meet our team. Accredited investors can schedule a call with one of our team members to learn more about our current offerings and opportunities. No investment is without risk. Make sure to consult your investment advisor or speak to an Ashcroft Capital team member before making any financial decisions.

*Past performance is not indicative of future results; investors may lose investment capital. Please see “Disclosures” for more information.

Sources:

- Ura, Alexa. “Texas is Now Home to 30 Million People.” The Texas Tribune. December 22, 2022. https://www.texastribune.org/2022/12/22/texas-population-growth-30-million-census/#:~:text=Texas%20has%20joined%20California%20as,from%20the%20U.S.%20Census%20Bureau.