March 29, 2023

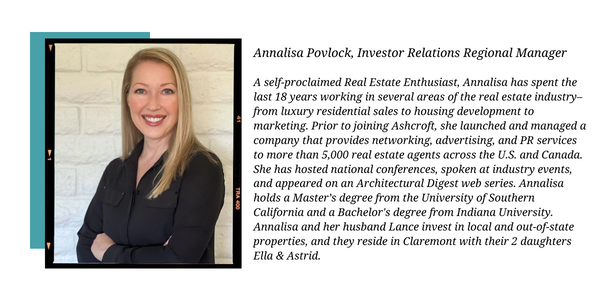

By: Annalisa Povlock, Investor Relations Regional Manager

Many investors look to real estate syndications for passive income and capital preservation. Real estate offers many benefits, such as lower volatility than other asset classes, a low correlation to stock market performance, a hedge against inflation, and the opportunity for depreciation.

A real estate syndication is a group of individuals who pool their money to invest in a property or in a fund model—several properties. Syndication opportunities exist in all asset classes of commercial real estate, including multifamily, hospitality, office, retail, self-storage, mobile home parks, and industrial.

Syndication opportunities are typically structured as limited partnerships; those who invest passively are referred to as the limited partners. The general partner, or syndicator, actively manages the deals, establishes the team, assembles the resources, and manages the day-to-day responsibilities to execute the business plan.

We understand that investors have many options to consider when deciding with whom to place their hard-earned funds. Investors often wonder if they are asking sufficient questions and how to compare one investment opportunity to another.

We talk about assessing deals and syndicators in our Passive Income Workshops, and we would like to share some of that information with you.

First, there are key financial metrics that should be available to potential investors for any deal. These are the following:

- Preferred return: This is also referred to as the “coupon.” This is a legal term for the agreed-upon return the general partner must pay the limited partners prior to splitting the profits.

- Cash-on-cash return: This is an annualized percentage that shows the total cash flow received from an investment divided by the total investment amount.

- Internal rate of return (IRR): This is a similar measure to cash-on-cash return, except it considers the time value of money. IRR can be helpful to reference when comparing different syndication opportunities with different hold periods.

- Equity multiple: This is similar to cash-on-cash return, except it is shown as a ratio instead of a percentage. For example, if $100,000 is invested, $80,000 is paid in distributions over the course of the investment period, and the initial investment is returned, the equity multiple is 1.8x.

In addition to these important financial metrics, here are some questions to ask syndicators. This is not an all-inclusive list, but it is a great place to start in your conversations and due diligence.

- What is your track record?

- What is your business plan?

- Who operates your day-to-day deals?

- What is the minimum investment?

- Will you share references of existing investors?

- Is this a single asset or a fund structure?

- What has been your experience through previous recessions?

- How frequently do you communicate with your investors?

- What percentage of your investors invest with you multiple times?

- Are your returns gross or net of fees?

What questions or information would you add to this list? We would love to hear from you.

At Ashcroft Capital, we focus on multifamily syndication, and to date, we have taken 26 properties full cycle. You can view more information about our current offering, the Ashcroft Value-Add Fund 3, here.

Please reach out to me at Annalisa@AshcroftCapital.com to ask questions and to learn more.