March 19, 2024

By: Travis Watts, Director of Investor Development

Deal Sourcing Strategies in 2024

Think of a professional sports team scouting for talent. Just as a team meticulously evaluates players to ensure they’re getting the best fit for their roster, we at Ashcroft Capital meticulously analyze apartment communities to ensure they’re the perfect fit for our investors.

Just like a sports team needs top-performing players to excel on the field, we need top-performing properties to excel in the market. But, deal sourcing in 2024 is no easy task.

In fact, last year multifamily investment volume fell by 60% from 2022 to $117.5 billion, marking the lowest annual multifamily investment volume since 2014. General Partners and investors have been scrambling over the past two years to find deals that pencil and many have been unsuccessful in their pursuit.

However, Ashcroft Capital has a competitive advantage in this area. Our thorough deal sourcing strategies ensure that we are acquiring best-in-class properties for our investors. Let’s examine the three ways we go about sourcing deals.

#1 Off-Market Transactions – Unlocking Hidden Gems

In the realm of commercial multifamily transactions, the significance of off-market deals cannot be overstated. Despite the amount of publicly listed properties you may see online, a significant portion of transactions in the commercial space occur discreetly. This is a selling strategy that can help avoid disruptions to current residents and can help ensure that a deal closes on time.

An off-market transaction refers to a deal that occurs directly between two parties without being facilitated through a public marketplace, such as a real estate listing service. A broker is often involved to help facilitate the transaction, though this is not always the case.

Consider being the owner of a large apartment community and you’re looking to sell. There is a high demand of buyers interested in making a purchase, but every buyer also wants to conduct their own due diligence, walk the units, do inspections, surveys, appraisals and so on. This process will not only disrupt the current residents, but there is also risk if the potential buyer cannot raise the capital needed or if the deal gets re-traded, which means renegotiating the price or terms after getting the property under contract.

This is why off-market transactions are common in the commercial space. In fact, at Ashcroft Capital, over 60% of our acquisitions have been sourced off-market.

One example of a property we purchased off-market was Elliot Norcross in Atlanta, GA. A broker who we had previously worked with on another deal knew that the owner was thinking about selling this deal. Given the ease of a transaction that we had with the broker, he was able to get us an off market look at this deal and convinced the owner to sell to us. This provided us with the opportunity to forgo multiple bids or having to compete with other buyers in the market.

Photo: Elliot Norcross (Atlanta, GA)

#2 Direct to Seller – Cutting Out the Middleman

In a similar instance, we purchased Vista 121 in Dallas, TX directly from the seller. This was our 2nd deal that we bought from them. They wanted to close and given our previous experience with them and their knowledge of our other deal in the market, they reached out to us about buying Vista 121.

No seller wants to be re-traded or have a deal to fall out of contract. These setbacks can be costly and cause tenant disruption and delays. At Ashcroft Capital, we have an excellent reputation of buying more than 60 acquisitions and selling 26 of them after completing the business plan. This track record of fast and easy transactions is attractive to sellers and brokers.

Photo: Vista 121 (Dallas, TX)

#3 On-Market Multifamily Gems

Now let’s discuss finding on-market deals that are publicly listed. Some sellers want to get as many eyes on the property as possible in hopes of creating a bidding war. In other cases, it can be a requirement among sellers to market a deal publicly when it comes time to sell.

In acquiring Midtown 501 in Chapel Hill, NC, we bought the property from a group that we had purchased two other deals from and have an extremely strong personal relationship with. We negotiated a purchase price and terms and were able to purchase Midtown 501 at a 20%+ discount relative to previous pricing in that market. Our pre-existing relationship with the seller set us apart from the competition and made this transaction possible.

Photo: Midtown 501(Chapel Hill, NC)

Why 60% of Our Acquisitions Have Been Sourced Off-Market

Considering all three deal sourcing strategies, most of our deals have been acquired as off-market transactions, but there are pros and cons to consider with each acquisition. Below are a few things to keep in mind when seeking off-market deals.

Exclusivity: Off-market deals offer a level of exclusivity, allowing buyers to access properties that are not widely available to the general market. This can provide a competitive advantage and potentially lead to better negotiating terms.

Reduced Competition: Since off-market deals are not openly advertised, there is typically less competition from other buyers. This can give buyers a better chance of securing a property at a favorable price without engaging in bidding wars.

Privacy: Off-market deals provide sellers with privacy and discretion, which can be desirable for various reasons. Sellers may prefer to keep the sale of their property confidential, especially in sensitive situations such as financial distress.

Potential for Better Deals: Sellers may be more willing to negotiate favorable terms or pricing in off-market transactions, especially if they are motivated to sell quickly or avoid the costs associated with traditional marketing.

Limited Exposure: Off-market deals lack the exposure and visibility that come with listing properties on MLS or other public platforms. This means that sellers may miss out on potential buyers who are not part of their immediate network.

Risk of Undervaluation: Without the competitive pressure of an open market, sellers may undervalue their properties or settle for lower offers than they could potentially achieve through broader exposure and competition.

Difficulty Deal Sourcing: Buyers may find it challenging to identify off-market opportunities since these properties are not openly advertised. Securing access to off-market listings often requires strong networks, industry connections, and working with experienced real estate professionals and brokers.

Discovering Diamonds: The Broker Connection

Brokers can also serve as indispensable allies in our pursuit of exceptional deals. Through close collaboration and clear communication, we leverage their expertise to help source new opportunities. We work closely with brokers specializing in Class B, value-add, garden-style, multifamily properties in Sunbelt markets. We provide them with specific investment criteria and our preferences, and brokers then alert us to new listings and off-market opportunities that match our criteria, ensuring a comprehensive approach to finding the best investments.

Excellence Starts with Location: Maximizing Investor Value

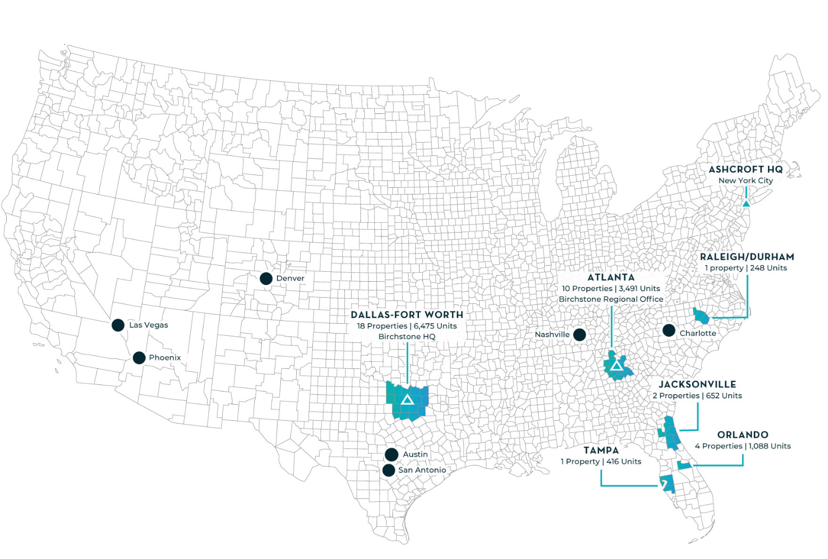

Headquartered in New York City, Ashcroft Capital strategically positions itself to capitalize on opportunities arising from proximity to buyers and sellers. We transact with many large institutional investment firms who are also headquartered in New York City. Our proactive engagement within the real estate investment community affords us invaluable insights and access to exclusive deals that many of our competitors will never see. These relationships have provided dozens of multifamily opportunities for our investors over the years.

Photo: Ashcroft Capital Headquarters (NYC)

From Vision to Venture: Where We Invest

Focused primarily on US Sunbelt markets, our strategic footprint spans across Texas, Florida, North Carolina, and Georgia. With over 62 acquisitions since inception, our targeted approach aligns seamlessly with the prevailing trend of Americans migrating to Sunbelt metros in pursuit of employment prospects, affordability, and an appealing lifestyle. As these regions flourish with increasing populations and economic growth, the demand for multifamily properties remains robust.

Investing Made Simple

At Ashcroft Capital, we want to make it simple and easy for our investors. We have you covered from start to finish. From deal sourcing strategies, to evaluating markets, to acquisition, to managing the properties on your behalf. Our investment model is tailored to investors who want to enjoy all the benefits of owning multifamily real estate without the headaches of being a landlord. We are known for our best-in-class value-add strategy that creates forced appreciation in addition to organic market growth.

Our Track Record is a Testament to our Capabilities

Since inception, we have delivered 25%+ annualized cash-on-cash returns to investors on the first 26 deals we have taken full cycle through the business plan. We have over $2.8 billion dollars in assets under management (AUM) and more than 21,000 units. Our track record is a direct result of a commitment to excellence in property management and a focus on capital preservation for our investors.

Investing is a Team Sport

Whether you’re a new investor stepping onto the field or a seasoned professional looking to gain further insight into deal sourcing strategies, we welcome you to meet with our team. If you are an accredited investor, please schedule a call to learn more about our current offerings and opportunities. Remember, no investment is without risk. Make sure to consult your investment advisor or speak to an Ashcroft Capital team member before making any financial decisions.

*Past performance is not indicative of future results; investors may loose investment capital. Please see “disclosures” for additional importance information. The number of units, purchase price, and disposition price sum. The average year built is a weighted average based on number of units. All other values are weighted averages based on disposition price. Please see “Disclosures” for more information.