April 2, 2024

“One of my biggest realizations was that no matter what business you’re in, you’re actually in business for yourself.”

Refusing to Retire

Air Force veteran, and still-active real estate broker, Jim Cummings is celebrating his 81st birthday this year. He has devoted his career and a large portion of his investment portfolio to real estate––and he’s still not in the mood to retire.

“I got licensed in 1988, progressed through being an agent, then a broker, and eventually went out on my own,” says Jim, summarizing his long and successful career. Along the way, he’s amassed a great deal of wisdom (and property), and his investment journey is a classic study in transitioning from single-family property management to real estate investing.

Getting the Hang of Real Estate

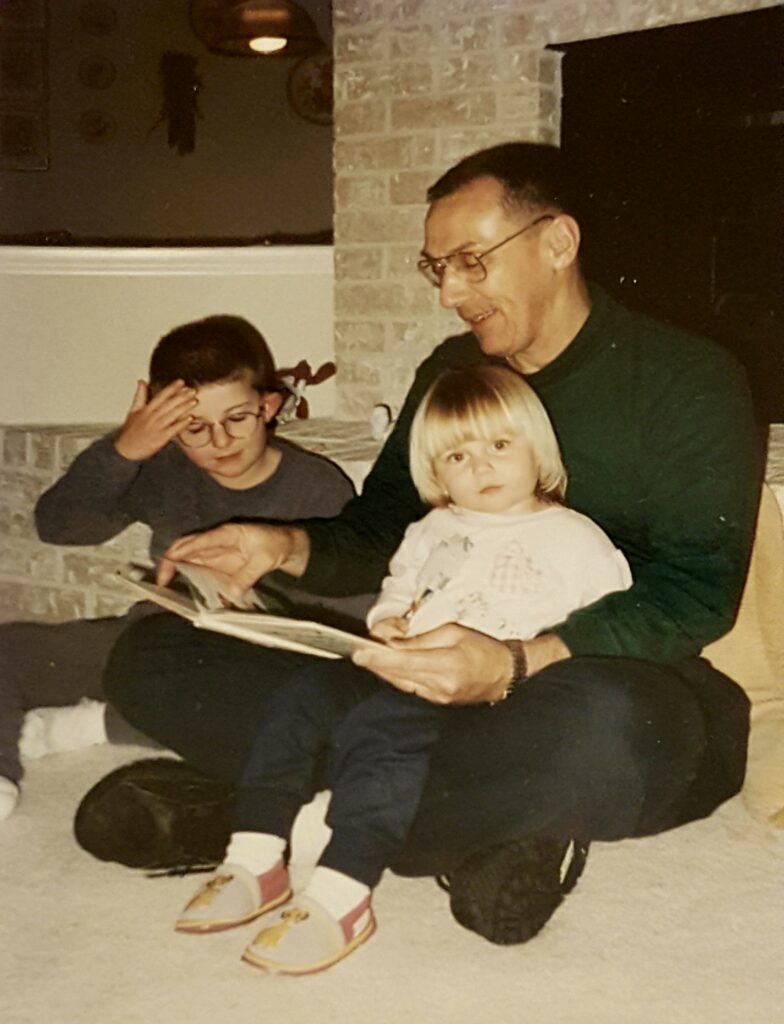

“In a military career, you move every few years, and you become familiar with buying and selling houses,” explains Jim. “So, that sparked an interest in real estate. I actually got a license before I left the service. When I retired from the Air Force, the economy was not good, but a friend of mine I’d been stationed with before was an agent, and I just decided that if I’m going to do it, now is the time to take the plunge.”

It was the bottom of the dotcom bust, but more experienced colleagues encouraged Jim that he would do well as soon as the market recovered. “I just kind of persevered. Fortunately, my wife was working, and I was bringing enough money from the military that we could keep food on the table, the lights turned on, and the rent paid. As the market turned up, those first few years were probably the hardest I’ve ever worked in any job––and I’ve worked in an oil field.”

Jim recalls learning how to work “smarter, not harder” in those early years. “You learn what you have to do and what you need to make happen,” he says. And he was helped along by the advice of a trusted mentor:

“It doesn’t matter if you go with a big company, a small company, or a medium sized company. It’s all up to you. You either make it yourself or you don’t make it.”

Learning to Make Smart Real Estate Investments

Luckily Jim was a quick learner––and determined to find success in his career as well as his investment strategy. But it wasn’t without trial and error. “While I was still in the Air Force at the last duty station, I bought a vacant lot with the idea that if I end up staying, I’m going to build a triplex. It was in a relatively renewed duplex community that was within a mile or so of where we lived at that point. When we decided we weren’t going to stay there, I just put up a sign and made a few thousand dollars on it.”

Around the same time, Jim acquired two rental properties in Austin, Texas. “Market timing was not good––I lost my shirt on both of them!” he laments in good humor. “When I moved back to Austin, I basically ended up giving them both away to get out from under the expense of it.”

With his investment feet now firmly underneath him, it was smooth sailing into the future for Jim and his family. “I bought a foreclosure, which we moved into, but it wasn’t in great shape,” Jim explains. “There was actually a lot in the same neighborhood that I ended up buying myself with the idea that I’d build a house on it and resell it. But once we got the house built, we decided to move into the new house and keep the old one for rental property. That’s really where the investment started.”

“I always could see the potential for real estate. It’s a good way to make use of other people’s money, and over time you can grow yourself a real estate business.”

Jim was able to quickly pay off the note for his first home using rental income, and even remodeled it before selling when he moved the family to College Station. “I made a pretty good pile of money on it, so I took the proceeds from the sale and ended up putting down the minimum required on one new property, and then put all the rest into another one.”

This became Jim’s preferred real estate investment strategy. He’s since added two additional properties, with the eventual goal of up to eight. “Interest rates have kind of taken me out of meeting my income goals on properties at this point in time, so that’s where I am now. I have four investment properties of my own. One will be paid off in June, and the others are cash flowing pretty well.”

Additionally, Jim still manages three properties for his clients, down from a hefty load of 25 under his purview in the past. And the result of all this experience in the industry? “I’ve been bloodied a little bit, so I have a pretty good feel for what makes real estate profitable or not,” he says.

Letting Ashcroft Capital Do the Heavy Lifting

Jim is a self-described “recovering workaholic” and doesn’t plan to ever fully retire, but he recently found himself needing to offload some of the labor of single-family property management. That’s when he turned to Ashcroft to facilitate a more passive income investing strategy. “I’ve reached the point that I’m getting too old to continue pursuing more single-family properties. And with the market the way it is, I just want to put my money to work.”

After hearing about Ashcroft on BiggerPockets, Jim was inspired to connect with the team.

“With the interest rate staying up there and some money on hand, I just said, ‘Now’s the time to take the plunge.’ So, we took off a small chunk and invested with Ashcroft just to see how well it worked. I was looking to get more return than CDs, which at that point were doing little or nothing. The fact that I could expect a 13-14%, maybe even up to 20%, total return on the investment was attractive to me.”

However, for Jim, money is just the byproduct of good decisions and good intentions––and we couldn’t agree more. His philosophy is, “Take care of the customer; the money will take care of itself. They’re paying good hard-earned money, and they deserve a great place to live. That’s what you’re there to provide, and ideally, you’re making a profit in the end.”

Jim is just one of our 3,000+ investors. Hear what passive income has meant to over 100 of our investors.