October 8, 2025

As we enter Q4 of 2025, the U.S. multifamily sector is at a strategic turning point. A September interest rate cut by the Federal Reserve signaled a continued shift in monetary policy. While supply pressures persist in certain metros, demand fundamentals remain sound. Rent growth has moderated, but occupancy rates continue to hover near equilibrium in many markets. Transaction volumes are increasing, and cap rates appear to be peaking, and in many metros, have already begun to decline.

In case you missed it: We recently hosted a webinar with John Chang from Marcus & Millichap, where John discussed how macroeconomic headwinds are impacting investor sentiment—and what that means for multifamily positioning in Q4 and beyond. Check out the replay HERE.

Key areas of focus include:

- The Fed cut rates by 25 bps (0.25%) in September, sparking optimism and setting the stage for renewed activity.

- Rent growth is subdued, but demand is holding steady; oversupplied markets face short-term softness, while others remain resilient.

- Construction starts are falling rapidly, laying the groundwork for improved fundamentals in 2026.

- Multifamily continues to outperform riskier asset classes and remains an attractive hedge against economic uncertainty.

Multifamily Fundamentals Snapshot

Source: https://bdi-insurance.com/commercial-specialties/apartment-owners/

- Over 116,000 units were absorbed in Q2 2025, continuing one of the strongest years on record. (Cushman & Wakefield)

- Renters continue to delay homeownership due to high interest rates and home prices, bolstering demand for apartments.

Rent Growth & Vacancy:

- National average apartment rent as of September 2025 is $1,750, reflecting +0.6% YoY (Yardi Matrix)

- Some oversupplied metros have experienced rent declines; however, the national occupancy rate remains stable (~94.7%), unchanged year-over-year. (Yardi Matrix)

Key Trend: Resilient demand is being tested by elevated supply. We anticipate equilibrium returning as deliveries taper in 2026.

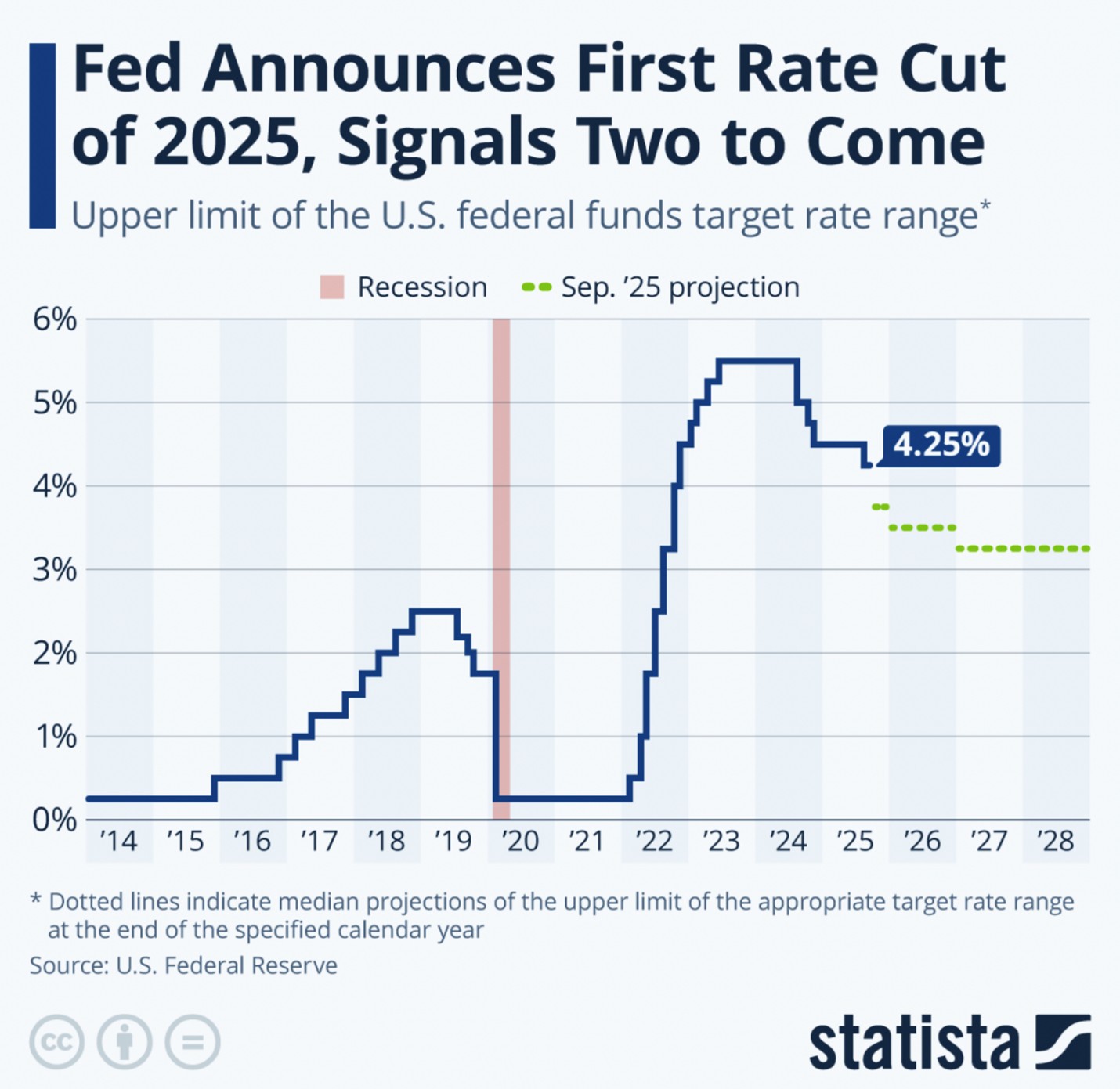

September Fed Cut: A Subtle But Strong Signal

Source: https://www.statista.com/chart/21023/us-federal-funds-target-rate/?srsltid=AfmBOoqR1MJFa26HtzRA5KdYAE8mwh39dIQo42EHbCjxeP9tM-fD2c3z

The Move:

- The Fed reduced its target rate to 4.00% – 4.25% in September 2025.

- Rationale: Softer labor data, improved inflation trends, and increased global risk factors. (Source: Federal Reserve)

Why It Matters:

- Lower Cost of Capital: Reduced borrowing costs improve feasibility of acquisitions, refinances, and recapitalizations.

- Market Psychology: Even modest cuts can boost confidence and reactivate capital markets.

- Valuation Upside: With cap rates near peak, the path to compression may unlock value.

- Tailwind for Multifamily: Compared to office, industrial, or retail, multifamily gains the most from financing tailwinds.

Construction Slowdown: Relief on the Horizon

Source: https://www.opportunitynowsv.org/blog/could-common-sense-be-the-answer-to-solving-californias-housing-crisis-the-answer-may-shock-you

- The latest projections predict annualized starts will drop to approximately 372,000 units in Q4 2025, the lowest since 2017. (Source: Trinity Street)

- Developers continue to face challenges from high material costs, stricter underwriting, and debt availability.

- Supply pipelines are thinning, particularly in markets like Austin, Phoenix, and Orlando.

- Investor Implication: These trends support a bullish long-term view on stabilized assets in constrained metros.

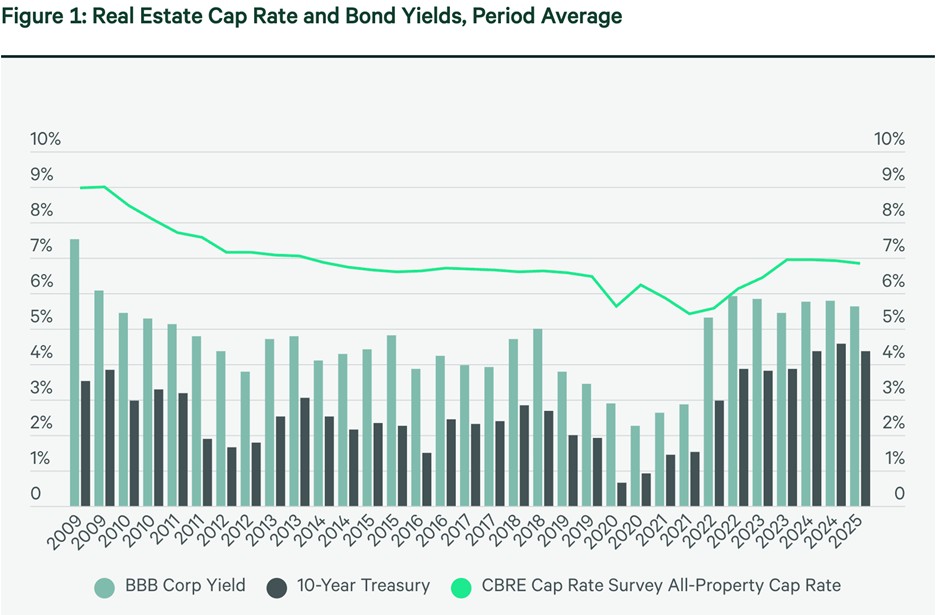

Valuation & Capital Markets

Source: https://www.cbre.com/insights/reports/us-cap-rate-survey-h1-2025

- Cap Rates: CBRE’s H1 2025 survey reported modest ~9 bps compression, suggesting we may be at the cap rate peak. (Source: CBRE)

- Spreads: The spread between multifamily cap rates and Treasuries remains tight, but may widen with more Fed easing.

- Debt Market: Lenders remain selective. Financing is more widely available for stabilized deals with moderate leverage (55-65% LTV).

Ashcroft’s Strategic Positioning

Selectivity Over Scale:

- We are focused on fewer acquisitions this year in markets with tighter supply pipelines and market tailwinds.

Value-Add Flexibility:

- Our recent acquisitions offer optionality to improve and reposition as market conditions shift.

Cautiously Optimistic Underwriting:

- Our pro forma assumptions include: modest rent growth and stabilized vacancy, coupled with a disciplined capex strategy.

Capital Flexibility:

- Our capital stack strategies allow us to remain opportunistic as recap scenarios emerge and more buyers re-enter the sector.

Why Multifamily: Now More Than Ever

- Construction Decline: Fewer starts today = tighter supply in the near future.

- Lower Rates: With a 2024 and 2025 Fed cut already at play, and lower rates forecasted in 2026, today’s market signals a bullish turning point.

- Cap Rate Compression Opportunity: Even 25-50 bps of future compression could materially lift investor returns.

- Demographics: Household formation remains strong, especially among Millennials and Gen Z renters. Did you know the United States now has over 100 million renters? (ApartmentList).

“The Fed’s cut didn’t just open a door – it nudged it wider. With demand resilience and construction retreating, the next few quarters may offer the best entry point in years.”

Looking Ahead to 2026

- We expect supply pressure to gradually ease across major metros into 2026.

- We expect more opportunities will emerge as over-leveraged and underperforming assets reset.

- We continue to prioritize:

- Strong submarkets with market tailwinds

- Fixed-rate leverage

- Discounted acquisition pricing

- Disciplined, vertically integrated execution

Capital is coming off the sidelines—and it’s flowing back into multifamily. As the window of opportunity reopens, Ashcroft Capital is positioned to lead the next cycle of growth.

Sources & References:

- CBRE US Cap Rate Survey H1 2025 https://www.cbre.com/insights/reports/us-cap-rate-survey-h1-2025

- Yardi Matrix Rent Data: https://www.yardimatrix.com/blog/national-multifamily-market-report/

- Federal Reserve September 2025 Release: https://www.federalreserve.gov/newsevents/pressreleases/monetary20250917a.htm

- Trinity Street Construction Forecast: https://trinitystreetcp.com/multifamily-real-estate/end-of-year-outlook-multifamily-construction-q4-2025/

- Cushman & Wakefield Multifamily Report: https://www.cushmanwakefield.com/en/united-states/insights/us-marketbeats/us-multifamily-marketbeat

- Apartment List: https://www.apartmentlist.com/research/rent-statistics

Disclaimer:

Neither Ashcroft Capital LLC, nor any of its affiliated companies (collectively,” Ashcroft”), is an investment adviser or a broker-dealer nor are any of them registered with the U.S.

Securities and Exchange Commission. The information in this presentation should not be used as the sole basis of any investment decisions, nor is it intended to be used as advice with respect to the advisability of investing in, purchasing or selling securities, nor should it be construed as advice designed to meet the investment needs of any particular person or entity or any specific investment situation. Nothing in this presentation constitutes legal, accounting or tax advice or individually tailored investment advice. This presentation is not an offer to buy or sell securities nor a solicitation of such offers.

The content in this presentation contains general information and may not reflect current developments or information. The information is not guaranteed to be correct, complete or current. The reader assumes responsibility for conducting its own due diligence and assumes full responsibility for any investment decisions.

Examples are provided for illustrative purposes only and are not necessarily indicative of potential investment results, nor does this material constitute an exhaustive explanation of the investment process, investment strategies or risk management.

This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements express Ashcroft’s expectations or predictions of future events or results. They are not guarantees and are subject to many risks and uncertainties. There are a number of factors beyond Ashcroft’s control that can cause actual events or results to be significantly different from those described in the forward-looking statements. Any or all of the forward-looking statements in this document or in any other statements Ashcroft makes can turn out to be wrong. Except as required by applicable law, Ashcroft does not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. In light of the significant uncertainties inherent in the forward-looking statements made in this document, the inclusion of this information cannot be considered a representation by Ashcroft or any other person that its objectives, future results, levels of activity, performance or plans will be achieved.

Ashcroft Capital’s offerings are made pursuant to Regulation D, Rule 506(c) and are available only to verified accredited investors. Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal. This presentation is for informational purposes only and should not be construed as an offer to sell or a solicitation of an offer to buy any securities.