January 20, 2023

By: Danielle Jackson, Investor Relations, Senior Manager

There are many factors when structuring debt that can impact debt servicing costs and, therefore, net operating income. Some investors might look for loan structures that provide flexibility for the duration of their hold. When acquiring commercial real estate, syndicators base their decision on financing structure by the asset type, estimated holding period, and investor .

Fixed rate loans yield fixed monthly mortgage payments and can provide a hedge against volatility. Because the rate is locked in, investors are assured that any inflationary effects on rates are risks that will be borne by the lender during the life of the loan. Additionally, in periods of rising market rates, a fixed rate loan can provide cost savings.i, ii

On the other hand, fixed rates are typically 1.5 to 2.0% higher than floating rates as the higher margin allows lenders to hedge future market fluctuations and account for all potential risks. On a $10,000,000 debt, this higher fixed rate means paying an additional $150,000–$200,000 each year. Fixed rate loans also can become costly in a climate where interest rates are falling. For example, a borrower may be locked into a fixed interest rate of 8% even though market rates have dropped to 3%.iii, iv

In addition, exiting fixed rate loans can be costly. Specifically, if a borrower decides to refinance a property prematurely it may trigger prepayment penalties. Prepayment penalties are fees borrowers are required to pay when they pay off (through refinance or sale) their loan balance prior to the maturity date. This high cost could limit syndicators’ flexibility to maximize their return by refinancing or their ability to accelerate their exit timing.v

Distinct from a fixed interest rate, a floating interest rate is one that is variable and fluctuates over time. Typically, floating rates are tied to an underlying benchmark rate or index. In the United States, we are now using alternative benchmarks like the Secured Overnight Financing Rate (SOFR) that, unlike LIBOR, bases rates on historical figures. The payment due on the loan changes in regular intervals, either monthly or quarterly, depending on the benchmark used.vi, vii

Floating rate loans are usually initially offered at a lower rate. If the fixed rate on a loan is 10%, the floating rate will usually range between 7.5% and 8%.viii These floating rate loans are mostly structured as interest-only loans, requiring a balloon payment at the end. A key benefit for floating rate debt is the inherent flexibility of limiting prepayment penalties and offering more flexible funding facilities. A funding facility works similarly to a line of credit or construction loan and can be used at the borrower’s discretion for capital expenditures such as construction and improvements, tenant leasing costs, tenant improvements, interest shortfalls, carry shortfalls, and tenant buyouts.ix, x

To help plan for expenses and to underwrite deals 5, 10, or even 15 years out, an interest rate cap is usually purchased to limit how high an interest rate can rise on floating rate debt. For example, a borrower can get a 10- year commercial property floating rate loan that charges 4% interest with an interest rate cap of 7%. The interest rate can go up or down, but it can never go higher than 7%.xi, xii

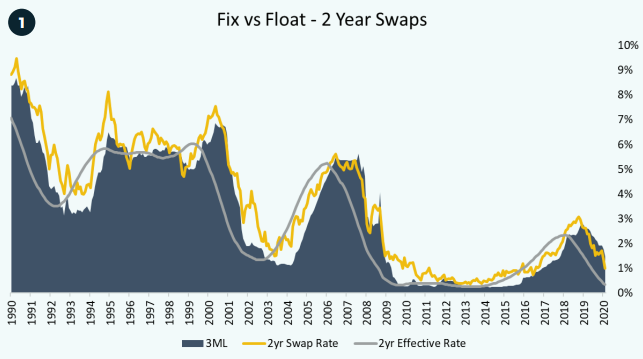

Let’s look at some historical charts.xii Shaded in blue is the LIBOR rate, the gold line is the swap rate— the interest rate at which floating rate holders can switch to a fixed rate—and the gray line the effective market rate floating rate holders were currently paying at that time. As Chart 1 shows, between 2006 and 2013 the gold line (the swap rate) for two years moving forward was, in fact, higher than the gray line (the floating rate) debt holders were paying.xiii

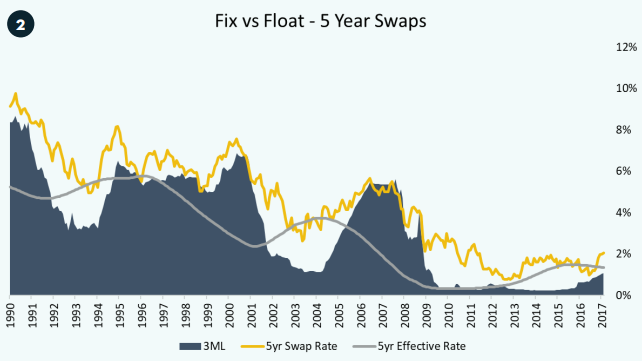

The chart below depicts a 5-year time period between 1990 and 2017. Floating the rate for five years resulted in a maximum savings of 4.82% over that time. Fixing the rate yielded a 0.90% savings on swap.xiv

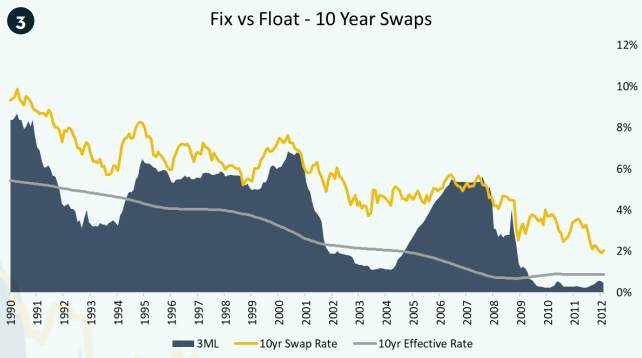

When looking at 10-year swaps between 1990 and 2012 (Chart 3), the maximum savings earned by floating topped 4.7% annually over a ten-year span, as shown.xv

The data illustrate that, at any point between 1990 and 2010, borrowers who leveraged floating rate financing, whether for a 2-year, 5-year, or 10-year period, saved more money than they would have with a fixed rate loan or by switching to such a loan during the course of their loan period.

Significant cost savings is the key reason Ashcroft Capital’s financing structure of choice is a floating rate loan. As a real estate investment firm that specializes in a multifamily value-add strategy, Ashcroft Capital’s typical holding period is 5 to 10 years. Securing extremely flexible debt allows us to remain nimble and maximize our exit strategy. Ashcroft Capital recognizes rates are climbing, which is why in all our debt structuring we purchase interest rate caps, thereby limiting our exposure from rate increases beyond what we are already expecting. This allows us to properly underwrite our deals and remain focused on reducing debt costs and maximizing NOI.

If you would like to learn more about investing in multifamily assets, visit https://info.ashcroftcapital.com/fund, or schedule a call with our Investor Relations Team at investorrelations@ashcroftcapital.com.

Sources

i CCIM Institute. “The Rate Debate.” 2022, https://www.ccim.com/cire-magazine/articles/rate-debate/

ii The National Law Review. “Floating or Fixed Rates: Considerations in Choosing a Commercial Real

Estate Mortgage.” February 6, 2015, https://www.natlawreview.com/article/floating-or-fixed-rates-considerations-choosing-commercial-real-estate-mortgage

iii FRED. “30-Year Fixed Rate Mortgage Average in the United States.” June 9, 2022, https://fred.stlouisfed.org/series/MORTGAGE30US

iv Forbes Advisor. “Floating Vs Fixed Interest Rate: What Works For Your Home Finance?” April 19, 2021, https://www.forbes.com/advisor/in/personal-finance/floating-vs-fixed-interest-rate-what-works-for-your-home-finance/

v Bonneville Multifamily Capital. “Commercial Loan Prepayment Penalties Unwrapped.” 2022, https://bmfcap.com/commercial-loan-prepayment-penalties-unwrapped/

vi Investopedia. “London Interbank Offered Rate (LIBOR).” March 12, 2022, https://www.investopedia.com/terms/l/libor.asp

vii Forbes Advisor: “What Is Libor And Why Is It Being Abandoned?” December 21, 2021,

viii Shriram City. “Fixed or Floating – Which Type of Interest Rate Is Better on Your Business Loan?” 2022, https://www.shriramcity.in/articles/fixed-or-floating-which-type-of-interest-rate-is-better-on-business-loan

ix Putnam Investments. “Pursue reduced interest-rate risk with floating-rate bank loans.” April 2022, https://www.putnam.com/literature/pdf/II790-2e76cb5d847bce9e8fce5233e13bb294.pdf

x Ready Capital. “Q1 Earnings Conference Call.” May 6, 2022, https://ir.readycapital.com/investor-relations/News/news-details/2021/Ready-Capital-National-Bridge-Team-Closes-Approximately-655-Million-in-11-States-in-First-Quarter-of-2021/default.aspx

xi Rocket Mortgage. “A Quick Intro To The Floating Interest Rate.” June 24, 2022, https://www.rocketmortgage.com/learn/floating-interest-rate#:~:text=A%20floating%20interest%20rate%20does,monthly%20mortgage%20payments%20to%20increase

xii Janover Ventures. “Commercial Real Estate Loans.” 2022, https://www.commercialrealestate.loans/commercial-real-estate-glossary/interest-rate-cap-floating-commercial-property-loan

xiii Ibid.

xiv Ibid.

xv Ibid.