August 3, 2024

By: Travis Watts, Director of Investor Development

Don’t Count Out a Class A Property

There’s something I’ve been wanting to announce for a while. As an avid Limited Partner investor in the multifamily apartment space, I want to let you in on a rare opportunity happening right now.

To start, I’d like to address a common misconception that value-add business plans only apply to older, outdated properties. In past years, this was often the case as the term “value-add” was used to describe older Class B or C properties in need of updates and unit renovations. Once the property and units get updated, rents are increased accordingly.

Higher Risk, Higher Reward – Is This Always The Case?

There is often higher risk associated with investing in an older Class B property compared to a newly built Class A property. A few notable risks include, but are not limited to:

- Risk of renovation – when turning hundreds of units, complications often arise.

- Risk of inflation – materials and labor increasing beyond budget or unexpectedly.

- Risk of delays – supply chain disruptions, contractor or permitting delays.

- Risk of age – Older properties often require more maintenance and upkeep.

Imagine Buying New, Avoiding Renovations, And Still Getting Rent Premiums!

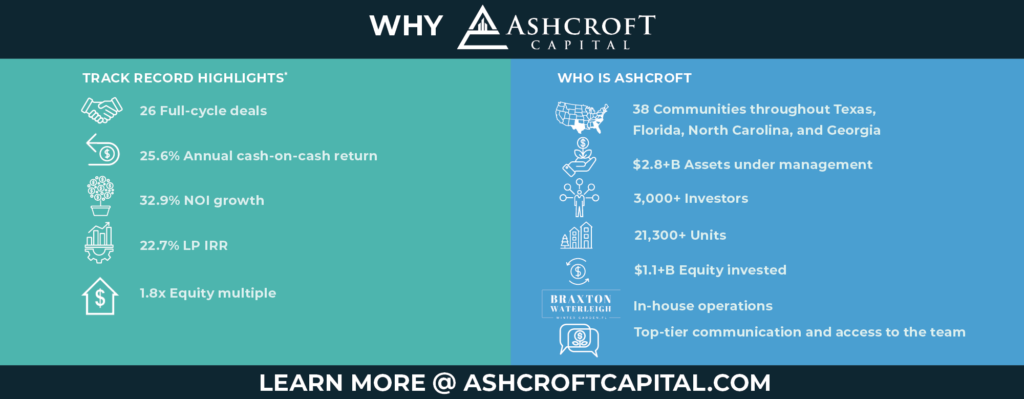

Introducing Braxton Waterleigh – our latest acquisition. This Class A property, built in 2021 and located in Orlando, FL, offers high-end finishes and best-in-class amenities. Despite its premium Class A status, Braxton Waterleigh is a rare type of value-add opportunity. This unique blend makes it an investor’s dream, and it’s why I’m so excited about this deal.

Upside Without the Headache – Introducing Mark-to-Market Value-Add Approach

Adjusting the rents to align with the current market rates is referred to as ‘mark-to-market’*, and Braxton presents a unique opportunity regarding this uncaptured upside potential.

Over the past 12 months, three new apartment communities were delivered in the nearby area. During the lease up phase of these communities, rents remained fairly flat and concessions were offered to entice new residents. As these properties are now getting close to reaching stabilized occupancy, rents are starting to increase, and concessions are being reduced.

Regarding Braxton Waterleigh, the mark-to-market rent premiums have yet to have been captured. This allows us to acquire the property below replacement cost due to the previous softness in the area and capture current market rents as these properties stabilize. This is a multi-million-dollar benefit as unit renovations are not required for the rents to increase roughly $100 per month across 354 units.

Maximizing Value with Ease

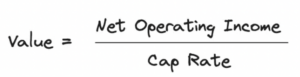

And that’s the beauty of it all. We can add value to the deal without the challenges associated with the typical renovation process. To fully understand what an amazing value proposition this is, it’s important to know how commercial real estate valuations are calculated.

Class A Property Example

If the mark-to-market rent upside results in collecting an additional $100 per month per unit, that would increase the net operating income by $424,800 a year. As a result, the property’s value would increase by approximately $7.7 million dollars without the need to take on the added risk of renovation.

Class B Property Example

With a typical Class B value-add business plan requiring a full renovation scope, operators would have the following hurdles to overcome:

- ≈ $3,540,000 needed to renovate 354 units, assuming a $10,000 per unit budget.

- In addition to upgrading units, further renovations would likely be required on the property such as updating the clubhouse, amenities, landscaping, and any deferred maintenance. This could add millions more depending on the property’s needs.

- The turnaround time for a business plan like this would likely take several years.

- Rent increases would not occur as quickly as each unit would first need to be renovated, compared to the mark-to-market value-add strategy.

Braxton Waterleigh is That Deal

Braxton Waterleigh represents a rare opportunity for value-add investors. Offering the combination of Class A luxury and upside potential, but without the usual renovation risks with older Class B or C properties.

I invite you to book a call with a member of our Investor Relations Team to learn more. Additionally, you can view the investment overview by visiting our Current Offerings page.

*The information presented is for illustrative purposes only and are not necessarily indicative of potential investment results, nor does not constitute an exhaustive explanation of the investment process, investment strategies or risk management.