The Ashcroft Value-Add Fund III

The Ashcroft Value-Add Fund III (AVAF3) is now available for accredited investors.

What is AVAF3?

The Ashcroft Value-Add Fund III focuses on capital preservation and risk mitigation while still having upside potential.

What are the investment criteria?

What are the targeted fund returns and projections?

Start the Process of Investing Now

Ashcroft Capital offerings are limited to accredited investors.

5-7 Years

ANTICIPATED LIFE OF FUND

$25,000

MINIMUM INVESTMENT

Investment Criteria

| Communities located in the growth markets of the Sun Belt including Dallas-Fort Worth, Atlanta, and Orlando. | |

| Class A/B properties with an excellent opportunity for value creation through improvements | |

| Under performing or distressed multifamily properties | |

| 200+ Unit assets in highly desirable submarkets | |

| $20 million to $150 million total capitalization per property |

(Avg including sale)

13% to 20%

(Avg excluding sale)

6.0% to 8.0%

13% to 18%

1.45x to 2.0x

Annual Cash-on-Cash Projections**

Year 1:4.0% |

Year 2:6.3% |

Year 3:7.0% |

Year 4:7.5% |

Year 5:8.0% |

*Based on 5 year hold for Class B Limited Partner Investment. Target returns represent ranges for base case, downside, and upside scenarios.

**Projected cash-on-cash returns are based on base case assumptions for the properties within the Fund

Note: Projected returns are based on LP levels of Fund.

Limited Partner (A) - Class A

Class A Limited Partner’s earn a coupon of 9% per annum of such Limited Partner’s investment in Partnership (the “Class A Coupon”).

Class A Limited Partners have limited distributions upon disposition of the Property. This tier offers stronger projected cash flow and reduced risk as compared to Class B Limited Partners.

Limited Partner (B) - Class B

Class B Limited Partners earn a coupon of 7% per annum of such Limited Partner’s investment in Partnership (the “Class B Coupon”).

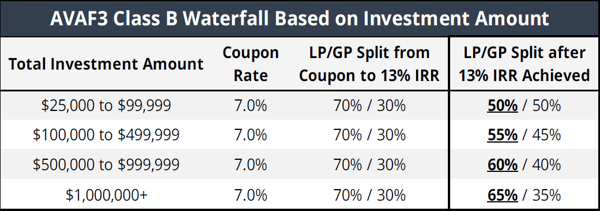

Upon the disposition of the Property, after payment of debt, return of Class A and Class B Limited Partner investments, payment of any unpaid Class A and Class B Coupon Amounts, and then, prorata, seventy percent (70%) to the Class B Limited Partners and thirty percent (30%) to the General Partner until such time as the Class B Limited Partners have received a cumulative amount equal to thirteen percent (13%) IRR. Then, Class B Limited Partners will receive starting at 50% and up to 65%, dependent on the total investment amount, of the remaining proceeds from disposition up. This tier has a lower coupon but provides greater participation upon disposition or capital event compared to Class A Limited Partners.

If you invest more with us, you get more potential upside on your returns. See the structure in the chart below:

Start the processes of investing now

You must be an accredited investor to start investing with Ashcroft Capital.

Understanding the

Benefits of Investing in a Fund

- Spreads out investor equity over multiple acquisitions

- Greater exposure to investments in various markets and asset classes

- Ability to invest in different individual property business plans and hold periods

- Provides the opportunity to participate in upside on property price appreciation upon sale, refinances, and supplemental loans

- Diversification offers the ability to reduce risks while offering the potential for higher returns

- Potential tax benefits for investors such as pass-through depreciation opportunities and 1031 exchanges

Ashcroft Capital is a vertically integrated multifamily investment firm comprised of industry-leading executives. The firm applies institutional policies and procedures while remaining entrepreneurial and implementing innovative solutions to each asset it acquires. We are driven by a focused mission to improve the quality of life for the residents at each community in our portfolio. Though Ashcroft is first and foremost focused on capital preservation, this approach has resulted in several outsized, full-cycle investor returns.

CONTACT

461 5th Ave

16th Floor

New York, NY 10017

© 2024 ASHCROFT CAPITAL™