January 3, 2023

By: Travis Watts, Director of Investor Development

The news about today’s economy sounds bleak – “Are we going to enter a recession?” “Are we already in a recession?” “Did you hear the Fed raised interest rates again?” “When is inflation going to peak?”

While much can be said about the current state of the U.S. and global economy at large, savvy investors are not without opportunities to profit during volatile times.

Did you know $63 billion dollars was invested in multifamily apartments during the first quarter of 2022? That is 56 percent more than Q1 of 2021.[1] People need a place to live and we have been behind as a country since around the year 2000 in keeping up with demand for safe, affordable, workforce housing. While the dramatic increase in home prices and rising interest rates have put a pause on many people’s dreams of homeownership, it has also pushed demand for apartments and rental properties.

Let’s examine some recent history of when we experienced elevated levels of volatility and uncertainty in the United States.

MULTIFAMILY APARTMENTS – LESSONS FROM RECESSIONS

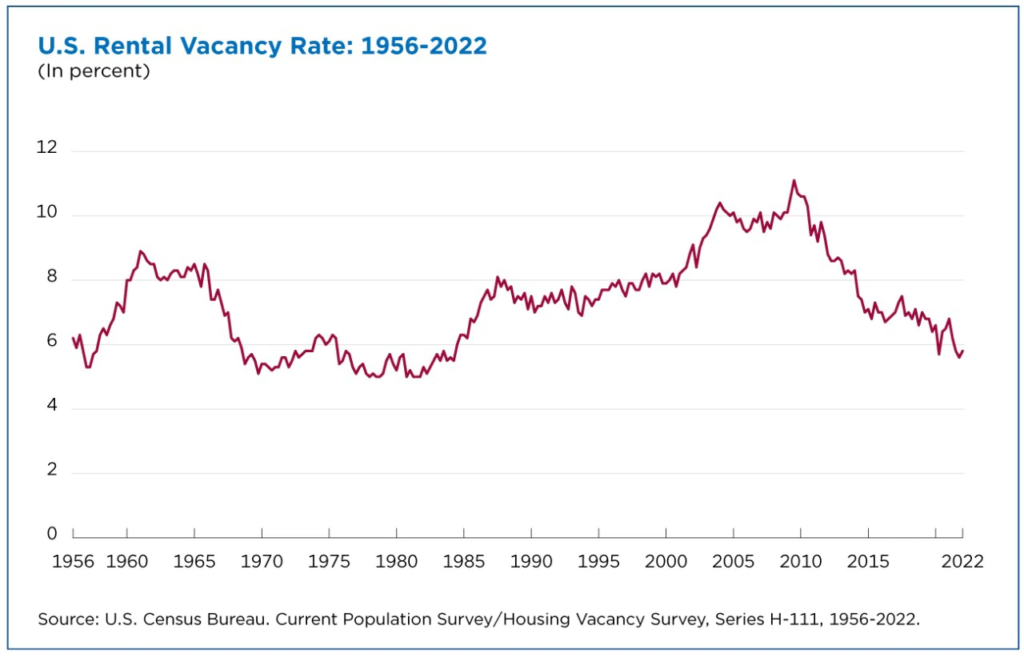

Recessions are seemingly unavoidable and present plenty of reasons for investors to question how their investments will fare in a downturn. Between 2007 and 2010, The Great Recession occurred, and vacancy rates spiked to the highest levels since the 1960s.[2] For multifamily property owners, that meant for every 100 units you owned, 10 were vacant or unrented. The percentage quickly spiraled down after 2010 as people who lost their homes and jobs needed affordable apartment housing to rent. So, even though vacancy rates shot up in the short-term, they recovered about a year later, and this proved to be a temporary setback.

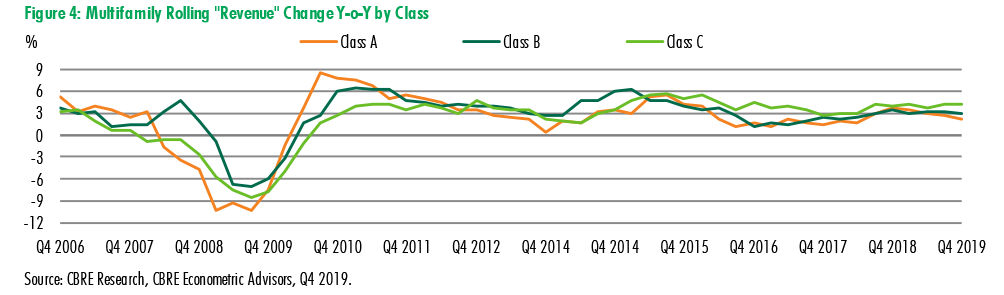

Let’s take a look at the overall revenue change in multifamily apartments. During the Great Recession, revenue did indeed fall in 2008.[3] Then In 2009, while still amid the recession, revenue started growing again because of the demand placed on apartments. Take note, that Class B properties quickly returned to their pre-recession levels and were less impacted than Class A and Class C properties during the recession.

REAL ESTATE PROPERTY CLASSES AT-A-GLANCE

Class A: properties that generally were built in the last ten to fifteen years Located in prime locations, highest rents, new amenities, luxury communities, little to no deferred maintenance.

Class B: properties that generally range from ten to thirty years old. usually offering standard amenities, such as in-unit laundry, pools, and on-site fitness facilities, may be located outside of a major metropolitan market, due to their older age, often have deferred maintenance and may be slightly out of date.

Class C: properties with varying risks, including the age of the building, potentially located in a less desirable location, generally have lower income tenants. These apartments are often in a state of neglect, and may lack amenities such as a pool, fitness center, or community areas.

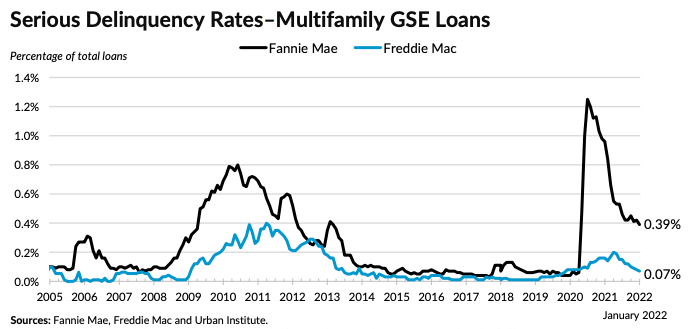

During The Great Recession, government-backed commercial real estate loan issued by Fannie Mae and Freddie Mac did see an increase in defaults but at mild levels of less than a one percent demonstrating the strength of this asset class.

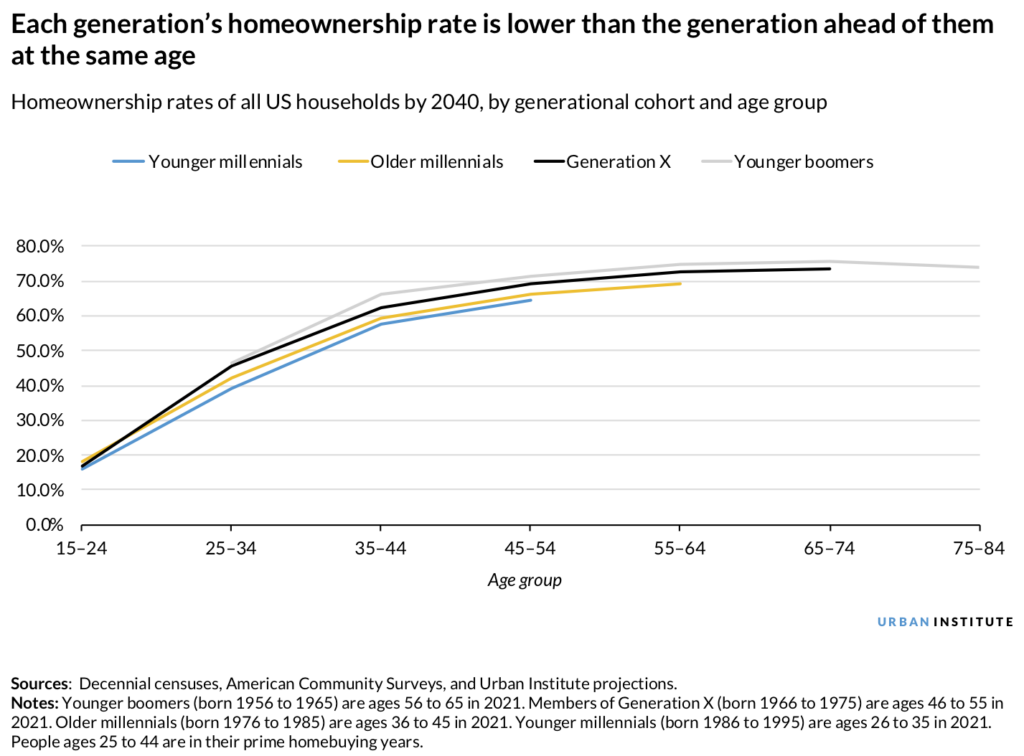

Today, homeownership rates continue to decline due to housing affordability and access. [4] An increase in remote work in the post-Covid era, institutional buying of single-family homes, and mortgage rates nearly doubling over the past year has led to less inventory and greater competition, making homeownership even more expensive and less attainable for many. As home prices and interest rates soar, many consumers have found themselves priced out, and as a result, the demand for multifamily apartments has increased considerably.

Did you know there is currently half the volume of housing inventory compared to 2019 levels? Delays, worker shortages and inflation are increasing construction timelines and while 900,000 units are now under construction, another 3.7 million units will need to be built by 2035 to balance the supply shortage.[5]

Recession fears, combined with rising interest rates and high prices, have made consumers more cautious when it comes to purchasing a home versus renting. Given the economic outlook, multi-family real estate investments are assets uniquely positioned to weather a downturn.

RENT GROWTH AND RISING INTEREST RATES

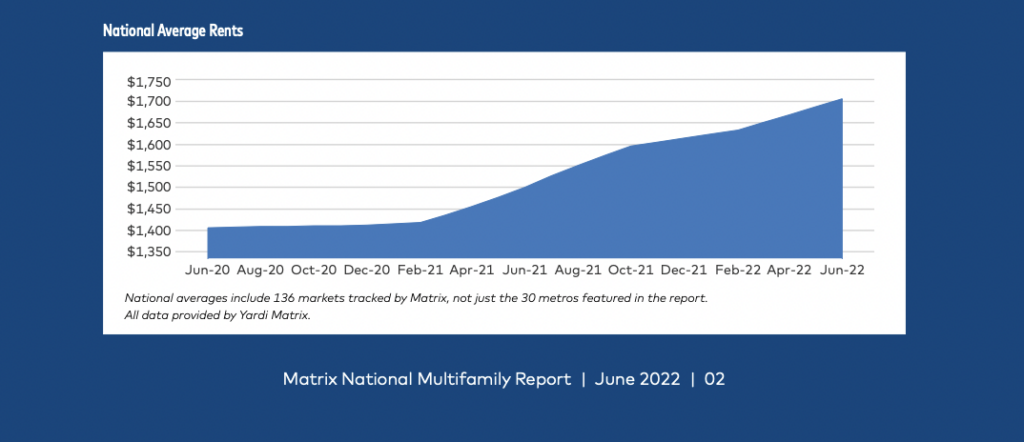

In 2021, we saw historically high rent growth, with rents starting to climb in February due to inflation and demand.[6] Rental markets have experienced higher rent growth in the past 18 months than in the five years leading up to 2020.[7]

Multifamily apartments have historically held their ground during recessions and in the face of rising interest rates. High rent growth and an increase in demand help to strengthen returns, and if apartment rents continue to rise with inflation, this will also help offset rising interest rates.

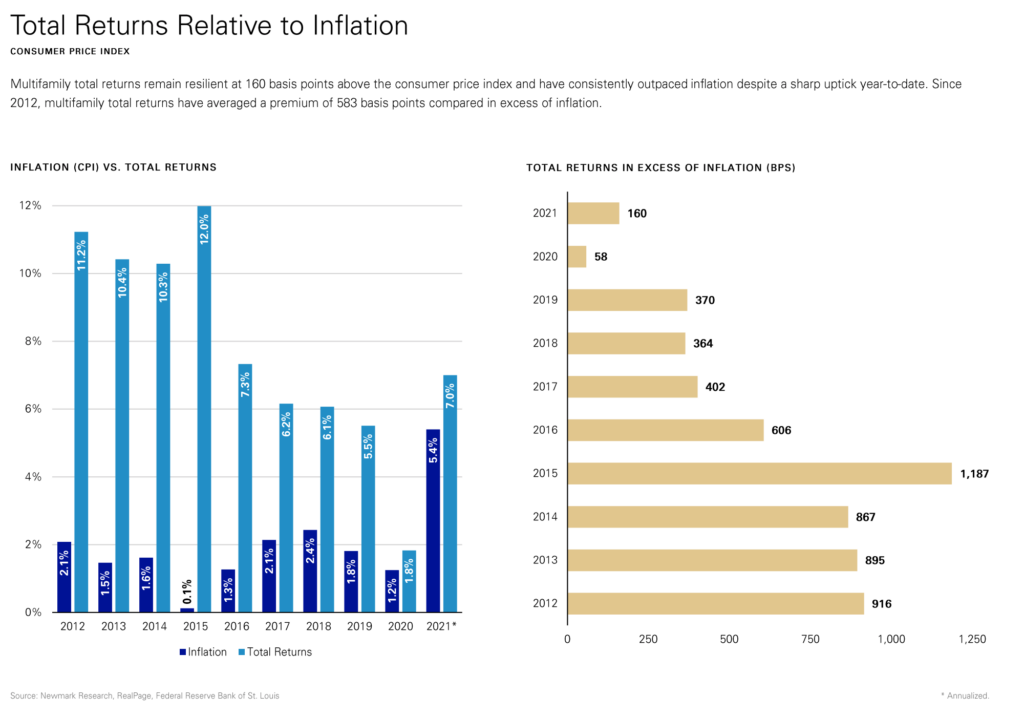

Additionally, multifamily apartments have also been a good hedge against inflation. The figure below shows multifamily apartment returns compared to the CPI inflation over the last decade. In the last 10 years, the total return in multifamily has outpaced inflation every single year, averaging an excess return of 5.83% after adjusting for inflation.

Though interest rates have risen considerably over the past year, record-setting rent growth has effectively outpaced the additional costs associated with the rate increases to help make the case for multifamily apartments during this downturn.

KEY TAKEAWAYS

- If apartment rents continue to rise with inflation, this can help offset rising interest rates and help multifamily apartments to remain an inflation-resistant investment vehicle.

- If a lack of multifamily apartment inventory persists prices should remain

- If the occupancy, collections, and net operating income continue to hold or increase, equity in multifamily apartments will be better protected

- If homeownership continues to decline and housing remains unaffordable consumers will need to rent.

ASHCROFT CAPITAL AND MULTIFAMILY INVESTMENTS

National multifamily rent growth has risen more than 10 percent on a year-over-year basis, with Florida (specifically, Orlando, Miami, and Tampa), Dallas, and Nashville leading in rent growth.[8] Currently, Ashcroft Capital’s communities are located in the growth markets of the Sun Belt region, including Atlanta, Dallas-Fort Worth, and Orlando, which experienced 14 percent, 17 percent, and 24 percent year-over-year growth, respectively, all exceeding the national average.

At Ashcroft Capital, we have a proven track record of creating value through renovating, rebranding, and repositioning our investment properties. We buy existing cash flow-positive, high-quality, well-located properties in markets with strong multifamily fundamentals, employment growth, and population growth.

Ashcroft Capital is vertically integrated = – not only do we purchase multifamily properties; we also manage our properties after acquisition via Birchstone Residential and Birchstone Construction – both in-house and wholly owned subsidiaries of Ashcroft Capital. Birchstone Residential manages the properties providing an unparalleled renter experience with superior service, maintenance, and digital marketing for the properties. Birchstone Construction performs large-scale, value-add renovations with efficiency and with complete control of the construction process from start to finish. These integrations streamline our management structure, allowing us to make decisions quickly and act decisively. By having our own in-house construction group, we are able to work directly with manufacturers, which has reduced our materials costs by roughly 35 percent. And by not having to work with third-party contractors, we are better able to manage our renovation timelines.

Ashcroft Capital owns over 12,500 rental units, with over $2.5 billion in assets under management. We have taken 26 deals full cycle, all the way from purchase to sale. Our net return to investors after all fees has been 21.7 percent annualized (This IRR return includes both cash flow as well as an equity return on investment for properties sold). This historic return represents a 1.8x multiple.

The Ashcroft Value-Add Fund III (“AVAF3”) is open for enrollment. We introduced for AVAF3 our Ashcroft Investment Incentive, which provides the opportunity for you to see a larger return the more you invest. With our new waterfall structure, as a Class B investor, you have the potential to receive a higher return on your investments.

Many questions regarding AVAF3 are answered on our AVAF3 deck. Read more about the opportunities that the Sunbelt market offers and our continued efforts focused on capital preservation and reducing risk to our investors. To start your investment, enroll here.

If you would like to learn more about investing in multifamily assets, visit https://info.ashcroftcapital.com/fund, or schedule a call with our Investor Relations Team at investorrelations@ashcroftcapital.com.

Sources

[1] Rising Interest Rates Aren’t Stopping Apartment Investors from Cutting Deals. wealthmanagement.com™. (n.d.). Retrieved October 10, 2022, from www.wealthmanagement.com/multifamily/rising-interest-rates-aren-t-stopping-apartment-investors-cutting-deals

[2] Homeowner and Rental Vacancy Rates Declined During COVID-19 Pandemic. census.gov™. (n.d.). Retrieved October 10, 2022, from www.census.gov/library/stories/2022/05/housing-vacancy-rates-near-historic-lows.html

[3] Class B Multifamily Performed Best During Past Downturn. cbre.com™. (n.d.). Retrieved October 10, 2022, from https://www.cbre.com/insights/articles/class-b-multifamily-performed-best-during-past-downturn

[4] By 2040, the US Will Experience Modest Homeownership Declines. But for Black Households, the Impact Will Be Dramatic. urban.org™. (n.d.). Retrieved October 11, 2022, from www.urban.org/urban-wire/2040-us-will-experience-modest-homeownership-declines-black-households-impact-will-be-dramatic

[5] THE STATE OF HOUSING SUPPLY: ‘NOT ENOUGH HOMES TO GO AROUND’. builderonline.com™. (n.d.). Retrieved October 26, 2022, from mf.freddiemac.com/docs/2022-multifamily-midyear-outlook.pdf

[6] National Multifamily Report. yardimatrix.com™. (n.d.). Retrieved October 11, 2022, from https://www.yardimatrix.com/publications/download/file/2514-MatrixMultifamilyNationalReport-June2022

[7] 2022 Multifamily Midyear Outlook. freddiemac.com™. (n.d.). Retrieved October 11, 2022, from mf.freddiemac.com/docs/2022-multifamily-midyear-outlook.pdf

[8] National Multifamily Report. yardimatrix.com™. (n.d.). Retrieved October 11, 2022, from https://www.yardimatrix.com/publications/download/file/2514-MatrixMultifamilyNationalReport-June2022